Why Did WLFI Freeze 272 Wallets Overnight? The Untold Story Behind Their “User Protection” Move That Could Change Crypto Forever

When a DeFi project starts freezing wallets — especially those belonging to big names like Justin Sun — it makes you stop and ask: Are we watching a smart move to protect the community, or a slip on the slippery slope of control? World Liberty Financial (WLFI) just hit that crossroads, blocking 272 wallets it labeled ‘high-risk’ to shield users from malicious actors. Yet, this protective shield doesn’t come without collateral — some early investors, including Tron’s founder himself, found their WLFI funds unexpectedly locked up. Now, with Justin Sun pledging a hefty $10 million buyback after his initial frustration, the big question looms — can WLFI bounce back from this wallet freeze fiasco, or is the damage already done? Let’s dive into how this unexpected clash unfolded, what it means for token holders, and whether trust can be rebuilt in the shadow of a blacklist. LEARN MORE

Key Takeaways

The WLFI team said that they only blocked wallets they deemed ‘high-risk’ to protect users. Will the token recover after Justin Sun’s pledge to buy $10 million of WLFI buy.

World Liberty Financial [WLFI] has responded to recent frozen wallet claims made by early investor and Tron’s [TRX] founder Justin Sun and other holders across X (formerly Twitter).

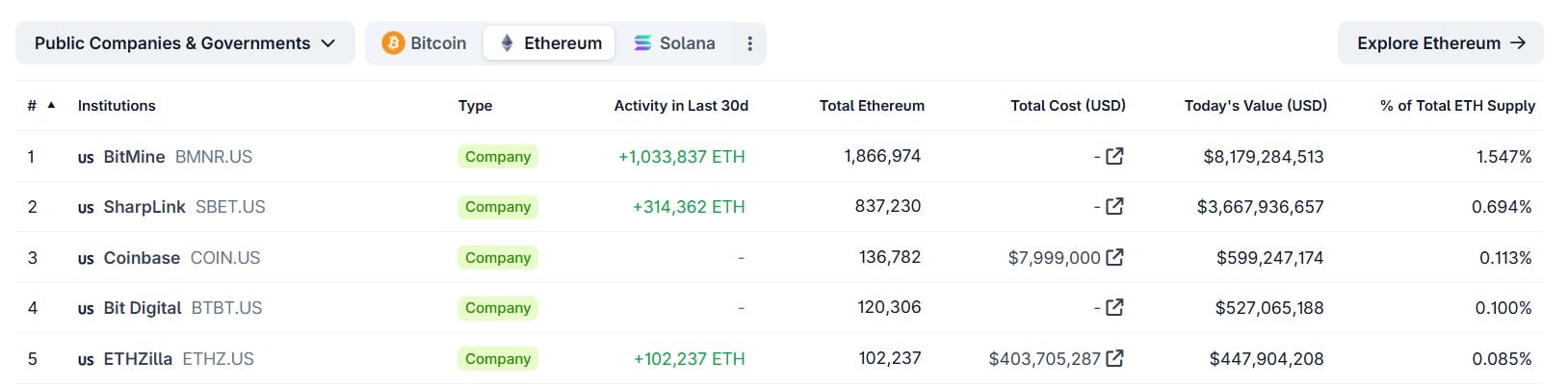

The Trump family-backed DeFi project acknowledged blocking 272 addresses. In a statement, the team added that they only restricted access to select addresses they deemed ‘risky.’

“We do not seek to blacklist anyone…WLFI only intervenes to protect users, never to silence normal activity. We respond when alerted to malicious or high-risk activity that could harm community members.”

Justin Sun’s U-turn

The statement followed a lengthy post by Justin Sun, complaining that the team froze his WLFI fund after carrying out ‘deposit tests.’

The WLFI team reportedly viewed the ‘tests’ as behind the token dump after it was made available for public trading.

However, in the latest communication, the team clarified that several addresses were blacklisted, too. Most of them, 79%, were linked ot phishing attempts, added the WLFI team.

To remedy some of the issues, the team asked victims to reach out directly with their details for faster review.

But as of press time, some users were still frustrated with the overall experience. In fact, one victim, Bruno Skvorc, a developer relations officer at Polygo [POL], claimed that the team failed to unlock his funds despite reaching out.

Amid the chaos and blame games, WLFI token retraced about 14% in the past seven trading days.

However, as of press time, market positioning was neutral based on Binance’s top traders. In other words, despite the phishing and scam issues raised, the price of the WLFI token could take any direction.

Interestingly, the Open Interest (OI) was up amid an attempted weekend recovery. After dropping from nearly $1B to $780 million, the OI was back above $900 million at press time.

This implied some were betting on a strong recovery despite ongoing concerns about the wallet blacklist.

The slightly improved speculative interest also followed Sun’s U-turn and pledge to buy $10 million worth of WLFI after the team’s latest clarification.

“We believe U.S.-listed crypto stocks are an undervalued opportunity. I will market buy $10 million worth of ALTS and $10 million worth of WLFI.”

Post Comment