Why Chainlink’s Supply Crunch and Profit Surge Could Trigger the Next Massive Crypto Explosion—Are You Ready to Cash In?

Ever wonder what happens when nearly 90% of a cryptocurrency’s circulating supply is comfortably in the green, but the tokens on exchanges are drying up like a desert in July? Well, Chainlink [LINK] is staring right down that barrel—and let me tell you, it’s setting the stage for something big. When holders are smiling at their profits and reluctant to cash out, while exchange reserves hit rock-bottom lows, you’ve got all the ingredients for a classic supply squeeze. Picture this: demand spikes, but there’s not much selling pressure to hold prices back. Sounds like the perfect recipe for a breakout, doesn’t it? Stick around—things might just get interesting. LEARN MORE

Key takeaways

As LINK holders enjoy high profitability and fewer tokens remain on exchanges, conditions are aligning for a potential price squeeze.

Chainlink [LINK] is getting ready for a major move.

With nearly 90% of its circulating supply sitting in profit and exchange reserves falling to multi-year lows, we’re all set for a potential supply crunch.

If fresh demand enters the market, dwindling sell-side pressure could quickly tip the balance in LINK’s favor.

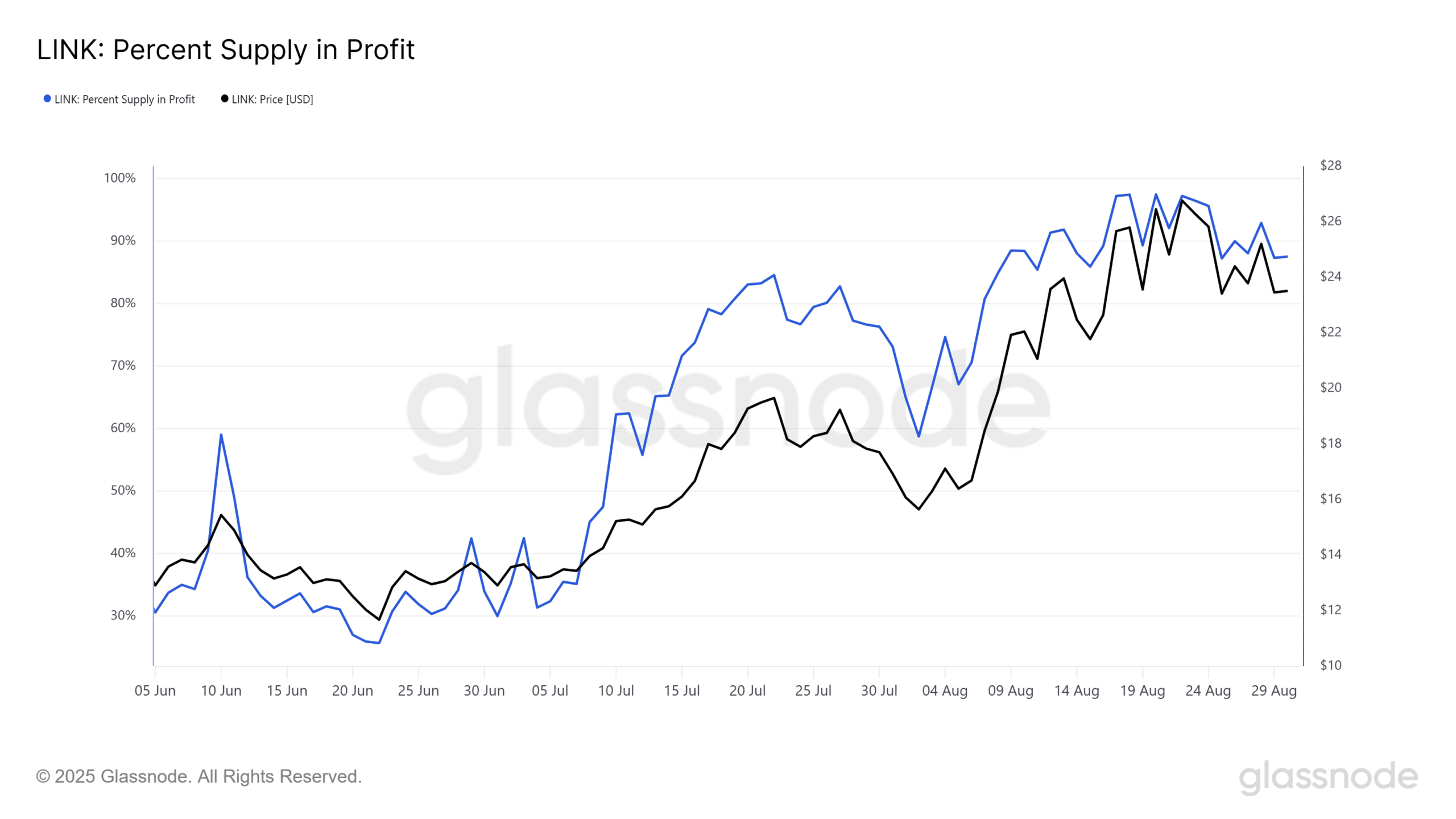

LINK supply nears peak profitability

At press time, 87.5% of Chainlink’s circulating supply was in profit, according to Glassnode data.

The chart shows a sharp climb in profitability since early July, closely tracking LINK’s rally from under $15 to above $25.

Most holders are sitting comfortably, with reduced incentive to sell at current levels.

If fresh demand accelerates, limited sell-side pressure could cause stronger upside momentum, putting LINK in the position for a breakout.

Post Comment