How One $1K Bet on AI Marketing Turned Into a Jaw-Dropping $2.5 Million Windfall—Here’s the Secret No One’s Talking About

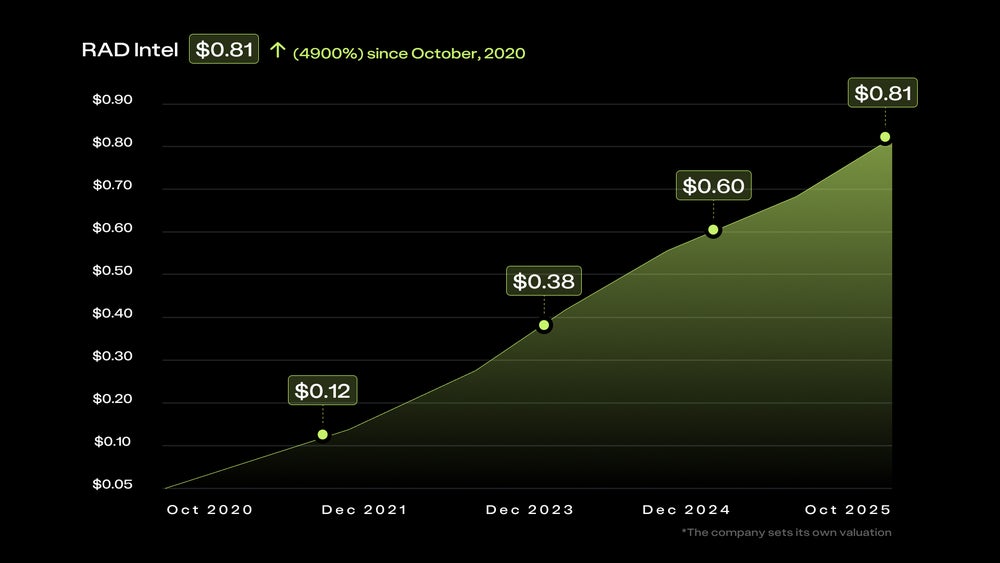

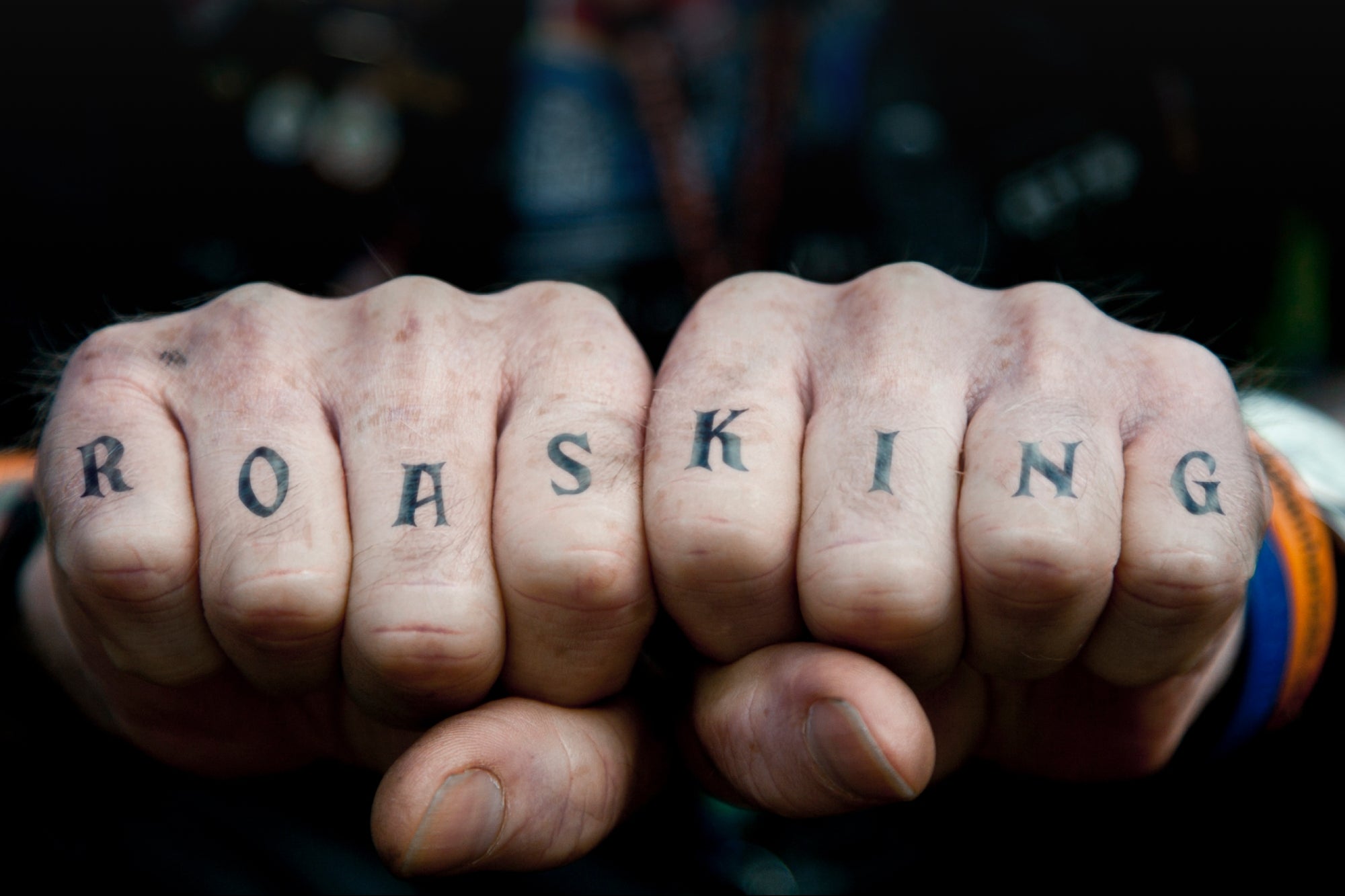

Ever wonder what it feels like to spot the next big thing before it explodes—kind of like snagging that $1,000 Nvidia IPO ticket back in ’99 and watching it balloon into a jaw-dropping $2.5 million? Yeah, me too. It’s that electrifying mix of gut instinct and a sprinkle of luck no investor can resist. Now, hold onto your hats because there’s a new player making waves in the AI space, often hailed as the “ROAS King” — RAD Intel. This isn’t just hype—they’re redefining how Fortune 1000 brands slice through the noise, predicting ad success before spending a dime. Imagine having a crystal ball for marketing that’s fueled by billions of data points across TikTok, Reddit, and beyond, pinpointing ROI gold mines others simply overlook. With a jaw-dropping 4,900% valuation surge in under four years and heavyweight backers like Adobe and Fidelity Ventures, RAD Intel isn’t just growing—they’re setting the pace, reserving their spot on Nasdaq under $RADI. Curious how performance marketing’s future is unfolding in real time? Don’t blink—you might just miss the next “I wish I had” moment. LEARN MORE

Disclosure: Our goal is to feature products and services that we think you’ll find interesting and useful. If you purchase them, Entrepreneur may get a small share of the revenue from the sale from our commerce partners.

In 1999, a $1,000 investment in Nvidia’s initial public offering would be worth more than $2.5 million today. Now, another early-stage artificial intelligence (AI) company is drawing that same early-investor buzz — RAD Intel, often called the “ROAS King” by marketers for its ability to boost return on ad spend through data-driven precision.

RAD Intel co-founder and CEO Jeremy Barnett.

Image credit: RAD Intel

RAD Intel’s award-winning AI platform helps Fortune 1000 brands predict ad performance before they spend a dollar — eliminating guesswork and waste. The company says its valuation has soared 4,900% in four years with more than $50 million raised and long-term partnerships spanning entertainment, retail, and consumer goods.

Unlike traditional adtech dashboards, RAD Intel’s system acts as an intelligent decision layer — forecasting which creative, influencer, or message will perform best in advance. Backed by Adobe and Fidelity Ventures, the company has also reserved its Nasdaq ticker symbol $RADI, signaling where it’s headed next.

Image credit: RAD Intel

For founders, CMOs, and investors who care about performance marketing, RAD Intel’s rise is a case study in compounding performance. The platform’s AI analyzes billions of data points across Reddit, TikTok, and the open web to reveal high-intent audiences others miss — and that’s why agencies have nicknamed it the ROAS King.

With traction and momentum building, the company has expanded partnerships across multiple Fortune 1000 brands — securing recurring, seven-figure contracts and driving measurable ROI gains. In 2025 alone, RAD Intel’s revenue is up 2.5× over 2024 (unaudited) and sales contracts have already doubled.

Why investors are paying attention:

- Valuation growth: 4,900% increase in less than four years

- $50 million raised from more than 10,000 investors

- 165% year-over-year revenue growth (unaudited 2025 vs 2024)

- 2× contract growth from 2024 to 2025

- Leadership experience: 225+ M&A transactions executed

- Recently recognized as a “Groundbreaking Step for the Creator Economy”

- Nasdaq ticker reserved as $RADI

Image credit: RAD Intel

Now, investors have a limited window to participate in RAD Intel’s Reg A offering before the company’s next scheduled share-price change on November 20. Shares are currently available at $0.81, offering early exposure to one of the fastest-growing AI platforms in marketing.

Don’t let this become another “I wish I had” moment. The opportunity is open — but not for long.

Lock-in $0.81 shares now – before the price change on 11/20.

This is a paid advertisement for Rad Intel’s Regulation A offering. Please read the offering circular at https://invest.radintel.ai/

In 1999, a $1,000 investment in Nvidia’s initial public offering would be worth more than $2.5 million today. Now, another early-stage artificial intelligence (AI) company is drawing that same early-investor buzz — RAD Intel, often called the “ROAS King” by marketers for its ability to boost return on ad spend through data-driven precision.

RAD Intel co-founder and CEO Jeremy Barnett.

Image credit: RAD Intel

The rest of this article is locked.

Join Entrepreneur+ today for access.

Post Comment