$190M Bitcoin Liquidation Looms as Whale’s Wipeout Price Draws Dangerously Near—Is Crypto on the Brink of Chaos?

Ever wonder what it feels like to balance on a financial tightrope just $357 from catastrophe? That’s exactly where a crypto whale finds itself right now—holding a staggering $190 million short position on Bitcoin, teetering on the brink of one of the most jaw-dropping liquidations in crypto history. Bitcoin’s current climb to $103,660 is nudging painfully close to the whale’s liquidation price at $104,017—a mere 0.34% away from triggering a potential market ripple no one will forget. What makes this scenario even more riveting? The whale’s bet is swimming against a bullish tide, as Bitcoin surged over 2% just today from its recent lows. Talk about bad timing! The question isn’t just if this leviathan will sink, but how the fallout might reshape short-term Bitcoin momentum… and perhaps the whole market’s mood. Hang tight—this high-stakes showdown is about to unfold. LEARN MORE

Key Takeaways

How close is this whale to liquidation?

Bitcoin trades at $103,660 with the whale’s liquidation price at $104,017—just $357 or 0.34% away from triggering one of the largest single-position wipeouts.

Why is this whale’s timing so bad?

The short position fights against strong bullish momentum as Bitcoin rallied 2.34% today from $99,000 lows.

A crypto whale stands on the edge of one of the largest liquidations in crypto history. The trader holds a massive $190 million short position on Bitcoin with liquidation set at $104,017. BTC currently trades at $103,660, leaving just $357 before total loss.

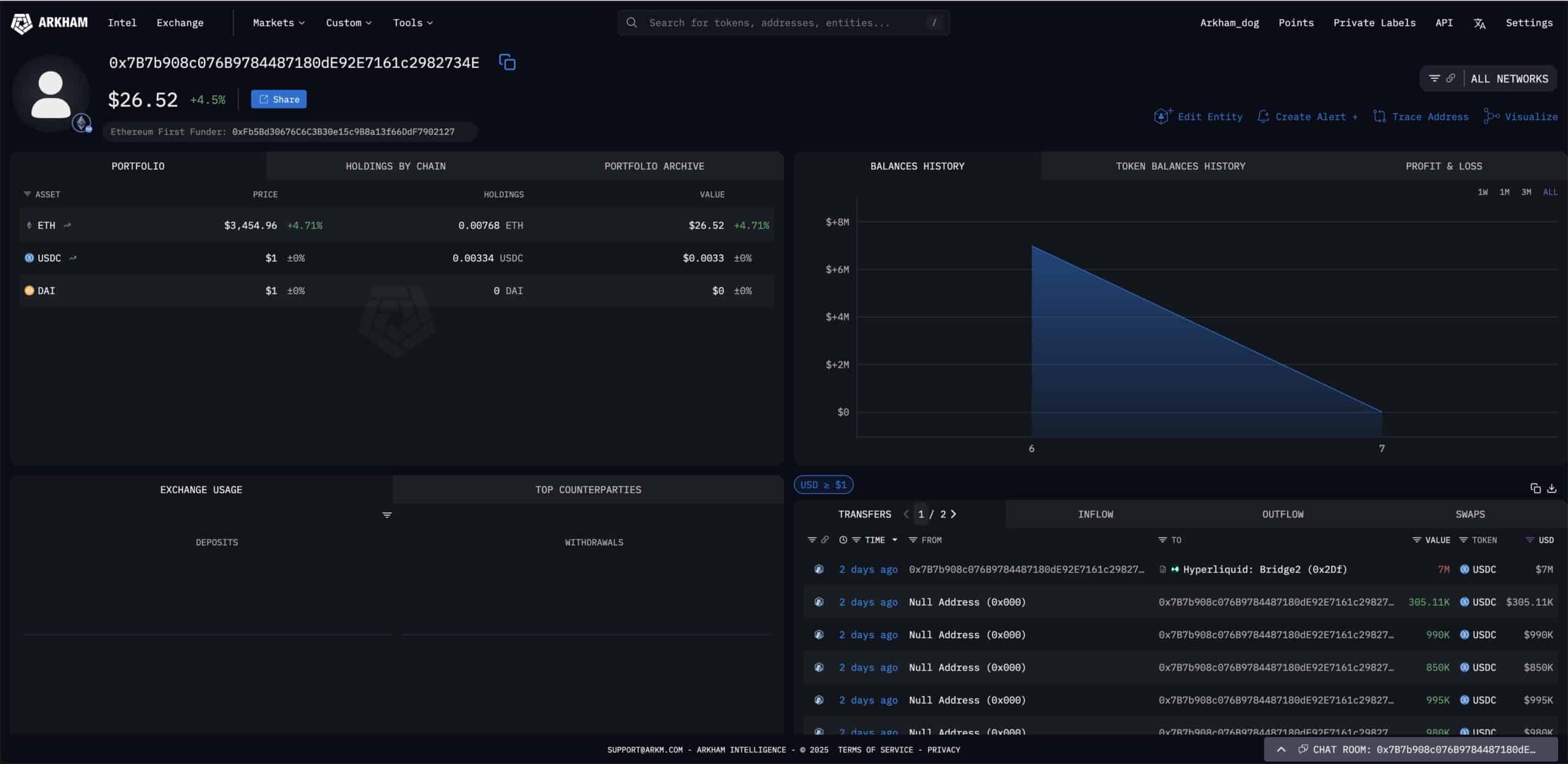

Blockchain analytics firm Arkham Intelligence flagged the precarious position today. The whale opened a massive short position on Hyperliquid, betting that Bitcoin would fall.

Instead, BTC rallied 2.34% today and continues climbing toward the liquidation trigger.

Liquidation could strike at any moment

Bitcoin needs to rise just 0.34% more to liquidate the entire position. At current volatility levels, BTC routinely swings hundreds of dollars in minutes. The whale has no room for error.

If liquidation hits, Hyperliquid will automatically close the short by buying $190 million worth of Bitcoin.

That forced buying would spike BTC’s price even higher, potentially triggering a cascade of additional short liquidations across exchanges.

Betting against the trend

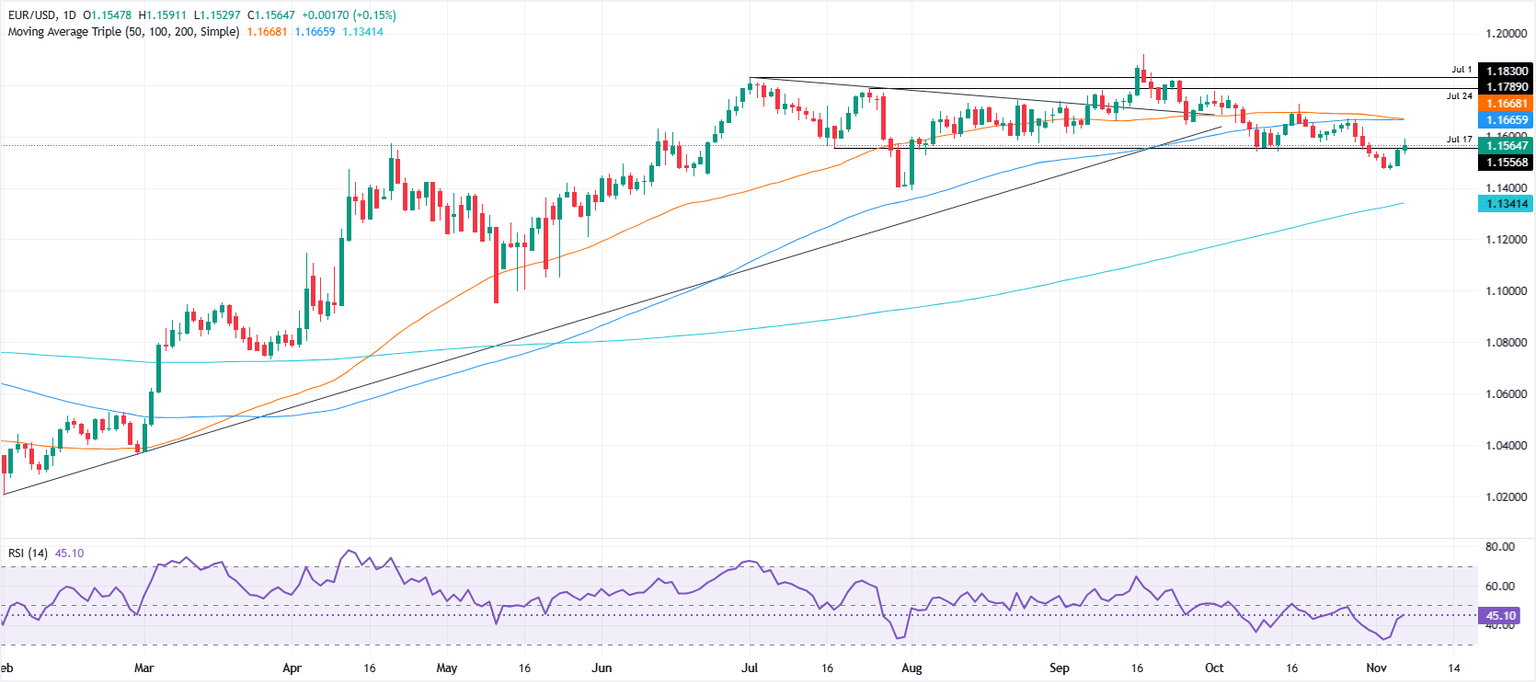

The whale’s timing looks disastrous. Bitcoin rallied from approximately $99,000 just days ago and shows strong momentum. The daily chart reveals BTC testing Fibonacci resistance levels near $104,000, exactly where the whale faces elimination.

Market positioning data makes the short even riskier. Bitfinex shows 178,260 BTC in shorts versus 64,876 BTC in longs. While shorts dominate, Bitcoin’s price action suggests bulls control the near-term direction.

Historic scale of risk

A $190 million liquidation would rank among the largest single-position wipeouts ever recorded in crypto markets.

The Hyperliquid platform would need to execute massive buy orders instantly, creating violent upward price pressure.

The whale apparently used significant leverage to control such a large position. Even small adverse price movements can be magnified dramatically with leverage, which explains how a $357 price change can threaten nine-figure losses.

Market watches and waits

Crypto traders are monitoring the situation closely. If Bitcoin breaks above $104,017, the liquidation will trigger automatically.

The resulting buy pressure could push BTC toward new local highs, potentially above $105,000.

Alternatively, if the whale survives and Bitcoin reverses lower, the short position could generate massive profits. But survival requires BTC to stop its current rally immediately!

Two possible outcomes

The next few hours will determine the whale’s fate. Either Bitcoin continues its momentum and wipes out $190 million in seconds, or the rally stalls and the short position survives to fight another day.

With just $357 separating success from catastrophe, this represents one of the highest-stakes bets currently live in crypto markets. The outcome could significantly impact Bitcoin’s short-term price action.

Post Comment