Arbitrum’s Next Move: The 2 Game-Changing Factors Investors Can’t Afford to Ignore

Ever wonder what it feels like when a hunk of the crypto world suddenly breaks free from the shackles of a stubborn range and starts sprinting uphill? That’s exactly what Arbitrum (ARB) did—busting out of a ten-day consolidation like it had a point to prove. It’s like watching a marathon runner finally break into a full stride after pacing cautiously, signaling that the real race might just be getting started. While Bitcoin shuffled sideways, ARB’s recent surge—14.2% in a day and over 20% for the week—has buyers buzzing, especially with its trading volume spiking over 200%. The big question now: will ARB’s bulls hold the line or is this a classic case of a sprint followed by a stumble? As liquidity clusters beckon just below current prices, traders find themselves at a crossroads where patience and aggression both have roles to play. Curious to see where this trend heads next? LEARN MORE

Key Takeaways

Arbitrum has broken out of a ten-day long range, and is likely to trend higher following a minor retracement into a liquidity cluster just below the current market price.

Arbitrum [ARB] rose 14.2% in the past 24 hours and 20.2% over the past week. Meanwhile, Bitcoin [BTC] shed 1.5% over the past week.

This reflected relative strength for ARB, which has made new highs for August.

The $3 billion market cap experienced a remarkable 222% surge in daily trading volume, according to data from CoinMarketCap at the press time. Such high volume and the price surge indicated strong bullish conviction.

Range formation and breakout for ARB

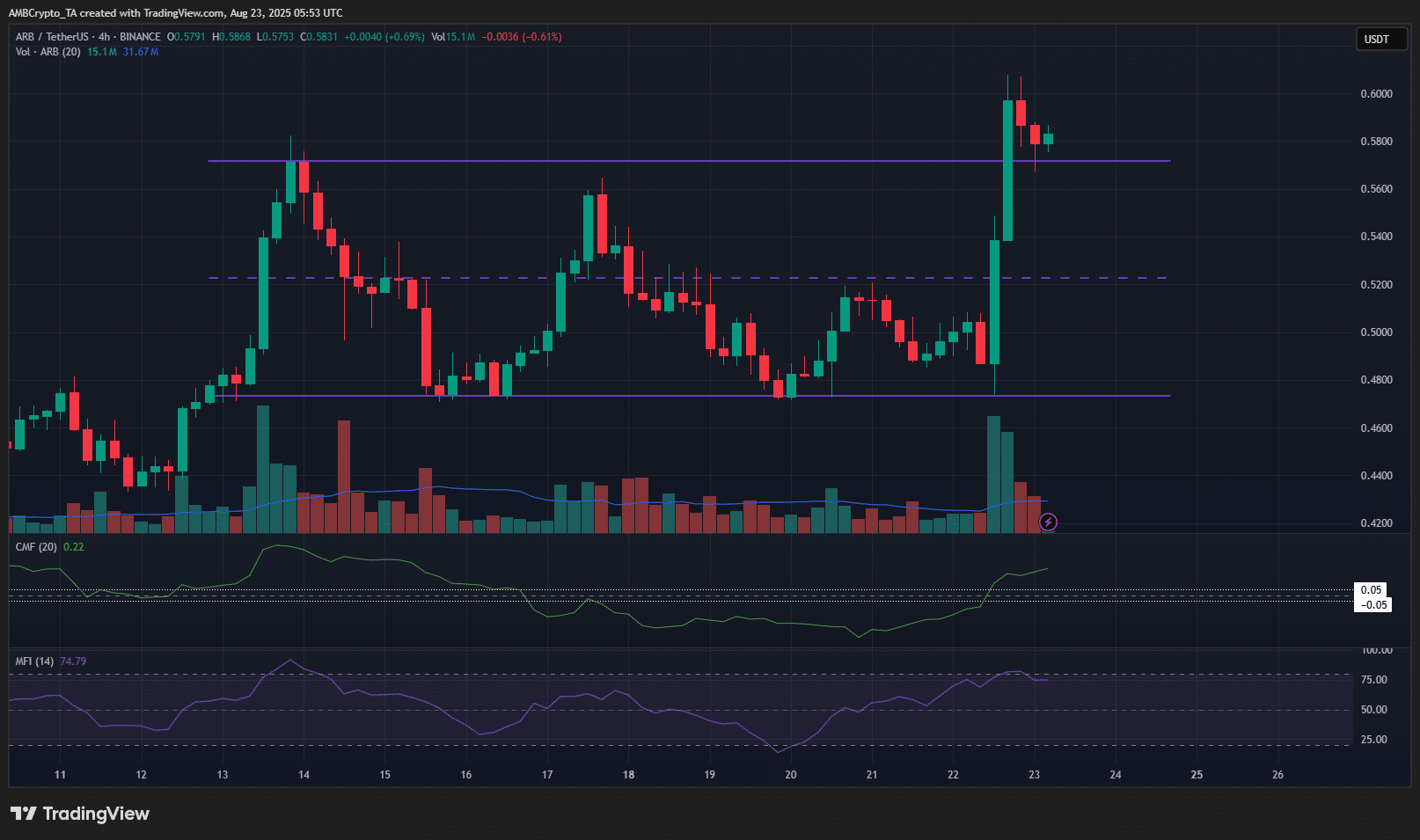

Over the past ten days, Arbitrum has traded within a range (purple) that extended from $0.473 to $0.572, with the mid-point at $0.523.

This level had a capped price repeatedly, but Friday’s rally cleared both the midpoint and the range high.

The only question now is whether ARB bulls can defend the gains they’ve made.

Naturally, it would hinge on market sentiment, which depends on Bitcoin’s strength. As long as Bitcoin can remain above $114.8k-$115k, ARB traders have reason to be bullish.

The CMF showed high capital flow into the Arbitrum market recently.

Alongside a convincing MFI reading of 74 and a bullish market structure on the 4-hour timeframe, it appeared likely that ARB bulls could drive the rally higher.

Liquidity zones shaping short-term targets

Source: CoinGlass

There is a chance of a retracement to $0.56 in the short term. The 1-week Liquidation Heatmap showed that the price began its rally from the $0.48 magnetic zone.

Aggressive buying, fueled by short liquidations around $0.53, drove the price to $0.607.

The $0.56 region was the next liquidity pocket of note nearby. It also lay just below the $0.572 range highs, making it a likely short-term price target. A sweep of this region would likely yield a bullish price reaction.

Traders should temper their expectations. The weekend might see heightened volatility and a deeper liquidity hunt.

Monday’s trading session would give more clues about what next week’s price action could be like.

Post Comment