Unlock the Secret: Why Now Might Be the Best Time to Own a Slice of Prime London Real Estate—Before Everyone Else Does!

How’s this for a curveball? Prime London residential property—the crème de la crème of real estate, nestled in the old-money haunts of South Kensington, Chelsea, Notting Hill, and Knightsbridge. Now, hold on—before you dismiss this as a fantasy for only the moguls with wallets deeper than the Thames, imagine snagging a modest flat near the Natural History Museum for around a million quid. Sure, a slice of stucco-fronted heaven stretching four stories is probably still a pipe dream for most of us mere mortals. But what if I told you that prices in these posh postcodes have rewound the clock all the way back to 2013 levels? Adjust for inflation, and we’re looking at a nearly 40% drop—ouch. Somewhere between a shrewd opportunity and a pitfall lies the question: could now be the moment to dive into London’s high-end property market before the herd rushes back? Or are we all just about to dance on the edge of another bubble? If this makes you think twice about your next cocktail party chat with that oligarch down at Stamford Bridge, you’re not alone. Buckle up—because this prime London property story is full of twists, turns, and maybe, just maybe, a golden ticket for those brave enough to play the long game. LEARN MORE

How’s this for a contrarian opportunity? Prime London residential property.

I’m thinking about flats and houses in South Kensington, Chelsea, Notting Hill, and Knightsbridge.

Okay, you could easily spend £1m just to secure a very bottom-rung apartment near the Natural History museum – so perhaps ‘houses’ is a stretch for all but a handful of moguls.

But then again, if you do have a few million quid to spare then why not grab yourself a four-storey slice of stucco-fronted heaven?

Because it looks like the best time in a decade to buy London’s most expensive property.

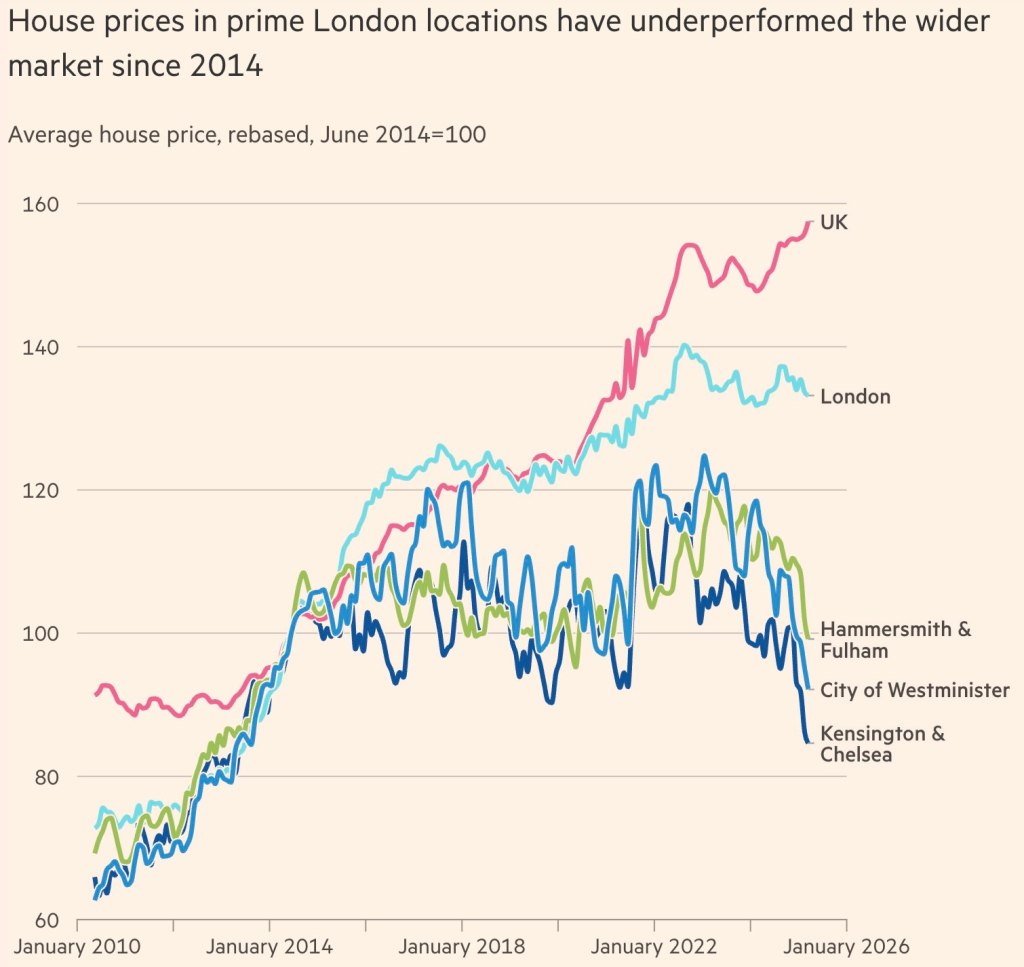

Astonishingly, prices in the prime residential areas of Kensington and Chelsea are back to 2013 levels:

Source: FT

These are nominal prices, remember. Adjusted for inflation, prices are down almost 40%.

Hence if you do bump into an oligarch at your next London cocktail party – or perhaps when they’re slumming it at Stamford Bridge, home of Chelsea Football Club and a previous plaything of multi-billionaire Roman Abramovich – please do extend your sympathies.

If they’d sold their prime London residential property at the start of 2013 and put the proceeds into a global tracker they’d be up nearly 350%.

That’s quite a price to pay for believing that ‘you can never go wrong’ with London property.

Come take a walk in sunny South Kensington

I guess if the Brexit vote for some was about sticking it to the elites, then the elites who owned property in Kensington & Chelsea have been well and truly stucked.

We might – ahem – have been taking back control. But foreigners saw a formerly sensible safe haven losing the plot and they began to steer clear. Shunning both our prime properties and our stock market.

Brexit and the half-a-decade of political tumult that followed it took the froth out of top-tier London prices first, but beyond that it’s ongoing hits to wealth – capital gains and dividend tax increases and swingeing stamp duty hikes, as well as the changes to the non-dom regime – that has seemingly put the boot in.

The hard data is debated. But the non-dom flight appears to be real:

True, that Guardian article goes into why it’s hard to quantify exactly how many non-doms have left – as well as what the hit to GDP and the subsequent tax receipts might be.

Reports of thousands of ordinary British millionaires leaving the UK are also hotly contested.

Nevertheless, we have prime London property prices back to levels last seen when Robin Thicke’s Blurred Lines topped the UK charts, untroubled by the still-to-come Me Too movement.

So something has definitely happened.

I’m not sure I’d finger higher interest rates, incidentally. Obviously rates rising hasn’t helped. But we’re talking about a slice of the market dominated by the wealthy, many of whom are cash buyers.

Wider London prices have been sluggish for years too. I’d definitely see rate hikes as a culprit there.

But those non-prime areas have seen prices up, whereas prime has actually fallen back. That’s a big difference.

The bottom line is foreign buyers have long been the pivotal players in prime London property. Both as investors and as residents. And in recent years they’ve not been very keen to buy.

Whether they’re coming or going and in what numbers, the prices don’t lie.

Primed for recovery?

It’s hard to be super-optimistic about the near-term future, too.

London’s productivity – which drives its non-imported wealth – is back down to pre-pandemic levels. And new data from UBS has found the UK’s rich actually got relatively poorer in 2024.

However… if you think Britain’s fortunes will change – or at least not get any worse – then could this be the dip that enables you to buy property in one of the world’s most desirable postcodes?

A neighbourhood with the highest life expectancy in the UK, not coincidentally.

The idea does hold some appeal.

Profiting from the Great London stock market sell-off is one thing. But the American private equity firms and hedge funds that are swallowing up UK PLC on the cheap can’t dismantle and ship King’s Road back to Connecticut. (Putting aside the fate of the original London Bridge).

Buying a stake in prime London property would be like putting down a wager for the decades.

What you’ll pay to move into prime London residential property

I know South Kensington well. I’ve watched its ups and downs – and the influx of foreign wealth – over three decades, and I’m confident it’ll eventually recover.

The French and Russians may have retrenched. But in time they’ll be replaced by more North Americans, Indians, and East Asians.

The numbers still make me blanch. Not only that sticker shock – over £1m for a entry-level prime postcode flat, and £1.5-£2m for anything with a modicum Rightmove appeal, up to multiple millions for a luxury apartment – but also the hefty service charges, low yields, and the high interest rates I’d have to fund any purchase with myself.

Nevertheless, I’ve toyed with a joint investment with friends within a limited company.

I have few moral qualms about letting a bijou buy-to-let in Chelsea to an Italian private equity fund manager with respect to the UK’s wider housing shortages.

Deal or no deal

For kicks I’ve run the numbers on a dozen properties. Despite stagnant prices, I see negative cashflows.

Let’s say the Monevator Mansion SPV buys a £1.5m two-bed flat in pretty good nick in South Kensington.

I model a 75% interest-only mortgage at 5%. The starting monthly rent is £3,750.

The flat will be managed by an agent (at 12% a year, with other costs), but I’ve generously not accounted for refurbishment (which is definitely unrealistic at this end of the market) nor for void periods.

Also, the simple calculator I’m using doesn’t increase service charges, which is clearly unrealistic too.

Using these ballpark figures, a 3% annual growth in prices (maybe optimistic) and matching rent rises (more credible, with inflation) yields:

Ouch! Who needs dodgy alt-coin pump-and-dump schemes when you can lose money with good old bricks and mortar?

But wait – buying into prime London is all about capital gains. And I am assuming 3% growth (left-hand side of table).

Even then – and with leverage – after a decade we have a 2% annual return on investment:

With returns like that, at least we wouldn’t have to worry much about paying higher taxes. No wonder Finumus says buy-to-let is dead.

On the other hand, wouldn’t we be doing this because we believe things will get better?

Well my 3% annual price growth does assume a turnaround. But let’s be even more optimistic. Say a 4% initial yield, interest rates cut to enable a 4% mortgage rate, and prices and rents rising at 4% a year for a decade:

That’s much better. The annualised return on investment improves to 10%, too.

Even so, 10% is only a little better than what you might hope to achieve from the global stock market – and after a lot of very optimistic assumptions and using a lot of mortgage debt to get you there.

I think we can assume few investors will be riding to the rescue of prime London property anytime soon.

Location, location, location

The better opportunity might be if you’re a high-earning HENRY type – or perhaps a retired couple who moved to the suburbs but who misses London life.

Because in that case, pleasing your heart might pay dividends that overrule your head.

For many years the majority of ordinarily wealthy British property buyers have been shut out of prime London property. But stagnant prices in Kensington and Chelsea for a decade might let a sliver of light in.

Consider that if in 2014 you were a young-ish banker (or more likely a couple) who’d reluctantly moved to still-lovely Zone Three – say Wimbledon – rather than continuing to live your dream life in Notting Hill.

Your Wimbledon property has gone up a bit in value:

Source: KFH

Okay, so a 10-30% price gain over ten years is hardly the crazy house price explosion that London saw from the mid-1990s to 2016.

But up is up. And compare it with the properties you couldn’t afford in 2014 in Kensington and Chelsea:

Source: KFH

As we’ve already seen, here prices are stagnant-to-down.

So a differential has opened.

I don’t want to overplay this observation. Prices are still sky high in the Royal Borough. And of course somebody young who eschewed Zone One in 2014 may have since acquired kids and a spouse and a golf habit that’s no longer compatible with what they can afford in prime London, even with a price cut.

Still, it’s an interesting reversal of a multi-decade trend – at least for as long as it lasts.

Streets paved with fool’s gold

I’d agree with you if you said flatlining prices for a decade around The Natural History Museum and Kensington Palace might reflect a bubble in 2013 as much as a market clobbered by later events.

Very fair.

And yet… be greedy when others are fearful.

Being greedy is easier said than done though. As we’ve seen, you’ll probably need a long time horizon to make an investment wash its face – economic miracles or self-help refurbishments notwithstanding.

Also, I don’t know any way to get exposure to the prime London residential market via equities. You might look at Foxtons (Ticker: FOXT) or Savills (Ticker: SVS) but there’s a lot else going on with those businesses, too.

Perhaps the best bet is to move to the borough. Besides saving on stamp duty, you’d be your own perfect tenant. Less money spent on agencies, regulations, and void periods. And a lot less hassle.

That’s not likely for me – I still love my flat – but it’s nice to daydream.

For now I’ve just bought a few more shares in the decidedly un-prime Mountview Estates and some other London-listed (commercial) property vehicles.

A man’s mogul’s got to know his limitations. But if you’re one of our wealthiest readers…?

Post Comment