Booking Holdings ($BKNG) Just Dropped Jaw-Dropping Figures That Could Rewrite the Future of Online Travel—Are You Ready to Cash In?

Imagine turning a modest $405 into a staggering $5,077 over just 14 years—sounds like a dream, right? Well, that’s exactly the kind of magic Booking Holdings has pulled off, delivering a 19.7% compounded annual return that leaves most investments in the dust. But here’s the kicker: this isn’t some overnight sensation; it’s the story of a travel-tech giant that has quietly morphed from Priceline.com into a global powerhouse connecting millions to hotels, flights, car rentals, and even restaurant reservations. How does a company carve out such an unshakable niche in an industry as fickle as travel—especially when faces like Airbnb and Google loom large? And what do those dizzying numbers really tell us about where Booking Holdings stands today? Buckle up, because we’re diving deep into the guts of this fascinating business, breaking down its brands, revenue models, and valuation nuances—all while asking: will artificial intelligence be a friend or foe to this travel titan’s next chapter? LEARN MORE

img#mv-trellis-img-1::before{padding-top:54.39453125%; }img#mv-trellis-img-1{display:block;}img#mv-trellis-img-2::before{padding-top:52.1484375%; }img#mv-trellis-img-2{display:block;}img#mv-trellis-img-3::before{padding-top:60.546875%; }img#mv-trellis-img-3{display:block;}img#mv-trellis-img-4::before{padding-top:61.9140625%; }img#mv-trellis-img-4{display:block;}img#mv-trellis-img-5::before{padding-top:61.42578125%; }img#mv-trellis-img-5{display:block;}img#mv-trellis-img-6::before{padding-top:50%; }img#mv-trellis-img-6{display:block;}img#mv-trellis-img-7::before{padding-top:61.328125%; }img#mv-trellis-img-7{display:block;}

Booking Holdings was $405 14 years ago and today it is $5077. That is a 19.7% p.a. compounded return over 14 years.

Booking Holdings is an American travel-technology company headquartered in Norwalk, Connecticut. It was originally known as Priceline.com, then The Priceline Group, before rebranding to Booking Holdings in 2018 after Booking.com became its largest brand. Booking Holdings operates as a global online travel intermediary, connecting consumers with travel service providers through its portfolio of well-known brands.

It enables users to book:

- Hotels and alternative accommodations (e.g., vacation rentals)

- Flights

- Car rentals

- Restaurant reservations

- Travel packages and experiences

The company earns money mainly through three models:

- Agency model – Booking acts as an intermediary; travelers pay the hotel directly, and Booking earns a commission.

- Merchant model – Booking collects the payment from the traveler and remits the net amount to the hotel or service provider, acting more like a reseller.

- Advertising and other revenue – Includes advertising fees, referral revenue from metasearch platforms, and other ancillary services.

Booking Holdings reports its results as a single operating segment but is best understood by its key brands, each serving different regions and parts of the travel market.

Main Brands

- Booking.com – The flagship brand and world’s largest accommodation platform. It dominates in Europe and offers hotels, apartments, and alternative stays.

- Priceline.com – Focused mainly on the U.S. market, offering deals and discounts on hotels, flights, and rental cars.

- Agoda – Based in Asia-Pacific, strong presence in Southeast Asia and the Pacific. Offers accommodations and flights with a focus on local pricing and mobile usage.

- KAYAK – A travel-search/metasearch engine that compares prices across providers (for flights, hotels, cars, etc.) and directs users to partners for booking.

- OpenTable – A restaurant reservation platform, mainly in North America, allowing users to book tables online.

- Rentalcars.com – Specializes in global car rentals, integrated with Booking.com and other group platforms.

We can also view Booking holdings through different revenue framing:

- Lodging (accommodation bookings) – The largest and most important source of revenue, contributing the majority of total sales.

- Air travel and ground transport – Includes flights and car rentals; smaller but growing.

- Advertising and other – Includes revenue from KAYAK’s metasearch and OpenTable’s restaurant services.

- Geographic mix – The bulk of business comes from international markets, especially Europe and Asia, with the U.S. being smaller in comparison.

Valuation

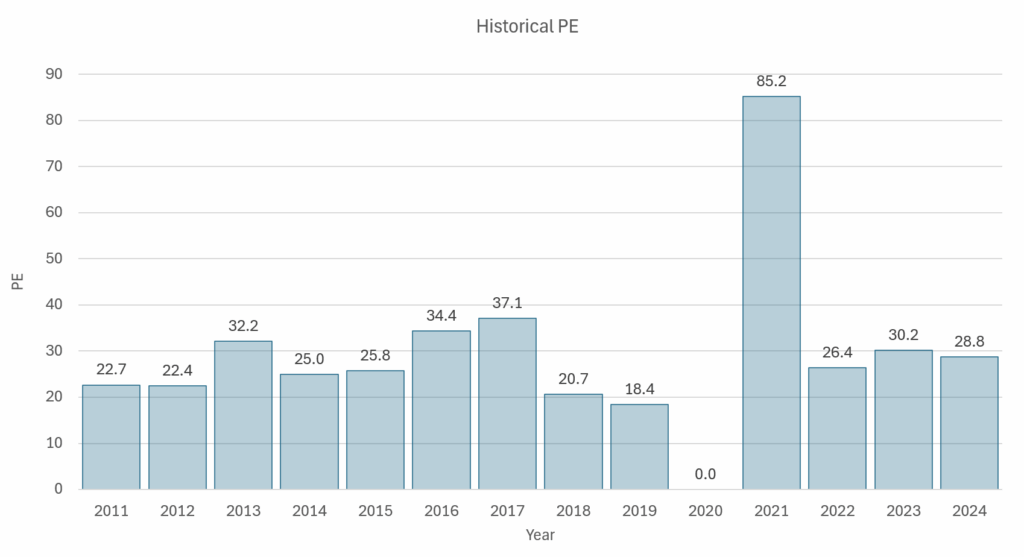

The following table shows Booking Holdings historical PE:

The current earnings per share (EPS) of $221 will put Booking Holdings PE at 23 times. If we use next 4 quarter’s guidance of $257 (a 16% growth in EPS), 20 times.

A price earnings that average 29 times is not cheap, but you got to see what you are buying. Are you buying Cai Png or are you buying Shake Shack?

The chart below shows the PEG of Booking Holdings:

PEG takes the PE as the numerator divide by the growth rate at the denominator. What we get is a relationship between valuation and growth. If the number is small, preferably less than 1.25, the stock is relatively cheap if we factor in growth.

In this case I take the yearly PE divide by the net income growth for the year. If the income is negative, I don’t calculate for it. As you can see, there are many years that the PEG end up less than 1.

But we got to be careful to draw conclusions with 1 year’s of growth because the earnings can have some crazy growth in 1 year and how likely is that kind of growth going to repeat. We are going to revisit this point later but for those who calculated PE before, notice how small most of these numbers are… that should give you some clues.

What We Are Buying if We Pay $5077 Today

The chart below shows the growth of Booking Holdings revenue year on year:

The dip in revenue in 2020 is due to…. the Pandemic shutdown when all of us cannot travel easily. The jump in revenue in the subsequent two years corrected the shut down as we start to travel and in a more ferocious manner.

Aside from that, Booking average a 20% a year revenue growth for the past 14 years. The guidance for Q4 2025 is a more muted 12%. Perhaps this explains the correction in share price.

The chart below shows the Gross Margins of Booking Holdings:

The Gross margin since 2018 is an insane 97%.

Gross margin is one of the area we can tell if a company is able to preserve its economic moat. A lowering of gross margin may indicate that the moat is not as strong.

Booking holdings growth in gross margin is partly how they shifted from a model where they charge full price first, then ask the merchant (hotels) to pay them back to a more agency model, where the revenue is recorded is already net of costs.

This explains why the gross margins can be very high.

The charge below shows the Operating Margins:

The operating margins will take into account marketing, general administration, interest expenses and any research & development costs. As we can see Booking was able to maintain roughly a 30% operating margin which is very healthy. I wanted to see if there are any observable operating leverage here. If there is, I should see progressively better operating margins. The disruption of Covid might mean we need more time to observe.

The chart below shows the outstanding shares of Booking holdings since 2011 and how that has changed till today (in blue bars):

Booking holdings outstanding shares was reduced from almost 50 million to 33 mil today, or a 33% drop in the past 14 years. The orange line shows the yearly share reduction, which averages 4% a year since 2014, when they decide to reduce the share count.

This share reduction has a meaningful impact of earnings growth.

The chart below shows the net income and earnings per share growth:

I limit the growth to 200% because the growth in 2021 is like 1800% after the devastating earnings drop in 2020. The average growth is an insane 160%. This explains why the PEG is so low. You could make a case that a 100% annual earnings rise doesn’t happen often but take a look at how many annual earnings growth that is above 30%.

The share buyback has started showing about a 10% difference in earnings growth in the past few years.

One thing you need to also take note is that currently Booking Holdings has negative equity.

This means that the total liabilities is higher than total assets. Booking has 17 billion in debt and 16 billion in cash. Their current liabilities is more than their total assets less cash.

Booking is probably one of the company that is very focus on shareholder yield. If you have such a business that is so resistant to competition, its like a golden goose that keeps laying more and more eggs. So you would just keep distributing the eggs.

But instead of distributing the eggs, if $1 kept in Booking holdings grows like 15-20% p.a. would shareholders benefit by paying out that 4%-5% as dividends (which is subjected to tax), or buy back shares so that the shareholders earn more of Booking?

Is it irresponsible to have debt if the long term growth rate of at least 10% a year is much higher than interest rates?

I leave the final thinking to you.

Epilogue

There are many good resources to learn more about Booking holdings

- Steady Compounding: The Travel Stock that Thrived When Travel Collapsed.

- Lengthy Interview with Booking CEO Glenn Fogel about Travel and Aggregation.

Numbers aside, you probably wish to figure out why Booking Holdings is a good business that can grow to this degree for so long. There are bound to be competition such as Air B&B, but how can their alternative accommodation business, which is the same line of business as Air B&B become almost bigger than Air B&B?

If this business is so easy to compete with, and Google is a front end to get leads, why can’t they just craft a better interface and take away Booking’s business?

The insane numbers probably show us that it has been futile up to now but will AI be additive or subtractive for a business like Booking Holdings? That is the next leg for you to figure out.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

Post Comment