Why “Private” is the Untapped Goldmine Every Entrepreneur Overlooks—And How Owning It Can Explode Your Business Growth Overnight

Ever get that feeling the public markets you once knew are quietly disappearing, like your favorite local coffee shop being replaced by yet another bland chain? Well, that’s exactly what blogger 3652 Days is tapping into — the public markets keep shrinking, IPOs are becoming rarer creatures, and capitalism is increasingly cloaked behind hush-hush NDAs and closed doors. So, in a witty twist of rebellion against passive investing dogma, they’ve started sneaking into private market investments through listed private equity vehicles — no $5 million buy-in, no Cayman lawyer required. I’m right there with them, juggling my active and passive sides, shifting money into private spaces where the rules are different and, honestly, a bit more complex. But here’s the crux: for purely passive investors, the private market is a whole different ballgame. You can’t just kick back and rely on the wisdom of the crowd because, well, the crowd’s just not invited. That brings bigger questions — are we heading toward a financial landscape where higher fees, less transparency, and tougher diversification become the norm? Maybe it’s time to wonder if the shrink-wrapped glamour of private markets will undo the rise of indexing as we know it. Dive into this thought-provoking shift—your portfolio might thank you for it… or at least make you think twice before going fully passive. LEARN MORE

What caught my eye this week.

Blogger 3652 Days has a great post up about why they’re shifting more of their money into private market investments, writing:

As a passive investor, I’m supposed to do nothing. Ideally forever. Also: I dislike thinking too much.

But public markets keep shrinking – fewer IPOs, more delistings, and an ever-increasing proportion of capitalism conducted behind NDAs and closed doors.

So, in a lapse of principle, I’ve been buying shares in listed private equity vehicles and management outfits – Oakley Capital Investments (OCI), Brookfield Corp (BN), and Blackstone (BX), to name a few.

This is the private equity exposure accessible without the $5 million minimum investment, a Cayman lawyer, and a relationship manager who calls you by first name and means it.

It is, admittedly, a semi-active decision. But then, so is breathing.

I’ve long identified the same trends in markets. For good or ill, as an active investor it’s a lot easier for me to shuffle some money into different pockets of the private space, whether it be through crowdfunded investments, or via some of the vehicles that 3652 Days discusses in their article.

But purely passive investors face a quandary with private markets. Investing widely in private companies is a very different proposition to buying into a basket of public companies via an index tracker.

Not only in the many technical ways that 3652 Days outlines. But also because by definition when you buy a private asset you cannot lean so much on the wisdom of the crowd (the public market) to assume you’re (usually) paying something like the appropriate price.

It’s a big existential divergence. It also potentially brings company analysis and fund manager skill back into the picture, which inevitably means higher fees.

No wonder the financial services industry likes private and alternative assets…

Fee-ver pitch

As I wrote recently for Moguls:

The fees on private funds are much higher than for cheap index funds. And as I explained above, private assets are always more opaque and illiquid.

Yet if we run the trend to stay/go private to its logical conclusion – and public markets continue to shrink – then we could all end up paying more in annual fees to hold much the same equity mix we once got cheaply via a tracker. And we’ll have far less idea about what we own and what it’s worth for the privilege.

Maybe this is what ultimately defeats the rise of indexing and passive investing?

The zero-sum maths of active investing in public stocks is irrefutable. So perhaps financial services simply changes the game instead.

A world where a huge proportion of our money goes into private market investments – and into the pockets of private managers – would be a step backwards for everyday investors.

Run to the logical conclusion, it’d mean we’d pay more for less transparent and likely less comprehensive diversification than we already get today from trackers. And yet with all that private money pooled into big pots, you’d not even have the fun of pursuing a 100-bagger.

We’re not there yet. We can still diversify widely via index funds. And it’s too soon to be sure that listed small caps are underperforming simply because the best start-ups are remaining private.

However the push to private (both in equity and debt) is for now the clear direction of travel. So take some time to read the roadmap at 3652 Days.

Have a great weekend!

From Monevator

Asset allocation rules of thumb – Monevator

Regular savings accounts for fun and profit – Monevator

From the archive-ator: They don’t tax free time – Monevator

News

Steeper productivity cut of £20bn makes tax rises more likely – Guardian

Reeves plans Budget council tax raid on expensive homes… [Paywall] – FT

…and is urged to cut pension tax-free lump sums to £100K – Telegraph via MSN

Nationwide: UK house prices ‘resilient’ – This Is Money

Santander boss urges intervention on car finance compensation – Guardian

Sky claims to have obtained Treasury’s definition of ‘working people’ – Sky

How deprived is your area? [Interactive tool] – Guardian

Amazon laying off 14,000 corporate workers as it invests in AI… – CNBC

…but is that what is really driving the job cuts? – BBC

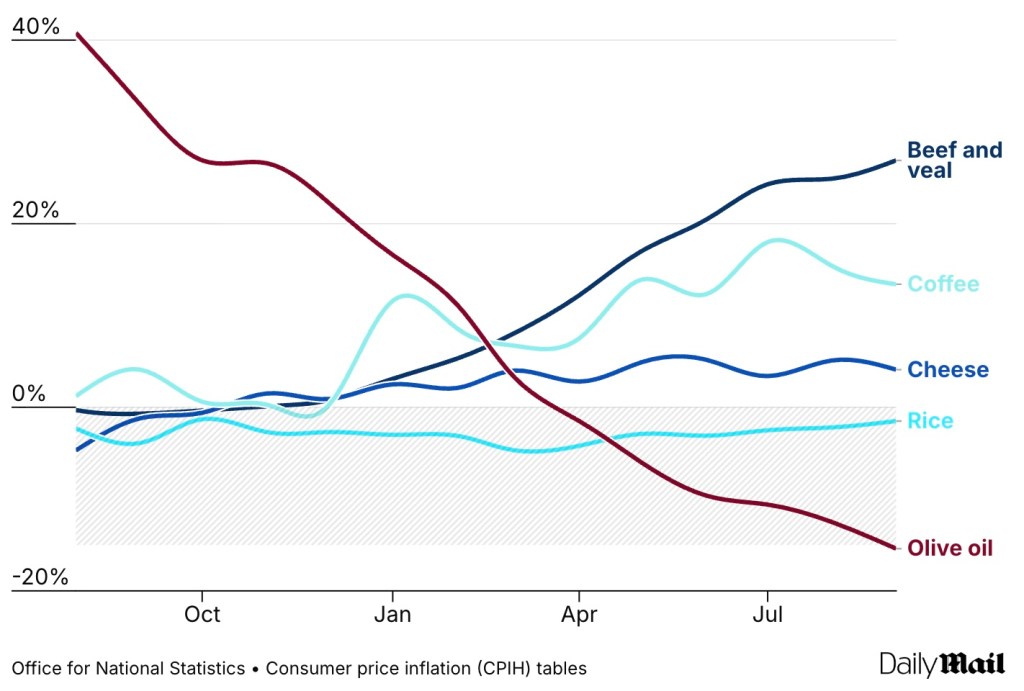

Olive oil: not so much – This Is Money

Products and services

Disclosure: Links to platforms may be affiliate links, where we may earn a commission. This article is not personal financial advice. When investing, your capital is at risk and you may get back less than invested. With commission-free brokers other fees may apply. See terms and fees. Past performance doesn’t guarantee future results.

Barclays lowers mortgage costs as further rate cuts loom – This Is Money

Be wary of whiskey cask ‘investments’ – Which

Crypto funds price war erupts in UK [Paywall] – FT

Get up to £200 cashback when you open or switch to an Interactive Investor SIPP. Terms and fees apply, affiliate link. – Interactive Investor

Is a fixer-upper the best way to a dream home? – Guardian

Home insurance premiums are falling – This Is Money

Can you get the Chase Bank £100 switch offer? – Be Clever With Your Cash

Get up to £100 as a welcome bonus when you open a new account with InvestEngine via our link. (Minimum deposit of £100, T&Cs apply, affiliate link. Capital at risk) – InvestEngine

Klarna launches new debit card and membership scheme – Which

Supermarket Christmas savings schemes – Be Clever With Your Cash

Does your motor and home insurance cover rodent damage? – Which

Stylish bungalows for sale, in pictures – Guardian

Comment and opinion

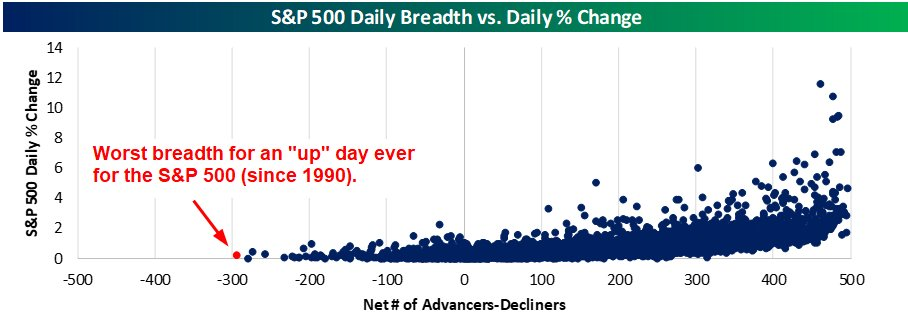

Beating the market is harder than you think – My Money Blog

The case for a good enough portfolio – Morningstar

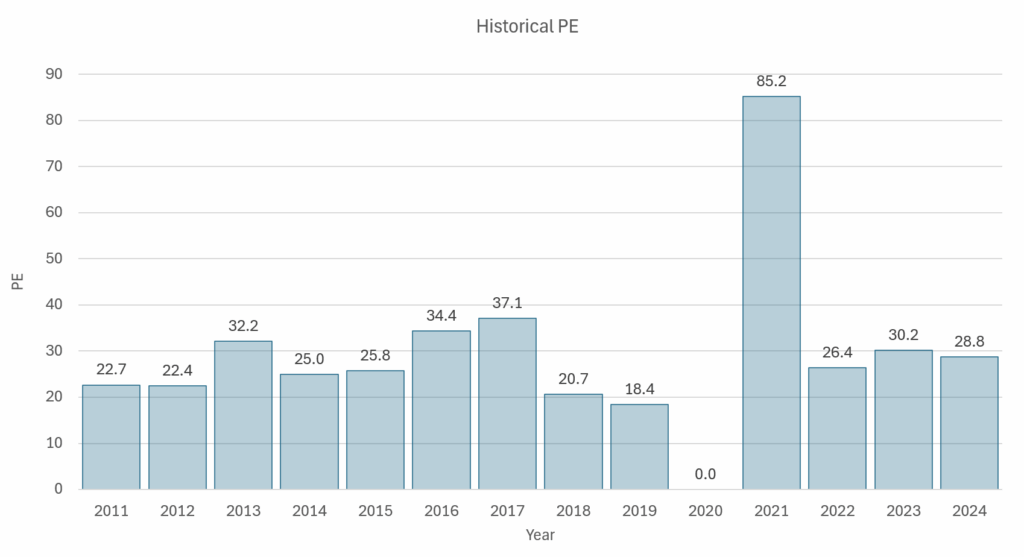

Maybe it’s not a bubble… – FT

…but if it is a bubble, so what? – Brooklyn Investor

Trying to time the market is like playing The Traitors – Behavioural Investment

Jesse Livermore and the magnet of dancing stock prices – A.W.O.C.S.

If your job didn’t exist, would anybody miss it? – Klement on Investing

What true wealth looks like – The Atlantic

Regrets in ‘unretirement’ – Next Avenue

How to benefit from good advice – Contessa Capital

What’s going on with gold? – Of Dollars and Data

Art Laffer on UK’s economic woes [Podcast] – Merryn Talks Money via Spotify

The impacts of romantic relationships with the boss [Research] – via SSRN

Naughty corner: Active antics

Will attending an investment conference make you sad? – The Falling Knife

Size matters in factor investing – Alpha Architect

How consultants drove an asset allocation shift at pension funds – Verdad

Cryptocurrency as an asset class – Quantpedia

How does inflation impact trading? – Alpha Architect

A reading list for would-be traders (as opposed to investors) – Moontower

Kindle book bargains

Poor Charlie’s Almanack by Charlie Munger – £0.99 on Kindle

The Man Who Solved the Market by Gregory Zuckerman – £0.99 on Kindle

Chip War by Chris Miller – £0.99 on Kindle

Meltdown: The Collapse of Credit Suisse by Duncan Mavin – £0.99 on Kindle

Or pick up one of the all-time great investing classics – Monevator shop

Environmental factors

Insurers call for ancient trees to be felled as quick fix for subsidence – Guardian

Inventor up for award for tackling microplastics – BBC

Richest 0.1% in US emit 4,000x the carbon of world’s 10% poorest – Guardian

Coffee-driven deforestation is making it harder to grow coffee – NPR

Two crucial coral species left ‘functionally extinct’ by latest heatwave – Guardian

In memory of the Christmas Island shrew – Mongabay

Robot overlord roundup

Surviving the AI capex boom – Sparkline Capital

When your favourite bands new song is an AI fake – NPR

How Hudson River Trading actually uses AI [Podcast] – OddLots via Spotify

AI models may be developing a survival drive, researchers say – Guardian

When AI breaks bad [Paywall] – Wired

Current AI has no intelligence – The Register

Not at the dinner table

The cosmopolitan conservative [Paywall] – FT

Our hypocrisy blind spot – Behavioural Scientist [h/t Abnormal Returns]

Dating across the political divide in America – Cosmopolitan

After Trump, the deluge – Noahpinion

The US is a casino economy now. You’ll probably lose – New York Times

How Trump’s ballroom will dominate the White House – W.P. via MSN

Off our beat

Why we doubt ourselves – More To That

“I dressed up as a superhero for Halloween, then saved a life” – Guardian

Grokipedia is racist, transphobic, and loves Elon Musk – The Verge

Why you feel the cold more as you age – Independent

The decline of deviance – Experimental History

Could the Internet ever go offline? – Guardian

The country making orphanages obsolete – Reasons to be Cheerful

900,000 vs 9 – Seth Godin

And finally…

“Happiness is found in doing, not merely possessing.”

– Napoleon Hill, Think and Grow Rich

Like these links? Subscribe to get them every Saturday. Note this article includes affiliate links, such as from Amazon and Interactive Investor.

Post Comment