Why Nasdaq’s Sudden Warning Sent Toncoin Plummeting 10% — The Untold Story Every Investor Needs to Hear Now

Ever wonder what happens when a Nasdaq warning slips into the market like a plot twist in a thriller? Well, Toncoin [TON], one of 2025’s beloved large-cap tokens, just got caught in that very drama. Nasdaq’s red flag to TON Strategy Co.—for skipping the shareholder nod on some hefty Toncoin buys—sparked a panic that sent TON sliding nearly 10% overnight. It’s as if the market collectively held its breath, then rushed for the exits, pushing exchange inflows up a staggering $2.47 million. And here’s the kicker: despite the misstep, Nasdaq decided against delisting, opting instead to issue a warning letter—a rare mercy that begs the question, how will traders navigate these choppy waters now? Is $2.00 the new battleground, or will the critical $1.80 support hold firm amidst the storm? Buckle up, because the Toncoin rollercoaster just added some serious twists. LEARN MORE

Key Takeaways

Why did TON slide today?

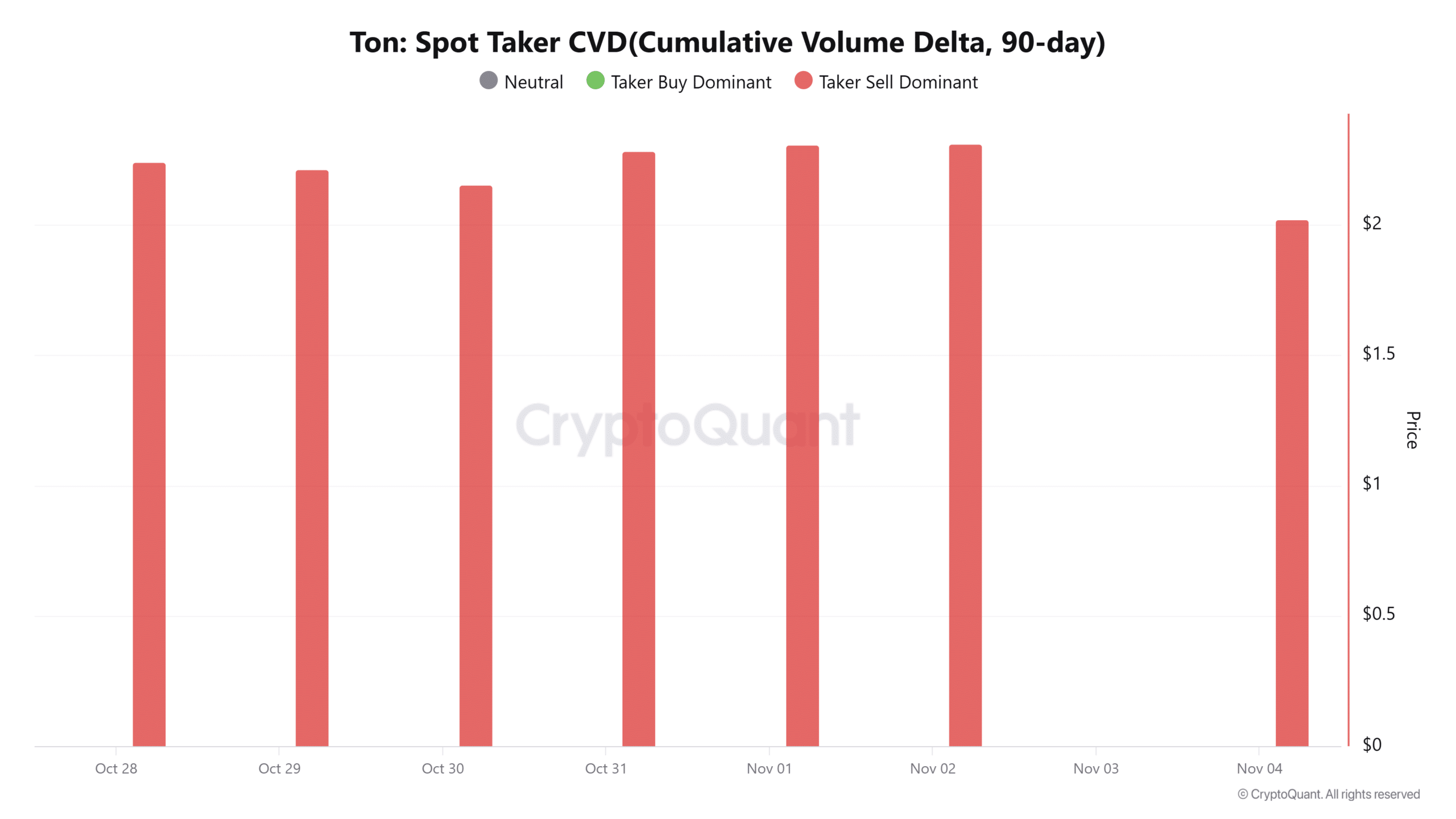

Nasdaq’s warning triggered panic selling. Spot Taker CVD turned red and Netflow hit $2.47 million, confirming heavier exchange inflows.

What levels matter now for Toncoin?

A rebound above $2 could lift TON toward $2.30, while $1.80 remains critical support.

Like most large-cap tokens in 2025, Toncoin [TON] has recorded significant demand from institutional investors. One of these institutional investors is TON Strategy Co., which has turned to aggressive accumulation of Toncoin as a treasury asset.

Nasdaq issues a warning

According to Nasdaq, TON Strategy Co. failed to obtain shareholder approval for its Toncoin purchases and a related private stock sale. Nasdaq said the firm raised funds via a PIPE before buying Toncoin.

Through PIPEs, companies can sell shares privately to institutional investors to quickly raise funds.

Through this approach, TON Strategy sold $558 million in shares in August 2025 to purchase Toncoin for the same amount. However, the firm failed to get shareholder approval for either a PIPE or the purchase of Ton tokens worth $273 million.

Despite these wrongdoings, Nasdaq determined that TON Strategy did not deliberately intend to avoid compliance.

Therefore, Nasdaq opted to issue a warning letter rather than delist the company, as is the norm.

Sell pressure builds on-chain

After the notice, traders turned defensive and sold into weakness. Spot Taker CVD flipped red at press time, extending a week of seller dominance.

By contrast, Spot Netflow turned positive, signaling tokens moved to exchanges. At press time, Netflow read $2.47 million.

Often, positive Netflow suggested holders were prepared to sell. In fact, past spikes accelerated downside moves.

Toncoin: price reaction and levels

Unsurprisingly, after Nasdaq warned TON Strategy, investors and holders panicked, causing significant pressure on TON.

This sell-off dragged the token 9.76% lower, breaking $2.00 and reaching $1.918, signaling clear bearish dominance.

On top of that, RSI dropped to 33, close to oversold territory, while Sequential Pattern Strength slipped to –13, confirming continued seller control.

With indicators flashing weakness, Toncoin may face further downside. If conditions persist, the price could test $1.80, with $1.60 acting as major support.

Even so, a rebound above $2.00 could open the path toward $2.30, should bulls regain momentum.

Post Comment