Could Altcoins Defy the Odds? The Hidden Surge Analysts Won’t Admit Is Coming!

Ever find yourself wondering if the altcoin market is just a crowded carnival where every token’s shouting to be seen, but no one’s really buying tickets? With millions of crypto tokens out there, it’s no surprise that some investors worry the magic of past altseasons might be fading into the noise of “too much.” But hey, just because there’s a swarm doesn’t mean there’s no honey to be collected, right? Recent shifts in Bitcoin’s dominance suggest there’s still plenty of room for altcoins to stretch their wings — yet the spark for a full-blown altseason hasn’t quite caught fire. So, does the altcoin market’s relative resilience really signal a comeback, or is it just a tease while the big BTC battles continue? Dig into the data, the trends, and some sharp-eyed analysis to peel back the layers on what might be next for crypto investors navigating this bustling bazaar. LEARN MORE

Key Takeaways

Why do some crypto investors fear altcoin market saturation?

With millions of unique crypto tokens created till now, there is a concern that the altcoin market might never find the kind of traction amongst investors that led to previous altseasons.

Will we see an altcoin season this cycle?

We might-the Bitcoin Dominance showed there was plenty of room for the altcoin market to grow, but the sentiment was not strong enough to spur sustained altcoin market rallies.

The recent Bitcoin [BTC] drop of 5% in 16 hours began on Wednesday, the 29th of October.

The move’s swing points were at $113.6k and $107.9k. At the time of writing, Bitcoin saw a minor bounce and was back at the $110k mark, though its short-term trend was downward.

AMBCrypto reported that the $116k resistance was a difficult milestone for the bulls to conquer recently.

Short-term holders were selling BTC, and though the spot exchange-traded funds (ETFs) saw inflows to start the week, they had $470 million in outflows on the 29th of October. This brought the week’s flows to a net negative figure of $119 million.

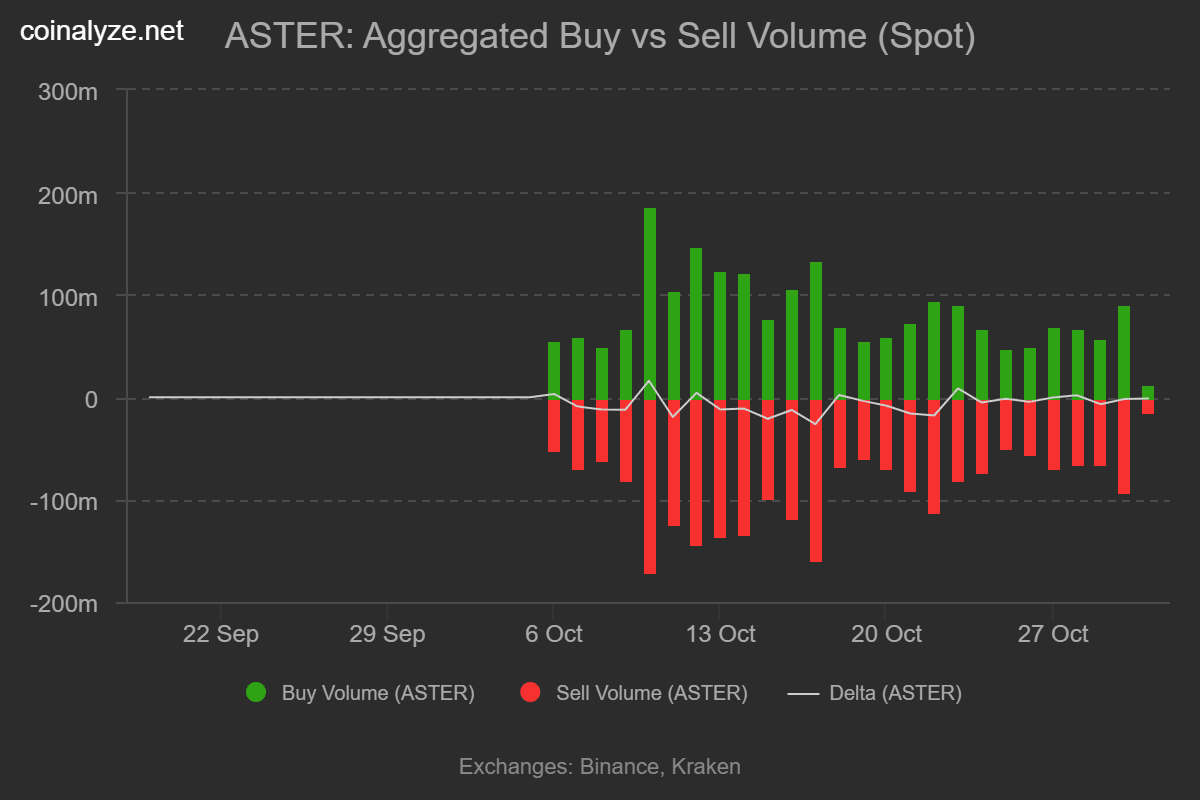

Notably, altcoins held up relatively well, while Bitcoin dropped 5%, the altcoin market cap fell just 3.62% over the same period.

Does the relative altcoin market strength justify expectations of a market recovery?

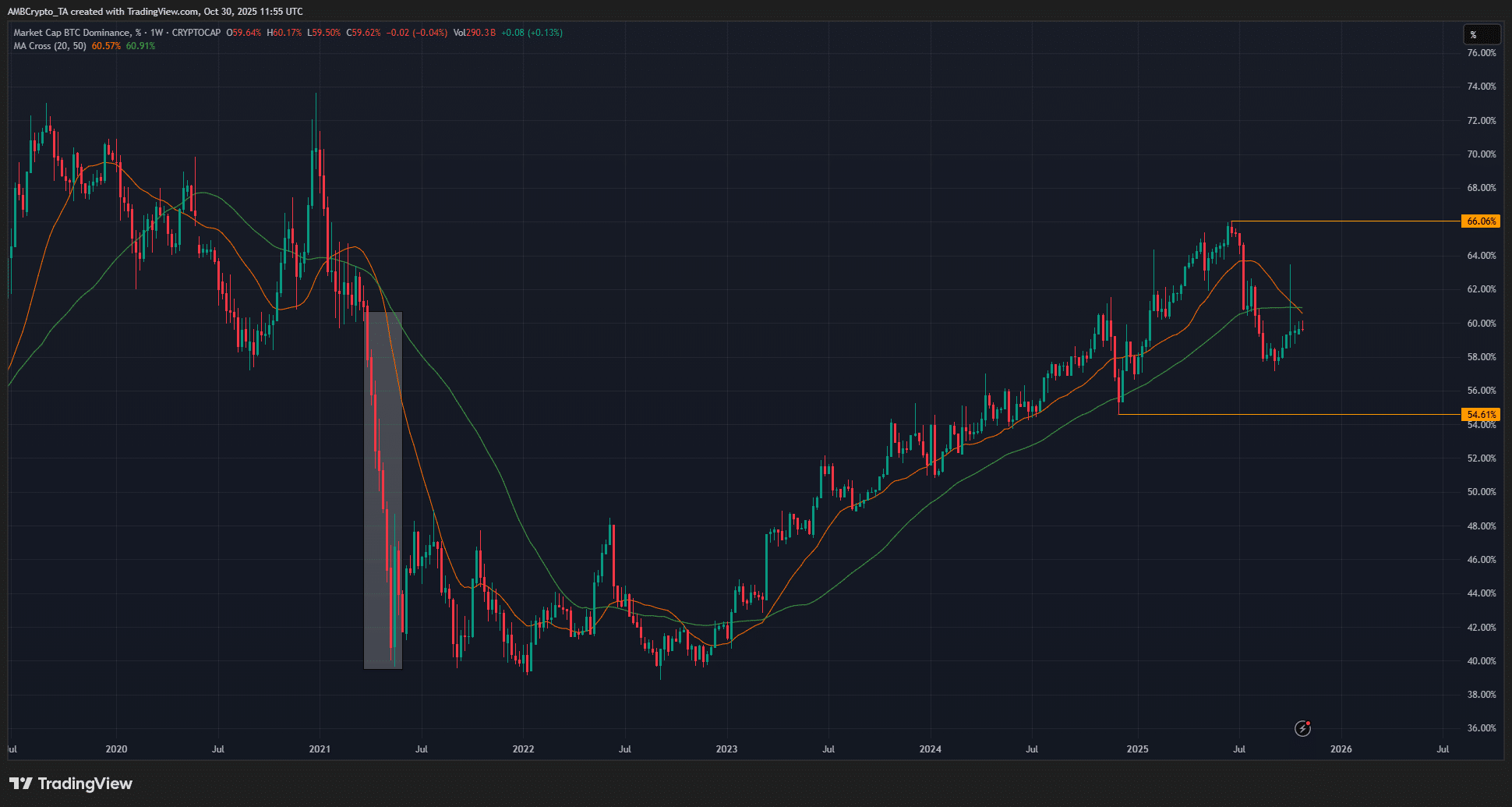

The past 24 hours showed that Bitcoin shed more value than altcoins, implying relative strength amongst alts. The Bitcoin Dominance dropped from 59.99% to 59.54% on the 29th of October.

BTC.D was substantially down from June, when the metric reached 66%.

Yet, we must not lose sight of the bigger picture. The weekly BTC.D chart above showed that despite the pullback since June, the swing structure remained bullish. The moving average crossover showed slowing momentum, but this is not enough for an altseason.

A true altseason would arrive when BTC.D plummets, like the summer of 2021. We are not at that point right now. Will that point ever arrive?

Source: EllioTrades on X

In a post on X (formerly Twitter), crypto analyst EllioTrades explained that there was plenty of space for a sustained altcoin market rally. The worries of “too many altcoins” in the market right now, or altcoin saturation, were unfounded.

The altcoin market has always been this way, and each time, it was a select bunch that rallied hard. Each cycle, some projects die, making investor due diligence extremely important.

Will you try your luck to pick the right one, or stick to the proven market leaders, or stay sidelined from the market entirely? The choice depends entirely on the investor’s risk appetite and what returns they seek.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

Post Comment