Why British Politics Can’t Touch Property—And What That Means for Your Wealth Strategy

Ever wonder how a simple slip-up over stamp duty could topple a high-profile minister faster than you could say “tax labyrinth”? Angela Rayner’s recent resignation over underpaying stamp duty on her flat in Hove is a reminder that even those with the sharpest minds—and professional help—can get caught in Britain’s bewilderingly complex tax code. It’s not about conspiracy or deceit, but rather a cautionary tale of navigating a system that trips up many, no matter their status. Yet, what’s truly refreshing is her stepping down promptly, harking back to a time when accountability in politics was less of an afterthought and more of a given. This episode also shines a light on the bigger picture—housing policies, construction delays, and the challenges of building homes in a sluggish economy. As the housing market teeters and political tensions brew on both sides of the Atlantic, one has to ask: Is the complexity of our property taxes stifling progress more than we realize? Buckle up, because this week’s roundup dives deep into these questions, plus much more that caught my eye. LEARN MORE

What caught my eye this week.

I can’t get very het up about housing secretary Angela Rayner’s resignation on Friday, as a result of her underpaying stamp duty on a flat in Hove.

For starters, it’s pretty clear that Rayner is just the latest person to run into the buzzsaw of Britain’s ludicrously complicated tax code – even with professional help in her case – and to come out supremely chaffed by the contact.

Nothing in this sad story involving divorce, a disabled child, and divided duties across the country has the hallmarks of a grand conspiracy to dupe the taxpayer.

All the same, as a leading minister she should have got it right and she didn’t.

And honestly, after the past few years it’s refreshing to see an MP resigning in good time, rather than having to be burned out of office like a recalcitrant tumour.

This is the way our knockabout democracy used to work.

Snagging issues

Perhaps as housing secretary she should have gone anyway, given Labour’s dismal showing to-date in homebuilding.

True, the creation of the Building Safety Regulator in 2022 long predates Rayner’s taking on the housing brief.

But industry voices have been warning for years that the new body was underfunded and that this was severely delaying development.

The construction sector is running at levels last seen during the pandemic – you know, when most of us weren’t even allowed out of the house. According to homebuilder Berkeley, new home starts in London are as low as in the aftermath of the financial crisis.

Sure I’m gloomy about the UK economy, but even I think it should be a better time to be building houses than during a plague or a potential depression.

Rayner must have seen similar numbers crossing her desk. I didn’t notice any urgency in response. Perhaps the next one can do better.

Homebuyer’s report

It’s notable that it’s a housing-related scandal that’s delivered this speedy resignation.

Would Rayner have faced quite the same opprobrium if she’d made a mistake on her self-assessment tax form?

Possibly not.

It’s an interesting coincidence too that Trump is currently pressuring the still-independent US Federal Reserve by firing a Fed committee member over alleged mortgage fraud.

Of course this is just the latest in his ongoing belittlement of the US institutional framework. He might have fired her for being late returning her library books if that was all his people dug up.

But mortgage fraud hits the sweet spot.

Indeed given how politically hot this potato is in the US and UK, I was surprised to also read a story in The Guardian this week that detailed the property holdings of Australian politicians.

Out of the 236 federal Australian MPs and senators who’ve disclosed their housing interests, more than half – 130 – have multiple homes, investment properties, or both.

Some have six properties! (Some have cattle ranches, but we’ll put that to one side. Fair dinkum mate.)

Australia is a vast country, and there’s lots of room for more homes. Though most of that room is in a desert and Australia has its own housing affordability crisis.

How are the Aussie lawmakers getting away with their side hustles as property tycoons? It must come down to cultural norms.

In her recent FIRE-side chat, Melbourne-based Monevator reader London a Long Time Ago told us how everyone with any money in Australia does property like we do ISAs.

I suppose that keeps any stone throwing through glasshouse windows to a minimum.

Fixer-upper

Will Rachel Reeves still go after stamp duty and other property taxes in the November Budget, given her own colleague just blew up on contact with this touchy subject?

The chancellor could spin it either way – as yet another pointer that complex property taxes are overdue reform, or as deciding to avoid complicating the situation even further given those infamously hard-working families already have enough on their plate.

Reeves should at least scotch the rumours pronto if there’s nothing doing. The uncertainty is slowing down the housing market, and the UK (and Treasury) needs all the economic growth it can get.

As for building more homes, an interesting article behind the paywall in the Financial Times this week makes the case that supply isn’t actually the problem many of us think it is. It even advocates for a wealth tax on land as a salve to a distorted market.

Personally, while I think stamp duty is a dysfunctional tax that desperately needs reform and that something must be done to slow the UK’s descent into neo-feudalism, the reality is an Englishman or woman’s home is their castle – one with barrels of explosive gunpowder in the basement.

If Reeves wants to follow Rayner out in a blaze of glory, then she only needs to light the fuse…

Have a great weekend!

From Monevator

When are fund fees low enough? – Monevator

Retail bonds: Rare, risky, and sometimes rewarding – Monevator

From the archive-ator: It’s survival of the fittest with ESG returns – Monevator

News

Rachel Reeves sets Budget date for 26 November… – UK Gov

…and the rumour mill has put plenty on the table… – Which

…prompting savers to pull tax-free cash from pensions again – This Is Money

Former footballers lost millions in investments – BBC

Gold price hits record high – BBC

UK fintech pioneers unite to build bank for high-net worths – Finextra

Average UK house costs a record £299,331, says Halifax… – Guardian

…though Nationwide says they fell – This Is Money

Google’s parent soars as court rules it doesn’t have to sell Chrome – Sherwood

High-frequency trading intern wanted. Monthly salary $35,000 – FT

Bitcoin treasury companies collectively own over one million BTC – The Block

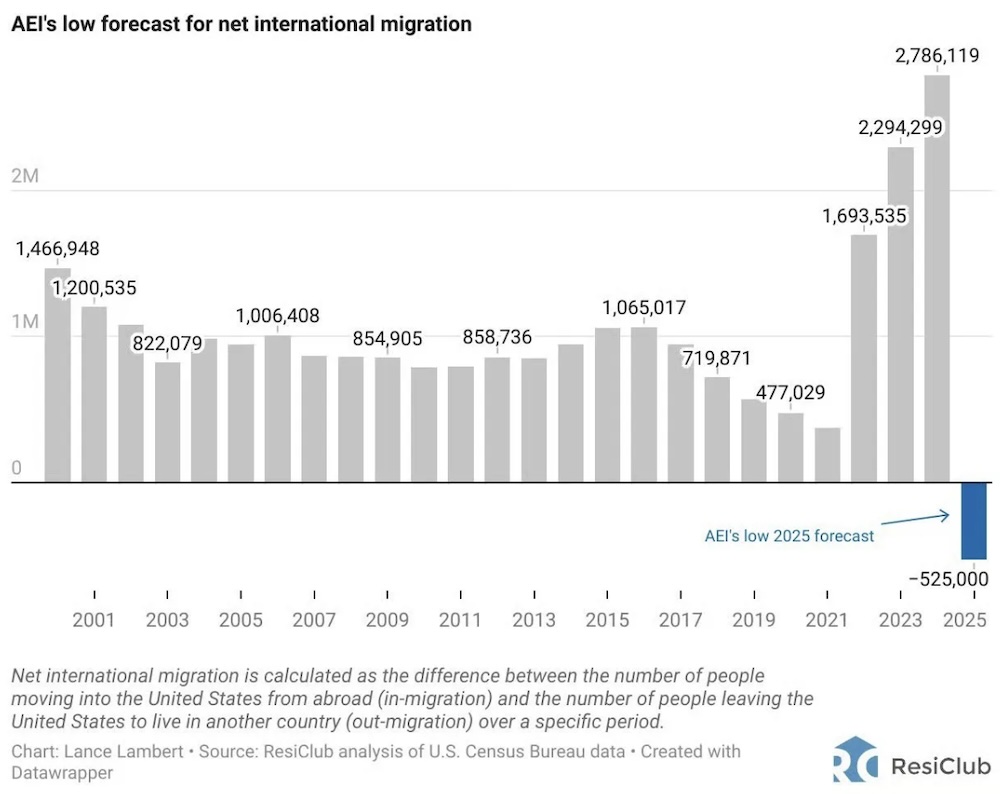

The US population could actually shrink in 2025 – Derek Thompson

Products and services

Households urged to lock down new mortgage deals now – This Is Money

The death of the wallet – Guardian

Get up to £1,500 cashback when you transfer your cash and/or investments to Charles Stanley Direct through this affiliate link. Terms apply – Charles Stanley

“Can I use a trust to pass my property to my adult children?” – This Is Money

Average pot to purchase an annuity rises 160% to over £166,000 – Which

Fixed tariffs to beat the energy price cap – This Is Money

Get up to £100 as a welcome bonus when you open a new account with InvestEngine via our link. (Minimum deposit of £100, T&Cs apply, affiliate link. Capital at risk) – InvestEngine

The self-storage pitfall that could cost you £2,000 a year – This Is Money

How to qualify for the attendance allowance benefit – This Is Money

Homes for sale near great schools, in pictures – Guardian

Long-term gilts rise mini-special

UK government borrowing costs hit a 27-year high – BBC

BoE chief warns against ‘exaggerating’ rise in government borrowing costs – Guardian

Torsten Bell has made me want to buy bonds – The Times

Note long-dated bond yields are rising globally – Reuters via MSN

Comment and opinion

AI hype will spur investors to do the wrong thing – Behavioural Investment

Four years on, the cost-of-living crisis endures – David Smith

Europe’s small-cap golden age – Verdad

The relationship between time and money – We’re Gonna Get Those Bastards

Proof of wealth – Of Dollars and Data

The case for short-term TIPS [PDF, holds for linkers, too] – Mekata

How to never run out of money in retirement – The Times

The 4% ‘rule’ and risk – Humble Dollar

Why it’s a terrific environment for bond income – Morningstar

The benefits of not regularly checking your net worth – Financial Samurai

Not-at-all biased Coinbase makes the case for crypto [PDF] – Coinbase

At what point do passive investing principles no longer apply? – Oblivious Investor

Naughty corner: Active antics

The new currency is narrative liquidity – Groundwork [h/t Abnormal Returns]

How consumer surplus affects pricing power – Flyover Stocks

Big fund inflows can be a precursor to poor returns – Morningstar

A good memory makes you a better investor – Klement on Investing

Is Venture Capital finally starting to come back? – Institutional Investor

Multi-asset managers ‘stuck in the past’ – Trustnet

IPOs don’t really leave that much money on the table [Research] – SSRN

Kindle book bargains

Flash Boys by Michael Lewis – £0.99 on Kindle

Alchemy by Rory Sutherland – £0.99 on Kindle

The Green Budget Guide by Nancy Birtwhistle – £0.99 on Kindle

Techno Feudalism by Yanis Varoufakis – £0.99 on Kindle

Or plump for one of our investing favourites – Monevator shop

Environmental factors

Why plastic-filled ‘Neptune balls’ are washing up on beaches – BBC

Europe debates restoring wetlands for defence – Semafor

Global temperatures to remain above normal, despite La Niña… – Guardian

…with Panama’s ocean upwelling failing for first time in 40 years – BBC Wildlife

World’s largest sand battery switched on in Finland – Independent

Electric cars’ range almost halves when driving in heatwaves – This Is Money

Robot overlord roundup

Chat GPT-5: the case of the missing agent – Second Thoughts

AI and jobs, again – Noahpinion

Will AI ‘do a Bloomberg’ on private markets? – Colossus

Cloudflare’s CEO on saving the web from the AI oligarchs – Crazy Stupid Tech

AI will end the Magnificent Seven’s dominance, says fund manager – Trustnet

Not at the dinner table

The authoritarian checklist – Can We Still Govern?

America’s gun problem isn’t hard to diagnose – Garden of Forking Paths

The myths of Chinese exceptionalism – Scott Sumner

Online speech laws in need of review after Lineham arrest, says minister – BBC

UK suspends refugee family applications – BBC

Xi Jinping says it’s peace or war at China’s grand military parade – Guardian

Off our beat

UK graduates crippled by debt swap degrees for plumbing courses – Standard

Breakneck’s take on China vs the US pits engineers vs lawyers – Noahpinion

Why US capitalism is a success story like nowhere else – WSJ

Hot mic catches Xi and Putin talking organ transplants and immortality – BBC

American Football teams ranked by value on the eve of new season – CNBC

This is still your first time – Raptitude

And finally…

“Life makes you pay…everybody pays something.”

– Min Jin Lee, Pachinko

Like these links? Subscribe to get them every Saturday. Note this article includes affiliate links, such as from Amazon and Interactive Investor.

Post Comment