Why Companies Crushing Cash Flow Today Could Suddenly Crash Tomorrow – The 10-Year Profit Trap You Can’t Afford to Ignore!

Sometimes, the most valuable insights come from asking the simplest questions: What if you could peek behind the curtain of your investments and truly grasp what’s driving their performance? Last week, I dove deep into the fundamentals of the Avantis Global Small Cap Value UCITS ETF, fascinated by its striking 23% cash flow yield. But here’s a curveball—one of my readers, ThinkNotLeft, nudged me with a thoughtful question: How useful is knowing the price-to-cash flow ratio, really? Turns out, his portfolio has some ETFs that perfectly fit this lens, and wouldn’t you know it, there’s a whole lot more to unpack here than meets the eye.

In a market that’s part maze, part roller coaster, understanding the subtle nuances—like cash flow yields versus price—could be the secret sauce between holding firm during storms and selling out at the worst possible moment (we’ve all been there). I even reached out to the experts, tossing questions to Avantis and value investing guru Tobias Carlisle—though their quick replies didn’t shake up what I already knew, they did spark a deeper dive. And oh, grab your coffee, because when a mind like Kenneth French’s, the other half of the legendary Fama-French duo, hands you 73 years of raw data, you sit up and pay attention.

So what’s got everyone scratching their heads? Since 2014, those “cheap” value stocks that historically doubled as the tortoise in the race suddenly started struggling against the flashy rabbits with sky-high price-to-cash flow ratios. Has the game changed? Or are we just side-eyeing the next bubble? Could cash flow data be our financial crystal ball—or just another shiny metric to confuse us? We’ll chew over this, break down the numbers, debate the wisdom behind sticking to value investing’s old-school principles, and explore what it means to really know what you’re holding. Curious? You should be.

img#mv-trellis-img-1::before{padding-top:52.5390625%; }img#mv-trellis-img-1{display:block;}img#mv-trellis-img-2::before{padding-top:52.5390625%; }img#mv-trellis-img-2{display:block;}img#mv-trellis-img-3::before{padding-top:51.46484375%; }img#mv-trellis-img-3{display:block;}img#mv-trellis-img-4::before{padding-top:15.625%; }img#mv-trellis-img-4{display:block;}

Last week, I wrote an article about why and how sometimes we need to take a step back and look deeper into the fundamental drivers of a systematic fund I invested in, the Avantis Global Small Cap Value UCITS ETF: What does Avantis Global Small Cap Value UCITS ETF’s 23% Cash Flow Yield Means?

My regular reader ThinkNotLeft left a comment and wonder how useful is knowing the price-to-cash flow and he realize that two ETFs he own fit that criteria.

There are many ways to value companies and your systematic active value strategy can use something else, and sometimes it just came out the companies the fund owns is also cheap on a price-to-cash flow basis.

All in LTAM (ishares MSCI EM Latin Amer ETF) case, the region is just cheap!

But ThinkNotLeft’s thoughts is not too far from mine as well. How relevant is this?

I think knowing certain nuances can be the difference between having the conviction to buy and just hold, over crisis and uncertainty, versus… paper hand over what you own.

I send two emails out to find out what others think about this. The first one is to Avantis, since this is their fund and the second is to Tobias Carlisle, of Value After Hours, Greenbackd, the ETF ZIG and Acquirer’s Multiple. I did not get anything that I don’t know from both their short replies.

But yesterday I saw Tobias Carlisle put out this Tweet:

This price-to-cash flow stuff might have interest him enough to do some work haha!

Professor Kenneth French (one half of the Nobel winning Fama-French) graciously provided everyone with data on his Dartmouth page.

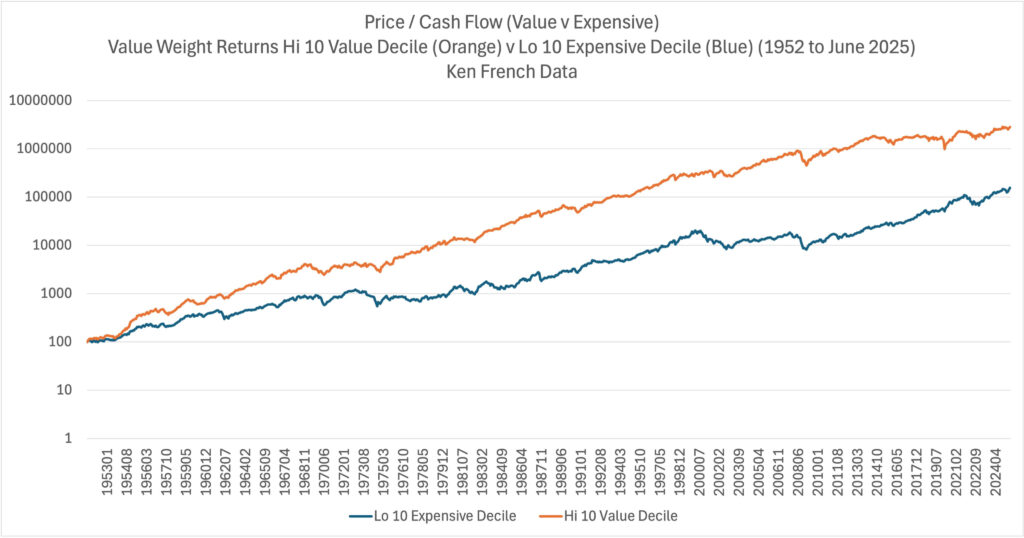

We have data about cash flows dating back to 1952 which is about 73 years. If we compare a value-weighted portfolio of those with the lowest price to cash flow (blue) against those with the highest price to cash flow (orange), you can see a distinct gap in performance. If there is anytime the low price to cash flow made a comeback, the lines will narrow.

This chart shows the spread between those with the highest cash flow yield minus the lowest cash flow yield (green line), overlaid with the underperformance.

The first thing you learn from the blue line is that there will be underperformance from time to time. And the underperformance can be pretty big.

The green line shows a good outperformance.

Every thing changes in 2014.

Then all the companies with lowest cash flow yield suddenly did so well. So much so that the underperformance makes people think that something structurally has changed.

Tobias, who pays more attention to this than most, does not have a single attribution:

- Loose monetary policy?

- Deficits?

- Software eats the world?

- Mania?

- The singularity?

- Flows?

People have tried to attribute but no clear answer. Perhaps it is a combination of these.

If it is so difficult to identify in hindsight, you wonder if you are able to identify before this.

The last chart plots cash flows divided by the market equity value. The blue are the low decile and red the high decile.

From this, you can see that those with high cash flow yield regularly hit 20% yield so the 23% I talk about is not something new.

In case it is not clear, this is not just small caps but US stocks in general.

Here is Kenneth French’s definition of cash flow:

The cashflow used in June of year t is total earnings before extraordinary items, plus equity’s share of depreciation, plus deferred taxes (if available) for the last fiscal year end in t-1. P (actually ME) is price times shares outstanding at the end of December of t-1.

I try to use ChatGPT to break it down for you all:

Components:

- Earnings before extraordinary items

→ This is similar to net income from continuing operations. - Plus depreciation

→ A non-cash expense added back, just like in the indirect method of calculating operating cash flow. - Plus deferred taxes (if available)

→ These are non-cash tax expenses, often included in the reconciliation from earnings to OCF.

Interpretation:

This formula is effectively:

Operating Cash Flow ≈ Net Income + Depreciation + Deferred Taxes

It excludes:

- Changes in working capital

- Non-operating items like capital expenditures or financing flows

Which makes it:

- A partial measure of operating cash flow, not full-blown free cash flow

- More representative of cash generated from operations than just raw earnings

This is closer to EBITDA than anything.

So for about 10 years, companies with low earnings, low cash flows, before even capital expenditure spending are outperforming those with cash flows to spend.

What Are You Holding in the End

On one hand a winning strategy can be one which has given investors the best return in the last 5 years.

Many would tell me “isn’t growth or returns what we are looking for at the end after all Kyith?”

That is true.

But what happens when what you buy into doesn’t work?

Or more realistically, it doesn’t work immediately? for 2 years?

Most will just sell out and move to the next shiny things.

And it will take a while for them to realize.. how come nothing lasts forever?

The truth might be that nothing always works. The consistent relative underperformance in the second chart should tell us that sometimes growth lose to value and sometimes opposite.

That is the nature.

It is when people assume there is something that always works.

I find that we talk too much about this large cap versus small cap, quality vs value, value vs growth too much.. that we tend to forget what we are buying.

And I think it is comforting to know that if you hold on to a basket of stocks that tend to generate cash flows that are high, relative to their price, you know you are holding on to something that is not excessively expensive.

I see so many people diss this diss that. Say this does not work or that.

Then when I ask them why aren’t they putting more money into the strategy they chose (which is not the one they diss), they say it is too “frothy” or “expensive”.

You should see my eyes roll as I see those messages.

The formula that we are taught to value a company is the discounted cash flow model above. We discount the cash flow that a company can earn in the future today back with a discount hurdle rate (r).

The cash flow (CF) can grow at a certain growth rate (g). Your stock can grows at a fast pace, or growth rate can be negative as well.

It reminds us that.. fundamentally what we are paying for today is the aggregate cash flow in the future.

How would you feel if you own a bunch of companies whose cash flows without growth is actually very low, relative to what you are paying today?

Not good.

It is disingenuous for you not to consider the greater growth Kyith.

Yes you are right.

But it is also much tougher to estimate accurate enough the degree of growth of an individual company. The saving grace is that if you are purchasing a portfolio of stocks with high growth, things might work out.

But you got to ask yourself what caused the great growth in the past ten years and would those factors still be present for the next twenty years you need?

That is for you to find out.

I don’t have an accurate answer. I suspect you won’t have as well. Your answer is just a good guess. And you believe enough in it to stake your retirement funds into it.

The traditional value investing way is to place more emphasis on the cash flow today.

The growth is just the icing on the cake. If it happens then its good.

But you want to make sure that you don’t overpay for the cash flow today. You want to make sure that even if the growth doesn’t happen, the cash flow is so ridiculous that the market will realize its value.

For those that understood these fundamentals, reflecting upon this with some of their systematic-active strategies would allow them to build the conviction to hold on even if it is not working (I am saying that this applies in general, not just value related strategies)

At the end, aside from the evidence of premiums shown by Mr. Carlisle with Professor French’s data here, your understanding of what drives returns are pretty important.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

Post Comment