Why Ethereum’s $3K Rejection Could Be the Unexpected Launchpad for ETH’s Next Massive Surge

Ethereum just took a subtle stumble—a 2% dip that wiped out a hefty $82 million in longs, shaking up the market and making $3,000 look more like a ceiling than a launchpad. But here’s the kicker: despite this shakeout and the liquidations, Open Interest barely flinched, holding strong near record highs. That’s not your garden-variety weakness—it’s conviction. Big players like BlackRock have quietly scooped up nearly 51,000 ETH, signaling a strategic rotation of capital away from Bitcoin and into Ethereum’s domain. So, while the broader market catches its breath, someone’s doubling down. The question isn’t if the market’s priced this in yet—it’s what’s about to come next. Are we witnessing the calm before a major breakout, or simply a pause in the relentless climb? Strap in, because the data hints at a fascinating story brewing beneath the surface. LEARN MORE

Key Takeaways

-

Ethereum just saw a 2% dip and heavy liquidations, yet Open Interest and ETF inflows suggest strong underlying conviction. BlackRock alone added 50,970 ETH as capital quietly rotates from Bitcoin.

Ethereum [ETH] just took a 2% hit and got rejected hard at a key resistance level, and suddenly $3,000 is looking more like a local top than a launchpad.

In fact, that drop wiped out $82.28 million in longs, nearly 80% of the day’s liquidations. And there’s still $47 million hanging by a thread, ready to go with even a minor dip.

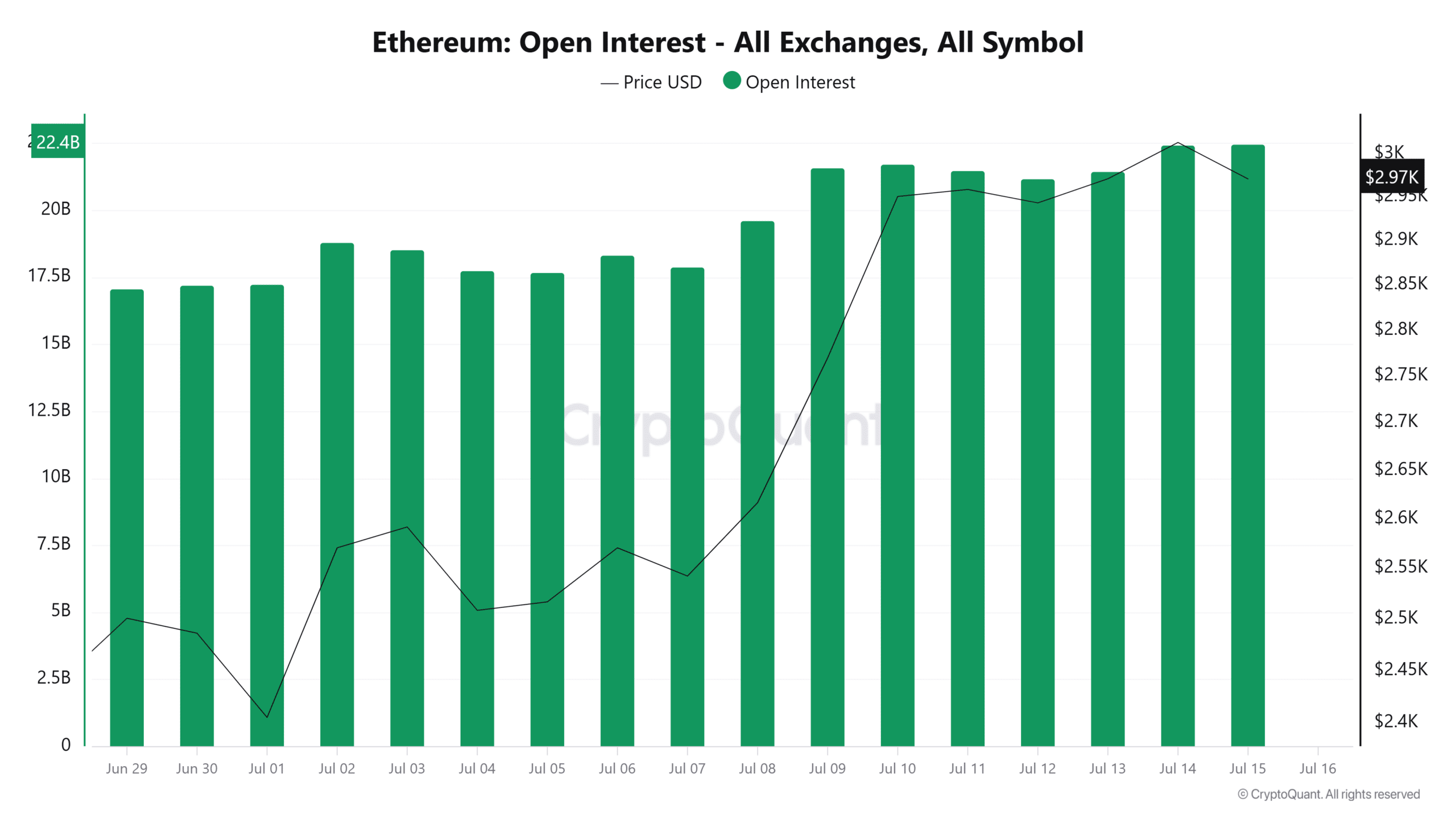

Typically, you’d expect a deeper flush in Open Interest (OI) after that kind of leverage reset. But interestingly, OI has barely budged, down just 0.55% from its record $43.94 billion the day before.

Zoom out a bit, and the setup feels familiar.

Back then, Ethereum’s OI held steady through a tight consolidation zone between $2,640 and $2,450. The result? A breakout rally that pushed ETH up 20% in under two weeks, alongside a fresh OI peak.

Now, throw in another $260 million into spot ETH ETFs, bringing the total to nearly $1.1 billion over just four trading days, marking the strongest run since their launch last July.

Put it all together: Futures positioning is holding strong, spot inflows are ramping. Clearly, someone’s leaning in while the broader market hesitates. Could this be a move the rest of the market hasn’t priced in yet?

Top entities tighten strategic control over Ethereum supply

For the first time ever, Ethereum’s strategic reserves have crossed $4 billion, with 1.11% of the supply now concentrated in just 50 entities.

BlackRock’s latest buy of 50,970 ETH worth $150 million only adds fuel to the narrative. And it might not be random timing.

The ETH/BTC ratio has posted two straight green candles, hinting that as Bitcoin [BTC] struggles at resistance, capital could be quietly rotating into Ethereum.

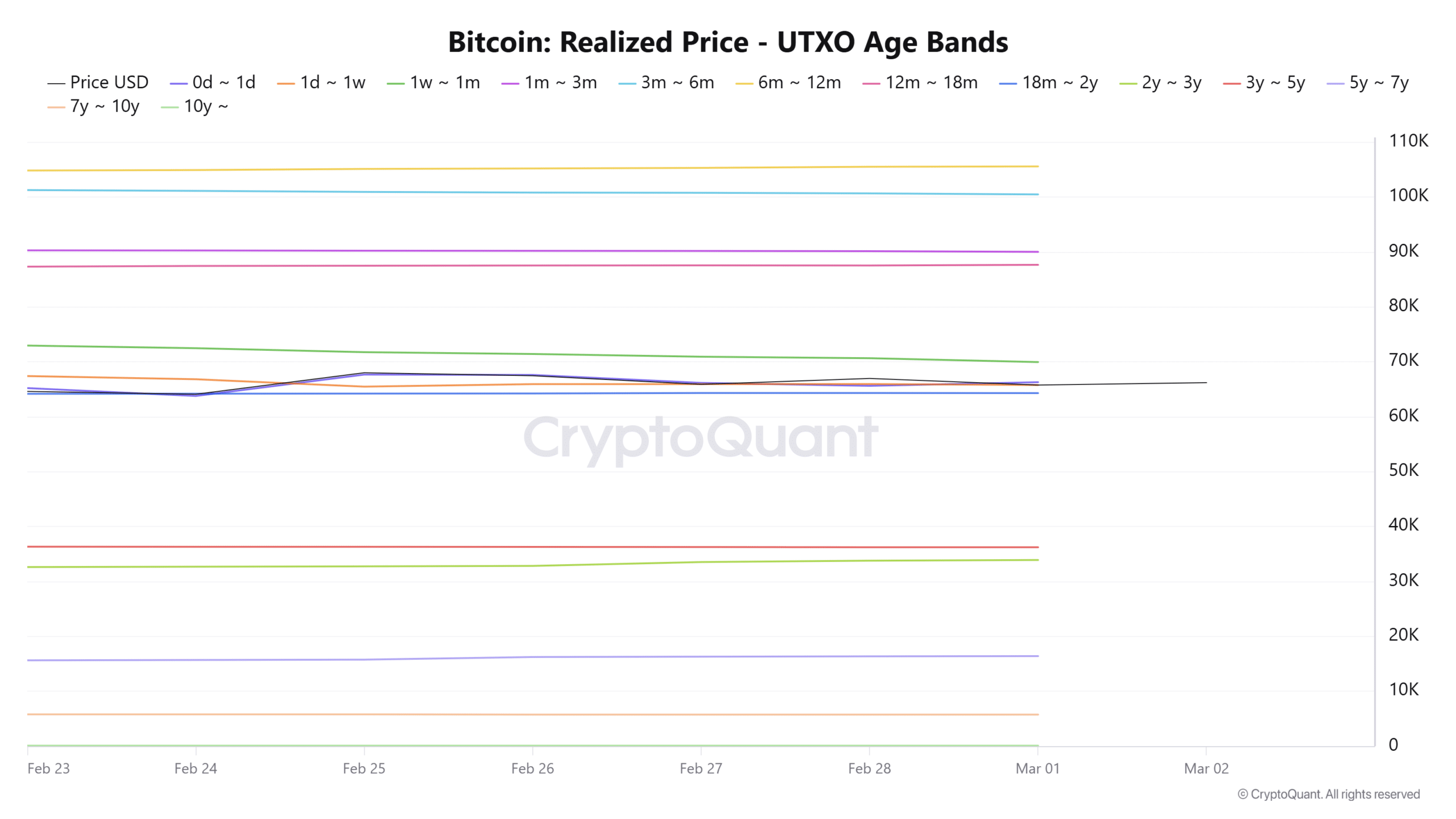

The divergence shows up in the data, too. Bitcoin’s Open Interest has dropped 3.72%, with the price now 5% off its $122k high. Meanwhile, ETH has kept its OI drawdown to just 2%, showing more stability under pressure.

If that relative strength holds, Ethereum could be setting up for another leg higher, using this 2% dip as a springboard for a breakout above $3,000.

Post Comment