Why Smart Money’s Bold $24M Bet on Solana Could Rewrite the Future of Crypto Investing—Are You Ready to Ride the Wave?

Ever wonder what it feels like when the “smart money” starts making a bold move? Well, Solana [SOL] just hinted at something big—those savvy investors aren’t just nibbling around the edges anymore; they’re diving in deep, pushing SOL over the $200 threshold with a solid 7% hike in just 24 hours. It’s like watching the early warning signs of a bull market stampede, but here’s the kicker: the path ahead isn’t all clear skies. A stubborn resistance level looms—a gatekeeper testing whether this rally is the real deal or just a tease. I mean, when the sharpest players pour nearly $5 million into a single asset, you have to ask—are we on the brink of a breakout or gearing up for another round of price drama? Traders and analysts alike are holding their breath, eyes glued to charts, waiting to see if SOL can shatter that ceiling. If you’re curious about the nitty-gritty behind this unfolding saga and what it might mean for your portfolio, stick around. This is not your run-of-the-mill market buzz; this is a high-stakes chess game where every move counts. LEARN MORE

Key Takeaways

Smart money has started accumulating SOL in bulk. A bullish tendency remains, with a breakout rally contingent on escaping the resistance level ahead.

In the past 24 hours, Solana [SOL] rose 7%, pushing the asset slightly above the $200 mark. This adds to its bullish momentum building up over the past weeks.

While bulls are piling into the market, analysts note that investors must still overcome a major price obstacle. AMBCrypto examines whether the asset can surpass this barrier.

SOL records most smart money Inflows

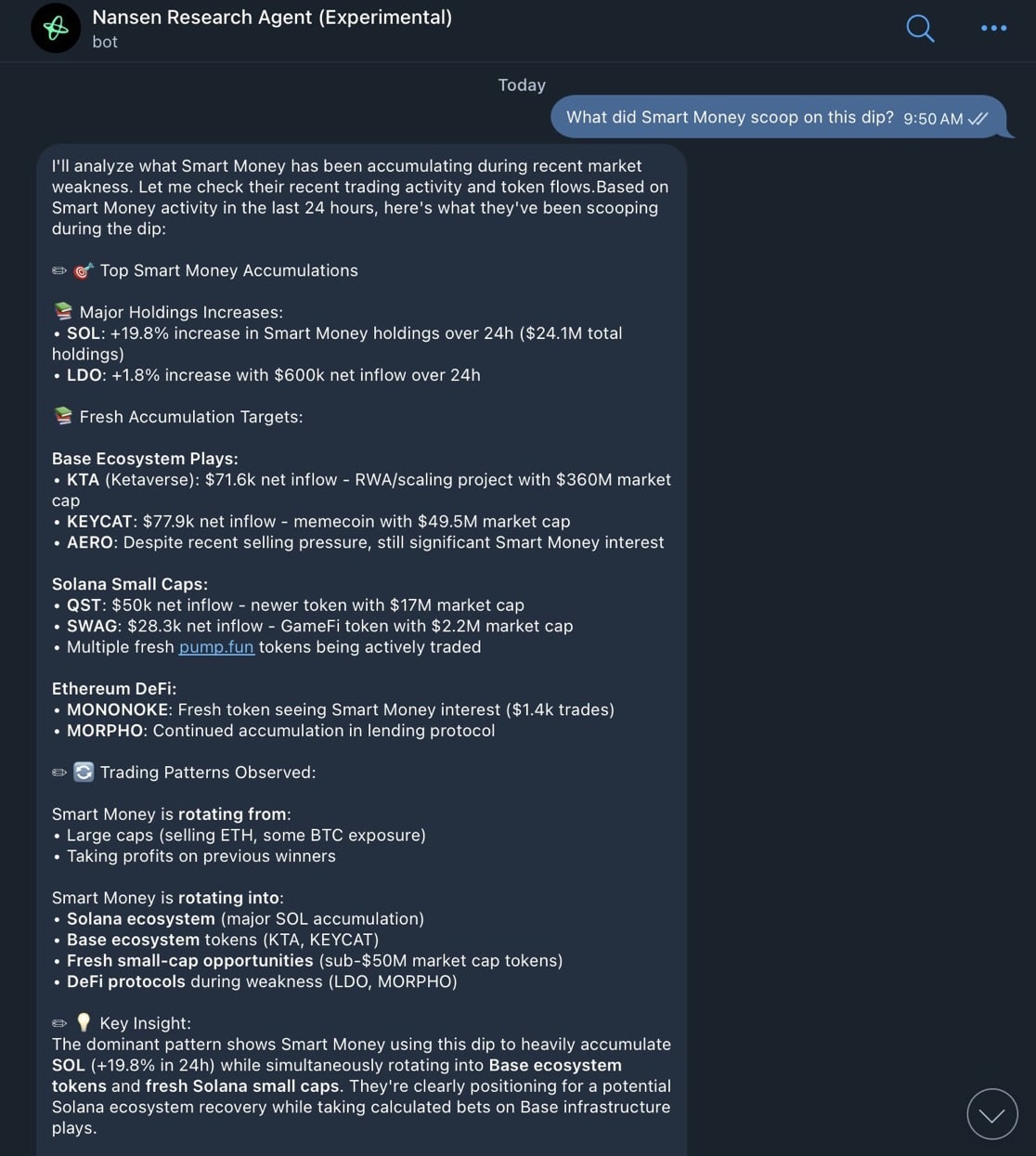

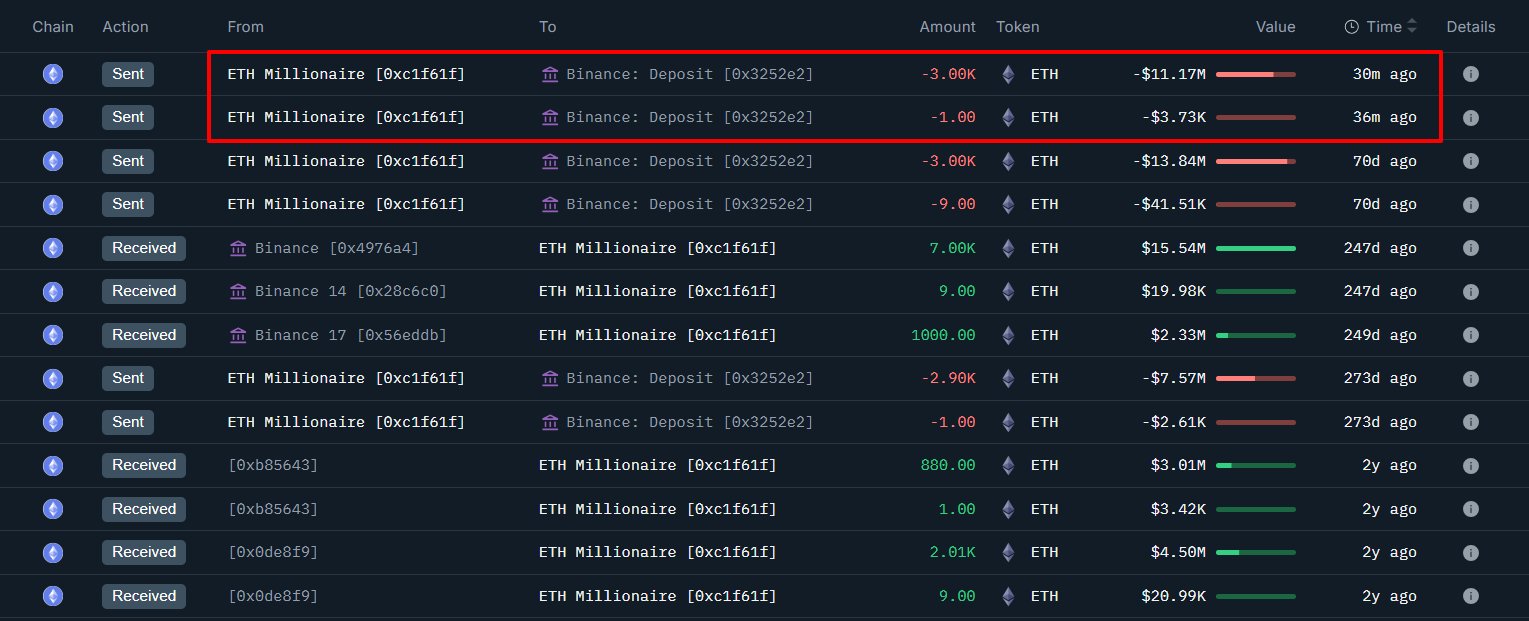

SOL has seen the largest smart money inflows in the past day, according to Nansen. This group, known for making profitable bets, increased their exposure by $4.77 million—a 19.8% rise.

This brings total smart money holdings in SOL to $24.1 million, the highest among tracked assets. LDO came second, recording only $600,000 in net inflows.

Spot investors have followed the same pattern, adding $798,000 worth of SOL over the same period.

If this buying pattern and the movement of SOL into private wallets continue, it would confirm the bullish sentiment from spot investors and add major momentum to price.

Major barrier ahead

Despite the bullish momentum, analysis indicates that a major price obstacle lies ahead.

Recent analysis shows SOL trading within a bullish triangle pattern, often associated with rallies.

However, the upper resistance level remains a critical hurdle for price to break through. This zone has triggered a decline on three separate occasions.

If SOL trades into this resistance again, a downturn could follow, leading to further consolidation before an eventual rally.

Technical indicators suggest, however, that a breakout may be closer than expected.

At the time of writing, both the Moving Average Convergence Divergence (MACD) and the Parabolic SAR align with a bullish outlook.

The Parabolic SAR, which tracks potential market direction through the placement of dots above or below price, currently shows dots forming below price—a sign of a possible rally.

Similarly, MACD has turned positive, suggesting upward momentum. A continued rise in the indicator would signal that bulls are gaining control, keeping SOL’s price trend higher.

With smart money positioning heavily in favor of SOL and technical indicators reinforcing bullish sentiment, the token has a strong chance of breaking through resistance.

Post Comment