Is Ethereum Poised to Eclipse Bitcoin This Quarter? The Surprising Signals Every Investor Needs to See Now

Is Ethereum really still trailing Bitcoin, or is there a twist in this tale we’re missing? The latest Q4 stats make it clear: Ethereum’s taken a tougher fall—down 18% against Bitcoin’s milder 9.41% dip. The ETH/BTC ratio slipping 7% paints a picture of investors favoring Bitcoin’s stronghold a bit more these days. But here’s the kicker—sometimes, when things seem bleak, a spark of opportunity flickers. Whales are quietly scooping up Ethereum at these lower price levels, Bitcoin dominance is hitting a wall, and a significant derivatives cleanup is underway. These moves hint at Ethereum gearing up for a potential momentum turnaround before the quarter wraps up. So, while it may look like Ethereum is losing ground, savvy eyes might just spot the early signs of a rebound waiting in the wings. Intrigued? Let’s dive deeper into what this could mean for your next move. LEARN MORE

Key Takeaways

Is Ethereum still struggling against Bitcoin?

Ethereum has underperformed Bitcoin in Q4, down 18% vs BTC’s 9.41%, and the ETH/BTC ratio slipped 7%, highlighting weaker capital flow.

Are there any bullish signs for ETH?

Whales scooping ETH, BTC.D hitting resistance, and deeper derivatives cleanse all point to ETH setting the stage for a potential Q4 momentum flip.

Ethereum [ETH] is struggling against Bitcoin [BTC].

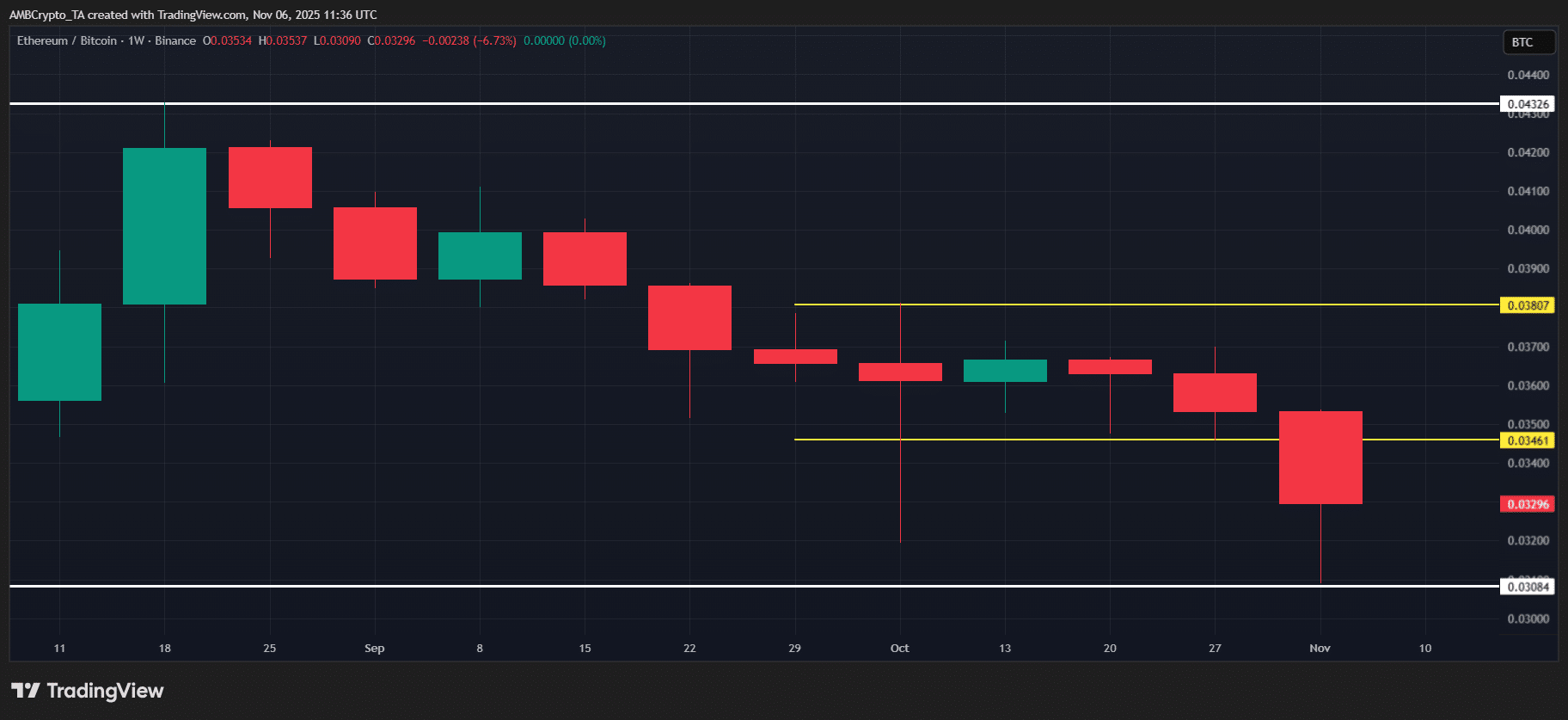

Over the past two weeks, ETH’s moves have been twice as harsh as BTC’s. Looking at Q4, the divergence is clear: Bitcoin has cut losses to 9.41%, while Ethereum is down 18%.

The ETH/BTC ratio also slid 7% this week, breaking below its sideways range around 0.36 that held through October. Put simply, capital flow into Ethereum is weaker, with investors still favoring BTC over ETH right now.

On the bullish side, though, this breakdown has shifted directional bias.

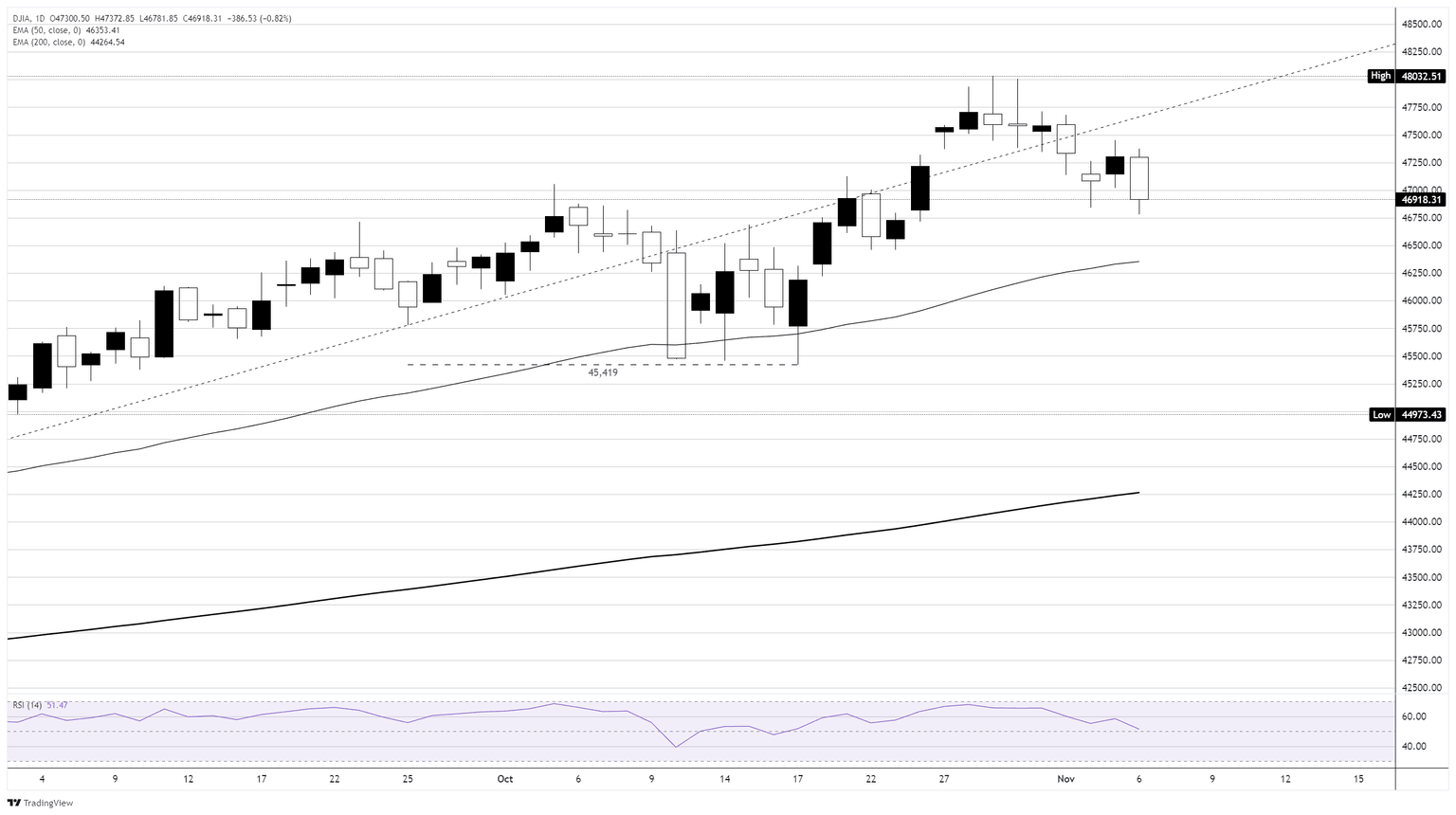

Simply put, ETH/BTC ratio breaking 0.36 triggered a fresh sell-off in ETH vs BTC, setting the stage for renewed trend clarity in the pair. Meanwhile, BTC dominance hitting resistance at 61% is reinforcing flows back into altcoins.

In this context, Ethereum dipping toward $3k acts as a bullish layer. If bulls step in, it sets the stage for capital rotation into select altcoins, while BTC looks riskier. Notably, it seems ETH traders are already playing this out.

Ethereum gains traction as bullish catalysts align

A mix of bullish triggers shows Ethereum might be catching up.

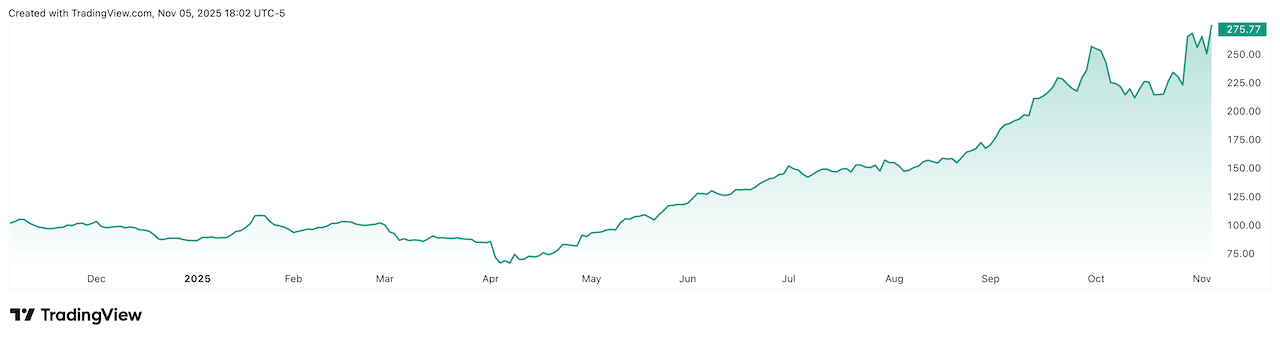

To begin with, ETH’s drop to a multi-month low of $3k on the 4th of November synced with whales scooping 394,682 ETH for $1.37 billion, putting their cost basis around $3,488 per coin.

That said, the biggest catalyst is in derivatives. Since the mid-October crash, Ethereum Open Interest has dropped $30 billion, compared with BTC’s $24 billion, signaling a deeper leverage shakeout for ETH.

In short, Ethereum’s Q4 tailwind vs BTC hasn’t flipped bearish yet.

With whales scooping the dip, ETH/BTC hitting a floor, BTC.D at resistance, and ETH’s clean flush out, we’re seeing a stack of early bullish signs, pointing to Ethereum in an accumulation phase.

If this holds, ETH could still flip its Q4 momentum, breaking the streak of lower quarterly gains vs BTC, with $3k acting as a solid rebound zone, potentially setting the stage for a bounce in Ethereum vs. Bitcoin.

Post Comment