Arthur Hayes’ Massive ENA Wager: The Untold Power Move That Could Rewrite Ethena’s Future—and Your Portfolio

Ever wonder what it takes for a savvy investor to signal a serious green light on a cryptocurrency? Well, Arthur Hayes’ recent move to bulk up his ENA holdings might just be that kind of nudge we all need to watch closely. He’s scooped up nearly 579,000 tokens, pushing his total stash north of 5 million ENA — a hefty $3.91 million worth, mind you. This isn’t just a casual buy; it’s a bold vote of confidence, especially as ENA wheels above critical Fibonacci levels that seem to be whispering, “buckle up.” What really piques my interest here is the developing cup-and-handle pattern — classic bullish territory — paired with a market where long positions dominate but funding rates keep things balanced. It begs the question: Are we on the cusp of a sustainable rally toward that juicy $1.16 target? Or is this a tempting setup that demands a watchful eye for potential pitfalls? Either way, Hayes’ strategic maneuvers combined with these technical signals make ENA a token worth dissecting right now. Ready to dive deeper? LEARN MORE

Key Takeaways

Arthur Hayes’ ENA accumulation boosts confidence. Besides, strong long dominance and balanced Funding Rates suggest sustainable upside toward $1.16.

Ethena [ENA] has come under the spotlight as Arthur Hayes expanded his holdings by acquiring 578,956 tokens worth $467.7K from Binance.

This addition pushed his total stash to 5.02M ENA, now valued at $3.91M.

The purchase comes as ENA price consolidates above key Fibonacci levels, reflecting renewed market confidence. Such whale accumulation often stirs speculation about potential breakouts.

ENA price eyes breakout

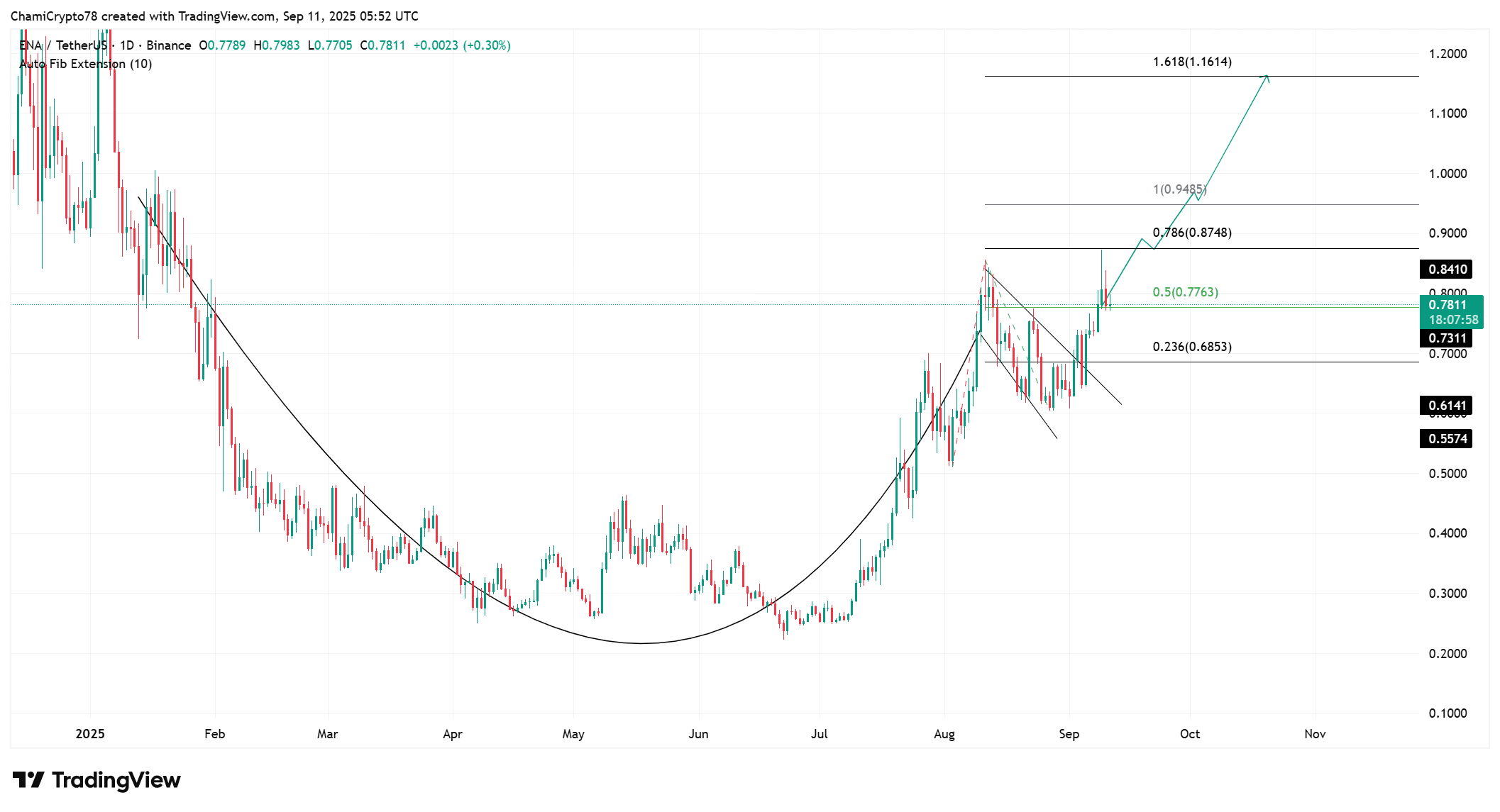

Ethena’s price chart revealed a developing cup-and-handle pattern at press time, a setup known for its bullish continuation.

The token traded at $0.78, holding near the 0.5 Fibonacci retracement at $0.77. Above this, resistance lay at $0.84, with targets extending to $0.95 and $1.16, the 1.618 extension.

However, failure to sustain above $0.73 could invite short-term selling. Still, the structure highlighted optimism, as cup-and-handle patterns often precede extended rallies.

If ENA continues climbing, it could validate the bullish pattern and open the door toward the $1.16 level highlighted on the chart.

Long traders set the stage

Data from Binance shows long accounts now dominate ENA perpetuals, holding 72.97% against 27.03% shorts. This imbalance pushes the long-to-short ratio to 2.70, underscoring overwhelming bullish sentiment.

Such aggressive positioning often creates conditions for extended upside, though it also increases liquidation risks if momentum fades.

However, the prevailing dominance suggests that traders remain confident in further upside moves.

Thus, ENA price could find significant support from leveraged buyers, strengthening the case for sustained bullish momentum in the near term.

Source: CoinGlass

Funding Rates hint at cooling

Despite the clear long bias, ENA’s OI-Weighted Funding Rate sat slightly negative at -0.008% at press time. Thus, long traders were not overpaying to maintain positions, signaling balanced market conditions.

However, funding has oscillated around neutral in recent days, reflecting cautious sentiment despite heavy bullish exposure.

Therefore, while the weight of longs supports the bullish narrative, Funding Rates showed that traders were not excessively leveraged.

This cooling effect could actually stabilize ENA price action, providing room for a healthier rally rather than a sharp, overheated surge.

Source: CoinGlass

Can ENA price sustain its momentum?

Arthur Hayes’ strategic accumulation, combined with a bullish technical pattern and strong long positioning, pointed toward an optimistic setup.

However, the slightly negative Funding Rate suggested that the market was avoiding unhealthy overexposure.

ENA looks poised for further upside if support holds, with the $1.16 Fibonacci extension as a realistic target.

Post Comment