Kraken’s Monero Shakeup: What Happens When One Mining Pool Grabs 50% Hashrate Control?

What happens when one mining pool quietly decides it wants to play the big game and suddenly commands more than half of a cryptocurrency’s network power? Well, Kraken just hit the pause button on Monero (XMR) deposits after Qubic alleged control of over 50% of Monero’s hashrate, sparking a wildfire of concerns about decentralization, security, and the dreaded 51% attack. It’s like watching a quiet chess match suddenly turn into a full-throttle poker showdown — except, this time, the stakes are blockchain security and the integrity of anonymous transactions. As traders watch XMR dip and the crypto community braces itself, questions swirl: Is this a bold move to expose hidden vulnerabilities or a red flag signaling deeper troubles? Let’s dive into the drama behind the numbers and what it means for Monero’s future. LEARN MORE.

Qubic’s effort to secure a majority of Monero’s hashrate sparked debate over its impact on network decentralization and security.

Key Takeaways

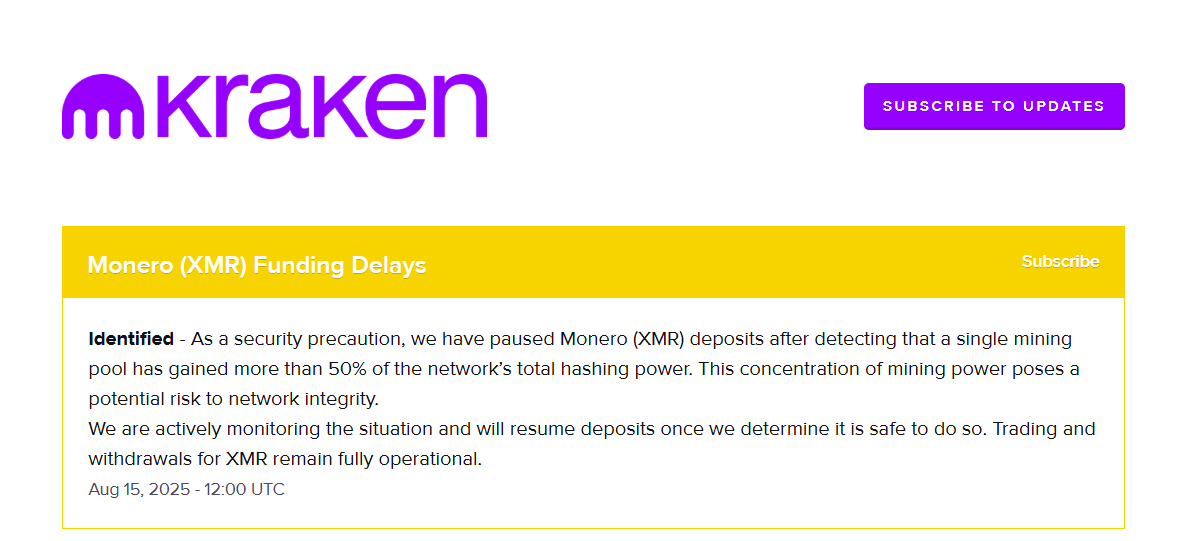

- Kraken has halted Monero deposits after a single mining pool seized more than 50% of the network’s hash rate.

- XMR last traded near $257, down about 6% over the past week.

Share this article

Kraken has suspended Monero (XMR) deposits after detecting that a mining pool had gained control of more than half of the network’s total hashrate, raising concerns about centralization and network security, according to its status page.

Kraken is actively monitoring the situation and will resume deposits once it determines conditions are safe. Trading and withdrawals for Monero remain fully operational on the platform.

The pause came after Qubic mining pool, led by IOTA co-founder Sergey Ivancheglo, claimed to have achieved control over 51% of Monero’s hashrate, which could theoretically enable block reorganization, transaction censorship, or double-spending attacks.

Ivancheglo said in a statement that the move was intended to expose vulnerabilities and prepare the Monero community for future threats.

Looks like #Qubic has achieved 51% over #Monero, we are waiting for independent confirmations. In the meanwhile #Monero team is polishing details of their 51% attack protection.

Many accused us of being sponsored by 3-letter agencies to attack this anon coin. What do you think…— Come-from-Beyond (@c___f___b) August 12, 2025

XMR fell earlier this week following the reported attack. The token was trading near $257 at the time of writing, down approximately 6% over the past week, per TradingView.

Share this article

Post Comment