Unlocking Cardano’s Hidden Trigger: The Surprising Level Set to Ignite a 14% ADA Surge—Are You Ready to Capitalize?

Ever noticed how the crypto world loves to keep us on our toes? Cardano [ADA] just took a 12% tumble yet somehow managed to cling to a crucial support level — talk about walking a tightrope! What really gets me intrigued is that nearly 80% of traders are positioned long, riding on hopes of a rebound, even as a hefty $6 million worth of ADA floods exchanges, signaling potential sell-offs. It’s like watching a high-stakes chess match where optimism meets caution head-on. Are these traders playing it smart, or are they just betting on a wing and a prayer? With the altcoin flirting with an ascending trendline and indicators flashing mixed signals, the question looms: will ADA hold firm and bounce back, or is it gearing up for a deeper slide? Let’s dive in and unravel the layers behind these moves. LEARN MORE

Key Takeaways

ADA slipped 12% but held key support. With 80% longs and $6 million inflows, traders weighed reversal hopes against looming sell-off risks.

After falling 12% over the past 48 hours, Cardano [ADA] reached a key support level, which appeared to be a make-or-break point for the altcoin.

Naturally, given ADA’s past reactions at this zone, traders showed renewed interest.

Nearly 80% bet long. Smart or reckless?

At press time, ADA traded at $0.8565, down more than 9% over the past 24 hours. This notable price dip triggered increased participation from investors and traders, resulting in a 22% surge in trading volume.

In fact, many traders viewed this zone as a prime entry point.

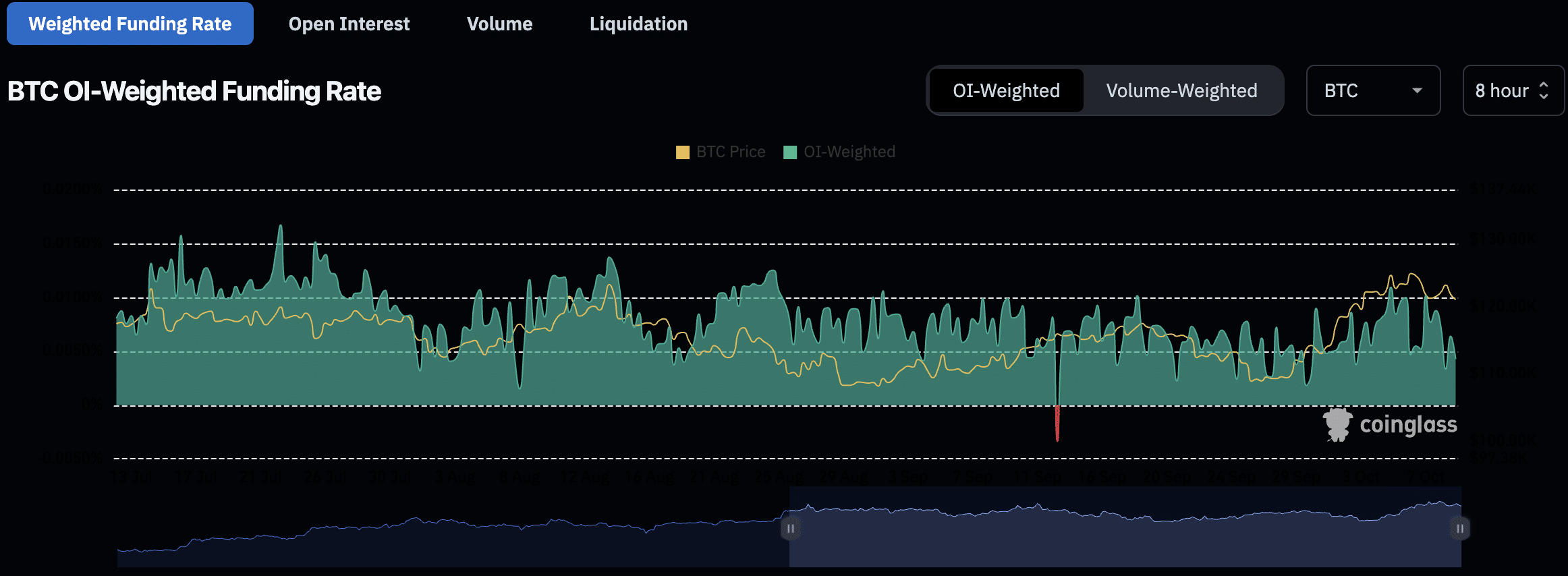

According to CoinGlass, the Binance ADAUSDT Long/Short Ratio stood at 3.99. This ratio suggested that for every 3.99 long positions, there is a single short position, meaning traders betting long are nearly four times higher than those betting short.

Furthermore, data revealed that 79.96% of accounts were long, while 20.04% were short.

This skew begged the question: was the optimism justified, or could Cardano slip further?

Trendline lifeline! Can ADA hold firm?

AMBCrypto’s technical analysis revealed that traders’ bullish bias likely stemmed from the current support zone.

On the four-hour chart, ADA had been respecting an ascending trendline since early August 2025. With the latest decline, the altcoin once again touched this line, naturally fueling hopes of a reversal.

Based on the price action, if ADA held above the ascending trendline, there is a strong possibility of an impressive price reversal. If this happened, the altcoin could soar by 14% to reach the next resistance level at $0.9791.

Meanwhile, if momentum carried through the $1 barrier, a further 20% run toward $1.20 remained possible.

At press time, ADA’s Supertrend indicator turned red and hovered above the price. This suggests that the altcoin is in a downtrend with strong selling pressure.

Meanwhile, the Relative Strength Index (RSI) printed at 39.97, nearing oversold territory and hinting at possible reversal.

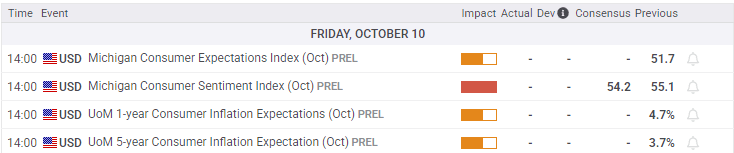

$6 million worth of ADA sell-off concern

Despite the bullish outlook, one metric that still flashes a red flag is the inflow of ADA into exchanges.

Over the past 24 hours, $5.95 million worth of ADA tokens has moved onto exchanges, hinting at ongoing dumping or profit-taking.

Naturally, such inflows risked adding selling pressure and extending downside momentum.

Post Comment