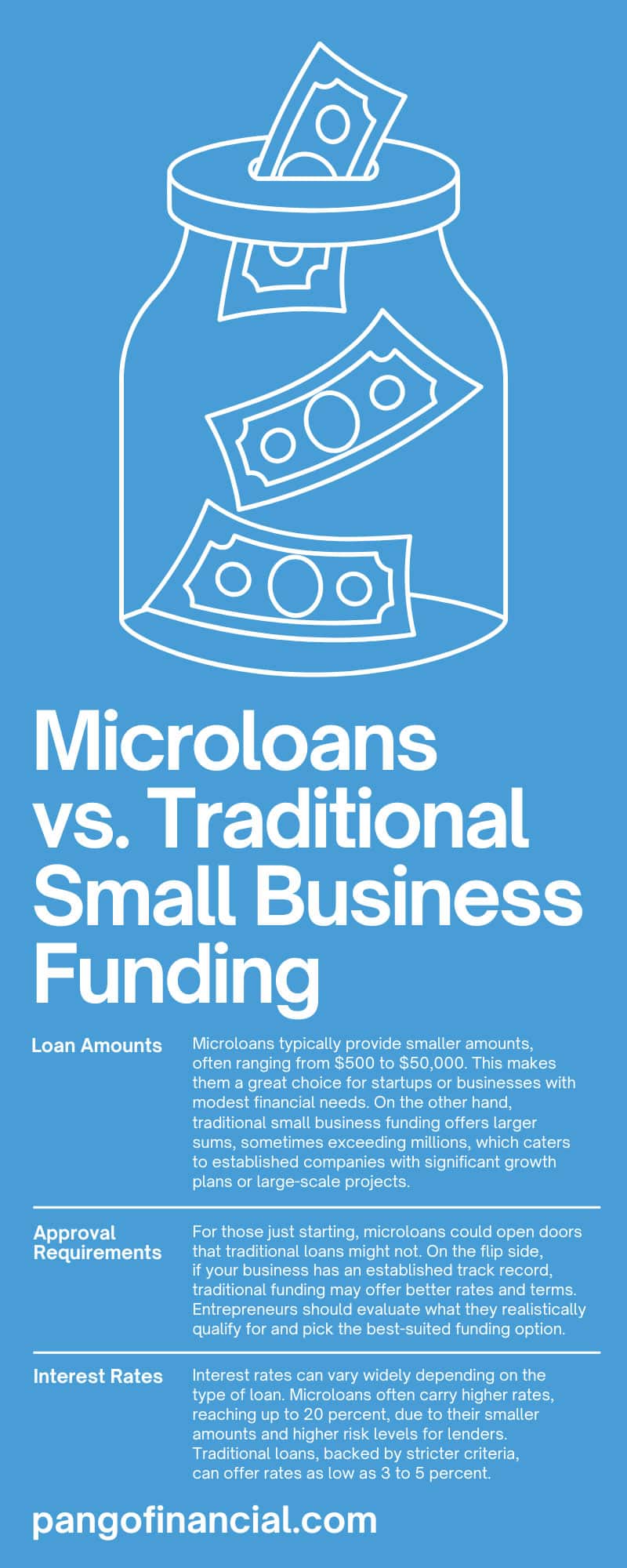

Unlocking the Funding Battle: Why Microloans Might Just Be the Game-Changer Your Small Business Desperately Needs Over Traditional Financing!

Alright, let’s cut to the chase—when you’re bootstrapping a small business or dreaming of scaling it up, the million-dollar question facing you is nearly always: where’s the cash coming from? Microloans or traditional small business funding? These two financing roads are miles apart in approach, perks, and pitfalls. And yeah, choosing between them can feel like staring into the abyss, especially when the fate of your hustle hangs in the balance.

But here’s the deal—I’m breaking it down for you. This isn’t just about numbers and paperwork; it’s about figuring out what truly suits your business’s vibe and needs. Microloans could be your golden ticket if you’re a lean, scrappy startup or maybe your credit history has a couple of wrinkles. Meanwhile, traditional funding tends to be the muscle behind solid, established enterprises aiming for the next big leap.

By the time you finish this, you’ll be poised to make a tough decision with confidence and clarity. Ready to find out which path aligns with where you’re headed? Let’s dive in.

Loan Amounts

Think of microloans as your small-but-mighty friend—they typically dish out between $500 and $50,000. Perfect for getting the basics covered or handling modest expenses without drowning in debt. On the flip side, traditional business funding is the heavyweight champ—dealing with eye-popping sums that can reach into the millions, tailored for businesses with big dreams and bigger projects.

Before you jump, consider what you truly need right now. A small loan might patch the immediate holes; however, if you’re planning to conquer the market or build a powerhouse, you might want a bankroll that matches your ambitions. But hey, don’t bite off more than you can chew—overborrowing or skimping on funds can throttle your progress just as fast.

Approval Requirements

Here’s where things get interesting. Microloans are known for playing nice with folks who aren’t yet financial rockstars. Lower credit scores? Short credit histories? No sweat. Traditional loans, however, raise the bar—expect a solid credit score, assets on the line, and proof that your business can pay its dues.

If you’re in the launch phase, microloans may be your best bet to open the door. But if you’ve got a track record and good financial chops, traditional loans could hook you up with better terms and less interest burning a hole in your pocket. So, know thyself and pick what’s really achievable.

Interest Rates

Brace yourself—interest rates can swing dramatically. Microloans, due to the higher risk lenders take on, can charge rates up to a whopping 20%. In contrast, traditional loans often cruise along with rates between 3% and 5%. The catch? Microloans get you cash quicker, but you pay a premium for that speed.

Understanding how your business flows financially is crucial here. Sometimes paying a little extra for fast money is worth it—especially if it keeps your gears turning. But keep a close eye on those repayment numbers so you don’t drown yourself in debt you can’t handle down the line.

Loan Repayment Terms

If you don’t love long dances, microloans may feel like a sprint—they typically come with shorter repayment windows, usually up to six years. This means higher monthly bills but faster freedom. Traditional loans, on the other hand, stretch payments over 10, even 25 years! While that’s a longer commitment, monthly payments are usually gentler.

Crunch your numbers and think cash flow. If you’re a nimble startup expecting rapid turnover, microloans offer a tighter, short-term fix. Established enterprises with long-term plans might find the stretched-out schedule of traditional loans more manageable. Just keep tabs on your debt-to-income ratio to dodge dangerous payment traps.

Application Process

Newsflash: microloans keep the bureaucracy light. Fewer forms, quicker yes or no’s, and none of the tangled red tape. Traditional loans? Get comfortable—there’s paperwork, audits, and enough hoops to make an Olympian proud. That patience can pay off with bigger sums and better deals, but it definitely requires prep.

If you need cash yesterday, microloans might be the way to zip through funding. If you can afford time and bother with the paperwork, traditional lenders have their own benefits. Pro tip: organize your tax returns, business plans, and all that growling paperwork beforehand—it’ll make either process smoother.

Flexibility in Use

<p

Post Comment