BNB Smashes $883 Record – But What’s the Hidden Barrier That Could Blow the $1K Dream Wide Open?

Alright, listen up—Binance Coin (BNB) just shattered its previous limits, hitting a fresh all-time high of $883 after a spirited surge on August 20th. That’s quite the leap, considering it jumped over 5% in a single day before cooling down slightly. Now, here’s where it gets juicy: with a massive $2 billion storming into BNB in August alone, the real head-scratcher is—can this bullish beast charge past the elusive $900 mark and set sights on the shiny $1,000 throne? It’s like watching a high-stakes game where bulls regroup, dust themselves off, and size up the next rung on the ladder. But wait—what about the shadow cast by Windtree Therapeutics’ $500 million BNB treasury plan suddenly facing Nasdaq’s delisting hammer? Despite that curveball, the options market is buzzing bullish, betting on short-term gains and a spirited rebound. Will BNB overcome these hurdles or hit a detour? Hang tight, because this rollercoaster could just be gearing up for the next big thrill. LEARN MORE

Key Takeaways

BNB printed a new ATH as bulls re-group for a potential move above $900. With a whopping $2 billion inflows in August, is $1K next on the line?

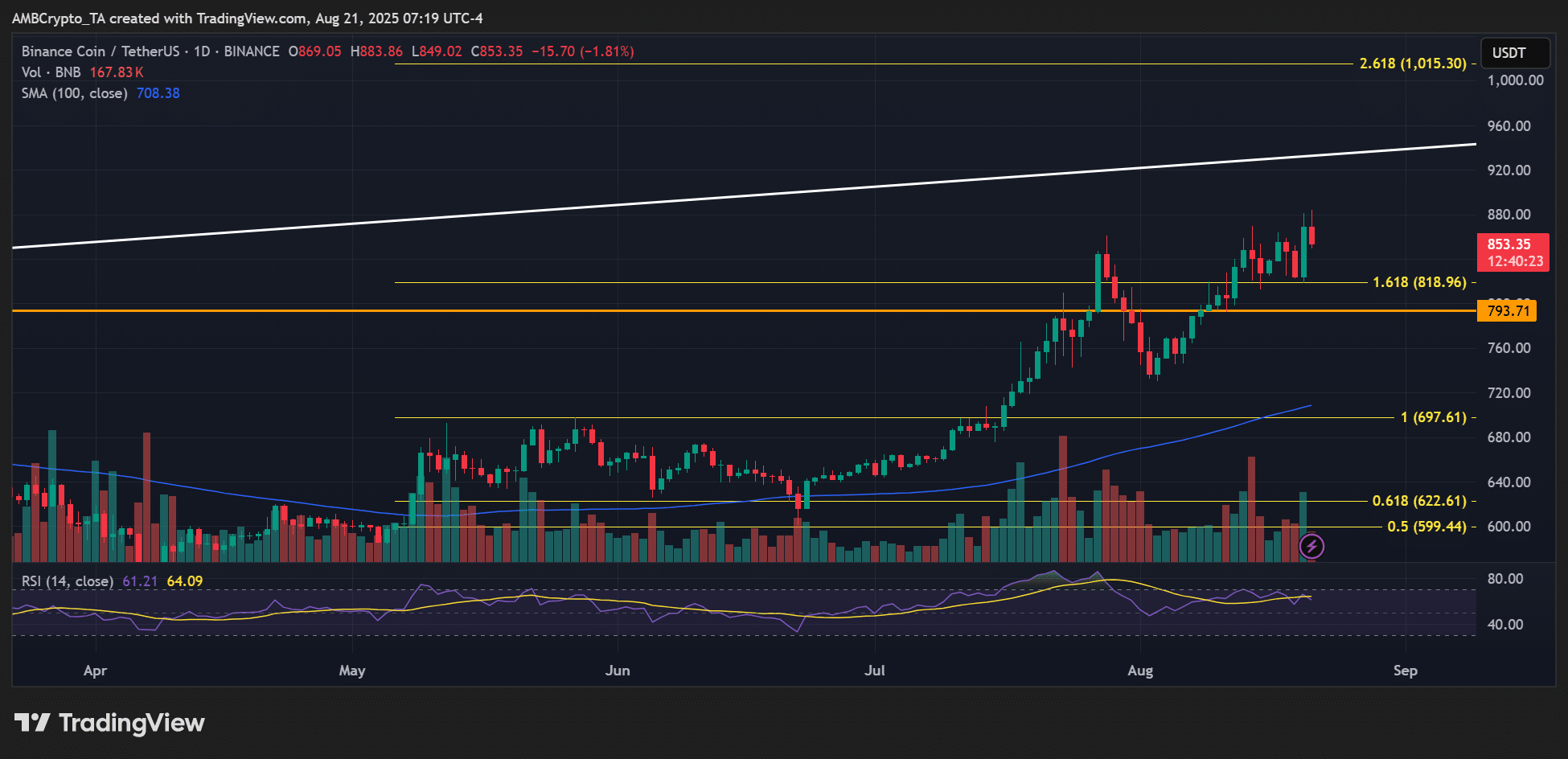

Binance coin [BNB] has printed a new all-time high (ATH) of $883 after a relief rally on the 20th of August.

The altcoin jumped 5.45% to $881 on the day, briefly extending gains to $883 before showing signs of a slight pullback. At press time, the coin was trading at $850.

With this momentum, the key question now is whether BNB can break through the $900 barrier and reach the psychologically significant $1000 mark.

Crypto treasury demand woes, but skew remains bullish

Both Bitcoin [BTC] and Ethereum [ETH] have enjoyed multiple demand from crypto treasuries and ETFs.

The same trend has been observed in Solana [SOL]. However, BNB’s momentum may face a temporary setback.

Windtree Therapeutics recently announced a $500 million plan for a BNB treasury. But Nasdaq has issued a notice to delist Windtree’s common stock due to non-compliance with listing requirements.

As of now, the company has not clarified how this delisting will affect its BNB treasury initiative. Given that Windtree is the first firm to launch a BNB treasury, this uncertainty could dampen demand in the short term.

Despite this, market sentiment around BNB remains bullish. A sharp rise in Delta Skew for 1-week and 1-day tenors indicates strong demand for short-dated call options, bullish bets.

Moreover, over $2 billion flowed into the BNB market in August. Realized Cap surged from $88 billion to a record $90.4 billion in just three weeks, highlighting growing investor interest in the altcoin.

When zoomed out on the price charts, the immediate hurdle was the multi-year trendline resistance since 2021.

Since the 2.618 Fib extension level also aligned with $1K, clearing $900 could push bulls to the psychological level ($1K).

Interestingly, the Options market also expressed a similar outlook. In the past 24 hours, call buyings (bullish bets) were concentrated at $900 and $920.

On the other hand, the main target for puts (bearish bets) was $820.

In other words, Option traders were betting on a rebound at $820 with a potential move to a new ATH above $900.

Overall, $1K was still on the cards for BNB. But bulls were concerned with clearing the $900 level first before embarking on the $1K target.

Post Comment