Tesla’s Bitcoin Blunder: How Selling at $20K Could Haunt Elon Musk’s Crypto Empire Forever

Ever wondered how much Tesla might have cashed in if it had held onto its Bitcoin instead of selling it off during the 2022 crash? It’s like watching a blockbuster movie and walking out five minutes early—you miss the jaw-dropping finale. Back in early 2021, Tesla made a bold move, snapping up 43,200 Bitcoin for $1.5 billion as part of a savvy diversification play. They even accepted Bitcoin as payment for their cars—until environmental concerns threw a wrench in the gears. Fast forward to mid-2022, Tesla offloaded a whopping 75% of their Bitcoin holdings when prices hovered around $20,000—a decision that now looks like a stunning missed opportunity. With Bitcoin’s meteoric rise past $100,000 and even touching $122,000 recently, those digital coins would have ballooned Tesla’s portfolio to nearly $5 billion. Instead, selling early cost them billions in unrealized gains amid a tough quarter for their core auto business. It begs the question—should Tesla have held the line on Bitcoin, or was cashing out when they did the smarter play? Let’s dig into the details behind this crypto conundrum. LEARN MORE

The company’s initial Bitcoin purchase would now be worth around $5 billion.

Key Takeaways

- Tesla missed out on billions in potential profits by selling 75% of its Bitcoin holdings too early.

- The company’s early Bitcoin sale coincided with challenges in its core auto business and impacted financial results.

Share this article

Tesla could have made billions if it had held onto Bitcoin (BTC) instead of selling the bulk of it when prices crashed in 2022.

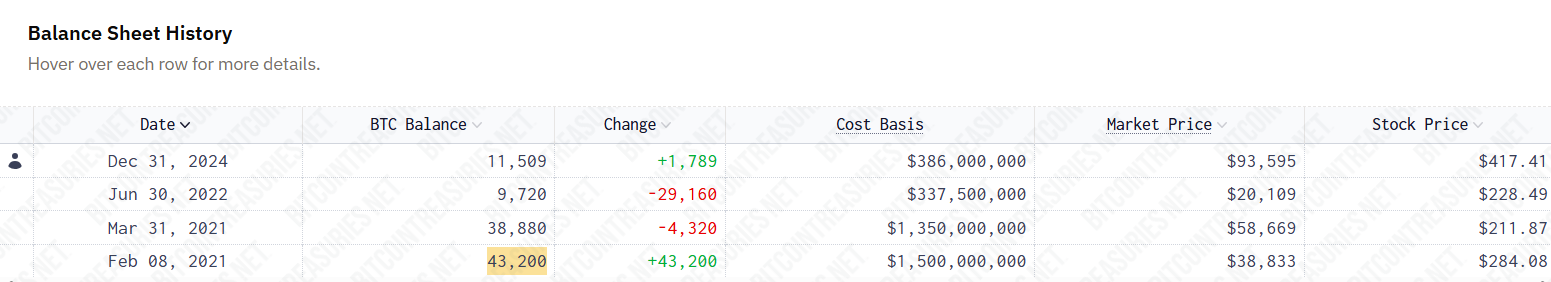

In early 2021, Tesla acquired 43,200 Bitcoin worth $1.5 billion as part of its treasury diversification strategy, data from BitcoinTreasuries.net shows.

Soon after, the company began accepting the asset as payment for its cars, but then suspended the option due to environmental concerns related to Bitcoin mining’s energy usage.

In March of that year, Elon Musk’s electric vehicle company made its first Bitcoin sale, offloading 4,320 BTC when Bitcoin was trading above $58,000. Bitcoin reached a high of $61,500 during the 2021 cycle, so Tesla’s initial sale was not entirely unreasonably timed.

By the end of June 2022, Tesla had sold another 29,160 BTC, representing 75% of its remaining holdings. At that time, Bitcoin was trading around $20,000 and later dropped to a yearly low of $16,500.

However, the second sale was less favorable. It resulted in massive missed gains.

Bitcoin has exploded since Wall Street stepped in, with major players like BlackRock, Grayscale, and other fund managers pushing to bring Bitcoin to institutional investors through ETFs. Grayscale’s court victory over the SEC paved the way for the landmark debut of spot Bitcoin funds in the US.

Following that, Bitcoin has left the $20,000 level well behind. The digital asset crossed $100,000 last December and extended its rally to $122,000, its latest high.

With Bitcoin trading at around $116,300 at the time of reporting, Tesla’s initial holdings would be valued at about $5 billion. The BTC it offloaded would be worth over $3.5 billion now.

Tesla now holds 11,509 BTC worth around $1.4 billion. The company has not adjusted its Bitcoin portfolio since its last purchase.

Tesla’s auto revenue dropped for the second quarter in a row, and the company missed Wall Street’s projections. The stock plunged 8% on Thursday before bouncing back 3.5% on Friday. It’s still down more than 21% so far this year, per Yahoo Finance.

Share this article

Post Comment