Unlocking $1.562M: The Daedalus Income Portfolio Secrets That Defy Market Chaos – August 2025 Update Revealed!

Ever wondered what it takes to build a portfolio that’s not just robust, but steady and inflation-proof for decades to come? Well, here’s the August 2025 update on my Daedalus portfolio — an investment journey I’ve painstakingly crafted to generate consistent, inflation-adjusted income to cover essential living expenses. While markets can be puzzling (seriously, why did the returns feel like a sneaky $36,000 when the charts suggested more?), the underlying strategy remains rock solid: a conservative initial withdrawal rate of 2.0–2.5% designed to weather the roughest financial storms history has thrown at us. Join me as I peel back the layers of this portfolio, explore its performance, and share insights on what’s working, what’s not, and why patience and discipline are crucial in this game. Curious about the nitty-gritty details and how I keep the strategy low-cost, systematic, and passive? Let’s dive in. LEARN MORE

img#mv-trellis-img-1::before{padding-top:67.48046875%; }img#mv-trellis-img-1{display:block;}img#mv-trellis-img-2::before{padding-top:27.5390625%; }img#mv-trellis-img-2{display:block;}img#mv-trellis-img-3::before{padding-top:63.671875%; }img#mv-trellis-img-3{display:block;}img#mv-trellis-img-4::before{padding-top:124.91039426523%; }img#mv-trellis-img-4{display:block;}img#mv-trellis-img-5::before{padding-top:73.454833597464%; }img#mv-trellis-img-5{display:block;}img#mv-trellis-img-6::before{padding-top:64.35546875%; }img#mv-trellis-img-6{display:block;}img#mv-trellis-img-7::before{padding-top:67.584097859327%; }img#mv-trellis-img-7{display:block;}img#mv-trellis-img-8::before{padding-top:55.180533751962%; }img#mv-trellis-img-8{display:block;}

Here is the update for my Daedalus portfolio for August 2025. If work is not too busy, I will try to provide an update where possible.

I explain how I constructed this portfolio in Deconstructing Daedalus Income Portfolio and Why I Currently Invest in These Funds for Daedalus. You might not understand what I wrote below if you haven’t read this post.

All my personal planning notes such as income planning, insurance planning, investment & portfolio construction will be under my personal notes section of this blog. You can also find the past updates similar to this in the personal planning notes section.

Portfolio Change Since Last Update

The portfolio was valued at $1.526 million at the end of July and is at $1.562 million at the end of August.

We reported a portfolio change of $36,000 for August 2025.

The portfolio is valued in SGD because that is the currency that I would most likely be spending on.

As of 4th September 2025, the portfolio is valued at $1.561 million.

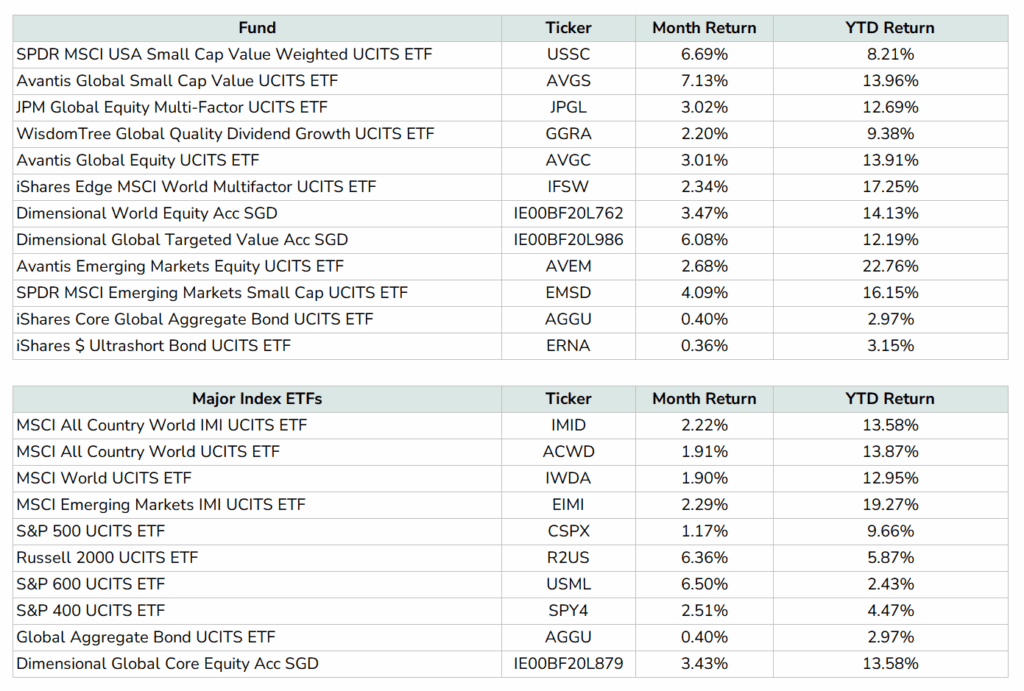

Here are the primary security holding returns for the month-to-date and year-to-date:

The table that shows the fund holdings denotes the month-to-date and year-to-date performance of the funds that I own, against Major Index ETFs. The Major Index ETFs is present to compare the performance. Just to be clear, I do not own the major index ETFs and you should see the top table as what I own.

The returns of all funds are in USD. This includes the performance of the Dimensional funds, which I use the returns of the USD share class so that the returns are comparable. I have also listed the major index ETF performance for comparison.

The market looks good and truth to be told, the returns should be more than just $36,000 from this table alone but that is the weird thing about the market.

Here are some comments about the portfolio:

- Small caps did well. Russell 2000 ETF and S&P 600 both moved up 6.3/6.5% and USSC, AVGS and Dimensional Global Targeted Value moved up 6.7%, 7.1% and 6.1% respectively.

- MSCI World is up 1.9% and those multifactor ETFs did better.

- GGRA: 2.2%

- JPGL: 3%

- AVGC: 3%

- IFSW: 2.3%

- Dimensional Global Core Equity: 3.4%

- MSCI Emerging Markets IMI did 2.3% and AVEM is keeping up at 2.7%. But MSCI Emerging Markets IMI have narrowed the difference. Now the AVEM outperformance is just 3.5%.

- MSCI Emerging Markets Small Cap did rather well at 4%, with a YTD performance of 16%. Not too shabby given the crazy volatility.

- The global aggregate bonds continue to trend higher.

- ERNA, the ultrashort bond ETF returns have gradually go down as the yield to maturity goes down.

The portfolio lost 1.16% due to the weakening USD against the SGD. YTD the portfolio lost 5.67% just from currency alone.

Role of Portfolio

The goal of the portfolio is to generate steady, inflation-adjusted income to cover my essential living expenses. It’s built using a conservative initial withdrawal rate of 2.0–2.5%, which is designed to hold up even under extremely tough market conditions — including scenarios like the Great Depression, prolonged periods of high inflation (averaging 5.5–6% over 30 years), or major global conflicts. In other words, it’s stress-tested to withstand some of the worst financial environments in history.

The income needs to last: from today (age 45) for the rest of your life — potentially forever.

I am currently not drawing down the portfolio.

For further reading on:

- My notes regarding my essential spending.

- My notes regarding my basic spending.

- My elaboration of the Safe Withdrawal Rate: Article | YouTube Video

Based on current portfolio value, the amount of monthly passive income that can be conservatively generated from the portfolio is

The lower the SWR, the more capital is needed, but the more resilient the income stream is.

Nature of the Income I Planned for

Generally, different income strategies produce different types of income streams. They can vary by:

- Consistency: Some provide steady income, others fluctuate over time

- Inflation Protection: Some adjust with inflation, others remain fixed

- Duration: Some last for a set number of years, others are designed to last indefinitely (perpetual)

An income stream based on the Safe Withdrawal Rate framework is consistent and inflation-adjusted, and if we use a low initial Safe Withdrawal Rate of 2.0-2.5%, the income stream leans towards a long duration to perpetual.

Here is a visual illustration of how the income stream will be based on the current portfolio value:

The income for the initial year is based on a 2% Safe Withdrawal Rate. The income for subsequent years is based on the inflation rate in the prior year (refer to the bottom pane of inflation in the previous year). If the inflation is high, the income scales up and if there is deflation, the income is reduced.

Investment Strategy & Philosophy

After trying my best to learn how to invest for a while, the portfolio expresses my thoughts about investing at this point.

The portfolio is run in a

- Strategic: allocation doesn’t change by short-term events.

- Systematic: rules/decision-tree-based implemented either myself or an external manager.

- Low-cost: investment implementation cost is kept reasonably low both on the fund level and also on the custodian level.

- Passive: I spend relatively little effort mentally considering investments and also action-wise.

You can read more in this note article: Deconstructing Daedalus My Passive Income Investment Portfolio for My Essential & Basic Spending.

Portfolio Change Since Last Update (Usually Last Month)

There are no change to the portfolio in August 2025.

Current Holdings – By Dollar Value and Percentages

The following table is grouped based on general strategy, whether they are:

- Fixed Income / Cash to reduce volatility.

- Systematic Passive, which tries to capture the market risk in a systematic manner.

- Systematic Active, which tries to capture various proven risk premiums such as value, momentum, quality, high profitability, and size in a systematic manner.

- Long-term sectorial positions.

Portfolio by Account Source Location

Portfolio by Region Exposure of Securities

Portfolio by Fund, Cash or Individual Security

Portfolio by Strategy.

What Systematic Active Means: Funds that help me execute passively very specific, repeatable underlying securities selection on an ongoing basis. Here are some examples of the systematic active strategies in my portfolio:

- Global Multifactor: From a basket of 1,600 developed market large and mid-cap stocks, rank the stocks by their value, by their 12-month momentum, by their degree of ROE and debt to asset, and then own the top 300. Do this every half-yearly or quarterly. You end up with a strategy that consistently owns 300 companies that are cheaper, quality and have greater momentum relative to a market cap weighted index.

- Small Cap Value: From a basket of 3,000 developed market small cap stocks, rank the stocks based on price-to-book value (include intangibles in the book value). Also rank the stocks by operating earnings minus interest divide by book value. Eliminate the companies with low profitability. What we end up is two group of small cap stocks: The more profitable small caps but not too expensive, and the small caps stocks that are at least profitable but are very cheap. Own the top 30-35% of this cohort consistently. Have a manager that consistently helps me execute this.

The Main Custodians for the Securities in this Portfolio

The current custodians are:

- Cash: Interactive Brokers LLC (not SG)

- SRS: iFAST Financial

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

Post Comment