Why Tom Lee’s Take on Market Valuations and ISM Surveys Could Rewrite Your Investment Playbook—Don’t Miss This Game-Changer!

How is it that after weathering a storm of six potentially devastating shocks — from Covid-19 to tariff wars, inflation surges, and geopolitical tension — the market still keeps chugging along like an indomitable giant? Tom Lee’s latest take might just flip your perspective on where we stand in this rollercoaster ride. He boldly claims, against all odds, that we’re still in the early innings of this market cycle. Sounds counterintuitive, right? Especially when even seasoned skeptics like Mike Wilson of Morgan Stanley are nodding along. What’s fueling this resilience, and could the overlooked ISM Manufacturing survey hold the secret to the market’s pulse? From AI breakthroughs reshaping business growth to seismic shifts brewing within the US financial sector — Lee’s insights invite us to rethink conventional wisdom about market valuations, risk, and opportunity. Curious about whether this market is a ticking time bomb or a sleeping giant? Stick around — there’s much more beneath the surface here. LEARN MORE

img#mv-trellis-img-1::before{padding-top:74.8046875%; }img#mv-trellis-img-1{display:block;}img#mv-trellis-img-2::before{padding-top:76.07421875%; }img#mv-trellis-img-2{display:block;}img#mv-trellis-img-3::before{padding-top:70.8984375%; }img#mv-trellis-img-3{display:block;}

Tom Lee makes his probably third or forth appearance on The Compound.

Tom Lee says it’s still early.

I think after going up so much, it is quite unbelievable that we are still early. Interestingly, Mike Wilson of Morgan Stanley (whom most only remember to be bearish for the wrong reasons) also thinks this is a start. So both share the view.

I think I let you see if you want to watch it but I just want to bring up two points that capture my attention (but might not interest you). For my crypto invested friends, you might want to check out what he says around Bit Mine, and also the financial sector.

An Alternative Framing to Contextualize Market Current Valuation

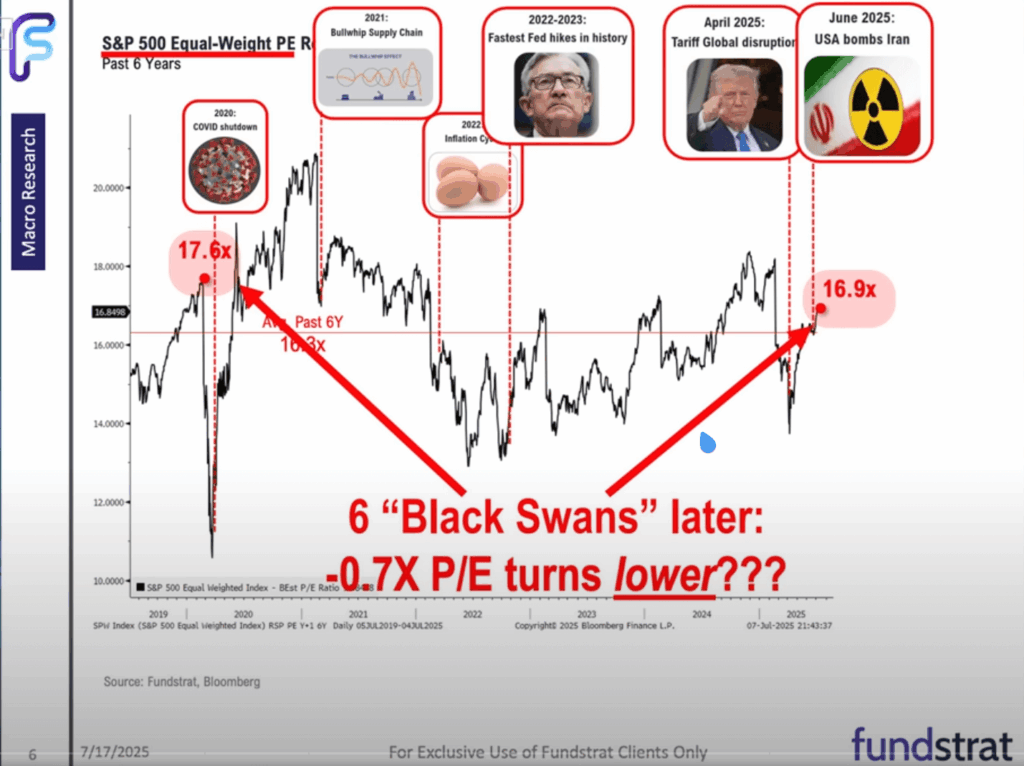

Tom Lee started off his career as a stock analyst and if we look at an equal-weighted version of the S&P 500 (to take away the arguments that a small number of stocks leads) as a single stock, this stock practically have six recent events that should have kill the stock:

- Covid-19

- Bullwhip chain effect (The supply chain problem as a result of the Covid)

- The fastest inflation in the history

- The fastest Fed hike in history

- The Trump Tariff shock

- US bombing of Iran’s nuclear facilities

Each of these should have interrupted the bull market or increase the risk. If you have a stock that trades at 16 times PE, that underwent this effect, survived, not just that but grew earnings significantly, a sensible price earnings for this stock should be higher.

But such a stock is not because the price earnings (see the chart 17.6x to 16.9x) is actually lower.

The Significance of a Weak ISM Manufacturing Survey Results and its relationship to this Broadening Idea

Tom Lee believes these are the major catalysts for broadening out:

- The Fed have been on hold all year and if they cut, this means a dovish cycle resuming.

- The US ISM Manufacturing PMI has been below 50 for 30 months so that is a tailwind if it swings above 50.

- Agentic AI is showing useful applications which means companies are using AI to grow their businesses.

I find his comment about why the ISM matters interesting.

Tom mentions that ISM survey is still more correlated to S&P earnings than the services index. This is in case we think that US is more services based less manufacturing based and this is less important.

He looks at it as a sign of business confidence. The CEOs of these companies get their view of the economy from the Fed and Wallstreet because most don’t have an internal economist. If the economist is cautious, than companies are cautious, that explains the suppression of the ISM. This means you are not funding capital expenditure beyond demand.

Since expansionary expansion has not taken plan that is a broadening.

Tom likes the ISM survey because it is a survey where there is no political bias. The hosts pushed back that isn’t a survey like this inaccurate or bias in their own way?

Tom sees this more as if the readings are low, and this low for so long (this is the longest stretch this is so low since the 1950s), then the people that is filling up the survey (the members of the institute of supply manufacturing including those purchasing managers at Intel, Apple, Nvidia) are bias in a negative and cautious way. And what interest us is that the general mood is cautious impedes growth capital expenditure. The reasons are likely inflation, and tariffs. So this is not an environment (aside from those who did fantastic well, who are spending so much on AI capex) where we are bullish and have spent a lot on growth capital expenditure.

The cautiousness tells us where we lean closer to from a real economy perspective. Tom says we never had a market cycle peak when ISM is below 50.

This chart will show us where the ISM survey reading is and how it relates to the recent 20 year market. The current behavior is more uncommon (we can say broken) in that the ISM have been down for this long but the S&P 500 are doing well despite that.

What would flip this ISM over is a combination of:

- Dovish Fed

- More predictability in policies

- We need the excess spread on interest products to fall.

All are not a given.

I would expand more on number 3.

If we are borrowing for a mortgage, we are usually borrowing at 1.6% above the US 10-year rate. If the 10-year is currently at 4.2% then the mortgage should be at 5.8%. But currently the rate is at 7% which means there is an excess spread on mortgage.

Tom thinks that when #1 and #2 happen, that excess spread might drop.

There is that excess spread maybe because banks are worried about prepayment velocity. This is the risk that the mortgage may be repaid earlier and just like those mortgage-backed securities, the banks lose money or alters the current present value when customers repay the loans earlier. Or it could be the uncertainty over the value of the collateral.

Tom thinks a simple way to visualize the impact is that if there are 20 Trillion worth of mortgage out there and half of them are at rates higher than that 7% (this is the part that I disagree with Tom. I think majority of the US mortgages are on 30-year mortgage which are much lower), and that would be around 10 Trillion. If there is 1.6% of this spread savings on 10 Trillion, that is $160 billion in people’s pockets collectively.

Side but rather notable comments:

- Many people like to believe this bull market is lead by that 6/7 mega companies but he felt that is misguided. This is because his Granny Shots ETF (ticker: GRNY), is made up of not just these companies but importantly the ETF is equal-weighted, and the ETF is outperforming the S&P 500 year to date. Granny Shorts in his opinion is quality growth, and that means you have the opportunity to do well and not having to rely on those mega companies.

- The host pointed out that there were winners and losers of this AI situation in that many of the software companies have reached 52-week lows. Tom commented that in many of these situations, the evergreen observation is the winners are easy to identified, but the potential winning opportunities from the losers are less visible but it does present an opportunity for those people to pick if they felt the market is expensive but willing.

- One of the most interesting thing that is on Tom’s mind is that the US financial system may be about to get rearchitected. It may be similar to the concept of oil when all of a sudden has more exploration and production. If the sector is rearchitected in a certain way, then the US financial sector may be as large as the tech sector. JPMorgan’s PE can become like a growth stock if they can really remove the friction (a lot of the intermediaries) in a lot of the traditional financial architecture. Tom reminds us that the banks might be late, but they are already big and have a lot of the assets. The first thing is what I mentioned about the regional banks, in that with AI, less compliance, the staffing may be able to drop a lot. JPMorgan, Goldman, and Morgan Stanley have the assets, the relationships of people who will follow them into new things, and if they make more money from stable coins, the metric to judge them may not be price-to-tangible-book only anymore.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

Post Comment