How I Turned Zero Real Estate Experience into $36,000 in Just 90 Days—And You Can Too

Ever wondered what happens when you swap your old career dreams for a whole new hustle—like diving headfirst into real estate investing? Picture this: once on a path to Nashville stardom, Tori Tyler found herself at a crossroads when the world suddenly hit pause. Instead of letting that derail her, she pivoted hard, turning the unexpected chaos into a golden opportunity that raked in a jaw-dropping $36,000 profit on her very first flip—all within just three months. Talk about turning the tables! Battling the usual rookie traps of analysis paralysis and info overload, with a bit of mentor magic and strategic networking, Tori crafted a real estate story that’s as inspiring as it is profitable. Now, swinging into her second flip and plotting a smart move into short-term rentals, Tori’s journey is a masterclass in resilience, savvy investing, and making your own luck. Ready to get inspired and maybe rethink your own career playbook? Dive in and see how bold moves pay off big. LEARN MORE

What happens when you leave your career to pursue real estate investing? Once dead set on becoming a country music star, today’s guest was forced to rethink her future when the world came to a screeching halt. Thankfully, real estate was the exact pivot her young family needed, allowing her to make a huge profit on her very first real estate deal!

Welcome back to the Real Estate Rookie podcast! For three years, Tori Tyler had wanted to jump into real estate, but like many newbies, information overload and analysis paralysis kept her on the sidelines. But eventually, with the guidance of a mentor and by attending networking events, she gained the confidence to take down her first deal—a house flip that pocketed her $36,000 with just three months of work!

Now, Tori is completing her second flip, and in the future, she plans to use short-term rentals to offset her family’s W-2 income and give them another place to vacation. If you want to know how to pivot from your current career and become a full-time investor, Tori’s story of bold pivots and bigger payoffs might just be the spark of inspiration you need!

Click here to listen on Apple Podcasts.

Listen to the Podcast Here

Read the Transcript Here

Ashley:

What do country music, motherhood and a $36,000 flip have in common? Well, today’s guest thought she was headed for Nashville stardom, but when the world shut down, she made a bold pivot that changed everything. And trust us, this rookie didn’t just dream big, she took action.

Tony:

Today we’re sitting down with Tori Tyler, a first time flipper who crushed her debut deal and is already scaling up. We’re getting into the numbers, the mindset, and the exact steps she took to go from analysis paralysis to profits.

Ashley:

Welcome to the Real Estate Rookie podcast. I am Ashley Kehr.

Tony:

And I’m Tony j Robinson. And let’s give a big warm welcome to Tori. Tori, thanks so much for joining us today.

Ashley:

Thank you guys for having me. I’m excited to be here. So Tori, to start us off here, you moved to Nashville to chase music, not real estate. So how did you go from that dream to actually starting to think about real estate investing?

Tori:

Absolutely. So yeah, real estate was never a part of my plan, which is kind of interesting because my aunt and my dad are both realtors and have been for a very long time, but I never considered it for myself. I started music at a really young age and always thought, this is what I want to do with my life. So after I graduated college in 2019, my husband and I moved to Nashville and I did exactly that. It was chasing the dream. I was writing songs and playing shows. I had a waitressing job just to do that in the mornings and then go alongside of my music, and that’s what I was doing and chasing. And then COVID happened, and it’s funny, I was actually walking on stage to do a show and the manager of the bar came out and was like, Hey, we have to shut down right now.

Tori:

The city just put something out that we have to close our doors. Everyone has to go home. You can’t play tonight. And I’d already paid my musicians everything. And they were like, well, you can’t play this show. And then I mean, everything shut down. All my shows got canceled. And it was kind of this moment of like, okay, what now? What am I going to do? I also got laid off from my waitressing job. Everything went to online to go orders. So I had a lot of time at home to think, what am I doing? What’s going on? What’s something that I can do besides waitressing? If the world goes back to normal, that would actually make some money and could still go alongside music. And so I thought about real estate, the market in Nashville, if you guys you probably know about that went crazy during C.

Tori:

And so I was like, might as well get my real estate license, see what this is all about, could make some good money, and it’s still flexible enough to be able to play shows. So got my real estate license in Tennessee and just continued to do that. And music actually did really well. My first year I joined really big brokerage up there with Max. They’re the number one max team in the world. So I learned a ton, got a lot of good knowledge, got a lot of good leads, was able to kind of jump in with traditional real estate and found that I actually really liked real estate. My husband and I ended up buying our first house during that time, about 30 minutes outside of downtown Nashville. And we planned on pretty much staying there forever. We were going to just settle in Nashville and raise our family there and that was going to be it. And then I had a baby and about one week after having that baby, I said, we got to move back home. I need my family. I need some help. And it was also freezing up there. I’m a Florida girl through and through and it was a snowstorm up there and I was trapped inside with a baby and I was like, honey, we got to move.

Tony:

I want to get into the move, Tori, but before we do, I just want to circle back to that moment because obviously COVID impacted so many people in so many different ways and obviously there were lives lost, but there was also this other component of a lot of people just reshaping what they want the rest of their lives to look like. It’s the whole world just kind of took a moment to breathe and reassess and say what I want to do next. But I guess what was going through your mind, it’s like you have this dream that you’ve worked your whole life towards and in a moment it almost gets pulled away from you. Do you feel like you were giving up on that dream? I guess how did you stay motivated or just what was going through your mind when your dream of becoming a musician is going away, the income that you had is disappearing? How are you staying motivated during that timeframe?

Tori:

So I would say that combined with having a kid is really what kind of shifted my dreams and goals. I would say as far as the music industry also during COD, the music industry changed a lot. Most of it became virtual, and so it was a lot of, you have got to build your social media brand, you’ve got to build that presence, you’ve got to be putting out tiktoks every day. And it just started to look a lot different than just going out and writing songs and playing shows. And so just during that time was kind of like, is this what I really want? And then having a baby, I’m like, do I want to be on the road and traveling and playing shows 50 weeks out of the year or is that maybe something that I can still do as a hobby, but it might not be my main thing anymore?

Tori:

And so it was kind of a closing of a chapter that I kind of had to grieve in some way. I grew up my whole life thinking this is what I want to, and then I had to realize it’s okay for your dreams to shift. And this real estate thing was a new passion inside of me that I never knew existed. And so realizing it’s okay that is now maybe taking priority where music used to be that for me. And so I would say it really solidified once I had my first daughter of like, okay, I want to be able to build something for our family, not just for me to be a star and be singing and playing shows, but something that will allow me to spend more time with my family and build something for our future. And I feel like that just kind of led me in the direction more of real estate.

Tony:

Tori, once you had that realization, I think a lot of people listening understand the power, the importance, all the things that come along with being a real estate investor. But once you made that decision, what did you actually start doing to get yourself ready to get that first deal?

Tori:

Like I said, I started out just as a realtor, so I wasn’t even initially interested in investing. I didn’t even know what that looked like until we moved back to Florida. We sold that first house that we bought right outside Nashville and in one year, so we bought it for $305,000. One year later we sold it for $450,000 without doing hardly anything to it. And that right there really got my attention and we sold it off market. I didn’t even have to do a showing anything. And so I was like, man, this is powerful. This can open doors. This is something that I should really start looking into of how can we do more of this? How can we tap into this side of the industry? And so that is really what started my, I guess thought process of just outside of being a realtor, investing things that we can do for us.

Tori:

But then for three years I just took in information and did absolutely nothing. I was like the person who you would say was totally stuck and the analysis paralysis side. I was listening to podcasts and I was reading books. And even when I got to Florida, started going to networking events and meetups and things, but I was never putting that into action. I would dabble in this and dabble in wholesaling or cold calling or do a few of these things, but never stuck to any strategy and just felt this overwhelming, I don’t know, I’m just spinning in circles. I’m not actually doing anything. And so finally it was last October, my husband looked at me and was like, okay, you need to stop talking about it and you need to do it. It’s time to do it. We had decided we were going to start with doing a flip and that’s the direction we were going to go. And so he was like, I’ll support you however I can, but you just got to pull the trigger and do it. So that was kind of my motivation to get off my butt, stop twirling and actually get started doing it for us.

Tony:

So for real, managing tenants can feel like a lot of work, but they don’t have to be. For me, it all changed when I found Turbo Tenant. They’re a free software that makes managing rentals super easy. I used to waste so much time on paperwork chasing down rent, but now with Turbo Tenant, I have everything in one place. They even have state specific leases, digital condition reports, and a simple way to schedule showings without all of the back and forth. Their automated rent collection saves me hours every month and their maintenance management keeps me organized. Everything’s in one place on your phone so you can be a landlord from anywhere. I’m actually good at managing rentals now, not just finding deals. Check it out at turbo tenant.com/biggerpockets and create your free account today.

Ashley:

Okay, we are back with Tori. So Tori, let’s first talk about your strategy. Why did you choose flipping over any other strategy like rentals or even wholesaling?

Tori:

Yeah, absolutely. So I have a good mentor here in Jacksonville that I’ve learned a lot from and she has a very successful flipping business here. And just after talking with her and she started with wholesaling, I looked into that for a little while and was like, I don’t really have the time to cold call all the time and go out and door knock and do all these things to maybe get wholesale deals and flipping just seemed like something that would be fun, would be exciting, something my husband and I could do together a big project and we had saved up enough to have a down payment, and so we decided to just start with that and go for it. I ended up going to a networking event and I had my second daughter by this time, she was in my front pack carrier taking a nap.

Tori:

She went with me, she slept the whole time. And I ended up meeting a girl at this networking event and her husband had started a wholesaling company, like a brokerage here in Jacksonville, and they find deals, distress properties and sell them to investors who are looking for rentals or to flip. And so I was like, Hey, that’s me. I want to get on your buyer’s list. And so we did and they started sending us properties and about the third property that we got from the agent there, I just hit my inbox and I had a good feeling about it, so I was like, let’s go take a look. So we went out and took a look at it and it ended up being the one. What’s funny is that I was FaceTiming my mentor, I was just talking about, and she was like, this isn’t really a zip code that I venture into in Jacksonville. I don’t flip in that zip code. She was kind of giving me some red flags and things to look at and I was just like, I don’t know. I was just starstruck with the whole idea. And so I was like, I have a good feeling about it, so I’m just going to do it. Looking back, I’m like maybe should have taken my advice.

Tony:

And Tori, I think that was going to be my question, right? I think a lot of Ricky investors can get enamored with a deal because maybe it is the one that they kind of feel makes the most sense, but how do we balance that excitement against the cold hard facts of what a good deal looks like? So I guess my first question is, knowing what you now know, would you still have done that first flip?

Tori:

It’s so hard to say that because knowing what I know now, I know I made money, but I did have a little bit of buyer’s remorse after I bought it. I was like, oh, I started to have that freak out moment of like, oh my goodness, this is the biggest house on the block. This person says, don’t ever buy the biggest house on the block. Well now we’re really going to be messed up. Started going into all these things and there were a few unexpected things that came up we didn’t see in the beginning that cost it a little more money, but I still think there’s something to that gut feeling. And we had looked at a few that we did say no to, and this one I really feel like had so much potential and that I looked at the comps, I knew it could sell, and that’s where being a realtor too helped me a little bit. So I would say I still would’ve bought it.

Tony:

And you touched on it a little bit, Tori, but I guess what else about the deal if your mentor is saying, I don’t really know what else about it made you feel like, okay, I think this one actually does make sense.

Tori:

So it had just come out in the pipeline for this company and there were several other investors lined up ready to jump at this, but we had first dibs because we scheduled first. So that made me feel good that there were other people also really interested in this. What’s funny is that we had to have a $10,000 deposit to put down to secure it for this company, and it was a Saturday. I didn’t have my checkbook, so I had to drive to the bank and pray that nobody else was there with their $10,000

Tony:

Or that was just a really good wholesaler trying to build some urgency. That

Tori:

Could be it as well.

Tony:

They’re banging down the door, you got to get your offer in quick, get your EMD over here.

Tori:

Exactly. But no, I mean the area, it’s a very up and coming area in Jacksonville. It’s about a mile from the heart of downtown where there’s lots of cool breweries and restaurants and new businesses opening. And so I felt like it could be a really good rental for someone or a home for somebody to live in. So I on the realtor side felt like this has good resale value. There’s a lot of potential here. And I really liked that It was mainly cosmetic. It had solid foundation, it had a new roof, it had a new hvac. All we had to do really was get in there and update all the cosmetics, which is what I wanted for my first deal. I didn’t want a full gut to the studs rehab.

Ashley:

I think this example has two points to it, and the first is you had a mentor that was basically telling you, no, this isn’t a good deal not to do it. And I think there’s a lot of rookie investors that are waiting for a mentor to tell them, yes, buy that deal, or No, don’t buy that deal. I mean, you go through the rookie Facebook group, you go in the forums and people asking, is this a good deal when it comes down to it and you are face-to-face with the deal and you are the perfect example of this, it doesn’t matter as much what that person is saying because that deal could be right for you but wrong for them. And when it comes down to it, you’re going to make the decision based upon the facts that you have in front of you, your life, your comfortability, the risk you’re willing to take.

Ashley:

So I think it’s an example of don’t have analysis paralysis because waiting for a mentor, you’re waiting for someone to tell you yes or no because even if they tell you their thoughts on it, majority of people are going to make the decision on their own. Especially real estate investors, entrepreneurs, they are focused on what is going to work for them. And so just remember that if you are a rookie listening, waiting for that perfect mentor to tell you, yes, do this deal, no, don’t do that deal that you may not even take their advice after all, because that deal will work for you.

Tori:

And I think that’s so important. At the end of the day, you have to be responsible and accountable for your own business. Somebody else can’t be the one to tell you, yes, you should do this, or no you shouldn’t. You have to kind of own it. And I think that in that deal, she was able to guide me and give me advice. But we are very different investors and I’ve realized that even after just doing my first flip is we have a lot of differences, which is totally fine because what works for her, again, like you said, might not work for me and vice versa. So it makes me more confident as an investor knowing that, okay, I can still be successful doing it a different way. And I think that is what is great about real estate.

Tony:

And Tori, I just also want to highlight that you didn’t wake up on Monday morning and to say, Hey, I want to invest in real estate and then go submit this deal. You had been setting, you said for a few years prior to that you were an agent in the area, so you had a strong foundation to be able to make this judgment call. So I just want to highlight that for the rookie audience, because we’re talking about going with your gout, we’re talking about maybe making decisions for yourself, but only if you’ve put in the work in the same way that Tori did to be able to confidently do that and not just waking up on a random day and trying to submit offers on deals that nothing about. But Tori, can you break down the numbers for us? What was your purchase price, your renovation budget? What did you initially project as your rv?

Tori:

Yeah, so we bought this house for $118,800. Our renovation ended up being about 45,000. And so the people who sold us the house kind of give us an estimated a RV, and they had it at two 10. So I was working all my numbers based off of that. We ended up selling it. I listed it at 2 25 and we sold it four days on the market. We had an over asking price offer, 2 28, 7 50.

Ashley:

I have to say, it’s not often you hear that your A RV is actually higher than what the wholesaler says. Usually it’s reversed. They’re always at the top end. Yes,

Tori:

We built a great relationship with this wholesaling company and they actually just sold us our second deal as well. But yeah, so I was totally blown away that we were able to go that much over and have an offer in four days. It was the perfect setup.

Ashley:

And what did you end up profiting off of that deal?

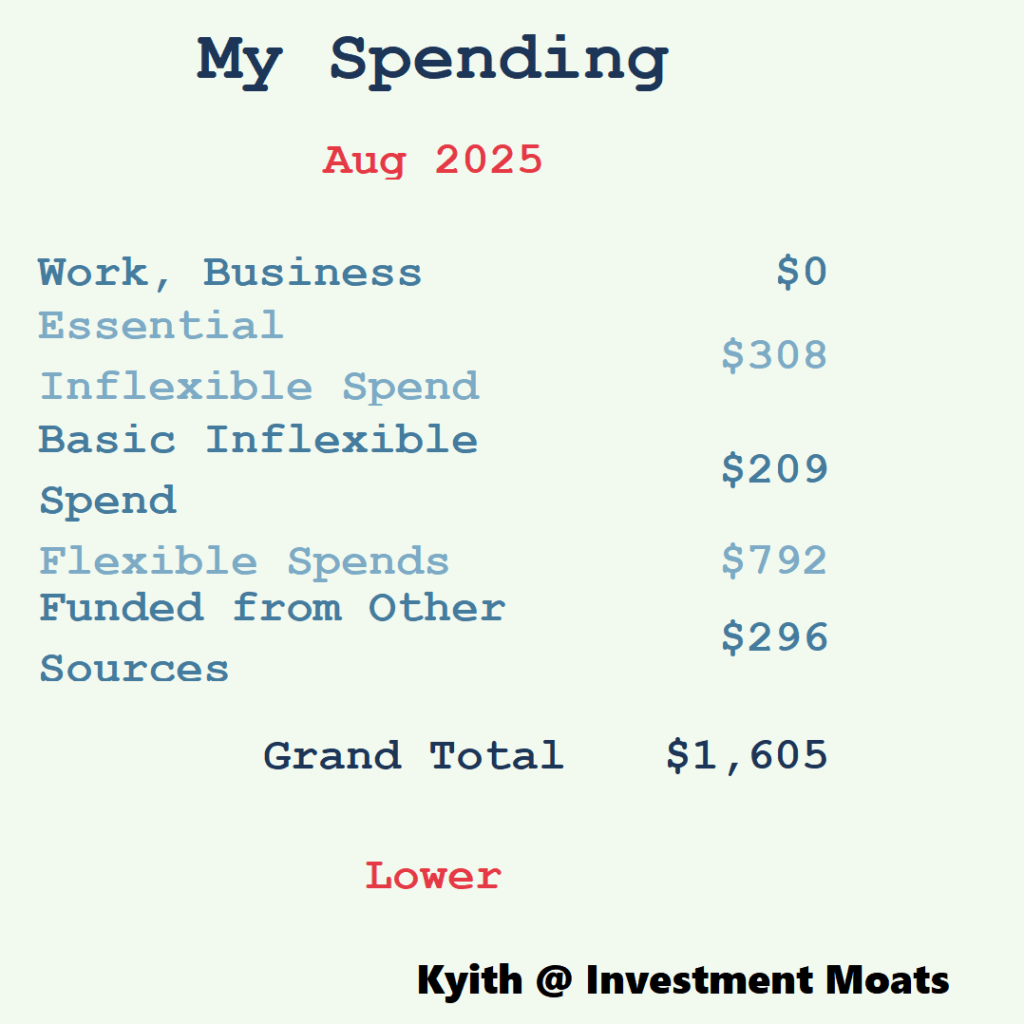

Tori:

So we ended up profiting about $36,000, and what’s amazing is going into this first deal, I was really just like, Hey, if we can break even on our first deal, I’ll be happy. My husband was like, no, we need to make some money. But I was like, Hey, at least we’ll have the knowledge. We’ll feel better going into the next one. Let’s just try to break even. So seeing a profit that big was, I mean, and for some people might not be that big, but for me, $36,000 hitting the bank account was a big deal. So I was very, very, very happy with that, especially in this market.

Ashley:

Well, and let’s talk about what you had to do to earn that $36,000. So how long did this project take and how active were you and your husband in this deal? Were you guys there every day? Were you guys the contractors? What did you actually have to do to earn that 36,000?

Tori:

Yeah, so we bought it January 31st of this year, 2025, and the rehab took exactly about eight weeks. We did hire a contractor to do most of the work, but my husband is very handy, loves doing projects, all that kind of stuff. So we wanted to get a little bit of sweat equity in there. So we did things like I ordered all of the fixtures and hardware, lighting, all of that, and we installed those things. We built wooden shutters to go on the front porch. I painted the front door. We did smaller projects like that. We did all the landscaping, just things that would bring the cost down a little bit and that we could easily do. Also was helpful for recording content for social media of us doing things. People love to see that. So we got our hands dirty a little bit, which brought the cost down, but I went by at least twice a week just to check on it, make sure things were going well, make sure that progress was being made.

Tori:

And we did go by, this was the second week when the plumbing and electricals all being kind of fixed and up to standard and we walk in and there’s water shooting out of the shower head all over the walls, all over the light fixture that had been left on. So that’s one of those moments where I was like, oh my goodness, what do we get ourselves into? This is crazy, one of those nightmare moments. You’re like, I hope this never happens. But I’m glad that it did happen because one, it wasn’t a huge deal. The new drywall wasn’t even up yet, so it wasn’t like it ruined anything. It made me realize, okay, this was one of my worst fears, and then it happened and it wasn’t that bad. We got through it, it’s not as scary as you think it’s going to be. And so that was a really big learning point for me of like, okay, we found this issue and we moved on and we still were able to make money.

Ashley:

So when did you actually sell the property? You bought it in January and then when did it close?

Tori:

Yeah, so we put it on the market April 1st, and we closed on May 5th. So all in all, it was about three months.

Ashley:

So to make $36,000 over three months and do some of the work in the house, I mean, I think that is a great deal.

Tori:

My husband has a W2 job. He’s in law enforcement and does that. I’m a mom to two little girls and we just fit it into our life and we were like, man, that was not as hard as we made it out to be and let’s do it again.

Ashley:

And it’s something you can do on your own time. You could pick and choose when you’re going to go work on the house, when you’re going to do that, what you’re going to outsource, what you do want to put sweat equity and just gives you so much flexibility. Yes, 100%.

Tony:

Tori, I’m curious about the financing piece. You talked about the purchase price and how much you guys put on the rehab, but how did you fund all of that? Was it you guys just paid cash? Did you have a rich uncle who funded the deal for you guys? What process did you guys use to get the funds to execute?

Tori:

Yeah, so we ended up using hard money for the purchase of the house, and then we used private money for the rehab. So we had a family member who was interested in investing and so we were like, Hey, you guys, if you would like to fund the rehab, that would be great. So they did that. And then for the rest of it, we used a hard money company that was associated with the wholesaling brokerage that we used. They connected us and got us all set up.

Tony:

So did you guys have any cash out of your own pocket for this deal?

Tori:

Yes. So we had to, as far as down payment and closing costs, we had to bring about $25,000 to the closing table.

Tony:

So you guys brought 20 5K, hard money, covered the other 80% of the purchase, and you brought in private money to fund the rehab. How did you guys structure the private money lender debt.

Tori:

So we had a second mortgage drawn up with the title company to make sure that everything was good to go there and they were secured with their money and then they would just pay us whenever we needed to draw and we would pay the contractor that way. And then at the end, we were able to just give them a lump sum of all their money and they actually collected their interest at the end. So we weren’t paying them monthly throughout. They didn’t really need that monthly, so we just lumped it all at the end and gave them back their money plus interest.

Tony:

I think that’s from a borrower’s perspective, the better approach, right? Because you’re able to conserve your cashflow and I think oftentimes if you’ve got a lot of flip projects going on, sometimes that can be the hard part of scalings that you have so much going out servicing this debt on a monthly basis. Were you also able to set up that arrangement with your hard money lender or was that a monthly payment that had to be made?

Tori:

Theirs was monthly, so we had to pay them their monthly interest, which is a decent payment. So it was nice that we were able to get this done so quickly, so we only had to make I think two payments.

Tony:

Then just ballpark, Tori, what was the interest cost for both the private money and the hard money or just the interest rate? I’m sorry, you can just tell us the interest

Tori:

Rate. Yeah, our private money, we did a 10% interest and then our hard money was 12% plus two points upfront.

Tony:

Can you explain the points upfront for Ricky’s that aren’t familiar with that phrase?

Tori:

Yeah, so a point is 1% of the loan amount, so two points would be 2% of that. So that’s just part of your closing costs upfront in order to get that loan.

Tony:

Alright, Tori’s first flip wasn’t just a one on paper, it was a mindset shift that changed how she saw real estate and herself, but was it just beginner’s luck or a start of something bigger? When we come back, we’ll dig into what that $36,000 profit taught her, how she built confidence through action and what pushed her to go on to flip number two. We’ll cover all that right after. Quick word from today’s show sponsors. Alright, so we’re back here with Tori. So Tori, you mentioned before the break that the same wholesale company that gave you your first deal, you just closed on another deal with them. What’s different about this second flip when you compare it to the first one?

Tori:

I think just my confidence level going into this one is totally different. I feel like I have more of a sense of what I want to do with the property. The first one I’m just, I was relying more on the contractor, relying more on other people. This time I just have a little bit more confidence in like, okay, I’ve done this before, I know that it can work and here’s exactly what I want for the next one. This one is a little bit different and that we actually are using a HELOC for our renovation costs versus using the private money. So we had just been listening to other people and decided we would have a better interest rate using the heloc. So we’re doing that this time. We are still using hard money for the purchase or that’s what we use for the purchase of this one, and we’re actually going with a different contractor this time.

Tori:

So nothing major happened with the last contractor. It’s just you want to build a relationship with someone and we personally want to find someone that we can grow with. The last contractor that we use had a really big company, which is awesome, but we were just looking for someone who was kind of more starting their journey as well, and we can grow together and have just kind of a closer relationship, more communication and just build that solid foundation. And so we’re using so many different this time it’s going really well, but it’s pretty similar as far as neighborhood and the area scope of work. This one does have a little bit more and involved as far as plumbing, it had to be totally replumb, all the pipes were cast iron, all that. So we’re having to replace all of that, all the electrical needed to be updated, but still a new roof on this one. And basically just all the cosmetics as well.

Ashley:

Now looking forward, do you have any interest and pivoting from flips and doing long-term buy and holds or short-term rentals?

Tori:

Absolutely. So our goal is to do two to three flips and build up capital and then buy an Airbnb. So we’ve been listening, I’ve been listening to this podcast for a long time. One of my favorite episodes is Laura Sides, and I love her strategy so much. We’ve actually become friends on Instagram and talk all. Oh, that’s awesome. The best. She’s so sweet and helpful and I know that’s what she does and uses the Airbnbs to offset taxes and I’ve just learned so much from her as well. And my husband and I would love to acquire some Airbnbs that we can use for our family as well. And we also have family that lives overseas, and so we’d love to find properties that they could utilize whenever they come back. So I feel like Airbnbs would just be a great route to bill a portfolio, have some flexibility for us to use in our

Ashley:

Family. That’s so funny because I was just talking to my mom yesterday about how my one son keeps asking, when can we go stay at the A-Frame? Because he was part of the whole remodel process, helped furnish it, put things together. And so he is like, when can we go stay there? Because we always talked about just think kids will be able to come here, stay whenever we want, enjoy this. We never ever go, maybe we’ve gone one time since we listed it and it’s just so funny. It’s like, do you realize I’ll have to pay a hundred dollars cleaning fee for us to stay there? Okay. It’s like such a funny mindset shift. We’ll have to block off two days, someone might book. That was our whole thing too. And it’s just funny that one property is to like, well, the money’s coming in, can’t have it. But yeah, we had the same thing.

Tony:

Well Ash, on that note, you mentioned one of your sons and Torah. You mentioned earlier that you’ve got two young kids. Same for me. I’ve got a teenager and two kids under two. How are you balancing the demands of your growing real estate business with your family?

Tori:

Yeah, absolutely. I take them with me a lot. Like I said, my youngest, she’s one, and I’ll still strap her in the front pack and we’ll go meet the contractor. It’s funny because everyone that we work with in this business knows her because they’ve seen her since she was literally two weeks old. I just bring her to everything. They’re like, Hey, Noah. So it’s just fun. She’s growing up around this. Literally at our last flip, we brought the little baby walker thing and just stuck her in that thing and she was scooting around the whole house while we were painting and caulking.

Ashley:

That’s a great idea.

Tori:

She loves it. And my oldest, she’s three and she’s in preschool, so she gets to go with us whenever she’s not at school and she always calls it the flipper house. So she’s like, can we go see the Flipper house? And they love it, so we just take them with us as much as we can. I feel like they just get to be a part of this journey, and at the end of the day, we’re building it for them too. So I want them to be as involved as possible.

Ashley:

Well, Tori, thank you so much for joining us today. We really appreciated the advice and the stories that you shared with us today. Where can people find out more information about you?

Tori:

Yeah, so I’m mainly on Instagram at Tori Jackson. Tyler and I also have been documenting everything about our flips on YouTube. So the link is there on my Instagram as well. It goes straight to my YouTube with all our videos, and I would love to connect.

Ashley:

Well, awesome. And will you be at BP Con in Las Vegas this year?

Tori:

I am working on getting there, yes.

Ashley:

Okay, awesome. Well let us know because we have a special discount code we can give you if you decide to come, but we would love to see you there. I’m Ashley. He’s Tony. And thank you guys so much for joining us for this episode of Real Estate Rookie.

Watch the Episode Here

Help Us Out!

Help us reach new listeners on iTunes by leaving us a rating and review! It takes just 30 seconds and instructions can be found here. Thanks! We really appreciate it!

In This Episode We Cover:

- How Tori pocketed $36,000 on her first house flip (in just three months!)

- Why this budding country artist gave up her childhood dream to invest in real estate

- How to break free from analysis paralysis and buy your first property

- Funding your first real estate deal using private money and hard money

- Fast-tracking your investing journey with the power of mentorship and networking

- And So Much More!

Links from the Show

Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email [email protected].

Post Comment