Why Galaxy Digital’s $205M Bet on Solana Could Signal the Next Big Crypto Surge You Can’t Afford to Miss

So, Galaxy Digital just pulled off a massive $205 million withdrawal of Solana tokens from Binance—talk about making a statement! Now, why should we care about this bold move? Because, frankly, it’s not every day you see an investment giant like Galaxy Digital stacking Solana like it’s a prized collector’s item rather than a quick flip. This maneuver is stuffing the institutional accumulation argument with some serious weight, hinting that these savvy whales are gearing up for a potential Solana surge toward the elusive $300 mark. But here’s the million-dollar question: with retail traders still holding the market’s reins on daily swings, can this momentum hold? Or is the chart’s bullish turn just another tease in the wild crypto dance? Buckle up; it’s about to get interesting. LEARN MORE

Key Takeaways

Galaxy Digital’s $205 million withdrawal added weight to the case for institutional accumulation of Solana. The altcoin’s bullish structure suggested a potential rally towards $300 may be next if momentum continues.

Galaxy Digital, the investment firm that recently led Forward Industries’ $1.65 billion Solana treasury raise, has made another notable move.

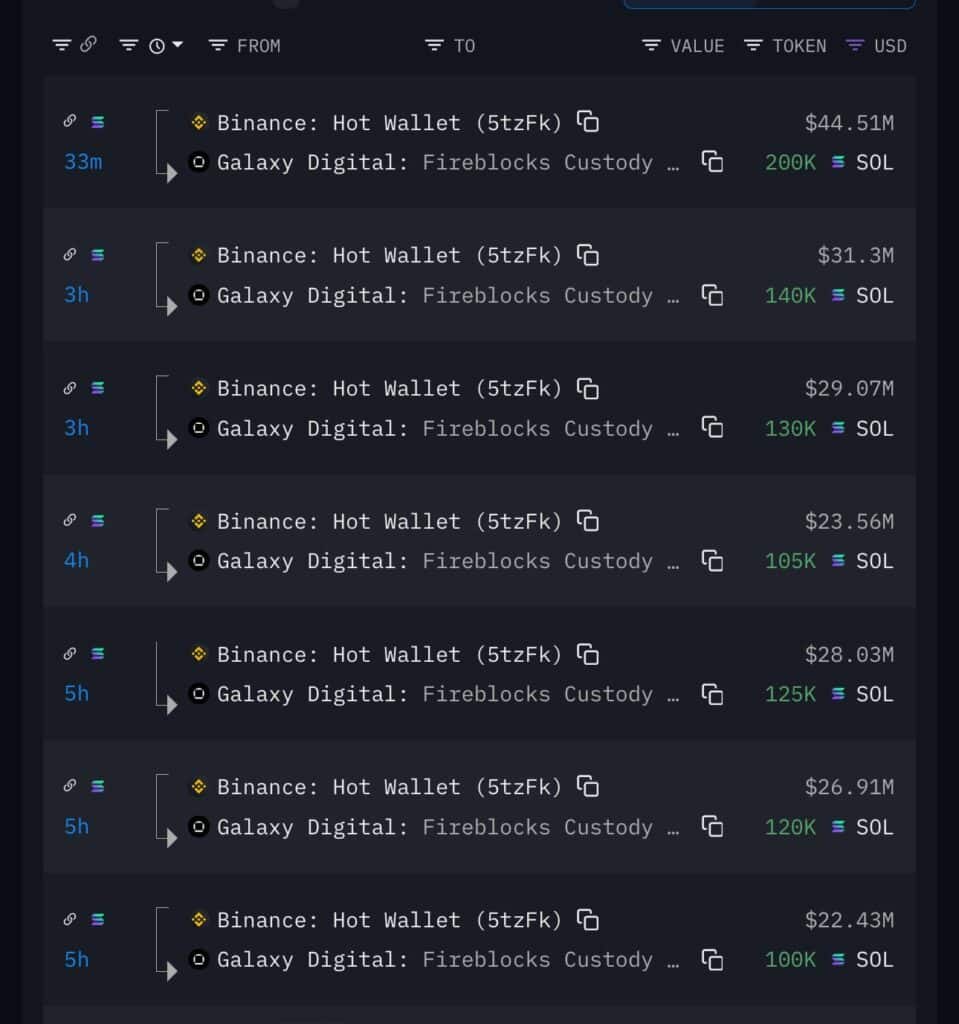

The firm is in the news today after it withdrew 920,000 SOL — worth about $205 million — from Binance, according to recent Solana floor reports.

Whale withdrawals signal accumulation

In most cases , such a move is rarely random. Large-scale withdrawals from an exchange wallet often hint at accumulation, rather than short-term trading.

By moving tokens off an exchange, institutions typically signal an intent to hold, reducing immediate sell-side pressure.

Here, it’s worth pointing out that this move came on the back of Solana’s broader exchange inflows surging to $234 million, with a majority originating from Ethereum, Arbitrum and Base. This suggested that big firms may be steadily tightening supply by converting their stablecoins into spot positions.

Solana’s bullish structure targets $300

For Solana, the timing could not be more important. The altcoin’s daily chart recently flipped bullish, breaking out from key resistance levels. If buying momentum holds, most analysts will see room for a push towards the $300-zone – A level that would mark its strongest rally in months.

However, investors should not ignore the risks. While institutional accumulation helps build confidence, the market still depends heavily on retail liquidity.

As it stands, the retail market is dominated by sellers. In fact, the Futures 90-day cumulative volume delta data hinted at surging seller dominance. While this could slow down the rally, institutional players will be the ones dictatating the market direction.

Risks remain, but momentum favors the bulls

Of course, no rally is guaranteed. Retail participation and spot market volumes will still play a role in sustaining Solana’s momentum. If buying activity from smaller players still stalls, even whales might hesitate to drive the price higher.

That being said, Galaxy Digital’s $205 million withdrawal sends a strong signal. As it stands, the balance of evidence might be leaning bullish.

Post Comment