Brevan Howard’s Bold Bet: Why Becoming BlackRock Bitcoin ETF’s Largest Investor Could Redefine Crypto Wealth Forever

Ever wonder what it takes to leapfrog a financial giant like Goldman Sachs and seize the crown as the largest investor in BlackRock’s Bitcoin ETF? Well, Brevan Howard just answered that question with a whopping 37.5 million shares valued at an eye-popping $2.3 billion. That’s not just a number—it’s a clear signal that the institutional world is warming up to Bitcoin, but through a regulated and sophisticated lens. This isn’t your typical Wall Street headline; it’s a testament to how strategic vision and timing can reshape the investment landscape. Let’s dive into how Brevan Howard climbed from the runner-up spot to the very top, and what this shift means for the future of Bitcoin ETFs and institutional crypto adoption. LEARN MORE.

Previously the second-largest IBIT investor, the company trailed Goldman Sachs, which disclosed holding more than $1.4 billion in shares in Q1.

Photo: Chris Ratcliffe/Bloomberg

Key Takeaways

- Brevan Howard is now the largest institutional investor in BlackRock’s Bitcoin ETF, holding 37.5 million shares valued at $2.3 billion.

- The firm’s holdings in IBIT grew since March, signaling rising institutional interest in regulated Bitcoin exposure.

Share this article

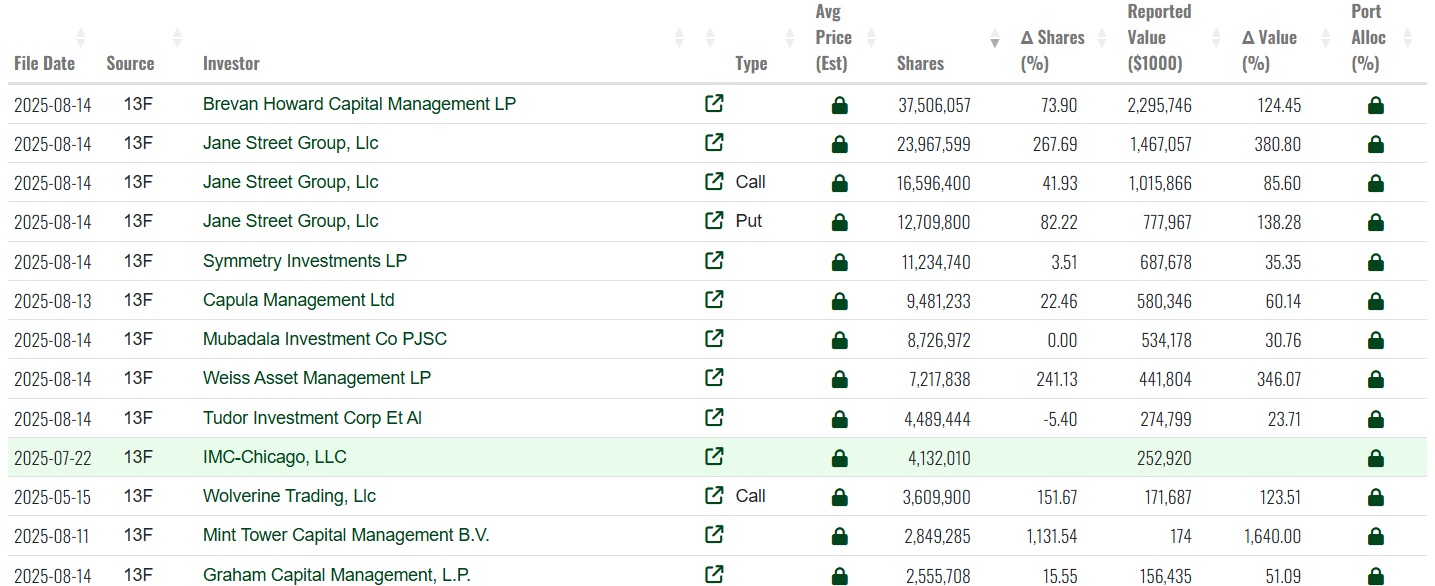

Hedge fund giant Brevan Howard reported owning around 37.5 million shares of BlackRock’s Bitcoin ETF (IBIT) as of June 30, valued at roughly $2.3 billion, according to a new SEC disclosure.

The investment, which represents a sharp increase from 21,5 million shares in the first quarter, makes Brevan Howard the largest institutional holder of IBIT based on available SEC filings.

The company was previously the second-largest IBIT investor, trailing behind Goldman Sachs. The investment bank held over $1.4 billion worth of IBIT shares as of March.

Brevan Howard, known for its macro trading strategies, has been steadily expanding into digital assets in recent years. The firm operates a dedicated crypto division, BH Digital, which manages billions of dollars in assets and invests in blockchain infrastructure and related technologies.

Other major IBIT holders include Symmetry Investments, Capula Management, and Mubadala Investment, according to the latest data from Fintel. Harvard Management entered the top 20 for the first time with a reported $1.9 billion stake.

IBIT continues to dominate the Bitcoin ETF market, with over $88 billion worth of Bitcoin under management.

Share this article

Post Comment