Zcash Open Interest Skyrockets to Multi-Month High – Is a Breakout or Breakdown Looming?

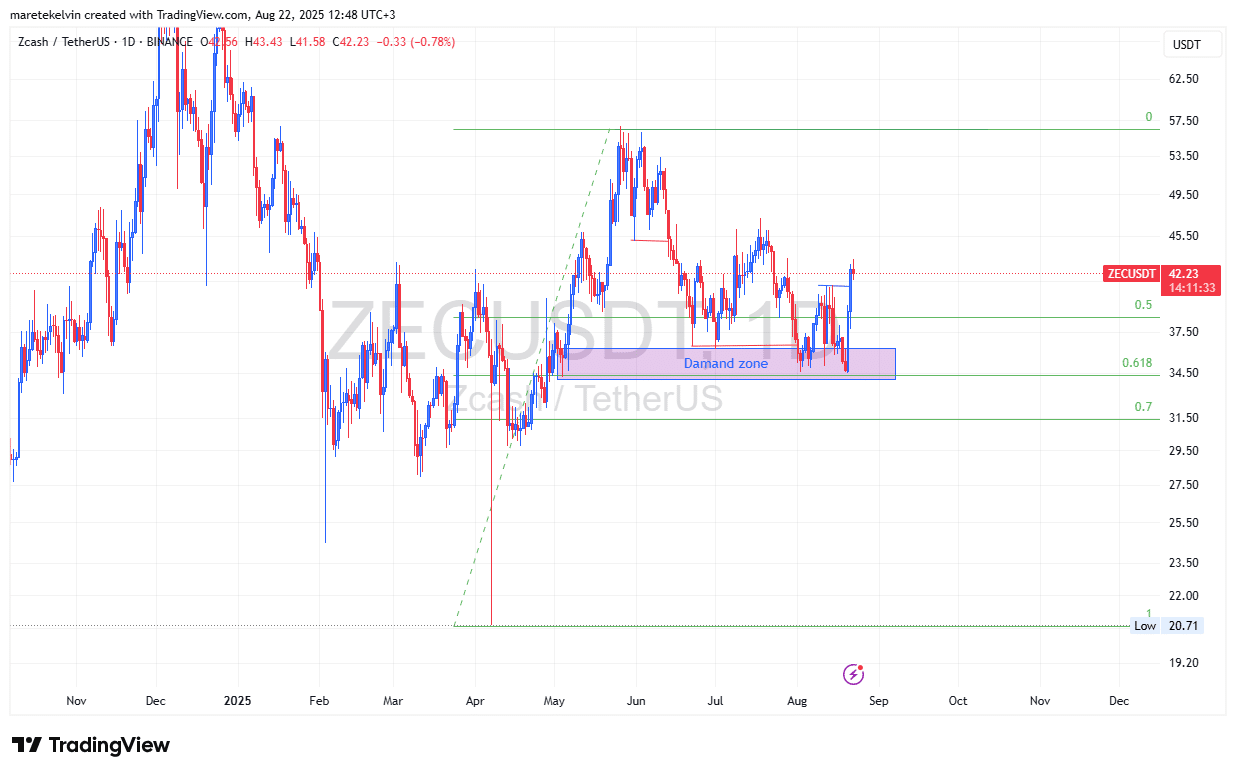

Ever had that moment when a market quietly flips the script overnight, leaving you wondering if you missed the memo? Well, Zcash [ZEC] just pulled exactly that stunt, soaring over 10% in the last 24 hours and flipping its daily chart from a bearish slump to a bright, bullish breakout. Now, here’s the kicker—ZEC’s Open Interest is ticking up to levels we haven’t seen since July, hinting that the big institutional players may be slipping back into the game. So, is this a mere blip or the start of a fresh rally fueled by serious capital ready to roll? With prices bouncing off a crucial demand zone and setting their sights on the $57 resistance, things are heating up in ways that have traders and investors alike rubbing their eyes twice. But, as always, a surging asset facing dense sell zones raises the question—can the bulls maintain the charge, or will the sellers slam the brakes? Let’s unravel this intriguing momentum shift and see what it might spell for ZEC’s near-term future. LEARN MORE

Key Takeaways

ZEC surged over 10% over the last 24 hours, shifting its market dynamics from bearish to bullish. The token’s Open Interest has hit its highest level since July, signaling fresh institutional activity that could sustain momentum.

Zcash [ZEC] has broken into the spotlight today, climbing more than 10% in the past 24 hours, at press time.

This rally is particularly significant as it shifts the token’s daily chart from a bearish trend to a more bullish structure.

The upward momentum was triggered after prices rebounded from a key demand zone, which aligned with a Fibonacci retracement level—adding strength to the move.

Notably, the technical outlook appears optimistic. If on-chain metrics continue to support the trend, the $57 resistance zone could soon come into play.

Institutions step back in ZEC ecosystem?

One of the most striking signals comes from derivatives.

ZEC’s Open Interest (OI) has climbed to levels not seen since early July, suggesting institutions and larger players are once again circling the market.

Historically, rising OI alongside a bullish price action often signals fresh money rather than just short covering, a dynamic that can keep momentum alive.

Liquidity clusters ahead

Still, the rally faces some challenges.

AMBCrypto’s in-depth analysis of ZEC’s on-chain liquidity data from Coinglass reveals a dense cluster of sell orders positioned just below the current price range.

To maintain momentum, ZEC will require sustained buying pressure to absorb this supply and prevent a potential slowdown.

If institutional investors are indeed driving the surge, this resistance zone could be tested sooner than expected.

Source: Coinglass

For now, ZEC is one of the strongest performers in a market that has seen massive corrections. The combination of rising open interest and a shift in technical structure gives bulls a reason to stay optimistic.

Whether this bounce evolves into a sustained trend will depend on how the token handles those liquidity pockets just overhead.

![Plasma [XPL] Surges 12%—Is $1.37 Just the Beginning or a Trap for the Bold?](https://wealthhealthself.com/wp-content/uploads/2025/10/plasma-xpl-surges-12-is-1-37-just-the-beginning-or-a-trap-for-the-bold.png)

Post Comment