HYPE Hits a New Peak — Discover the Hidden Power Move That Could Crush Hyperliquid’s Competition Before You Even Realize It!

Is Hyperliquid the next big disruptor we’re all sleeping on? With a staggering $25 million in fresh weekly inflows and revenue hitting a jaw-dropping $20 million, this protocol isn’t just making waves—it’s making a tsunami. Ranking third among top earners, Hyperliquid is proving that it’s not just hype; it’s muscle behind the momentum. Now, here’s the million-dollar question: can HYPE break past the critical $48 mark and sprint toward $59? The rising Money Flow Index suggests the bulls might just have the steering wheel, but as anyone seasoned in the market knows, the devil’s always in the details. Let’s unpack what’s fueling this surge and why staying ahead of these key levels could make or break your next move. Ready to dive deeper? LEARN MORE

Key Takeaways

Why is Hyperliquid drawing attention?

Weekly inflows rose to $25 million and revenue hit $20 million, placing it third among top-earning protocols.

What levels matter now for HYPE?

A break above $48 may clear HYPE’s path to $59 if rising MFI keeps bulls in control.

Hyperliquid [HYPE] continued its bullish rally with a 7% gain in the past day, as of writing, extending its momentum from last week, when the altcoin surged 31%.

Market fundamentals appeared strong as HYPE traded around $47 at press time, closing in on its all-time high. AMBCrypto analyzed how this could reflect on the price chart.

Hyperliquid attracts fresh liquidity

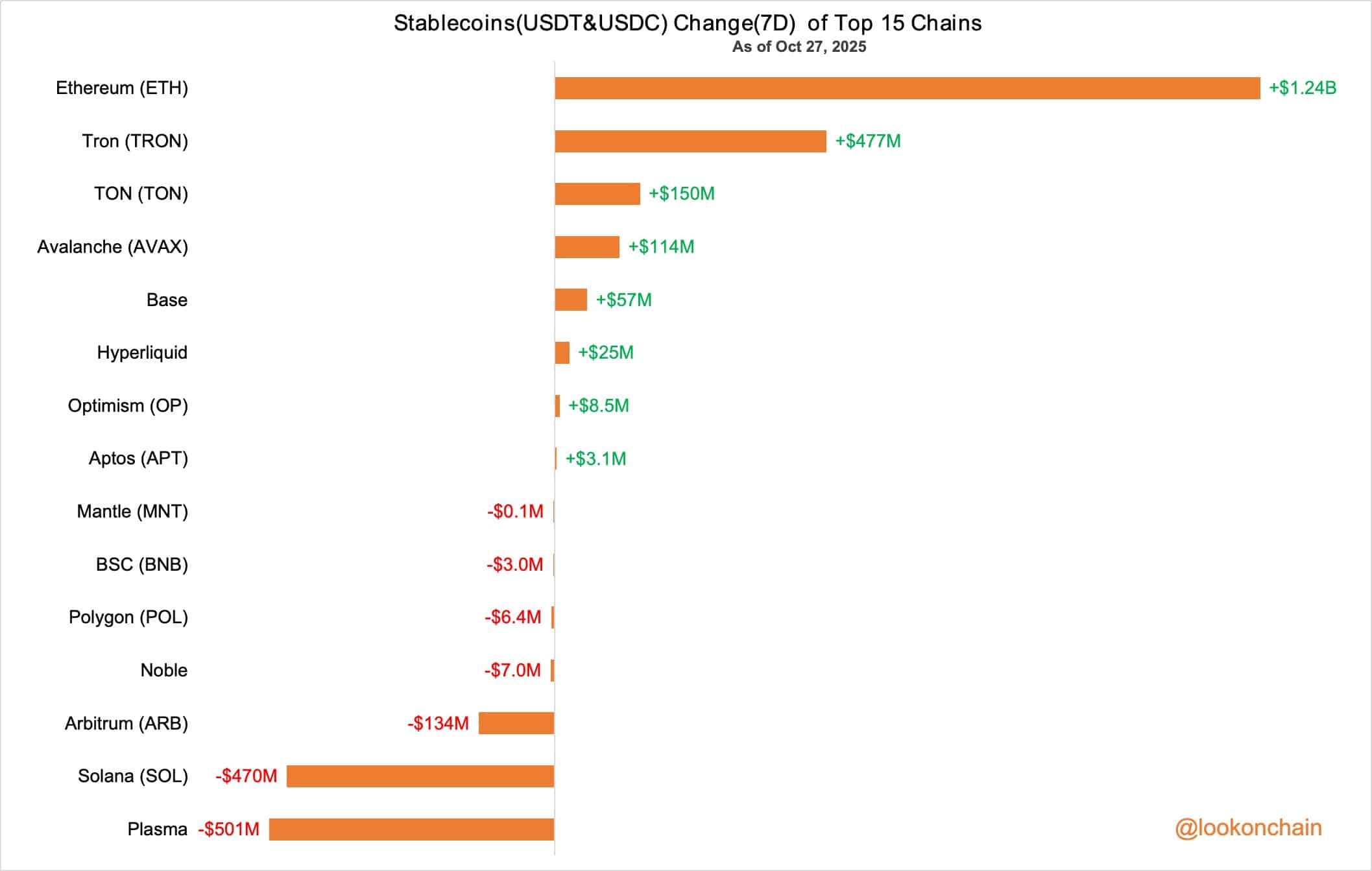

Among the top fifteen chains, Hyperliquid recorded $25 million in stablecoin inflows over the past seven days.

This coincided with a sharp rise in network participation—its Layer 1 Total Value Locked (TVL) climbed past $2.41 billion, ranking it the ninth-largest blockchain overall and seventh among Layer 1s.

The growth is even more evident in its perpetual trading protocol, which saw a similar pattern of capital inflow and usage.

Lookonchain reported that, within the week, Perpetual Volume surged 35.9%, reaching $58.08 billion in the market during this period.

To put this in perspective, two other major perpetual DEXs experienced mostly outflows, with Aster’s [ASTER] volume dropping 0.36%.

Profits surge across protocols and users

Moreover, Lookonchain reported that the surge in Hyperliquid’s Perpetual Volume coincided with a rise in revenue last week. Revenue reached a record $20.19 million, making it the third-most revenue-generating protocol in the market at the time.

In fact, it remained the most profitable protocol when stablecoin issuers like Tether and Circle were excluded.

At the same time, HYPE stakers received $90.07 million in cumulative rewards this month. The payout size signaled long-term holder confidence and limited short-term sell pressure.

This mix of revenue growth and staking yield reinforced the token’s bullish bias.

Chart setup favors a retest of highs

The technical outlook for HYPE showed the altcoin traded into a key resistance level between $47.36 and $48.88.

This level has influenced HYPE’s decline on four previous occasions. Should another rejection occur, the token could fall below the descending resistance line it recently breached.

Even so, the Money Flow Index (MFI) stood at 63.37 at press time, showing continued inflows and suggesting that investors viewed the asset as undervalued.

A breakout above this range could clear the path toward its previous all-time high near $59. Failure to do so might pull the price back under the descending resistance line it recently reclaimed.

Post Comment