Bitcoin’s comeback: Why returning miners are stirring the pot—and what they’re really after behind the scenes

Key takeaways

Bitcoin inflows to Binance surged, largely driven by a Satoshi-era miner. Long-term holders are taking profits as the market remains stable, but the spotlight is on what comes next.

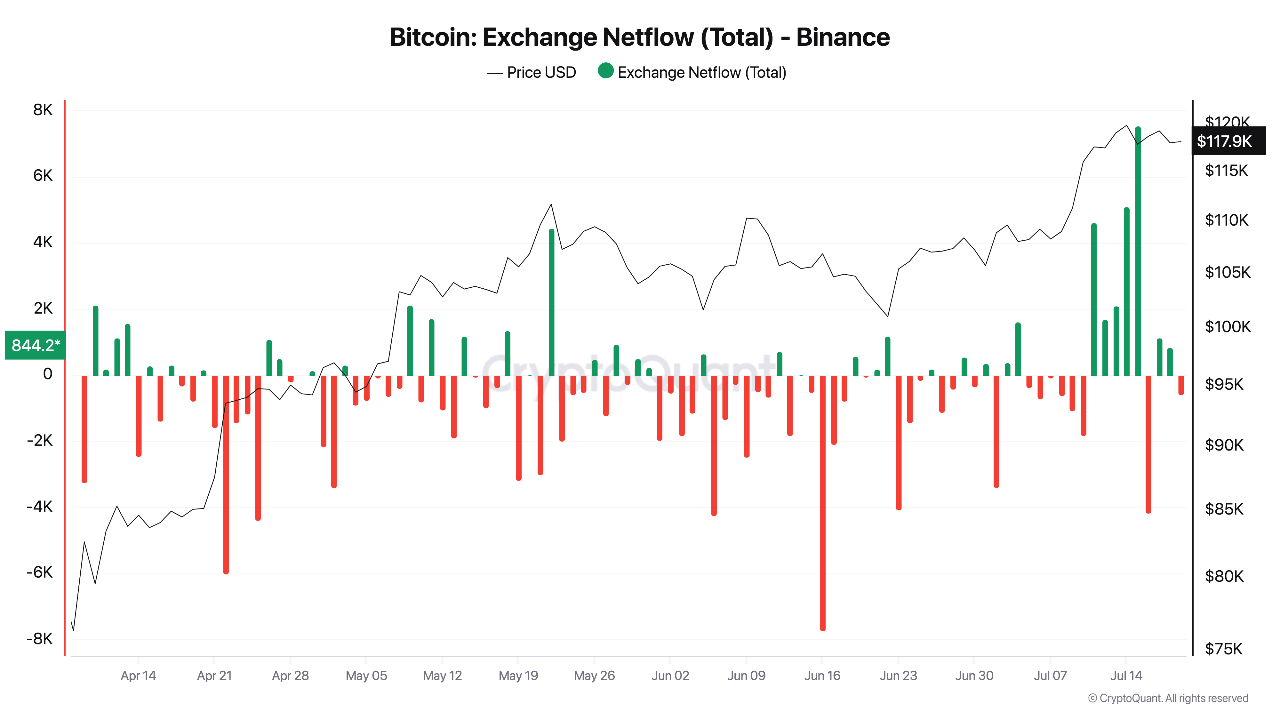

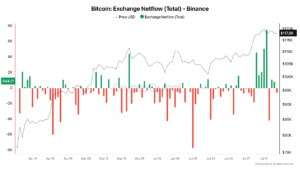

Bitcoin [BTC] is making waves again, with a sharp shift in momentum. Since the 11th of July, Binance has seen $2.7 billion worth of BTC flow in; a clear reversal after months of steady outflows.

Interestingly, much of this surge seems tied to a Satoshi-era miner resurfacing.

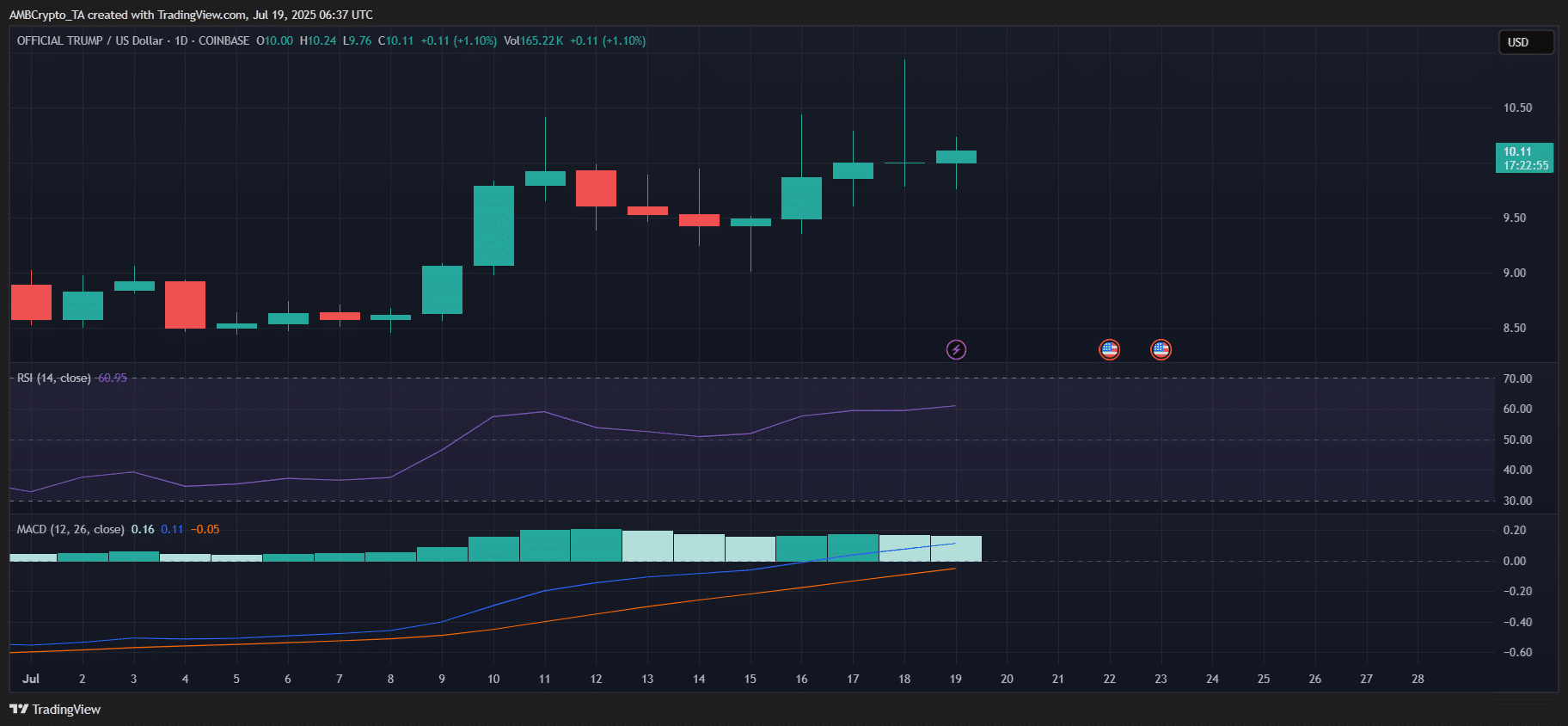

At the same time, long-term holders are cashing out more aggressively than short-term traders, pointing to a cautious phase of redistribution in the market.

Binance becomes BTC’s main stage again!

After months of steady BTC withdrawals, Binance has flipped the script. Since the 11th of July — when Bitcoin hit new a new ATH — more than 23,000 BTC, worth around $2.7 billion, has flowed into the exchange.

The biggest spike came between the 14th and the 15th of July, possibly tied to a dormant miner wallet linked to the Satoshi era.

These wallets have now moved over 80,000 BTC in recent weeks, reigniting market curiosity.

Despite the large volume, Bitcoin’s price has remained steady; proof of how resilient the market is and how integral Binance remains for major BTC transfers.

Post Comment