SOL ETFs Surge by $199M While Bitcoin Bleeds $799M — Is a Major Market Shift Underway?

Is the tide finally turning in the crypto arena, with institutional money sneaking out of Bitcoin ETFs and finding a new home in Solana’s shiny, recently launched spot ETFs? Over a whirlwind four days, nearly $200 million flowed into Solana’s funds, while Bitcoin ETFs are seeing some of the heftiest outflows this year. It’s tempting to call it a seismic shift, but hold your horses—Solana’s momentum is still lagging behind Bitcoin by a factor of four, and its total value locked (TVL) isn’t exactly lighting up the charts either. So, what gives? Is this just a flashy headline grabber or the start of a deeper, strategic pivot by the big players? In a market squeezing institutional conviction like no other, this dance between Bitcoin and Solana ETFs raises one burning question: Are investors genuinely rotating their trust and wallets, or is it simply a case of hype outpacing hard data? Let’s dive in and unravel the numbers and charts to see if Solana’s ETF debut is a genuine game changer—or just another cameo in Bitcoin’s long-running saga. LEARN MORE

Key Takeaways

Are institutions rotating from Bitcoin to Solana ETFs?

Inflows hint at it. Solana’s ETFs saw nearly $200M in just four days, while Bitcoin ETFs faced massive outflows.

Does the technical setup confirm the shift?

SOL’s momentum is still 4x weaker than BTC, and its TVL remains flat, signaling liquidity hasn’t caught up.

The market has been stress-testing institutional conviction this Q4.

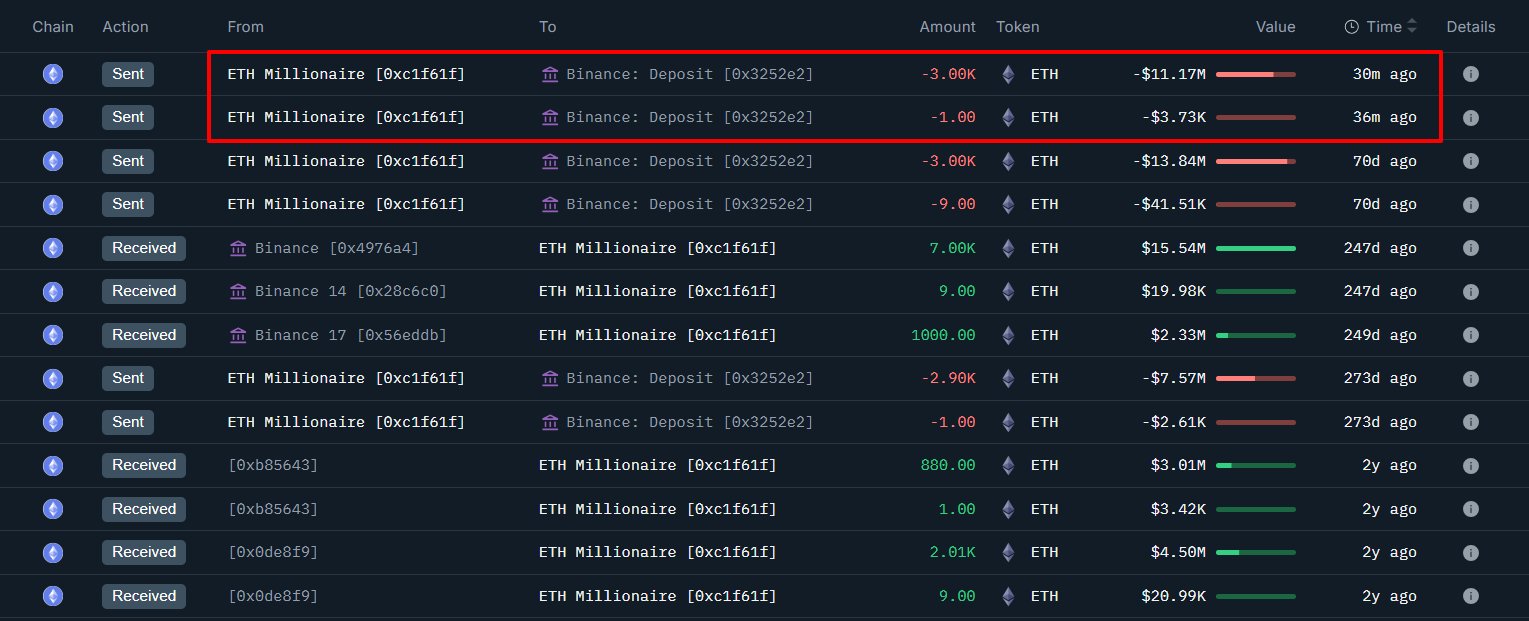

Massive outflows have hit crypto ETFs. Against that backdrop, Solana [SOL] rolled out its first-ever U.S. spot ETF. It’s a move that naturally reads as either a high-beta risk or a well-timed strategic pivot.

That said, the latest SOL ETF flows seem to back the latter.

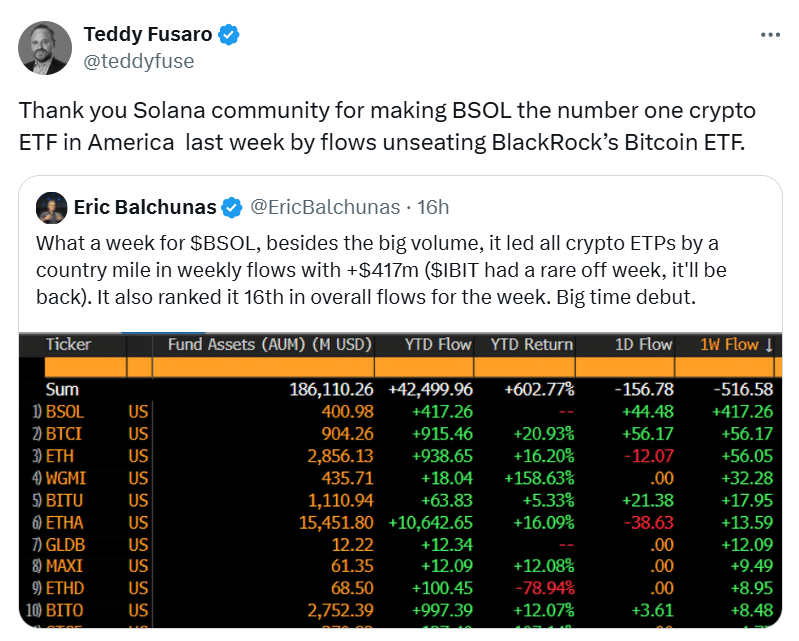

Over just four trading days, $199 million flowed into the Bitwise (BSOL) and Grayscale (GSOL) ETFs. In fact, BSOL led all crypto ETPs with $417 million in weekly inflows, based on data later reposted by Bitwise President.

In essence, it was a bullish week for Solana’s institutional pivot.

That said, the Bitwise President seemed to take a subtle jab at BlackRock’s Bitcoin [BTC] ETF. And, as expected, it stirred plenty of buzz. Analysts were quick to frame it as a strategic move rather than a one-off divergence.

With that in mind, the real question is: Are investors moving from BTC to SOL ETFs? The inflow data definitely hints at it. Still, the real tell might be in the charts.

Does SOL’s setup show momentum shifting against BTC?

Solana gains ground as Bitcoin sees outflows

Looking at the data, the Bitwise President’s jab didn’t come out of nowhere.

In fact, BlackRock’s BTC ETF (IBIT) made up over 50% of the $799 million in weekly Bitcoin ETF outflows.

Meanwhile, BSOL pulled in $197 million in inflows, effectively positioning Solana as a credible alternative to Bitcoin.

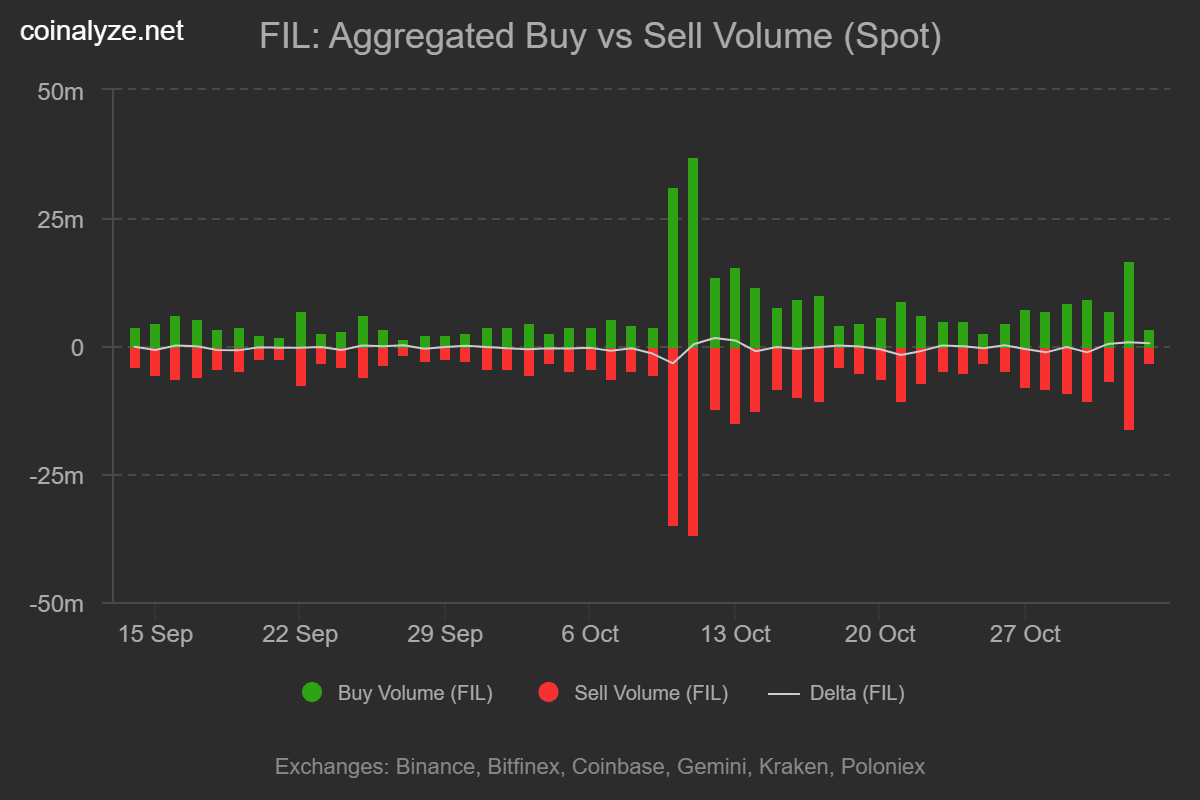

However, the charts tell another story. Despite that shift in ETF flows, it hasn’t really shown up in price action yet.

Solana’s Q4 momentum still runs roughly 4x weaker than Bitcoin’s, dragging the SOL/BTC ratio 8% lower.

So, from an investor standpoint, BTC still looks like the stronger play.

On both the technical and conviction front, Solana hasn’t yet synced with broader spot flows, leaving institutional exposure relatively light. Meanwhile, on-chain metrics echo that slowdown as well.

In the DeFi space, Solana’s TVL has stayed range-bound through Q4, signaling weak liquidity. All things considered, Solana’s ETF debut is a strong statement, but not yet a full-blown breakout, with Bitcoin still leading.

Post Comment