Why Betting Everything on AI-Driven Tech Could Be the Biggest Mistake for Long-Term Investors—Here’s the Untold Strategy to Secure Your Future Wealth

Ever caught yourself staring at a dizzying web of AI companies all funding each other — it’s like a financial cockroach hotel that Michael Burry wouldn’t touch with a ten-foot pole? Yeah, me too. The bubble whispers have been getting louder, with questions flying in from every corner about whether investing in AI and tech giants like Nvidia and Palantir is the smart play or a shortcut to disappointment. It’s the classic investor’s dilemma: embrace the shiny tech bonanza or run for the hills clutching your cash? But here’s the kicker — what if the answer isn’t as binary as selling everything or holding tight? What if the secret sauce lies in navigating the turbulence with savvy diversification rather than knee-jerk panic? Let’s unravel this rabbit hole, look beyond the hype, and get real about where the smart money might actually flow in this volatile AI-fueled market. LEARN MORE

img#mv-trellis-img-1::before{padding-top:41.133720930233%; }img#mv-trellis-img-1{display:block;}img#mv-trellis-img-2::before{padding-top:125.03052503053%; }img#mv-trellis-img-2{display:block;}img#mv-trellis-img-3::before{padding-top:182.20640569395%; }img#mv-trellis-img-3{display:block;}img#mv-trellis-img-4::before{padding-top:64.35546875%; }img#mv-trellis-img-4{display:block;}

I got this question in my Telegram chat. I know this person who is asking me is not exposed in any way so he is just getting a sense of what I think about it.

But in a way, I been getting weird vibes and questions regarding this. There is someone asking about how I rebalanced Daedalus Income, which is my portfolio, especially with bubbles mention in the same breath. Then we got this person coming in talking about cockroaches and Michael Burry shorting Nvidia and Palantir.

What this reader is referring to is this idea about various AI players, funding other AI players with what they earn, who is funding other AI players, almost in a circular fashion.

I think it is this diagram:

I think the peak of this is when Sam Altman, the CEO of OpenAI could not answer Brad Gerstner’s basic question about how OpenAI will handle $1.4 trillion of infrastructure deals with $13 billion of revenue.

He basically told those who are genuinely interested to go sell their stock if they don;t like it.

After that, OpenAI’s CFO, Sarah Friar, floated the possibility of asking for a federal government backstop.

It really feels peak.

I am not sure how many of my colleagues who are client advisers were asked this but so far they are not coming to me, except for one ex-client adviser.

I think those who have vested interest are worried that this is a bubble. If this is a real bubble and they get caught in one, especially if they are spending down in retirement, this would potentially be a negative sequence of return risk.

But I think generally, whether you are accumulating or an income investor, you think returns drive everything (which is not always the sole thing in some situations) and therefore they are worried.

Well, the simple solution is to be more diversify isn’t it?

Like don’t have all tech companies. Like have some… Europe, Australia, Canada, Emerging Markets companies? Have some fixed income?

No.

It seems for most people it is either I sell out of tech companies, AI companies or S&P 500, and go to cash, or nothing.

If that is what you want then go ahead then.

But some don’t dare to sell or even diversify.

I think the reason is they know they need to compound their money, and if they get it wrong their returns will suck relative to others.

Fxxk I think you cannot convince them otherwise.

In a way, I find that there are people who are so stuck to certain philosophy but are unaware that there are always some flaws, or uncomfortableness with investing in any forms. We just hope with more investment experience, they are able to figure this out because sooner or later they realize that they keep suffering from the same shit, chasing after shadows again and again.

There are always some sort of uncomfortableness:

- If you are invested in something that are performing so well, the better it performs, the more uncomfortable question that pops up is “when and how does this end?”

- If you are invested in something that has not perform so well, the longer it is, the more uncomfortable question that pops up is “when do I know I made a mistake?” or “am I an idiot to persist with this?”

Whichever way, you have to untangle some questions either by yourself… or with the help of someone.

Or you can look at it from my angle.

- If you kind of know that you are not sure where the sources of returns are from, and you wish to invest in equities, be diversified adequately so that you can be exposure to various risk exposure to potentially harvest the risk premiums.

- You won’t know what will be the eventual return. None of us know. Ask those in 2000 if they know emerging market is going to be gangbusters in the next 10 years. Ask those in 2010 if they know US is going to do so well. Ask those in 2019 whether they know they are going to be hit with a pandemic in a year, and AI is going to make that big of an impact after 2022.

- Think of equity as a 20-23 year pseudo-bond that should help you achieve your financial goal if held long enough. In every 20-23 year, there is going to be some weird shit happening and at the end you get either 4% p.a. to 10% p.a.

If you view it through 20 years, there is gonna at least be 3 pretty hairy downturns and some small downturns. You will explore bubble questions a few times until you sian already.

But I reckon many do not think with a wealth management/financial planning lens but look at it as “I need to earn 14% p.a. return if not my financial plan will fail” kind of mindset.

In a way, they fear diversification because that would be diworsification.

I want to share with you my perspective.

Now, if Artificial Intelligence succeed what would happen?

Will it make us more productivity? Like truly productive?

If as workers we are truly productive what might happen? Companies that managed to harness AI well will be more productive, their operating margins improve, and…. their earnings per share will improve?

If the productivity last long enough, and the EPS keeps improving what happens to the share price?

Should go up right?

Now, investing a lot often is where you are at and where do you get to.

Imagine if your companies are the so call shit non-tech companies that have poorer models.

You are at a shit base already.

If there is this thing… that everyone say confirm will improve productivity, then what happens?

You are no longer at a shit base.

So how many of these are there?

- People don’t like European companies. They kept saying there is maybe only 1 or 2 tech companies. So hard to seed startups.

- The mid cap, small cap US companies.

- Energy, material, real estate companies.

Those are to name a few segments.

Now if this AI magic pill is going to be so transformative, what will this do to their EPS and share price?

You might not know exactly the magnitude of productivity benefit, or which sector will benefit the most, and that is why the idea is to be adequately diversified and hold a basket today.

If you have an investment friend, or a client who always like to act smart, this is a question to go ask them which one will benefit the most that is not tech related.

Those Who Started It Might Not be the Ultimate Beneficiary

And this is the overall idea.

I think a lot of people see this technology adoption to be similar to the 2000 telecom boom and bust.

Many major companies spent a lot of capital expenditure on fiber optics.

The dot com bust partly show up that the adoption might not be so fast.

Today, many Americans benefit from the fiber optics that bankrupt companies initiated.

I am not saying those who spent capital expenditure today on AI is going to suffer from the same fate.

Look at it in a different way, the benefits will be felt not just by tech companies.

I think we should also remember that some regions such as China don’t have to always upgrade from 1G to 2G to 3G for their Telecom.

They were backward enough that when they decide to push for technology change they just started with the most latest tech.

They don’t have so much baggage.

In a way, isn’t that kind of like Europe now?

So much aging, brain drain, whatever you call it. What happens if there is something that improves productivity? Isn’t that a potential antidote to a long running challenge that you been trying to deal with?

Now What if… AI Doesn’t Improve Productivity So Much?

Then, by holding an S&P 500, where the top 8 are all AI levered companies, wouldn’t buying these firms be…. buying companies that is going to have poor return on assets, return on invested capital in the future?

What does that mean to the share price?

What Vanguard Economist who Spent the Last 10 years Looking into it and Just Wrote a Book Says about this AI and Asset Allocation.

I actually wanted to write this today, but coincidentally, I was mopping the floor and listen to this Meb Faber interview with Joe Davis, Vanguard’s Global Chief Economist and Global Head of Vanguard’s Investment Strategy Group.

Why the Next 5 Years Will Shock Investors (Vanguard Joe Davis Explains)

Joe and his team spent the last 10 years taking an extensive look at how Artificial Intelligence will impact our planning returns.

Which will definitely be something that interest us, since we want a good return because we want to fulfill our financial goals.

I think what you are interested in is at 33 min: Historical technology cycles and its impact on your asset allocation.

Joe outlines an investment strategy derived from historical technology cycles, which suggests a contrarian approach in the “AI wins” (optimistic growth) scenario:

- The Contrarian Take: The more bullish you are on AI, the more you should ultimately underweight technology in your equity portfolio over the next five to seven years.

This strategy is based on the observation that technological transformations typically unfold in two phases:

Phase 1: Production of Technology

- Focus: This phase is dominated by the creation and initial rollout of the new technology.

- Outperformance: The technology sector (or the equivalent “tech” companies of that era, such as utility companies in the 1910s) drastically outperforms.

- Timing: This is roughly the first half of the cycle (e.g., five or six years on the up).

Phase 2: Spreading and Application of Technology

- Focus: The technology spreads, becoming a platform that unleashes new industries and raises efficiency across the entire economy.

- Outperformance:Non-tech companies outperform the core technology sector. This is because:

- Efficiency Gains: The technology is transformational, raising the efficiency, productivity, and new earnings growth for companies outside the tech field (e.g., AI making hospitals or banks more efficient).

- Reduced ROI for Incumbents: A “massive amount of new entrance” (e.g., over 5,000 AI companies funded in the last four years) in the technology field increases competition. This influx of capital ultimately reduces the ROI of the incumbents after the initial phase, even if the technology is transformative.

- Timing: This is the second half of the cycle (e.g., five or six years on the spreading).

Final Portfolio Asset Allocation Conclusion

- The analysis suggests that in either the optimistic (“AI wins”) or pessimistic (“Deficits Dominate”) scenario, there is an elevated probability (85%) for technology stocks to underperform.

- Investors with new capital or looking to rebalance should focus on balancing risk and diversifying their bets by:

- Looking outside the S&P or the IT indices.

- Thinking about investing outside the US at the margin.

- Fixed Income does well in both scenarios because you have high interest rates due to either strong growth or high fiscal pressures, providing a resilient component in the portfolio.

The Data Set

i think you might be more interested in what data was used and what some of the conclusions.

The data set used for the model, which they call the “idea multiplier” framework, is noted for its depth and longevity:

- Novelty and Depth: It is described as the “most novel data set in the world” and the “deepest data set to our knowledge that exists,” going beyond what is available to governments or academia [08:29, 17:58].

- Scale: It involved a “huge data exercise” encompassing “billions billions of data points” [04:09].

- Historical Scope: The research looks at data across various dimensions for 150 years [11:51] and novel data sets for geopolitical tensions going back over 100 years [13:30].

- Focus: It tracks a wide range of scientific and technological ideas, including patents, new medicines, and scholarly articles [04:04]. It also analyzes the impact of AI across 800 occupations [15:41].

The model is driven by the push and pull of several “mega trends” which serve as the primary metrics for determining future outcomes:

- Technology (AI and General Purpose Technology): [03:03, 11:54]

- Rough Effect: A transformative AI boom could cause economic growth to accelerate above 3% (the “AI wins” scenario), overcoming demographic headwinds [15:23].

- Investment Implication: Paradoxically, a long-term AI boom suggests investors should underweight the technology sector and diversify into non-tech sectors as the technology spreads and new entrants compress returns for incumbents [32:00, 34:33].

- Debt Levels and Deficits (Fiscal Pressures): [12:35]

- Rough Effect: Rising deficits can put upward pressure on interest rates and push growth down [10:09, 29:25]. If this factor dominates (“Deficits Dominate” scenario), it could lead to a “loss decade for stocks” (bond-like equity returns) [29:11].

- Investment Implication: In a high-debt world without an AI boom, the best defense is to overweight short and intermediate-duration fixed income (bonds) due to the flight-to-quality effect [29:33, 30:43].

- Demographics: [13:01]

- Globalization (Trade Flows and Tariffs): [12:47]

- Geopolitical Tensions: [13:30]

- Climate Change: [13:37]

- Rough Effect: Earth and water temperature metrics are included to account for their long-term economic effects [13:37].

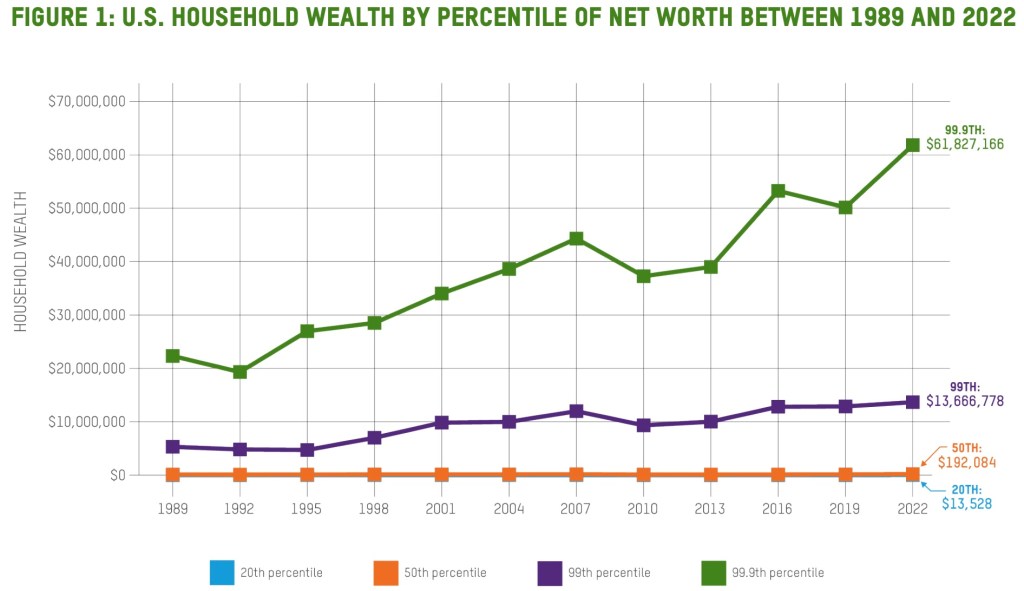

This Year Proves that Not Every Thing Always Revolves around the US Market.

One of the reasons some investors don’t dare to diversify away from the S&P 500 is that if US does poorly, then every other region will do poorly.

Which is not the case because this year US equity was some of the poorer performing ones relative to other regions.

They might not realize that every year, there are always going to be that Greece, or Turkey that did extremely well.

But more so, they are afraid that if US is in a bubble, there will be nowhere to hide.

Well, usually most markets go down, like April this year but the magnitude of recovery is different.

The chart below is the SP500 ETF (SPY) against the Avantis International Small Cap Value fund (AVDV) since March 2025:

The AVDV also plunge with great magnitude in April, but you can see how different it is the recovery. This year, you will see different charts like this, for various regions.

It should give you confidence that it is not always US is the best house.

The last time there was a so call bubble, of kind of similar nature was the Dot com bubble in March 2000.

Let me show you the 5 year performance of a few indexes from 1st Mar 2000:

- S&P 500: -1.66% p.a.

- S&P 500 Growth: -6.64% p.a.

- S&P 500 Value: 3.43% p.a.

- Russell 1000: -1.57% p.a.

- Russell 2000: 1.35% p.a.

- Russell 3000: -1.38% p.a.

- S&P Midcap 400: 7.49% p.a.

- S&P Smallcap 600: 7.56% p.a.

- MSCI World Index: -1.93%

- MSCI World Small Cap: 6.74% p.a.

- MSCI World Value: 3.43% p.a.

The other stuff did well, with returns that you will find it acceptable.

And I believe one of the reason they did so well is because they were neglected for too long, that their value was pretty reasonable.

It was not normal and pretty uncomfortable to own them.

Epilogue.

The hardest thing to do is to move away from recency bias.

Perhaps also as hard is to invest in what you find it uncomfortable. And if this is the case, then you can continue to remain invested in what you are “comfortable” with. But then if you are comfortable, I should not see you asking about this question time and again. Perhaps the biggest problem is too many wish to have your cake and eat it too.

You got to find your own way if you don’t trust this thing about:

- Viewing investments from a 20-23 year lens.

- Be diversified enough.

The hardest to predict is when things will inflect.

I suspect the tech companies will go overvalued, but when they do, it will be so so difficult for people to move away.

Those who think its overvalued will sell, only to realized they missed out… like Thomas Edison, and get suck back in at the top.

And they would not be able to switch to less attractive ones.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

Post Comment