Why Bitcoin’s Break from M2 Liquidity Signals a Game-Changing Reset You Can’t Afford to Ignore

So, is the Bitcoin cycle finally waving the white flag, or is it just catching its breath before the next big sprint? I’ve been hearing the chatter, and let me tell you—despite the October shakeout that took $20 billion off the table, experts aren’t ringing the death knell just yet. Instead, they’re eyeing potential upside heading into year-end and even early 2026. But what’s this talk about Bitcoin decoupling from M2 liquidity? Turns out, a little dance with government borrowing since July has temporarily thrown off BTC’s usual rhythm with global money supply—and that’s got a lot of folks scratching their heads. Yet, savvy analysts suggest this isn’t a breakdown, but a reset; a pause that might just set the stage for the next explosive leg up. Curious how this liquidity tug-of-war plays into Bitcoin’s future moves? Stick with me as we unravel the signals, the resets, and the strategies shaping BTC’s path forward.

Key Takeaways

Is the Bitcoin cycle top in?

No. According to experts, there is potential upside into year-end and early 2026.

Why has BTC decoupled from M2 liquidity?

A temporary government borrowing that has been net negative for liquidity and BTC since July.

The Crypto Twitter (CT) community is nearly split in half on whether Bitcoin [BTC] has entered a bear market phase.

Unsurprisingly, the bearish claims have been reinforced after the 10th of October deleveraging event, which wiped out about $20 billion worth of positions.

BTC is barely holding above $100k in November, down about 21% from its recent peak of $126K. Now, the bearish camp is citing the decoupling of BTC from the M2 global liquidity supply as another potential downside signal.

What does M2 decoupling mean for BTC?

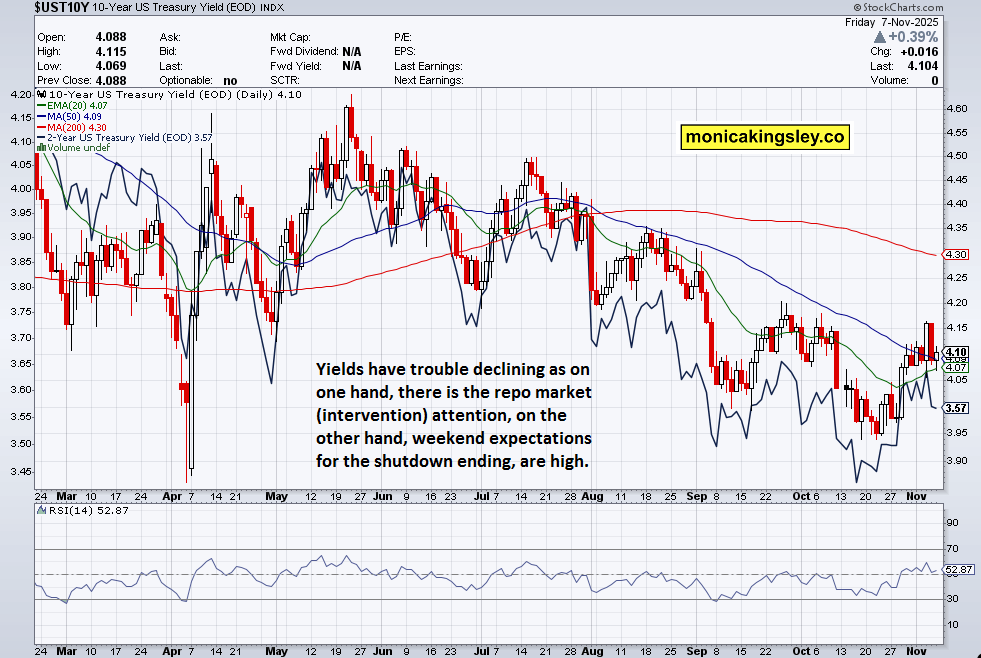

The M2 indicator tracks the level of aggregate global liquidity. However, BTC also responds to “who has liquidity,” according to analyst Jesse Eckel.

Since July, when the U.S. government raised its debt ceiling in July, net dollar liquidity has been withdrawn from markets, noted Eckel. This marked the M2 decoupling and has dragged the BTC price.

He noted that year-over-year (YOY) liquidity, which had been limited in 2025, saw massive growth in 2017 and 2021, triggering significant crypto rallies. Eckel added,

“The M2 BTC chart should start to correlate again once we see market tradable liquidity start to move higher as well. I believe our next major burst in YOY liquidity is due for 2026.”

Analysts call the October flush a “reset”

Most macro analysts, including BitMEX Founder Arthur Hayes, also held a similar stance to BTC, from a liquidity perspective.

Regarding the October flash crash, Coinbase viewed it as a healthy reset rather than a cycle top. The analysts added,

“Our view of the sell-off is that this leverage flush was a necessary reset for crypto markets rather than a cycle top, potentially setting the stage for a grind higher in the months to come.”

In fact, Fundstrat CIO, Tom Lee, also agreed with the outlook that the October leverage flash was a needed rest for another leg higher.

Additionally, the Coinbase analysts highlighted that the market was positioning for a BTC price range $90k-$160k for the next three to six months, according to Options data.

Overall, large players were positioning for a potential dip to $90k, while anticipating a likely upside to $160K in the mid-term.

Post Comment