$3.6M HYPE Exodus from Exchanges: Is This the Quiet Before an Explosive Market Surge?

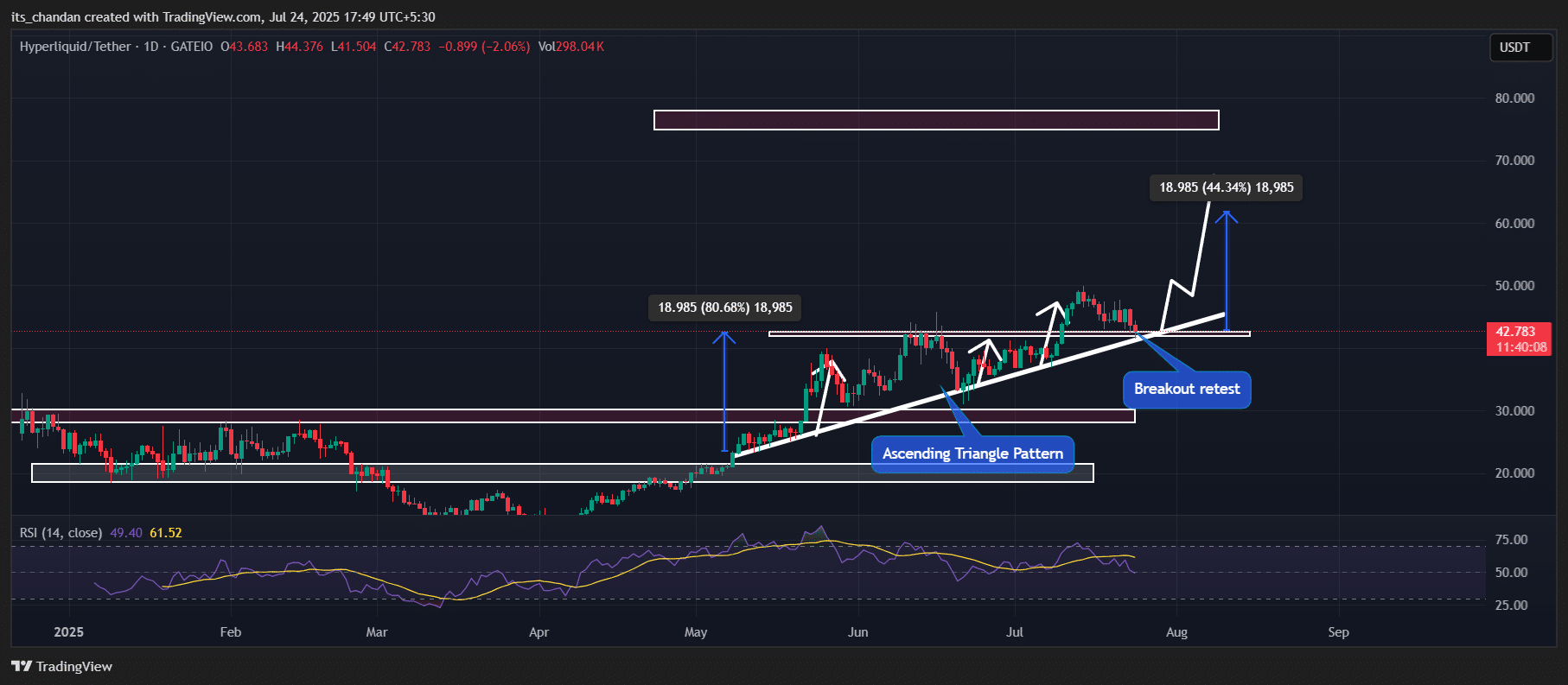

Ever wonder what it takes for a token like Hyperliquid [HYPE] to break free from the pack during a market correction? Well, here’s a nugget that caught my eye: over $3.6 million worth of HYPE has quietly slipped off the exchanges, signaling some serious accumulation beneath the surface. That kind of move is the very heartbeat of informed investing — and with HYPE’s RSI perched at a balanced 49, it’s sitting on the edge of a potential breakout just waiting for market sentiment to flip the switch. Now, combine that with rising trading volumes and a solid trendline that’s backed this token since May 2025, and you start to see a pattern — one that hints at a big revival in the making. Could HYPE be gearing up for a 45% climb all the way to $60? The charts, the on-chain data, and the trader vibes say maybe yes. But here’s the million-dollar question: Are you ready to position yourself before the momentum truly kicks in? LEARN MORE

Key Takeaways

$3.6 million worth of HYPE has left the exchanges, indicating potential accumulation. HYPE’s RSI stands at 49, suggesting it has strong potential to see upside momentum if market sentiment shifts.

Amid the ongoing market correction, Hyperliquid [HYPE] is showing signs of a potential reversal.

Speculation arises as the price reaches the recent breakout and trendline that has acted as a strong support since May 2025.

Hyperliquid’s rising trading volume

At press time, HYPE traded near the $42.40 level, having lost 4.10% of its value in the past 24 hours.

The potential reasons behind this decline include an overstretched price, the continued rise in Bitcoin dominance, and the prevailing market structure.

During this period, investors and traders have shown strong interest, leading to a 30% surge in trading volume compared to the previous day.

Signs of a potential reversal

AMBCrypto’s technical analysis suggested that the HYPE token was in an uptrend and appeared bullish at press time. On the daily chart, the asset seemed to be retesting its recent breakout from an ascending triangle pattern.

The current level aligns with an ascending trendline that HYPE has followed since May 2025. This is the fourth time the asset has tested this level, which appears to be a bullish sign for token holders.

This level has a strong history of price reversals; the daily chart reveals that whenever HYPE reached this zone, it consistently showed upside momentum.

Based on the asset’s past performance, HYPE appears to be repeating this pattern again.

If this happens, there is a strong possibility that HYPE could make a new high this time.

Based on recent price action, HYPE has the potential to soar 45% from the current level, with the price possibly reaching the $60 mark in the near future.

As of press time, HYPE’s Relative Strength Index (RSI) was 49, indicating that the asset was neither overbought nor oversold, but was in neutral territory.

This suggests that the asset had strong potential to see upside momentum if market sentiment shifts.

Bullish on-chain metrics

Data from the on-chain analytics tool CoinGlass revealed that over $3.5 million worth of HYPE has left the exchanges over the past 48 hours, signaling strong accumulation by investors.

Not just that, traders are also following the same trend by betting on the bullish side. At present, HYPE’s OI-Weighted Funding Rate was 0.0082%, indicating an overall bullish bias among traders.

Notably, the Funding Rate has remained positive since April 2025, with only two brief instances of negative values recorded, reflecting consistent long-side dominance in the market.

Post Comment