Why Canada’s Biggest Bank Just Bet $76M On This Bitcoin Proxy—and What It Means for Your Portfolio

Ever wonder what pushes a traditional banking giant to dive deeper into the thrilling—and sometimes wild—world of Bitcoin? Well, Canada’s biggest bank, Royal Bank of Canada (RBC), just made a move that might have you raising an eyebrow or two. They’ve amped up their stake in Strategy Inc. (MSTR), essentially doubling down on their Bitcoin proxy play by boosting their holdings to a hefty $76 million in the second quarter of 2025. With Bitcoin itself climbing over 30% during that time, hitting a staggering peak near $112,000, RBC’s bet highlights a growing trend — Wall Street’s old guard sensing crypto’s new dawn amidst shifting regulatory winds and market optimism. Is this the start of a wider embrace by traditional finance, or just a savvy gamble on the future of digital assets? Either way, it’s a move worth watching closely. LEARN MORE.

Traditional banks intensify their exposure to digital assets amid rising market confidence and favorable US regulatory trends.

Key Takeaways

- Royal Bank of Canada increased its stake in Strategy Inc. (MSTR) by nearly 16% in Q2 2025.

- Bitcoin reached a high of $111,980 during the quarter, reflecting over 30% quarterly growth.

Share this article

Royal Bank of Canada (RBC) has boosted its bet on Bitcoin treasury company Strategy Inc. (MSTR).

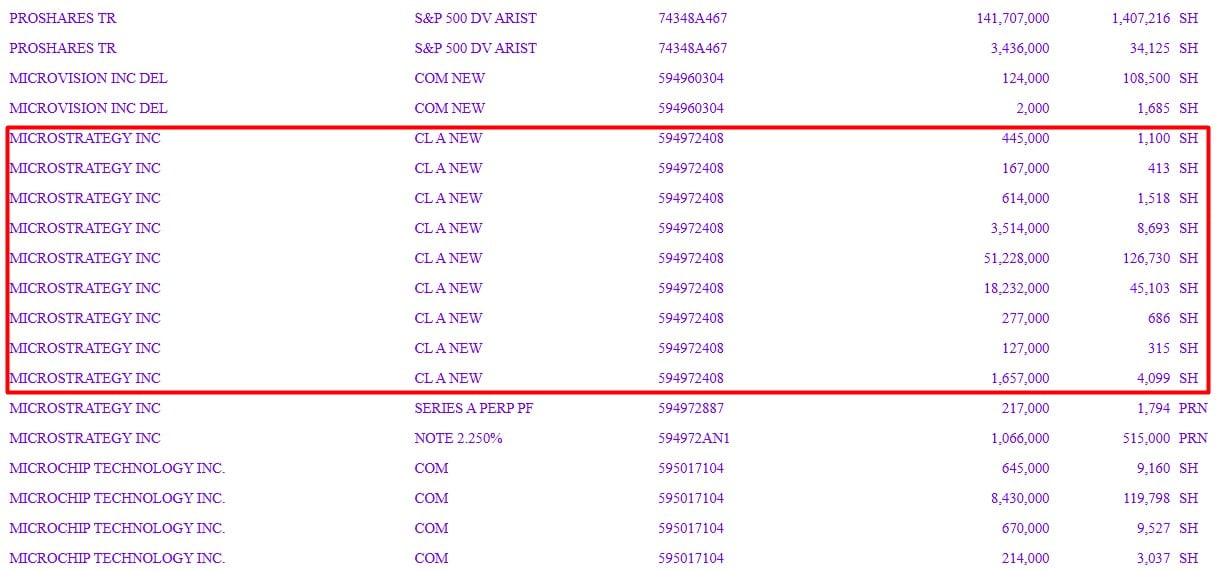

According to a new filing with the SEC, Canada’s largest bank by market capitalization held 188,657 MSTR shares worth over $76 million during the second quarter, up about 16% from the 162,909 shares it held at the end of the first quarter.

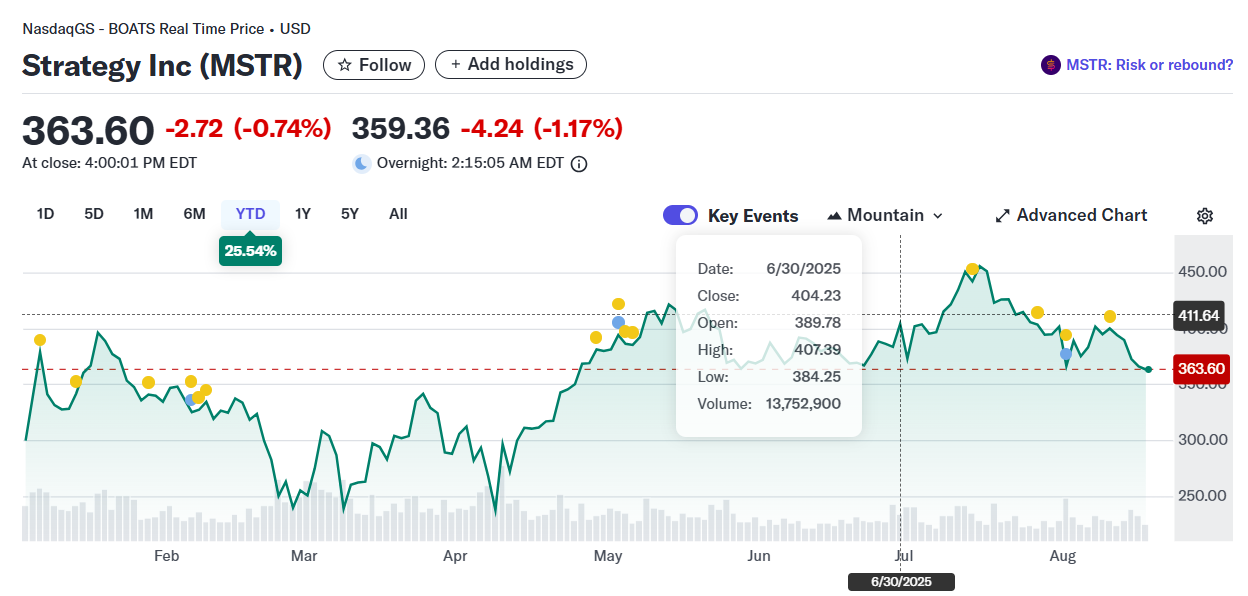

Strategy’s stock ended Q2 2025 at approximately $404 per share, showing a 32% gain during the quarter, according to Yahoo Finance.

While the stock experienced a slight decline at Monday’s market close, it has maintained a 25% gain year-to-date.

Bitcoin surged more than 30% in Q2 2025, reaching a high of $111,980, exceeding December’s previous peak of $109,300.

The digital asset was trading around $115,000 at press time, down 1% over the past 24 hours, according to TradingView data.

RBC, along with Morgan Stanley and Bank of America, has enhanced its focus on crypto-related business, motivated by expected growth in IPOs and financial deals in the sector, as reported by Bloomberg in February.

The crypto sector’s expansion has been supported by the Trump administration’s more favorable regulatory stance toward digital asset market growth.

Several crypto firms have recently gone public in the US, including Circle, eToro, and Bullish, as peers like Gemini, BitGo, Grayscale, and Kraken line up for their market debuts.

Share this article

Post Comment