Why TRON’s Whale Moves Are Quietly Setting the Stage for a $0.36 TRX Surge You Can’t Afford to Ignore

So, TRON just took a little stumble down to $0.34, even as those whale-sized players have been making waves with a remarkable spike in transactions. Here’s the kicker: spot market sellers have been throwing more weight around than buyers, pushing prices down, while Open Interest has been quietly shrinking. Yet, somehow, the Funding Rates keep their sunny disposition, even though the momentum indicators have switched gears to a stark bearish outlook. It’s like watching a high-stakes poker game where the big fish keep buying chips, but the table’s vibe is shifting fast. What does it mean for TRON’s next move? Will those whales’ steady accumulation act as a safety net, or are we bracing for a deeper dive below $0.33? Let’s dive in and peel back the layers behind this curious contradiction. LEARN MORE

Key Takeaways

TRON slipped to $0.34 despite a sharp rise in whale transactions. Spot selling outweighed buying, while Open Interest fell. Funding Rates stayed positive, yet momentum indicators flipped bearish.

Since hitting $0.36, TRON [TRX] faced heavy selling pressure, dipping to $0.33. At press time, TRX traded at $0.34, down 3.18% on the day.

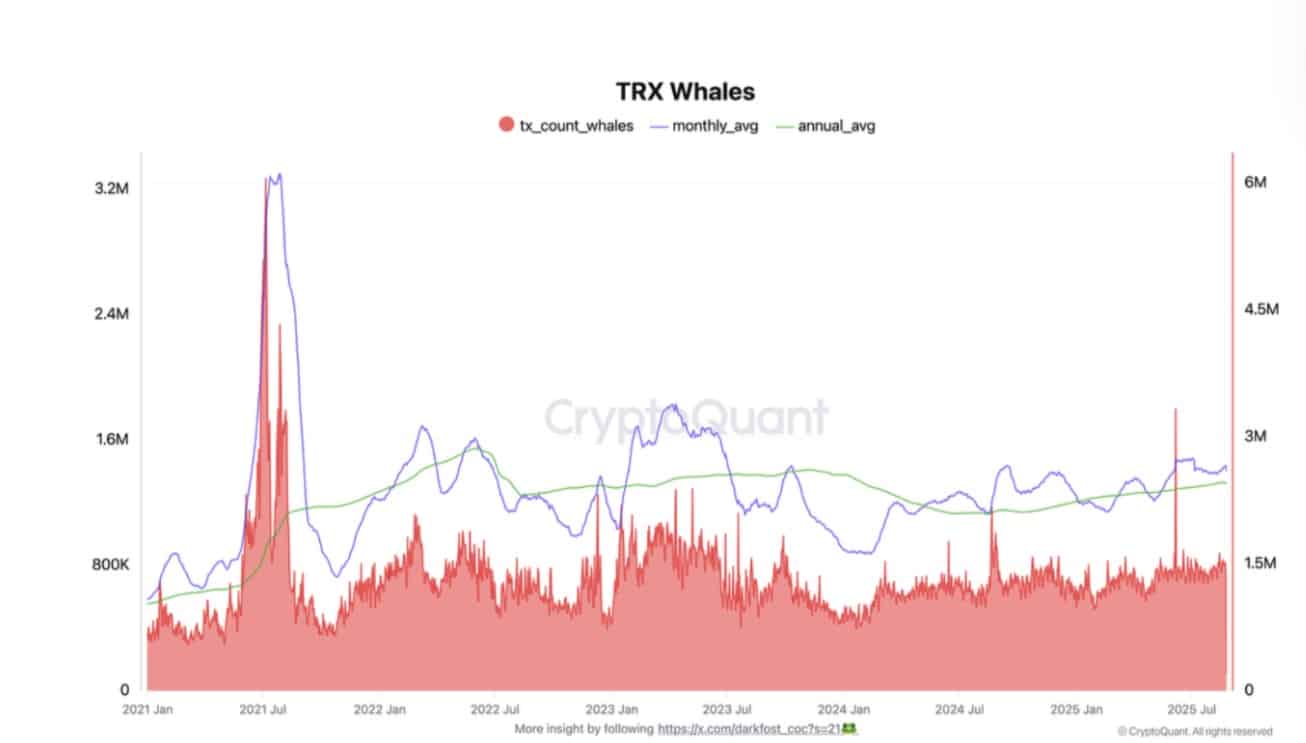

Surprisingly, despite a substantial price drop, TRON’s whale activity has remained relatively high, according to CryptoQuant’s Darkfost.

Average Monthly Whale Transactions rose from 1.23 million in January to 1.43 million in August.

Likewise, the Yearly Average Whale Transactions climbed from 1.20 million to 1.32 million. For comparison, TRX logged just 582k Monthly Whale Transactions in 2021.

Naturally, such consistent accumulation often signals long-term confidence from large investors.

Sellers overwhelm Spot market

However, sellers have dominated the spot market in recent days.

According to Coinalyze, TRON recorded a negative Buy-Sell Delta for three consecutive days. Over the past day, sellers have offloaded over 650 million TRX.

As a result, the market recorded -197 million in Buy Sell Delta, a clear sign of aggressive spot selling.

Equally, exchange activities echoed the same trend. After recording three consecutive days of a negative Spot Netflow, sellers outnumbered buyers.

At press time, Spot Netflow stood at $6.71 million. Historically, a higher exchange inflow has preceded increased downward pressure on assets, often a prelude to lower prices.

Futures market sends mixed cues

As the market retraced three days ago, investors pulled capital out of the Derivatives market.

According to Santiment data, TRON’s Aggregated Open Interest (OI) per exchange declined $205 million to $177 million, at the time of writing.

When OI reduces, it signals reduced capital inflow and participation in the futures market.

Meanwhile, the altcoin’s Funding Rates have mainly remained positive over the past two months. This implied that investors holding onto positions are bullish and are mostly going long.

Also, TRX’s Long/Short Ratio stood at 1.05, reinforcing bullish bias among leveraged traders.

Momentum weakens as indicators flip

AMBCrypto’s analysis suggested recent gains were fueled by whale activity. Now, momentum appeared to fade as sellers regained control.

At press time, TradingView data indicated a shift in momentum for TRX, with the Positive Directional Movement Index (DMI) falling to 24 and the Negative DMI rising sharply to 48, signaling increased bearish pressure.

The Stochastic RSI also dropped to 12, following a bearish crossover that occurred two days earlier, reinforcing the downward trend.

If selling pressure persists, TRX may retest the $0.328 support level. However, consistent demand from whale investors could provide a cushion and potentially drive a recovery toward $0.36.

Post Comment