Crypto Fear & Greed Index Rockets to 70 – Is Bitcoin’s Next Move Set to Break the Market Wide Open?

Ever wonder why folks just can’t seem to hit the brakes when the crypto market lights up with greed? It’s like watching a high-stakes poker game where Bitcoin and Ethereum play the chip leaders, pushing prices skyward—even when the cards say ‘overbought.’ This bullish frenzy, marked by a Crypto Fear & Greed Index nudging around 70, suggests investors aren’t just optimistic—they’re riding a wave of confidence that’s hard to ignore. Yet, as I’ve seen time and again in markets, intense greed often teeters on the edge of cautionary tales, where seasoned pros start wondering: is this momentum sustainable, or are we cruising towards a bump? With the global crypto cap ticking up by over 2%, reaching a staggering $4.05 trillion, and key players like Bitcoin jumping over 3%, the scene is set for both opportunity and risk. So, what’s the real story behind these soaring numbers and frenzied sentiment? Let’s dive deep and unpack what the charts and chatter might be whispering beneath this bullish roar. LEARN MORE

Key Takeaways

The crypto market remains in a strong “greed” phase, with bullish sentiments pushing Bitcoin and Ethereum higher despite overbought signals.

Investor sentiment in the crypto market took a bullish turn recently. This, after the Crypto Fear & Greed Index peaked at 70 – A clear signal of heightened optimism.

At the time of writing, it had eased to 62. However, it’s worth pointing out that the index remains firmly in the “Greed” zone. What this implies is that there is a state of sustained market confidence right now.

The improvement in investor sentiment seemed to align with a 2.38% uptick in the global crypto market cap to $4.05 trillion. It was supported by Bitcoin [BTC] surging by 3.33% to $121,706 and Ethereum [ETH] climbing by 2.02% to $4,271 over the past 24 hours.

Do historical trends indicate anything?

In the past, periods of intense greed in the cryptocurrency market have frequently been followed by price pullbacks or sideways trading. This, as investors secured profits or repositioned to avoid the risks of inflated valuations.

The Crypto Fear & Greed Index hinted at robust market confidence at press time. At the same time though, its readings can also be seen as a warning sign. Could there be potential turbulence in the near term? For active traders, this dilemma underlines the importance of assessing risk tolerance and avoiding impulsive moves driven by FOMO.

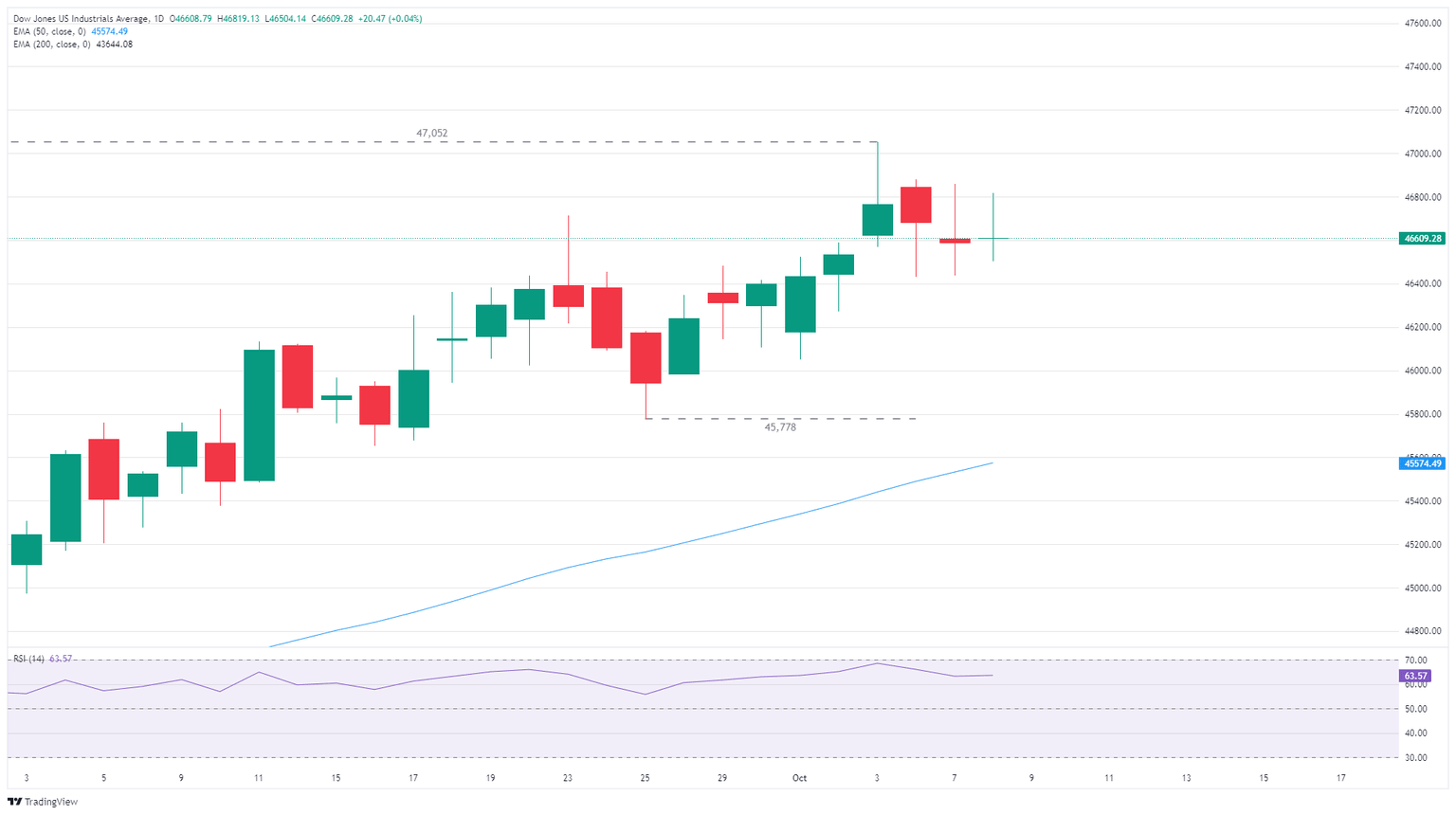

Santiment’s latest datasets seemed to add another layer to this analysis. For instance – Both Ethereum and Bitcoin’s Relative Strength Index (RSI) appeared to be on the way down after peaking in the overbought zone.

Such a combination could hint at the possibility of a near-term market pullback. However, certainty will remain elusive in such dynamic conditions.

A look at Bitcoin’s dominance…

Bitcoin’s market dominance continues to play a pivotal role in maintaining the overall bullish sentiment across the crypto sector though.

With a value of 60.80% at press time, this level alluded to a “flight to safety,” with investors increasingly leaning towards the most established and liquid cryptocurrency. Such dominance often sets the tone for the broader market, particularly during periods of rapid price swings or heightened uncertainty.

If this dominance persists, it could help prolong the current wave of greed, keeping bullish momentum intact for now.

Community weighs in…

Remarking on the same, an X user said,

“And they said crypto was dead. This is just the beginning fam – if we map the growth trajectory to traditional markets, we’re looking at serious upside potential. Remember when $1T seemed impossible? Now we’re at $4T and the fear/greed index is only at 62.”

Another X user, Sebastian Diaconu, went a step further and talked about both the good and bad sides of the market, wherein, for the good side, he said,

“Fear-Greed meter is still at decent levels, which means there is a lot of upside potential.”

For the bad side though, he added,

“Altcoin season that everyone is waiting for is not happening. At least not now. Yes, we have Ethereum, XRP and…that’s about it. So, the major question is: will there be an Altcoin Season or not?”

Is that the whole story though? Well, according to AMBCrypto, a high greed signal doesn’t always translate into an instant downturn. Market sentiment can remain elevated for extended periods, before any significant correction sets in.

For example – On 23 May, the Crypto Fear and Greed Index touched 78, a level firmly in the “extreme greed” zone. This coincided with Bitcoin’s ascent to $111.8k.

Such an alignment is also evidence of how bullish momentum can persist, despite overheated sentiment. This could leave room for further gains before market forces potentially recalibrate.

Post Comment