Stablecoins Unveiled: Why One Dollar Sparks a Global Financial Divide You Never Saw Coming

Stablecoins—they’re no longer just buzzwords tossed around the crypto water cooler. Nope, these digital dollars have carved out two distinctly different paths: one paved with regulation, yield, and institutional heft in the U.S., and the other grounded in real-world survival—fighting inflation, dodging currency collapse, and slashing remittance costs in emerging markets. The passage of the GENIUS Act in 2025 marks a turning point stateside, setting a federal framework that’s boosting trust but clipping some wings of innovation, especially when it comes to sharing interest yields. Meanwhile, billions in the Global South rely on stablecoins not for profit but for financial lifelines. So here’s the million-dollar question: As the U.S. flexes its regulatory muscles, how long before the rest of the world catches up—and will the split stablecoin reality eventually merge or keep growing apart? Stick around, because what stablecoins mean for you depends on which side of the globe you’re calling home. LEARN MORE

Key Takeaways

Stablecoins are splitting between U.S. and emerging markets. With the GENIUS Act setting the pace in the West, how long before the rest of the world catches up?

Stablecoins have evolved into one of the most crucial innovations in digital finance, closing the gap between traditional money and crypto markets. But their use cases are not the same everywhere.

For developed markets in the Global North, stablecoins have become regulated, yield-bearing instruments for institutions, businesses, and individuals, as seen in the U.S.

In the Global South, however, they are lifelines against inflation, currency devaluation, and expensive remittances. But no yield, at least for now.

This bifurcation signals that stablecoins are no longer a monolithic financial instrument; rather, they are diverging to meet the varied economic needs of different populations across the globe.

The sector hit $280B for the first time and could grow to $2 trillion by 2028. This prompted the U.S. to pay attention and pass the stablecoin bill, the GENIUS Act. And others are watching closely.

Amid these shifts, a critical question emerges: Who stands to benefit from each stablecoin model, and what are the risks and opportunities for U.S. users, institutions, and billions of users in emerging markets?

GENIUS Act: Setting the pace for U.S. stablecoin space

The GENIUS Act, passed in July 2025, establishes the first federal framework for U.S. payment stablecoins. It requires the digital dollars to be fully backed by short-term assets like T-bills and deposits.

Commenting on the matter, BitPay noted in an email to AMBCrypto,

“With clear regulations now in place, we expect stablecoin adoption to accelerate even faster, and we’re expanding support for the networks, assets, and use cases where we see the most real-world traction.”

The global crypto payments provider adds that USDT and USDC are no longer restricted to crypto. They are being used for settling suppliers, bills, and are becoming the ‘next evolution of digital money.’

Yellow Card’s Director of Strategy, Gillian Darko, echoes a similar sentiment,

“For Yellow Card, which serves a number of non-U.S. markets, this elevates trust in USD-backed stablecoins issued under these regulated parameters. It sets clear expectations for how reserve assets should be held, how disclosures should be made, and how consumer redemptions should be prioritized.”

While the GENIUS Act boosts trust and safety, it also limits innovation. It bans issuers from sharing the interest revenue earned from T-bills with holders.

Hence, retail users get faster payments, but no yield. However, interest is shared in institutional grade yield-bearing products, which are popular in heavily regulated markets.

So, issuers and banks keep most of the interest.

This also explains why banks lobbied hard against allowing yield-sharing with users, as passing interest back could have triggered deposit flight from traditional accounts.

By keeping the yield in-house, the model protects their balance sheets while cementing their control.

When asked about the key differences in stablecoin adoption between the U.S. and emerging markets, Ben Reynolds, Managing Director of Stablecoins at BitGo, said,

“The biggest differences right now are use cases and asset type. For example, in the U.S., USDC is the most prominent stablecoin and is mostly used for institutional use cases and DeFi.”

However, for other regions like South America, the adoption is driven by demand for digital dollars.

“In emerging markets, especially in South America, we have seen USDT volumes explode, driven largely by individuals that are looking for access to U.S. dollars in a digital form.”

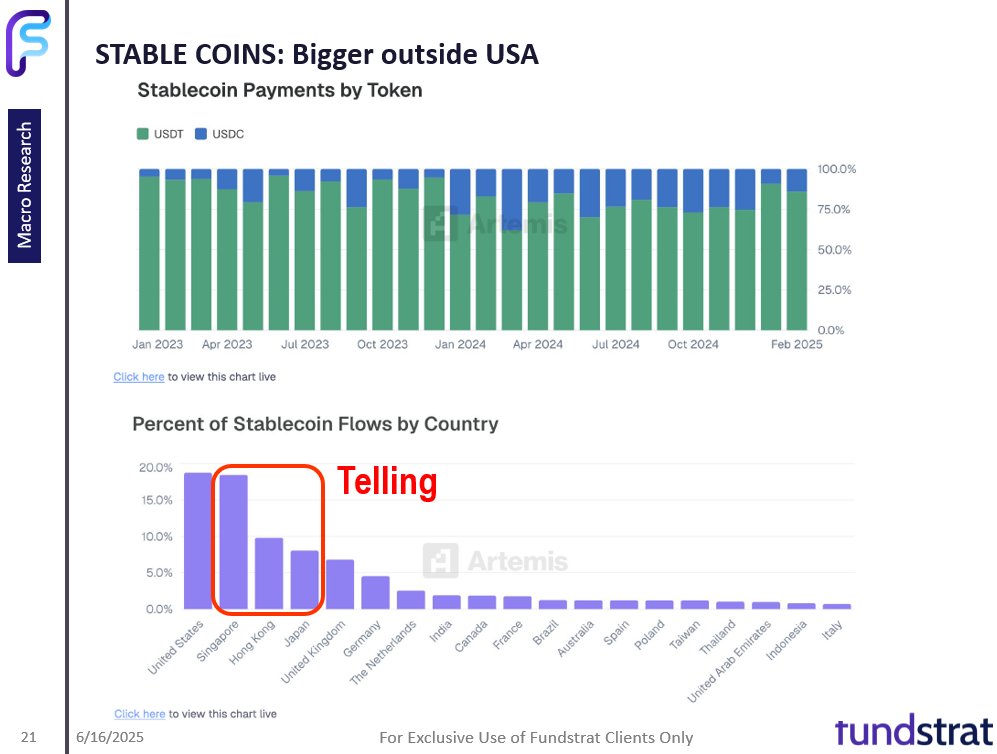

In fact, there is more stablecoin volume outside the U.S., about 80%, mostly dominated by the Asian corridor, according to Thomas Lee, the CIO & Portfolio Manager at Fundstrat Capital.

However, sharing a big chunk of interest earned with users has sparked doubt on the yield-bearing model, especially for issuers.

In a recent Bankless podcast, Tether CEO Paolo Ardoino said,

“The US stablecoin model is broken. You can’t make money here—it’s a race to the bottom.”

Emerging markets: Different use cases and risks

Across the emerging markets in Africa, South America, and Southeast Asia, the stablecoin story is very different. Here in the Global South, stablecoins are not just upgrades to financial rails; they are lifelines.

In these regions, reliability and cost are the crucial factors at play, according to Ben El-Baz, Head of Global Expansion at Hong Kong-based digital asset management firm HashKey Group.

“In volatile or inflation-prone economies, users care less about yield and more about dollar stability and affordable transactions.”

Nowhere is this more visible than in Africa. Yellow Card’s Gillian Darko enlists three key drivers of adoption: ‘remittances, corporate treasury, and savings.’

She notes that the use cases her firm sees daily reinforce stablecoins as a solution to real-world pain points.

“Remittances in markets like South Africa can cost more than 12% per transaction. Stablecoins allow users to bypass much of that cost and delay — enabling instant, cost-effective transfers in ways that traditional rails can’t.”

Beyond remittances, businesses are also showing interest in stablecoins.

Yellow Card’s treasury and OTC products are supporting firms to manage liquidity, hedge against FX (foreign exchange) volatility, and settle cross-border payments in U.S. dollars.

The USDT preference is evident, adds Darko.

“Even within Yellow Card, many of our employees prefer to have their salaries paid in USDT. That says a lot.”

Shifting preferences

Stablecoin yield is now a hot topic following a strong opposition from the U.S. banking sector. Issuers can still use exchanges like Coinbase to offer yield and bypass the GENIUS Act.

Surprisingly, there is growing interest in such yield products in emerging markets, as well. Yellow Card’s Darko notes that the African demand is not from the retail sector, though.

“These teams are asking about yield-enhanced instruments backed by T-bills, such as Circle’s upcoming model or JPMorgan’s deposit token structure.”

But she adds that ‘access, stability, and efficiency’ of stablecoins are still foundational.

Simply put, inflation hedge remains a key use case for most users, but corporates in emerging markets are beginning to lean towards yield, like their colleagues in the developed markets.

The data also support this payment shift. According to BitPay, one of the largest global payment processors, stablecoins now make 40% of overall total payments in 2025 compared to 30% in 2024.

For Bitpay, the average payment is about $3K, with luxury, real estate, and B2B payments as key categories with the fastest growth.

Likewise, stablecoin preferences are changing too. Unlike 2024, USDT has topped USDC on BitPay as the preferred payment.

“But as of 2025, USDT has overtaken it, now accounting for 61% of stablecoin payment volume versus USDC’s 38%.”

On the network level, Ethereum[ETH] and L2s like Polygon [POL], Arbitrum [ARB], and Base handle most of the stablecoin volume.

But more affordable chains like Tron [TRX] and Solana [SOL] are seeing growing usage, too.

Stable, but risks still lurk

Despite the promise and growing adoption, stablecoins have inherent risks, especially for users dealing with unregulated players in the emerging markets.

HashKey’s El-Baz summarized the risks as;

“Counterparty risk from unregulated issuers, lack of transparency on reserves, exposure to platform hacks or scams, and potential regulatory crackdowns.”

According to Yellow Card, South Africa and Rwanda are leading regional pilots and easing the regulatory risks.

In Asia, another adoption hurdle could be competition between private stablecoins and state-controlled CBDCs (central bank digital currencies).

But Matthew Sigel, VanEck’s Head of digital asset research, argues that CBDCs may lose appeal due to surveillance features.

“They (CBDCs) could be universal and low-cost, but they also come with risks: programmability, surveillance, and even expiration of balances.”

Stablecoins: Two realities, one future

Despite the current divergent uses, the paths of the Global North and South may converge in the future. In the developed markets, stablecoins are a new financial upgrade with compliant, yield-bearing products.

In the South, they have evolved into the preferred infrastructure of remittance, FX, and corporate treasury. But there is growing interest in yield, too. Yellow Card’s Darko adds,

“We’re at the forefront of practical stablecoin innovation — because the use case is already here. This isn’t speculative. This is real infrastructure.”

For HashKey’s El-Baz, the dual model means stablecoin issuers must adapt to the needs of each market,

“Issuers must design flexible strategies that serve both ends of the spectrum.”

In the end, stablecoins are reshaping how we use money and the broader financial system. But whether they act as a convenient payment option, a lifeline for retail, a cash cow for issuers, or a yield for institutions depends on which world you live in.

Post Comment