Whales Just Snapped Up Over 10,000 Bitcoin in 24 Hours — What Could This Mean for the Market’s Next Move?

Ever wonder what it takes to turn uncertainty into opportunity on a colossal scale? Well, in the wild world of Bitcoin, over 10,000 BTC have just been snapped up by the crypto whales—those big players who move markets with the flick of a fin. While ordinary investors are hit with jitters and selling off in panic, these whales are doubling down, signaling not just confidence, but a bold bet on Bitcoin’s comeback under turbulent market skies. Could this massive accumulation be the early drumbeat of a bullish revival? Or is it just another ripple in the crypto ocean? Either way, it’s a stark reminder that when the tide goes out, the wise don’t just watch—they dive in deep. LEARN MORE

Large holders demonstrate strong conviction in Bitcoin’s recovery as retail investors retreat, highlighting increasing institutional involvement during market turbulence.

Key Takeaways

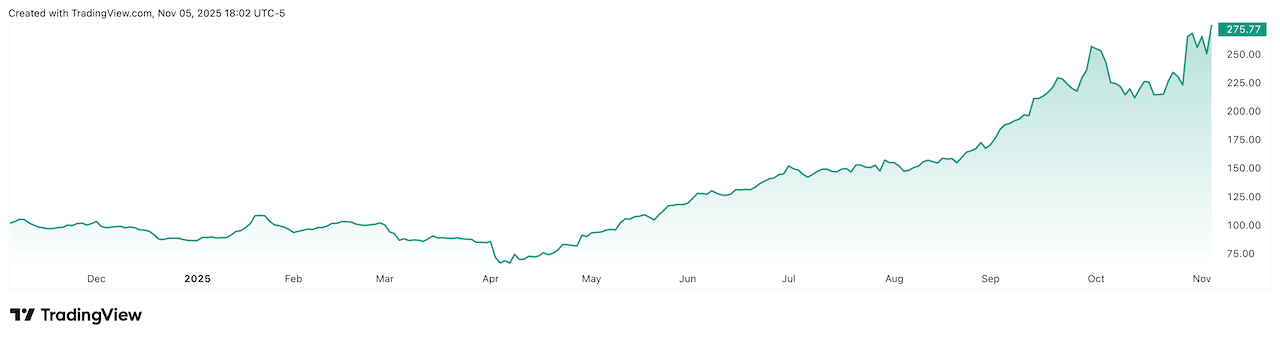

- Whales purchased more than 10,000 BTC (around $1 billion) in the last day.

- The accumulation signals high holder and institutional confidence in Bitcoin amid market uncertainty.

Share this article

Bitcoin whales accumulated over 10,000 BTC in the last 24 hours, signaling major holder confidence amid broader market uncertainty.

The accumulation comes as retail investors show fear and engage in panic selling. Whales, large cryptocurrency holders with significant market influence, often increase positions during price dips to capitalize on potential recovery trends.

Major whale cohorts, including accumulator whales, have been boosting their Bitcoin positions as a signal of conviction in upcoming rebounds. Smart money players typically load up on Bitcoin during market cooldowns, following patterns of pre-uptrend accumulation.

The buying activity represents approximately $1 billion worth of Bitcoin at current prices, demonstrating substantial institutional-level interest in the flagship cryptocurrency.

- Login

- Sign Up

Post Comment