Whale Moves Are Stirring the Waters: Is MNT on the Brink of a Volatility Storm?

Ever wonder what happens when innovation, big-money whales, and the thrill of speculation all collide in the crypto seas? Mantle [MNT] is answering that question loud and clear with a surge that’s turning heads across the market. Clocking in a hefty 15% jump at $1.36, this rally isn’t just a flash in the pan. It’s fueled by a cocktail of Bybit’s staking integration, whale-led accumulation, and a striking climb in Open Interest that whispers both promise and peril. But here’s the kicker—while the momentum paints a bullish canvas, the lurking possibility of heightened leverage hints that volatility could spike faster than you can say “bull run.” So, can Mantle maintain its climb, or are we looking at a wild ride ahead that’ll leave traders gripping their seats? Let’s break down the forces setting Mantle ablaze and what it means for you, the investor navigating these choppy waters. LEARN MORE

Key Takeaways

Mantle’s surge blends Bybit staking integration, whale-led accumulation, exchange outflows, and rising Open Interest. Heightened leverage could quickly intensify volatility.

The market has turned its attention to Mantle [MNT] as it experienced a sharp upward momentum, supported by both rising derivatives activity and whale-driven accumulation.

At press time, Mantle traded at $1.36, marking a 15% daily surge that has attracted significant investor attention.

This move follows a week of steadily increasing speculation in the derivatives market alongside improving on-chain trends.

However, while short-term price action appears favorable, the question remains whether Mantle can extend its gains sustainably, especially as broader market volatility continues to test altcoin strength.

What’s fueling Mantle’s price surge?

A primary factor behind Mantle’s rally is its recent Bybit partnership, which includes staking integration that unlocks new yield opportunities for token holders.

This collaboration has enhanced accessibility for investors, driving institutional inflows and strengthening Mantle’s positioning within the broader market.

Additionally, network growth supported by increased stablecoin circulation has further fueled demand for MNT.

Therefore, the token’s price surge appears to stem not only from technical trading activity but also from fundamental ecosystem expansion.

Such developments have combined to deliver strong momentum, bringing Mantle to the forefront of trader focus.

How significant is the Open Interest jump?

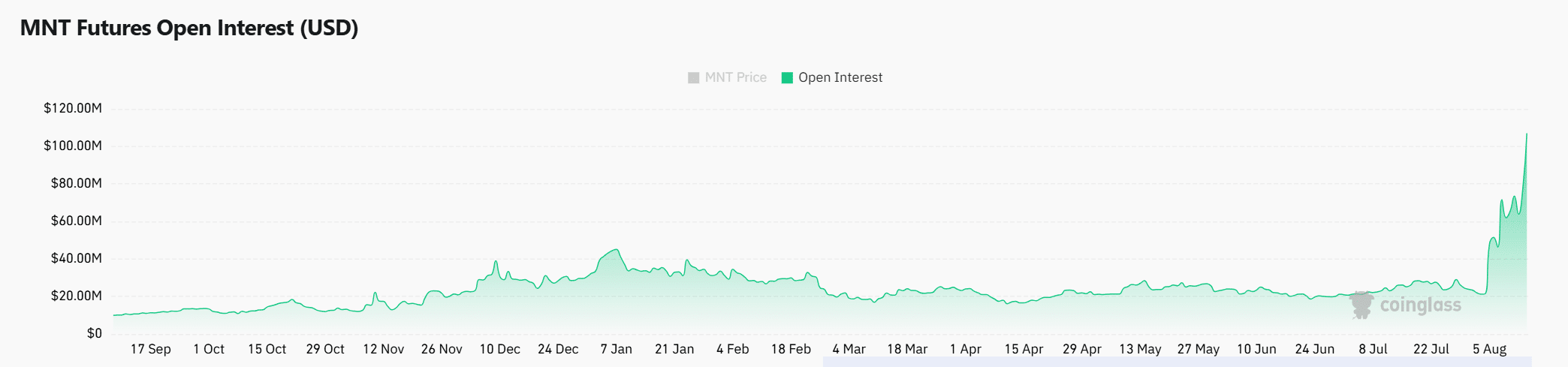

Open Interest has climbed sharply by 43%, now standing at $112 million, reflecting a surge in speculative appetite.

This rise demonstrates that more traders are positioning aggressively on Mantle’s next price move, often a precursor to heightened volatility.

Typically, such a sharp increase in Open Interest signals renewed leverage activity, magnifying both upside and downside risks.

However, with Mantle’s price rallying alongside this spike, the momentum appears to favor bullish bets.

Therefore, the derivatives market reinforces confidence that traders expect continued upward pressure in the short term.

Source: CoinGlass

Are whales driving the rally through big orders?

On-chain metrics show a clear rise in whale-driven trades, as average spot order size has expanded significantly.

This suggests that larger investors are accumulating MNT, complementing the bullish narrative emerging from derivatives markets.

Whale accumulation often provides both liquidity and confidence to retail participants, strengthening the trend’s sustainability.

However, while this signals stronger conviction among large holders, it can also trigger sharp profit-taking events.

Therefore, whale participation remains a double-edged factor, yet in Mantle’s case, it is leaning toward reinforcing the ongoing bullish trajectory.

Source: CryptoQuant

Do netflows confirm strong accumulation?

Exchange netflow data reinforces the bullish picture, showing $9.78 million in outflows within the past day.

Consistent outflows of this magnitude suggest tokens are moving away from exchanges toward storage or staking, often reducing sell-side pressure.

This aligns with Mantle’s price climb, as reduced liquidity on exchanges can amplify upward moves when demand strengthens.

If this pattern continues, the price could remain supported by reduced immediate selling pressure and consistent whale demand.

Source: CoinGlass

Can Mantle sustain this momentum?

Mantle’s recent rally has been driven by a strong combination of exchange outflows, whale accumulation, and speculative positioning reinforced by Open Interest growth.

Furthermore, its Bybit partnership and staking integration provide fundamental support beyond short-term trading catalysts.

However, sustainability depends on whether buying pressure persists in the face of increased leverage risks and potential profit-taking by whales.

For now, Mantle holds a strong bullish structure, suggesting its rally could extend further, though volatility will remain a defining factor in the coming sessions.

Post Comment