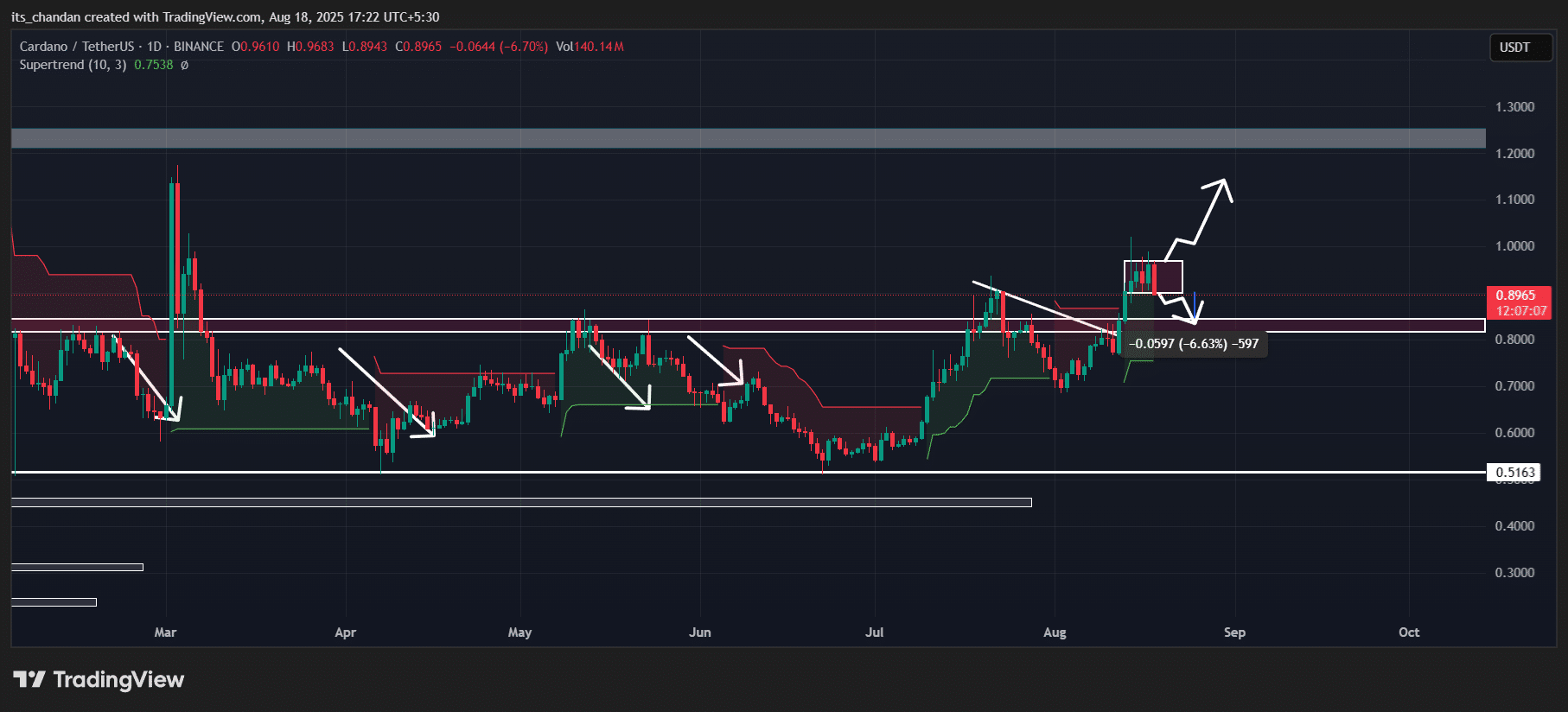

Is Cardano’s $0.90 Support About to Shatter, Triggering a 6.5% Freefall You Can’t Afford to Ignore?

So, here we are—Cardano’s ADA has been dancing around the $0.90 mark for four days straight, barely moving the needle on price, yet behind the scenes, futures trading volume just blasted through a five-month ceiling at nearly $7 billion. Now, that’s what caught my eye. It’s like watching a tightrope walker teetering on the edge; one wrong step below $0.90 could send ADA tumbling over 6.5%—ouch. But here’s the twist—amidst this pressure cooker, trader interest is surging, signaling a thrilling make-or-break moment. Is this the calm before a parabolic storm or just another sideways shuffle? One thing’s for certain: whether ADA will bounce back or break down isn’t just a question for traders—it’s a masterclass in market psychology and momentum. Buckle up, because the next move could make or break some serious gains. LEARN MORE

Key Takeaways

ADA could fall 6.5% if it closes a daily candle below the $0.90 level. Futures trading volume reached a five-month high of $6.96 billion, hinting at rising interest in the asset.

It has been four consecutive days of sideways movement for Cardano [ADA], but traders’ interest in the asset has skyrocketed. The sharp price drop has pushed ADA into a make-or-break situation.

Current price and record surge in Futures

On the 18th of August, Cardano’s price slipped 3.5%, reaching the lower boundary of consolidation at $0.91.

Despite the sharp decline, investor and trader participation has increased, with trading volume rising 12% compared to the previous day.

Not just that, a well-followed crypto expert shared on-chain data showing that ADA’s Futures trading volume reached a five-month high of $6.96 billion.

This substantial surge in Futures volume reflects strong interest and confidence among traders as well as institutions, potentially paving the way for a parabolic move.

Although the price is consolidating within a tight range, the spike in trading volume signals a possible shift in market activity.

Along with this, the expert also noted in a post that the TD Sequential technical indicator is now flashing a buy signal, hinting at a potential price bounce ahead.

Cardano: Price action and technical analysis

AMBCrypto’s technical analysis reveals that Cardano’s ADA price has been hovering within a tight range between $0.90 and $0.96 for the past four days.

During this period, each time the asset touched the lower boundary, it experienced upward momentum, a move that could potentially repeat in the coming days.

On the daily chart, it is not yet confirmed whether this sudden fall will lead to further downside movement, but that would only be possible if the lower boundary is broken.

If ADA closes a daily candle below the $0.90 level, there is a strong possibility of a decline of over 6.65%, with the price potentially dropping to $0.835.

On the other hand, if the price holds this level, it could repeat history and reach the $0.969 mark again.

However, a major rally would only occur if the asset breaks out above the $0.969 upper boundary, which could trigger a 28% price uptick.

Despite ADA being in a make-or-break situation, the Supertrend indicator is still in green and hovering above the price, suggesting that the asset remains in an uptrend.

On-chain metric flashes mixed sentiment

Given the current market sentiment, investors and long-term holders appear to be accumulating tokens and taking advantage of the price dip.

Data from the on-chain analytics tool Coinglass shows that, over the past 24 hours, $25.94 million worth of ADA has been moved out of exchanges, suggesting potential accumulation.

This could help ease downside momentum and restore buying pressure.

Traders are closely following the current trend by heavily betting on the bearish side. At present, major liquidation levels stand at $0.876 on the lower side and $0.928 on the upper side, where traders are over-leveraged.

Post Comment