September’s Crypto Showdown: Which Contender—Bitcoin, Ethereum, or Solana—Is Poised to Dominate the Market Surge?

If you’ve been watching the crypto scene lately, you’ve probably noticed September hasn’t exactly been a walk in the park. Volatility’s been the name of the game, leaving investors squinting at charts and wondering—who’s really got the upper hand? Bitcoin’s premium gap and scarcity stats are flexing hard, seemingly cementing its throne. Ethereum, on the other hand, is juggling some shaky derivatives with surprisingly strong withdrawal numbers from exchanges—kind of like that underdog who quietly prepares for the big leap. Then there’s Solana, whose DeFi ecosystem keeps expanding like a stubborn weed, yet falling trading volumes are whispering caution in our ears. So, which of these crypto contenders is primed to take the lead this month? Is Bitcoin’s dominance just hype, or does its premium demand tell a deeper story? Can Ethereum’s spot accumulation outshine its derivatives headaches? And will Solana’s fundamental growth outpace its cooling speculative spark? Pull up a chair—because the clash of these digital titans is as fascinating as it is unpredictable. LEARN MORE

Key Takeaways

Bitcoin’s premium gap and scarcity metrics reinforce its dominance. Ethereum offsets weak derivatives with strong exchange withdrawals. Solana’s DeFi growth persists, though falling volumes spark short-term concerns.

Since the start of September, volatility has shaped crypto markets, with investors searching for direction after months of mixed performance.

Bitcoin [BTC] continues to anchor sentiment, while Ethereum [ETH] and Solana [SOL] each present unique strengths and challenges.

Institutional interest, derivatives positioning, and DeFi growth now form the critical factors that will determine which of these three assets emerges as the leader this month.

Therefore, examining structural signals, spot flows, and ecosystem data offers insight into the battle for dominance.

Is Bitcoin’s strength built on premium demand and scarcity narrative?

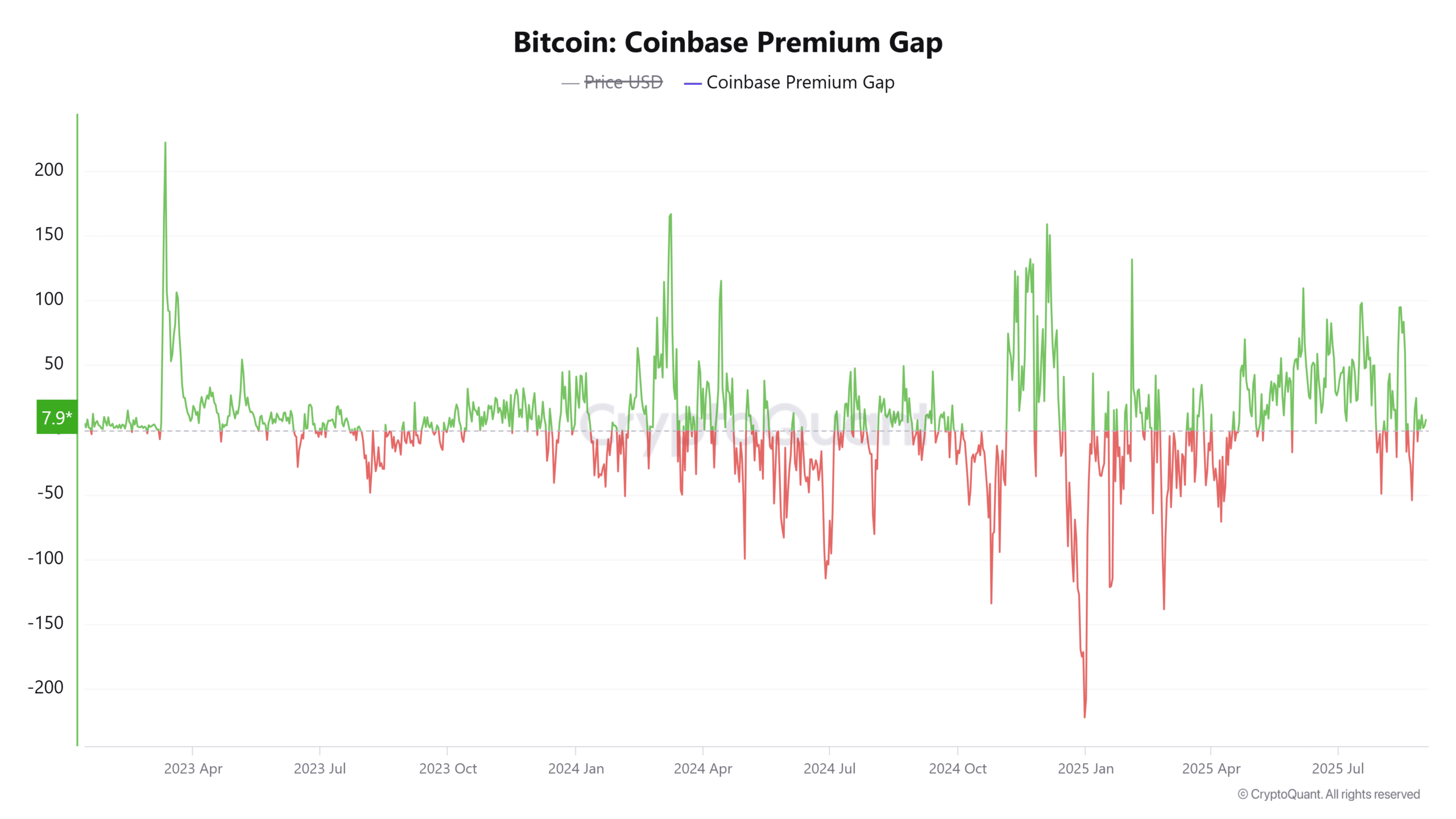

Bitcoin’s Coinbase Premium Gap surged by 129.67%, at press time, showing robust U.S. institutional demand compared to offshore exchanges.

This metric emphasizes that large investors are willing to pay higher prices domestically, adding strength to the market’s structural foundation.

Additionally, the Stock-to-Flow ratio jumped by 57.15%, reinforcing the long-term scarcity thesis that continues to attract attention. Together, these signals highlight that Bitcoin’s appeal is far from fading.

However, whether this demand translates into higher price action this month depends on sustained accumulation, especially as volatility continues to weigh on short-term moves.

Can Ethereum’s spot accumulation counter its derivatives weakness?

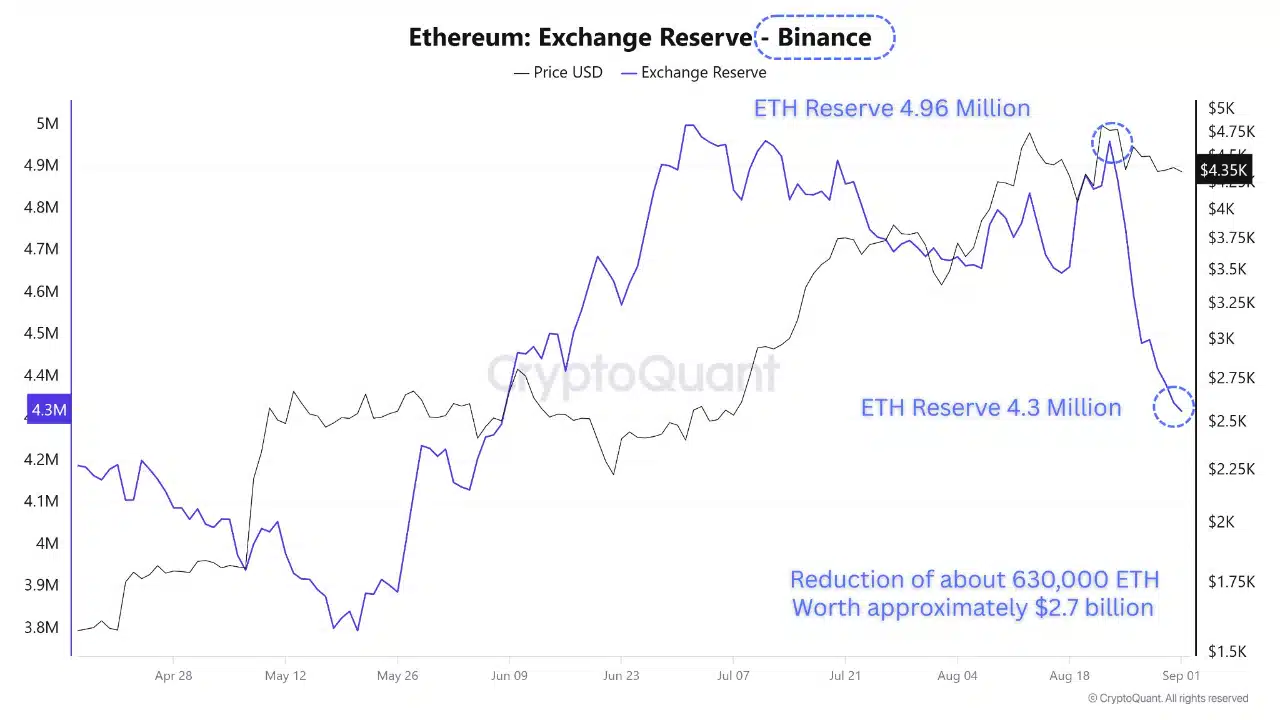

Ethereum’s derivatives market has shown signs of stress, with persistent negative Net Taker Volume reflecting aggressive selling pressure from dominant short positions.

Open Interest remained above $8.4 billion, as of writing, though its contraction slowed from –6.25% to –3.4%, suggesting deleveraging is easing.

However, a different picture emerges in spot flows, where over 120K ETH is withdrawn daily from exchanges like Binance and Kraken. These withdrawals reduce available supply, signaling potential accumulation.

Therefore, Ethereum stood at a crossroads: derivatives indicate caution, while spot withdrawals inject optimism, giving the asset a balanced but uncertain outlook.

Source: CryptoQuant

Does Solana’s DeFi growth outweigh its cooling trading activity?

Solana has seen consistent ecosystem growth, with Total Value locked rising to $15.7 billion, at the time of writing, marking a 4.19% increase in 24 hours.

This signals ongoing adoption of Solana-based decentralized finance projects, strengthening its long-term outlook. However, trading activity has not kept pace.

DEX volumes hit $3.46 billion but declined –8.33% over the week, while perpetual volume dropped –14.1% to $1.43 billion according to DefiLlama analytics.

This divergence suggests that while usage and locked value grow, speculative enthusiasm has slowed.

Therefore, Solana faces a crucial test: can fundamental network expansion outweigh cooling activity in speculative markets to support its September push?

Solana TVL (Source: DefiLlama)

Which crypto is best positioned to lead September’s market?

Bitcoin leads, with strong institutional demand and limited supply. Ethereum strikes a balance, derivatives show caution, but steady accumulation signals confidence.

Solana pushes forward through DeFi growth, though lower trading volumes raise short-term concerns.

Each asset charts a distinct path: Bitcoin offers stability, Ethereum reflects mixed market signals, and Solana bets on innovation.

Ultimately, September’s market leadership may depend on which story investors believe: Bitcoin’s safety, Ethereum’s quiet buildup, or Solana’s disruptive momentum.

At present, Bitcoin retains the strongest footing, but the month remains open for surprises from Ethereum or Solana.

Post Comment