EUR/USD Poised on a Knife’s Edge—Will the Upcoming US Jobs Data Ignite a Market Tsunami or Crush Traders’ Dreams?

Ever get that feeling when you’re watching the EUR/USD dance just below 1.1500 and wonder if it’s stuck in a quiet holding pattern or gearing up for a breakout? Well, Wednesday’s action had that same vibe — practically flat near 1.1480, with the safe-haven US Dollar holding firm as global equities stumbled. Investors seem caught between hope and hesitation, thanks to mixed Eurozone data: services PMI rising sharply in Germany and the broader Eurozone, yet the Producer Price Index taking a second tumble in October. Meanwhile, across the pond, the US government shutdown drags on into its fifth week, adding a wrinkle of uncertainty just as key reports like ADP Employment and ISM Services PMI are set to drop. So, is the EUR/USD primed for a breakout, or stuck in limbo as markets weigh these conflicting signals? Hang on tight — this rollercoaster ride isn’t over just yet. LEARN MORE

EUR/USD remains practically flat on Wednesday, hovering below the 1.1500 level, trading near 1.1480 at the time of writing. A risk-averse sentiment, amid sharp sell-offs in equities around the world, is underpinning demand for the safe-haven US Dollar, and the mixed Eurozone data has failed to improve investors’ mood.

Data from the Eurozone and the German HCOB Services Purchasing Managers’ Index (PMI) revealed that the sector’s activity accelerated beyond expectations in both countries. Eurozone’s Producers’ Price Index, however, declined for the second consecutive month in October, adding pressure to the common currency.

In the US, the government shutdown has extended for its fifth week, on track to become the longest in the record. This gives particular relevance to the ADP Employment report, due later in the day, and the ISM Services Purchasing Managers’ Index (PMI), both of which are likely to show mild rebounds after September’s downbeat figures.

Euro Price Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Canadian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.02% | -0.02% | 0.02% | 0.28% | 0.14% | 0.14% | 0.00% | |

| EUR | 0.02% | -0.02% | 0.04% | 0.30% | 0.17% | 0.18% | 0.03% | |

| GBP | 0.02% | 0.02% | 0.06% | 0.30% | 0.17% | 0.17% | 0.03% | |

| JPY | -0.02% | -0.04% | -0.06% | 0.25% | 0.12% | 0.10% | -0.02% | |

| CAD | -0.28% | -0.30% | -0.30% | -0.25% | -0.13% | -0.15% | -0.27% | |

| AUD | -0.14% | -0.17% | -0.17% | -0.12% | 0.13% | -0.01% | -0.13% | |

| NZD | -0.14% | -0.18% | -0.17% | -0.10% | 0.15% | 0.00% | -0.14% | |

| CHF | -0.00% | -0.03% | -0.03% | 0.02% | 0.27% | 0.13% | 0.14% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: Risk aversion buoys the US Dollar

- The US Dollar remains bid as investors rush for safety, with equities across the globe selling off while they ponder the chances of further Fed monetary easing in the December meeting, amid hawkish comments from Fed Chairman Jerome Powell and diverging views from the central bank’s policymakers.

- Eurozone PPI contracted at a 0.1% pace in October, following a 0.4% drop in September, and against market expectations of a flat reading. Year-on-year, producer prices eased 0.2% following a 0.6% decline in the previous month.

- Somewhat earlier, the final Eurozone HCOB Services PMI increased to 53.0 in October, up from the previous month’s 51.3 reading, surpassing the preliminary estimate of 52.6.

- Likewise, the German HCOB Services PMI final reading revealed an improvement to 54.6 in October, its strongest performance in more than a year, from September’s 51.5 reading, also beating the previously estimated 54.5 score.

- Data released previously revealed that German Factory Orders increased 1.1% in September, following a 0.4% contraction in August, and beating expectations of a 1% growth. Year-on-year, however, orders have declined 4.3% in September after increasing by 2.1% in the previous month.

- In the US, in the absence of official employment data releases, all eyes will be on the ADP Employment Change figures for further clues about the Fed’s rate path. The report is forecast to show a net increase of 25,000 jobs in October, following a 32,000 decline in September, levels well below the 150,000 average new jobs created per month from 2010 to 2025.

- The US ISM Services PMI is also due this Wednesday. The market consensus anticipates a moderate rebound to 50.8 in October, from 50 in September.

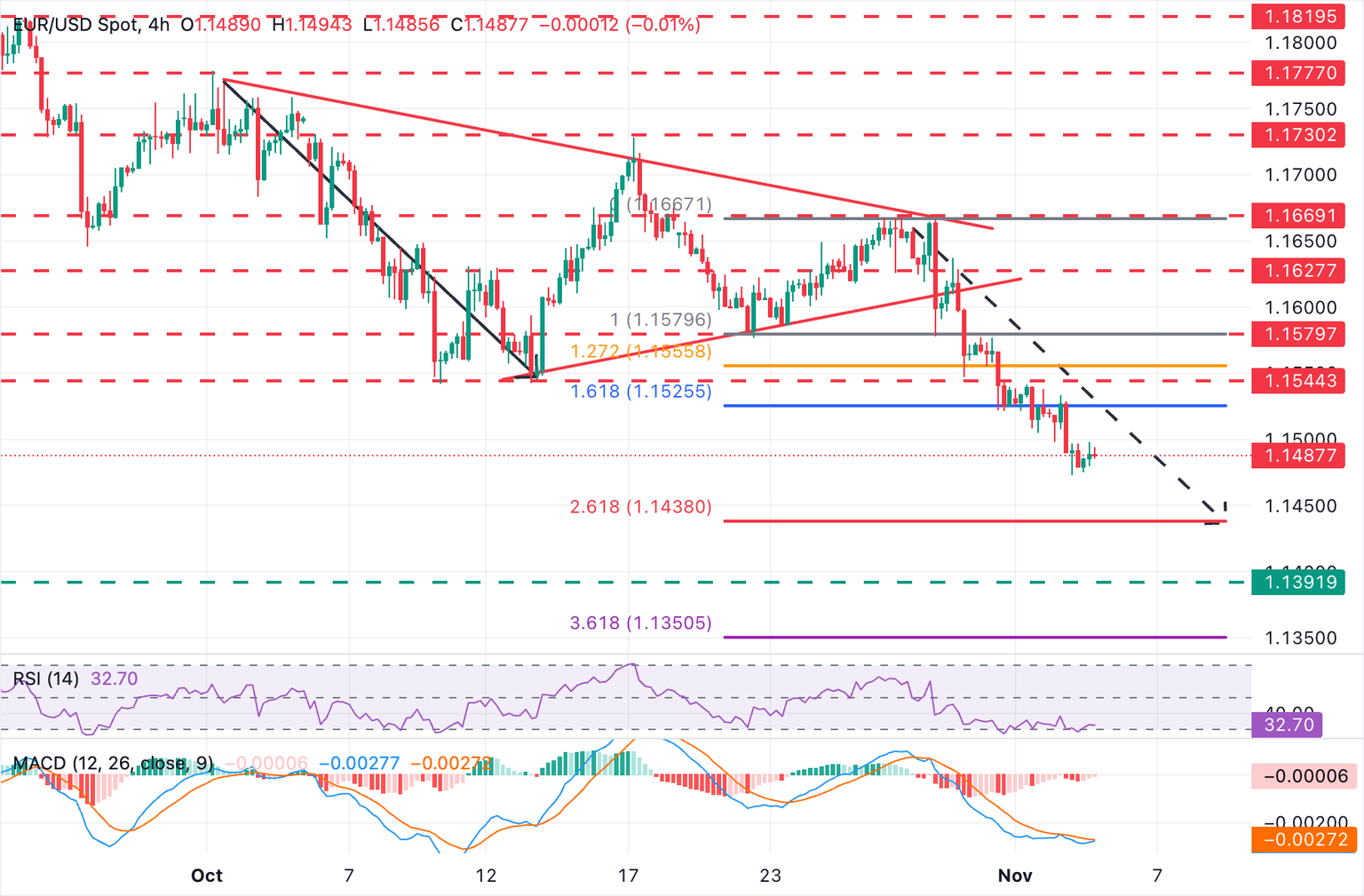

Technical Analysis: EUR/USD remains vulnerable with 1.1440 support in bears’ focus

The EUR/USD pair is trying to pick up from three-month lows, but upside attempts keep finding sellers after depreciating nearly 1.5% in the last five trading days. Technical indicators remain well within negative territory, but the 4-hour Relative Strength Index (RSI) is flirting with oversold levels, while the Moving Average Convergence Divergence highlights an easing negative pressure, suggesting the possibility of some consolidation.

The immediate bias, however, remains bearish with Tuesday’s low at the mentioned 1.1475 area at hand. The measured target of the broken triangle pattern, which meets the price at the 261.8% Fibonacci retracement of the late October rally, is near 1.1440. Further down, August’s low comes around 1.1390.

To the upside, the pair should return above the 1.1500 area to ease bearish pressure and shift the focus towards Wednesday’s high at 1.1530 and the previous support area near 1.1545 (October 14, 30 lows). Further up, the next target is the October 22 and 23 lows around 1.1580.

Economic Indicator

ADP Employment Change

The ADP Employment Change is a gauge of employment in the private sector released by the largest payroll processor in the US, Automatic Data Processing Inc. It measures the change in the number of people privately employed in the US. Generally speaking, a rise in the indicator has positive implications for consumer spending and is stimulative of economic growth. So a high reading is traditionally seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Next release:

Wed Nov 05, 2025 13:15

Frequency:

Monthly

Consensus:

25K

Previous:

-32K

Source:

ADP Research Institute

Economic Indicator

ISM Services PMI

The Institute for Supply Management (ISM) Services Purchasing Managers Index (PMI), released on a monthly basis, is a leading indicator gauging business activity in the US services sector, which makes up most of the economy. The indicator is obtained from a survey of supply executives across the US based on information they have collected within their respective organizations. Survey responses reflect the change, if any, in the current month compared to the previous month. A reading above 50 indicates that the services economy is generally expanding, a bullish sign for the US Dollar (USD). A reading below 50 signals that services sector activity is generally declining, which is seen as bearish for USD.

Post Comment