Is BlackRock’s 58% Bitcoin ETF Stake the Silent Force Ready to Shake Up BTC’s Future?

When BlackRock flexes its muscles, you know the game is changing—and fast. Their IBIT ETF gobbling up nearly 58% of all Bitcoin ETF holdings? That’s not just dominance; it’s a power play that raises an eyebrow or two. Makes you wonder—are we watching Bitcoin’s destiny being steered by a single titan, or is the broader market still calling the shots? Add to that the cooling off in futures volume—a subtle hint that traders are catching their breaths after an intense sprint—and a falling NVT ratio signaling healthier valuations. It’s like the market’s gearing up behind the scenes, quietly sharpening its knives for what could be a breakout moment. But here’s the kicker: with derivatives surging alongside ETFs, the speculative engines are revving harder than ever. So, what’s really going to push Bitcoin over the edge next—the steady hands of institutional flows or the wild cards in the derivatives arena? Hold on tight, because this mix might just set the stage for the next big move in crypto. LEARN MORE

Key Takeaways

BlackRock’s ETF dominance with a Derivatives surge shows institutions and speculators aligned, while cooling Futures and a falling NVT ratio suggest healthier conditions for a potential breakout.

BlackRock’s IBIT ETF now commands the Bitcoin [BTC] ETF landscape with 751,283 BTC, representing nearly 58% of all holdings.

Fidelity trails with 200,956 BTC, showing a wide gap that highlights BlackRock’s dominance. At press time, Bitcoin traded at $112,960, up 1.01% daily while consolidating near a critical level.

Having said that, this concentration raised concerns that Bitcoin’s next directional move may depend more on BlackRock’s flows than broader market forces. Institutional positioning stayed the key driver.

Are cooling Futures a warning for Bitcoin traders?

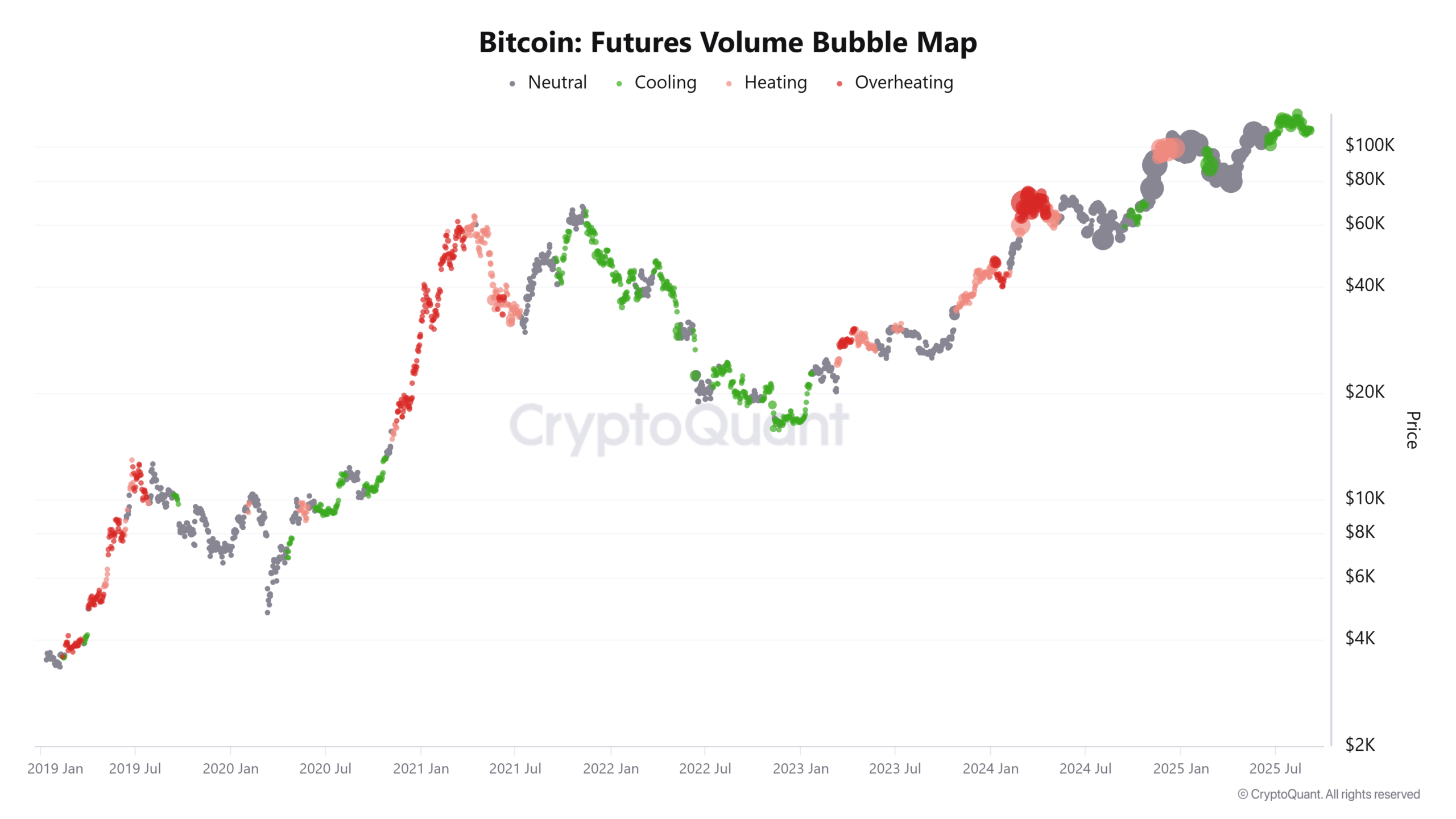

AMBCrypto analyzed the Futures Volume Bubble Map that indicated a cooling phase. It reflected reduced speculative demand in leveraged markets.

In contextual terms, it meant that traders are becoming cautious after heightened activity earlier in the week.

Consequently, declining Futures activity could also reflect hesitation in taking aggressive positions, especially with ETF flows dominating the headlines.

Since Futures often acted as a short-term barometer of sentiment – this, in turn, left participants recalibrating ahead of volatility.

Source: CryptoQuant

Does NVT ratio point to healthier valuations?

At press time, Bitcoin’s Network Value to Transaction (NVT) Ratio dropped 34%, reaching 27.93 at press time.

This decline suggests that the network is becoming more efficient relative to its market valuation.

While a lower NVT often indicates healthier, more grounded valuations, it doesn’t fully rule out the risk of market over-exuberance.

Traders should remain cautiously optimistic and rely on on-chain metrics to validate the strength and sustainability of the current trend.

Source: CryptoQuant

Why are Bitcoin Derivatives flashing speculative interest?

Bitcoin Derivatives markets saw explosive activity, with trading Volume surging 69.54% to $73.59 billion. Also, Open Interest (OI) rose modestly by 3.6% to $82.29 billion, as of writing, showing steady positioning.

However, Options activity took center stage, with Options Volume spiking 170.85% to $4.48 billion and Options OI climbing 4.03% to $53.23 billion.

Therefore, traders are increasingly turning to derivatives to hedge or speculate, amplifying potential volatility.

This surge in Options and Futures together shows growing speculative appetite, which, if sustained, could amplify Bitcoin’s next price swing significantly.

Source: CoinGlass

Can Bitcoin rely on ETFs or derivatives for its next breakout?

BlackRock’s commanding ETF share highlighted institutional control. Futures cooling hinted at fading retail aggression.

Meanwhile, the lower NVT Ratio showed healthier valuations, and derivatives activity reflected speculative drive.

This mix suggested Bitcoin’s next breakout could depend on ETF flows combined with derivatives positioning, setting the stage for a decisive move.

Post Comment