Inside Interactive Brokers: The Untold Secrets Behind How They Actually Manage Your Stock Corporate Actions—and Why It Could Make or Break Your Portfolio

Ever wonder how those little corporate surprises tucked into your investment portfolio actually work? You know, those nudges from companies like dividends, stock splits, or mergers that can either make your day or scramble your to-do list. Managing corporate actions might not be the flashiest part of investing, but it’s crucial—miss one, and you might be leaving money on the table or scrambling to catch up. If you’re using Interactive Brokers, navigating these corporate twists doesn’t have to feel like decoding a secret message. From dividend choices to mergers and spin-offs, understanding how Interactive Brokers keeps you informed—and what steps you need to take—can turn this complexity into a smooth ride. Ready to demystify this vital aspect of your investment journey? LEARN MORE

img#mv-trellis-img-1::before{padding-top:148.19102749638%; }img#mv-trellis-img-1{display:block;}img#mv-trellis-img-2::before{padding-top:141.59544159544%; }img#mv-trellis-img-2{display:block;}img#mv-trellis-img-3::before{padding-top:48.73046875%; }img#mv-trellis-img-3{display:block;}img#mv-trellis-img-4::before{padding-top:33.49609375%; }img#mv-trellis-img-4{display:block;}img#mv-trellis-img-5::before{padding-top:47.94921875%; }img#mv-trellis-img-5{display:block;}img#mv-trellis-img-6::before{padding-top:69.82421875%; }img#mv-trellis-img-6{display:block;}

If you invest in various individual securities in brokerages, one thing investors have to deal with are corporate actions surrounding the securities that you own.

Today, we are going to deal a little with how you will deal with Corporate Actions in Interactive Brokers.

It is Not Just Dividends.

The most common corporate actions that you had to deal with is maybe dividends, which is what attracted you to particular stocks in the first place.

1. Dividends

- Cash dividend – Company pays shareholders cash per share.

- Stock dividend (scrip dividend) – Company issues new shares instead of cash.

- Special dividend – A one-time dividend, often larger than usual.

2. Stock Splits & Reverse Splits

- Stock split – Each share is divided into multiple shares (e.g., 1 share → 2 shares), lowering the price per share but not total value.

- Reverse split (consolidation) – Multiple shares are combined into fewer shares (e.g., 10 shares → 1 share), raising the price per share.

3. Bonus Issues (Capitalization of Reserves)

- Company issues free additional shares to shareholders, usually in proportion to existing holdings (e.g., 1 bonus share for every 5 shares held).

4. Rights Issue

- Shareholders are given the right (but not obligation) to buy additional shares, usually at a discount, within a fixed period.

5. Mergers & Acquisitions (M&A)

- Merger – Two companies combine; your shares may be exchanged for shares in the new entity.

- Acquisition / Takeover – Your company is bought out, often with shares converted to cash or shares of the acquirer.

6. Spin-Off / Demerger

- The company separates a business unit into a new independent company, and shareholders receive shares in the new entity.

7. Delisting

- Shares are removed from the stock exchange, either voluntarily (strategic decision) or involuntarily (regulatory non-compliance).

8. Liquidation / Bankruptcy Proceedings

- If a company winds up, assets are sold and proceeds (if any) are distributed to creditors and shareholders (common shareholders are last in line).

If you own a few securities, you hope to be informed about them and not have to look them up.

Crucially, some corporate actions require the investor to take actions and you hope not to miss out on them.

In the past, these came in your mail box for the Singapore stocks. In a nominee account like Standard Chartered Bank, they will send you a SMS when there is a need for corporate actions. Nowadays, they have a corporate actions panel as well.

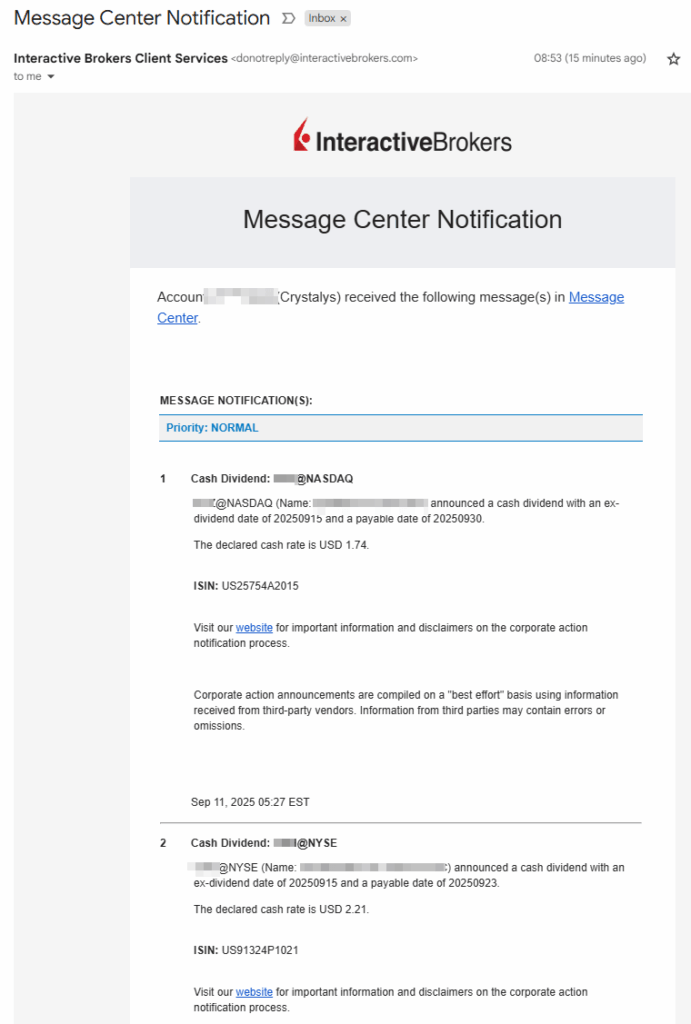

Interactive Brokers Sends You an Email If There are Corporate Actions.

The most common encounter will be if there are any dividends declared in stocks or cash.

In this email sent from Interactive Brokers message center, two securities announce dividends and your brokerage inform you about it.

But there are some corporate actions that you might need to take actions to choose or to vote. In this Jardine Matheson example, there is a need o make a choice regarding receiving the dividends as cash or stock.

I received this email on the 9th and the period to take action is from 8th to 11th.

Not a lot of window to work with just like Standard Chartered Online Trading in the past.

If you click on the Portal link you will be sent to the Interactive Brokers Corporate Action Manager:

Navigating to Interactive Brokers Corporate Actions Manager

Suppose you don’t have the time to do it immediately, and would like to revisit this, you can login to your Interactive Brokers portal:

From the search bar at the top, type “corporate”

You will be able to see Corporate Actions Manager there and just click on it.

You be able to see a bunch of corporate actions with many just information where you don’t need to take action.

If there are some that you need to take actions, click on Choice Actions, and Mandatory Actions just to be sure what they are.

In my case, it is whether I wish to receive my Jardine dividends in cash, or reinvest back as stock dividends. I will need to key in the amount of shares between the two to make choices.

In this case, this means that I can receive half as stock dividends and half as cash dividends.

Hope this gives you some enlightenment regarding how the brokerage handles this aspect of your securities management.

My Comprehensive Interactive Brokers How-to Guides

Interactive Brokers is a great low-cost, financially strong brokerage platform that can be the standard broker for holding your long-term investments. You can access 150 global exchanges, including exchanges such as Singapore, the US, Hong Kong, London, European and Canada.

You will enjoy cheap commissions and zero minimum recurring platform fees or maintenance fees. Convert your funds to different currencies at near-spot rates, paying a flat US$2 fee.

To get started or become familiar with Interactive Brokers, check out my past articles on how to invest with Interactive Brokers. I hope the guides make your life and investing experience easier and brighter.

An Easy Step-By-Step Guide to Setup Interactive Brokers (IBKR)

How to Fund & Withdraw Funds from Your Interactive Brokers Account

How to Convert Currencies in Interactive Brokers

How to Buy and Sell Stocks and Securities on Interactive Brokers

How Competitive are Interactive Brokers Commissions Pricing?

How Safe is it to Custodized Your Money at Interactive Brokers? The things they do better than other brokers.

How Safe is it to Custodized Your Money at Interactive Brokers (2)? Financial strength of IB during recent banking crisis and during Great Financial Crisis

Interactive Brokers have Eliminated the US$10 monthly inactivity fee. More details here.

How to Transfer your shares from Standard Chartered Online Trading to Interactive Brokers

How to trade after-hours and premarket

Create Customized Reports and automatically send them to your email

What is the PortfolioAnalyst Report and Automatically Send the PortfolioAnalyst Report to Your Email

Send Money from TransferWise to Interactive Brokers

Interactive Brokers’ Fluid Interest Income on Cash

Introducing IMPACT by Interactive Brokers

Post Comment