Is Stagflation Inevitable? Here’s What Every Entrepreneur Needs to Know Before It Hits Hard

Ever get that nagging feeling that everyone’s dancing around the giant pachyderm stomping through the UK’s economic living room? Yeah, that’s exactly what caught my eye this week. The Bank of England’s latest half-hearted rate cut to 4%—decided only after a double vote—feels like trying to fix a leaking tire with bubble gum. Inflation’s stubborn as ever, growth’s barely a blip, yet our media keeps mum on the real culprit gnawing at the nation’s fiscal muscle. It’s not exactly stagflation, but oh boy, its sketchy cousin is lurking just around the corner. Meanwhile, a cheeky Coinbase ad goes viral, not out of shock but because everyone’s quietly nodding, realizing maybe—just maybe—the economic emperor has no clothes. But why is this conversation still the awkward, off-limits taboo? And how much of this slow bleed can we really chalk up to Brexit’s lingering shadow carving a £41bn hole in the government’s budget? Let’s unravel the undercurrents that no one’s brave enough to headline… LEARN MORE

What caught my eye this week.

Once again we have disappointing economic data in the UK. And once again, the elephant in the room is missing from media chatter.

The Bank of England was split on its decision to cut rates by 0.25% to 4% this week – it had to vote twice to reach a verdict – with stubborn inflation making cutting rates riskier than it should be.

This despite a UK economy that is barely growing.

It’s not stagflation – not yet – but it’s a close cousin. No wonder there’s fewer people accusing me and others of talking Britain down these days.

I mean, it says something when a Coinbase ad mocking UK PLC – and our dumb acceptance of our lot – goes viral not because we’re outraged, but because we see the truths:

Now, it doesn’t seem like this ad was really banned, as some claimed.

And if it was steered off-air by the regulators, it’ll be for disclosure reasons, not because of Stalinist diktats from on high.

All the same, given that almost nobody else dares to speak of the economic ill that continues to grind in our gears, I’m sympathetic to the notion (not the reality) that ‘they’ are suppressing the truth.

Leave it out

Despite this near-blackout on Brexit, at least the public has woken up to its mistake.

A new poll for The Sunday Times showed only 29% would vote Leave again.

And no wonder!

Reminder: not only is the UK economy growing nowhere, but the government is said to face a £41bn fiscal ‘black hole’ which means taxes will have to rise again.

From the BBC…

NIESR said the shortfall in the government’s budget was in part due to weakening growth over the past few months, resulting in a lower tax take and higher government borrowing.

But the reversal of welfare cuts, which were originally designed to save £5.5bn a year by 2030, had also had an impact, it said.

…which is all true, no doubt. But the UK economy wasn’t born yesterday.

I know some are bored of me repeating it, but multiple independent estimates say that a ‘Remain economy’ would be at least £100bn bigger.

And that missing GDP equates to around £40bn of lost taxes.

So – once more with feeling – this £41bn black hole is basically due to Brexit.

My diagnosis: the State carried on with its pre-Brexit cruise control spending, but the economy to pay for it has leaked too much air from the tyres.

Sure things would be rough regardless. Covid happened. Ukraine. Trump and his trade wars.

But we lowered our baseline growth in 2016, and that all just made it worse.

A lot of little decisions add up

Counterfactuals and shades of grey seem hard for some people to understand.

So to give just one example, yes, the City of London has expanded after Brexit.

But it would expanded more quickly without it.

How do I know? Because the banks have told us so – and the wonks have backed it up with research.

Goldman Sachs’ CEO said this week that London’s position was “fragile”, noting:

“London continues to be an important financial centre. But because of Brexit, because of the way the world’s evolving, the talent that was more centred here is more mobile.

“We as a firm have many more people on the continent.”

EY’s Brexit tracker reported this week (paywall) that the five biggest investment banks have added 11,000 jobs in the EU in the five years since Brexit.

Most of those would have instead been high-paying and tax-generating jobs in London in a Remain timeline – simply because there would have been no reason for anything to change.

From the same article (my bold):

Michael Mainelli, the former Lord Mayor of the City of London who leads consultancy Z/Yen, estimates that 40,000 financial services roles have moved from London to the EU because of Brexit.

Meanwhile, the number of people employed in the City has grown since the 2016 Brexit referendum by around 130,000 to reach 678,000 at the end of 2024.

“The City of London has been growing and continues to do so,” he said.

“I remain bullish on London, but proportionately it is likely to have done better if it wasn’t for Brexit.”

Is the penny starting to drop at the back?

It’s not all or nothing.

It’s not depression or boom time.

It’s just a bit worse, year after year, which is more than sufficient to add up to the 4% hit to GDP that the OBR and others have estimated – and to create a £41bn headache for Rachel Reeves.

Dealing with it

Before anyone comments, yes the US-UK trade deal is slightly better than the EU’s.

The trouble is we sell almost twice as much in goods and services to the EU. Europe remains our lynchpin trading partner by far.

What’s more, the EU (and the world) will very likely get a new deal soon after Trump leaves office and economic sanity returns to the White House.

Whereas we’re stuck with our economically-damaging exile from the EU for at least a generation. (Sorry Ed Davey.)

An overnight crisis ten years in the making

Read the right-wing press – even a few sensible commentators who I know read this blog – and it’s implied that the UK’s travails are all Rachel Reeves’ fault.

As if we were all lounging in the sunlit uplands this time last year. Having our cake and eating it.

Look, I agree that Labour has done nothing much in its first year to improve matters.

Labour’s planning reforms should have helped, but so far we’re building fewer homes. And its better relations with the EU are welcome, but Starmer’s new deal was far from an Undo button.

Meanwhile the hike in employer’s National Insurance is hammering small UK firms, especially those in the service economy. I’m an investor in a few, and they all say it’s been another kick in the teeth.

And let’s not even mention Labour’s welfare reform farrago.

The only tough decision this government has stuck to so far is its foolish election pledge on income tax.

Nevertheless, pinning the UK’s malaise on Labour is rank hypocrisy. Not only do these elements shirk their responsibility for our national blunder, they seeks to stick everything on a one-year old administration.

He who smelt of it dealt it

Why do I still bring up all this ancient history?

Firstly because it’s not ancient. As I explained, we’re living with the consequences. Yet that obvious truth is absent from the prevailing narrative, and it infuriates me.

Secondly, because if we don’t know how we got here then we’ll potentially double-down to make things even worse and vote for Farage and Reform. Whereas that man should be unelectable for what he’s already done to our economy.

But I don’t really need to prove my point. The economy today looks pretty much how I said it would nine years ago, after we voted Leave – a bit worse than otherwise every year, which adds up. And obviously nothing fixed by leaving the EU.

Circumstantial evidence perhaps, but pretty on the nose.

In contrast the other side should have everything to explain. Because Britain in 2025 does not look anything like the nonsense they promised us in 2016.

It should feature in every economic analysis. Yet you barely hear a peep about it.

“Move on!” they cry.

British beef

Okay, so where does all this leave us as investors and savers?

Well, interest rates kept higher for longer for starters. The UK struggled with inflation for decades before it joined the EU, perhaps due to its small size and reliance on foreign trade. Like others, I see signs this disease may be re-emerging.

As for UK assets, it’s obviously incredibly tricky to judge – presuming you’re the naughty type who likes to speculate.

All things being equal the pound will be higher given higher rate expectations versus other currencies, but inflation can work against that.

Same with conventional gilts. Perhaps more reason to overweight mid-duration index-linked gilts in our safety cushions?

As for equities, UK companies continue to get taken out by foreign predators, mostly US. (If the fund manager who disputed my prediction of this in our comments a couple of years ago would like to update us, please feel free…)

So despite all the gloom, I remain very overweight the UK market.

Many UK companies still look reasonably priced, especially versus the US. And the liquidation of the LSE is a catalyst to unlocking their value.

Which is good for shareholders, even if it’s a sorry state of affairs for the LSE – and for the UK more widely.

Pips squeak

Presumably some taxes will have to rise, too. For good or ill more borrowing seems to be off the table.

I think Labour’s income tax pledge is foolish not because I love higher taxes from this level, but because I think endless speculation about where they can pinch and pilfer around the margins is more damaging than just a straight hike.

But really we’re taxed enough already by my lights. There are no good options, and I wouldn’t be surprised to see things get worse if more rich people flee.

There’s been a lot of debate and debunking as to what extent this exodus is actually happening, but I do judge something is going on. The collapse in London prime property prices is surely one eagle-sized canary in the coal mine.

Also before anyone waves a copy of Socialist Worker at me, understand this really matters for the welfare state that most of us – and Labour – care about.

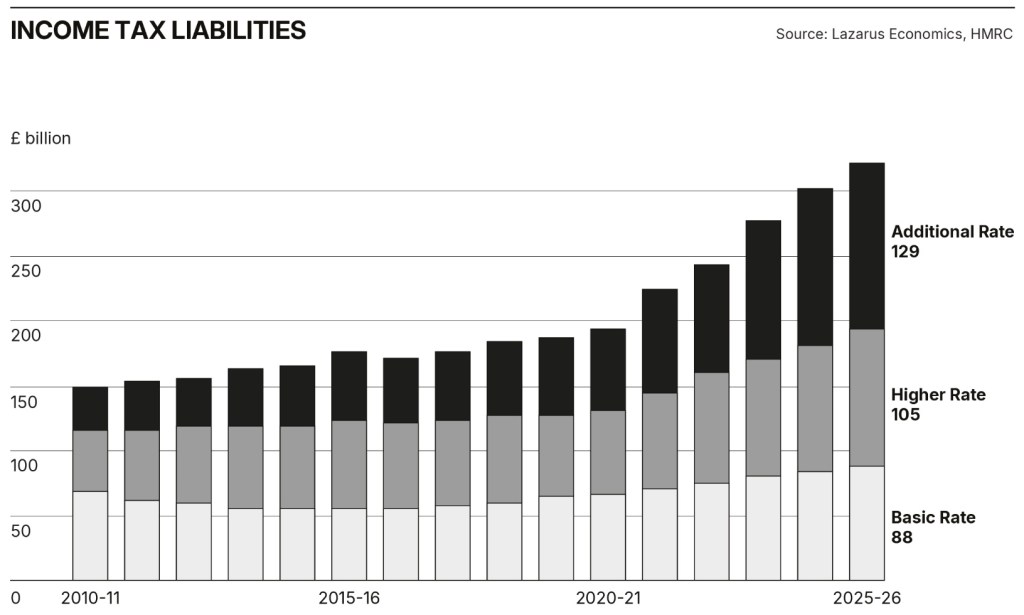

Not only do the rich drive a lot of economy activity, but a mere 3% of taxpayers represent a huge chunk of income tax receipts:

Source: Four.Zero

Finally, it usually is darkest before the dawn and we’ve been in a fix for a decade.

Perhaps if something breaks soon it’ll be a wake-up call that could yet see off even worse in four years time.

Have a great weekend.

From Monevator

Is now a good time to invest? – Monevator

FIRE-side chat: Scot-free – Monevator

From the archive-ator: How much in an ISA vs a SIPP for financial independence? – Monevator

News

BOE cuts interest rates to 4%, lowest in two years – BBC

Committee was deadlocked and needed a second vote – This Is Money

FCA to allow us to buy crypto ETNs from 8 October – ETF Stream

Gold futures soar on reports of US tariffs on Swiss bars – Guardian

Wealthier areas set to pay more council tax under new plans – This Is Money

Warning over ‘most sophisticated’ fake savings scam – Guardian

Number of borrowers over 36 taking out 35-year mortgages surges 251% – This Is Money

FCA fines Neil Woodford nearly £46m – FCA

Nearly 3m savers will pay taxes on interest this year – This Is Money

My ‘time-bombs don’t explode’ rule: US corporate pensions – Axios

Products and services

What the interest rate cut to 4% means for your money – This Is Money

Probate: executors reveal the challenges they’ve faced – Which

Get up to £1,500 cashback when you transfer your cash and/or investments to Charles Stanley Direct through this affiliate link. Terms apply – Charles Stanley

Get 6.5% interest with a Virgin Money Regular Saver… – Be Clever With Your Cash

…though like these other regular savings accounts, there’s a catch – Which

What to do if your fixed mortgage deal is ending – This Is Money

Get up to £100 as a welcome bonus when you open a new account with InvestEngine via our link. (Minimum deposit of £100, T&Cs apply, affiliate link. Capital at risk) – InvestEngine

With £105m in Premium Bond prizes unclaimed, NS&I urged to join Tell Us Once scheme – This Is Money

Audible vs Spotify Audiobooks – Be Clever With Your Cash

Homes for sale with a roof terrace, in pictures – Guardian

Comment and opinion

The parents who charge their children rent – Sky

“Living on universal credit is a constant battle” – BBC

The latest thoughts from Bill ‘4% rule’ Bengen [Video] – The Unlock via YouTube

Resurgent international value – Verdad

Not one step back – A Teachable Moment

Wise words on market cycles – Novel Investor

The spectrum of infrastructure assets [Research, PDF] – Meketa

Understanding asset return expectations [Research, nerdy, PDF] – AQR

Meme stocks are back mini-special

Meme stocks and Mr Market – A Wealth of Common Sense

No country for short sellers – BakStack

The grand illusion – The Uncertainty of it All

Is the US housing market driving the meme stock resurgence? – Of Dollars and Data

Naughty corner: Active antics

Venture Capital fund maths for dummies – Digital Native

Does moat investing work? – Flyover Stocks

More on the infamous Treasury 2061 gilt – Macro Credit Thinking

Private unicorns may throw a lifeline to stock analysts – Bloomberg via Advisor Perspectives

How to start your own wealth management firm [US regs, but relevant] – Investopedia

Kindle book bargains

What They Don’t Teach You About Money by Claer Barrett – £0.99 on Kindle

Too Big to Fail by Andrew Ross Sorkin – £0.99 on Kindle

50 Economics Ideas by Edmund Conway – £0.99 on Kindle

Mastering the Business Cycle by Howard Marks – £0.99 on Kindle

Or pick up one of the all-time great investing classics – Monevator shop

Environmental factors

The rare predator we risk losing from British waters forever – Country Life

Great Barrier Reef suffers worst coral decline on record – BBC

You are contaminated – The New York Times

Can Earth’s beaches survive a sand shortage? [Paywall] – FT

Danish zoo asks for unwanted pets to feed its predators – BBC

World’s rarest shark species found living off Welsh coast – Oceanographic

Are the ‘world’s most beautiful islands’ in danger? – BBC

Robot overlord roundup

Genie 3: Google DeepMind’s new world generator – DeepMind

The rage of the AI guy – Freddie deBoer

Navigating the AI revolution as an asset allocator – Cambridge Associates

It’s 2025, the year we decided we need a common slur for robots – NPR

AI can certainly replace enshittified jobs – Pluralistic

How AI conquered the US economy… – Derek Thompson

…but will data centres crash the economy…? – Noahpinion

…and what would the aftermath look like? – The Diff

Not at the dinner table: US statistics mini-special

Roughly no non-US citizens voted in 2024 election, contrary to claims – NPR

Trump, the BLS, and choose-your-own-reality governance… – Derek Thompson

…with even Republicans condemning Trump’s firing of job-stats wonk… – Guardian

…and apolitical Joachim Klement urging redress – Klement on Investing

…while report warns US data and stats agencies are in peril [PDF] – Am Stat

Off our beat

Notes on growing older – The Ruffian

What the marshmallow test got wrong about child psychology – Psyche

Big Mags: the paedophile-hunting granny who built a heroin empire – BBC

Every message is a gift – A Year of Mental Health

Fandom is big business. This company is poised to cash in – Sherwood

Animals keep evolving into anteaters. Could humans? – BBC

How 100 years of medical advances slashed cardiovascular disease mortality – Our World in Data

Putting yourself out there – We Are Gonna Get Those Bastards

And finally…

“Capitalism works only when institutions are forced to absorb the consequences of the risks that they take on.”

– Sebastian Malby, More Money Than God

Like these links? Subscribe to get them every Saturday. Note this article includes affiliate links, such as from Amazon and Interactive Investor.

Post Comment