How This Bold $1.65B Bet on Solana Could Redefine the Future of Wealth—And Why Everyone’s Watching Closely

So, Forward Industries just went all in — dropping a jaw-dropping $1.65 billion to stash their treasury in Solana. Yup, you read that right. When a Nasdaq-listed company makes such a bold crypto play, especially backed by the heavy hitters like Galaxy Digital and Jump Crypto, you can’t help but wonder—are we witnessing the next big pivot in how corporations handle their cash reserves? With SOL’s price climbing steadily and the market’s bullish signs flashing everywhere, Forward’s move isn’t just gutsy; it might be downright visionary. Now, here’s a question worth chewing on: when a public company bets this colossal on a crypto asset, is it a savvy masterstroke, or a gamble that’ll keep Wall Street buzzing for months? Either way, the spotlight is blazing on Forward, and it’s thrilling to see this kind of game-changing maneuver shake up the scene.

Key takeaways

Forward Industries just made a massive $1.65 billion move to anchor its treasury in Solana, backed by major crypto players. With Solana’s price climbing, the market appears to be backing the bet.

Forward Industries just made one of the boldest bets on crypto we’ve seen from a public company. The Nasdaq-listed firm closed a $1.65 billion private investment in a public equity (PIPE) deal to load up its corporate treasury with Solana [SOL].

Backed by heavyweights, the move puts Forward squarely in the spotlight now.

Forward bets big on Solana

Led by Galaxy Digital, Jump Crypto, and Multicoin Capital, the round saw over $300 million committed by the trio. This, alongside support from Bitwise, Borderless Capital, SkyBridge, and a slate of crypto founders and angels.

The move will reshape Forward’s balance sheet, putting SOL at its core. To cement the strategy, Multicoin’s Kyle Samani is stepping in as Board Chairman, with Galaxy’s Chris Ferraro and Jump’s Saurabh Sharma joining in as observers.

As expected, the market reaction was instant. In fact, the stock price spiked by 15% in pre-market trading before cooling down.

Is it in elite company?

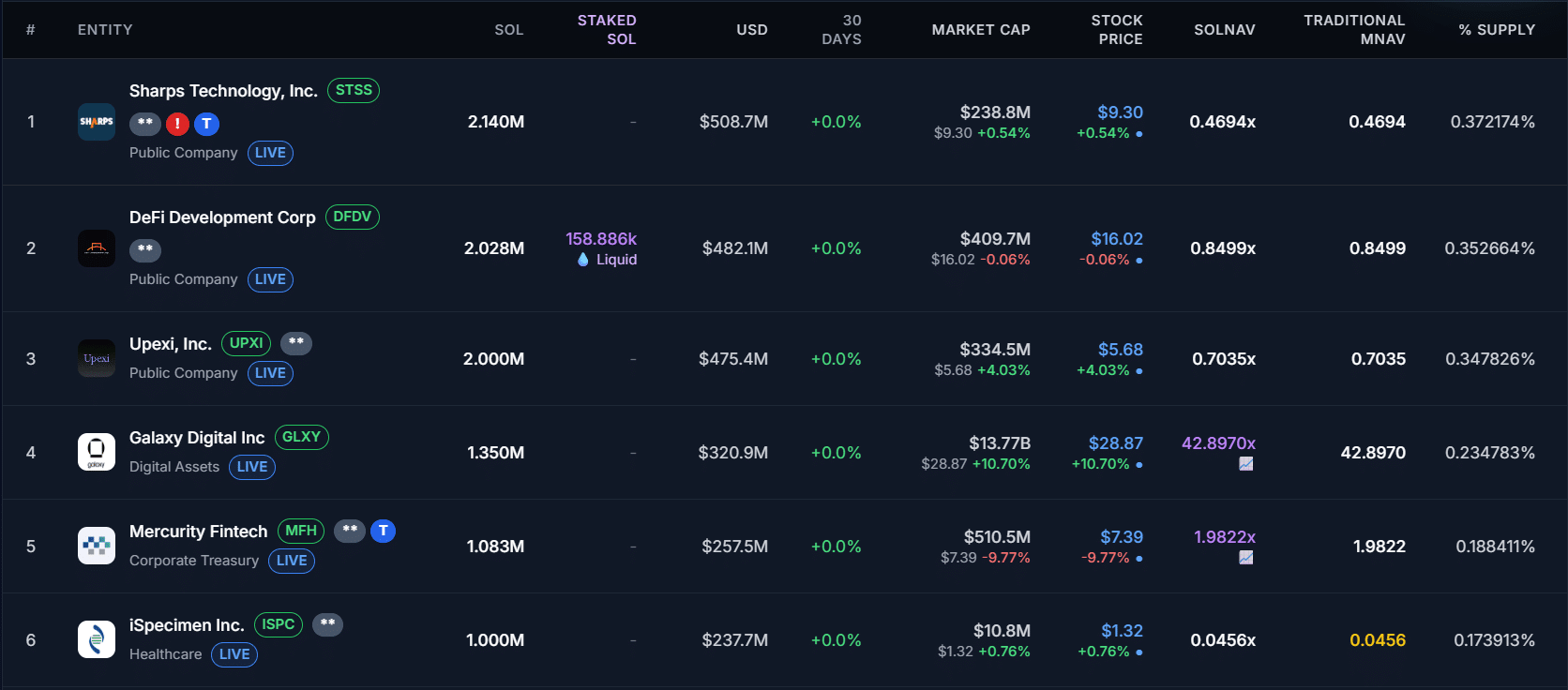

A look at Solana’s biggest corporate holders highlighted the scale of Forward’s latest move.

Sharps Technology leads with 2.14M SOL, followed closely by DeFi Development Corp. and Upexi with around 2M SOL each. Galaxy Digital sits on 1.35M SOL worth $320.9M, while smaller players like Mercurity Fintech and iSpecimen round out the list.

In comparison, Forward’s $1.65 billion allocation will instantly place it well above these names – Making this one of the most aggressive Solana treasury plays to date.

OI rises as Solana pushes higher

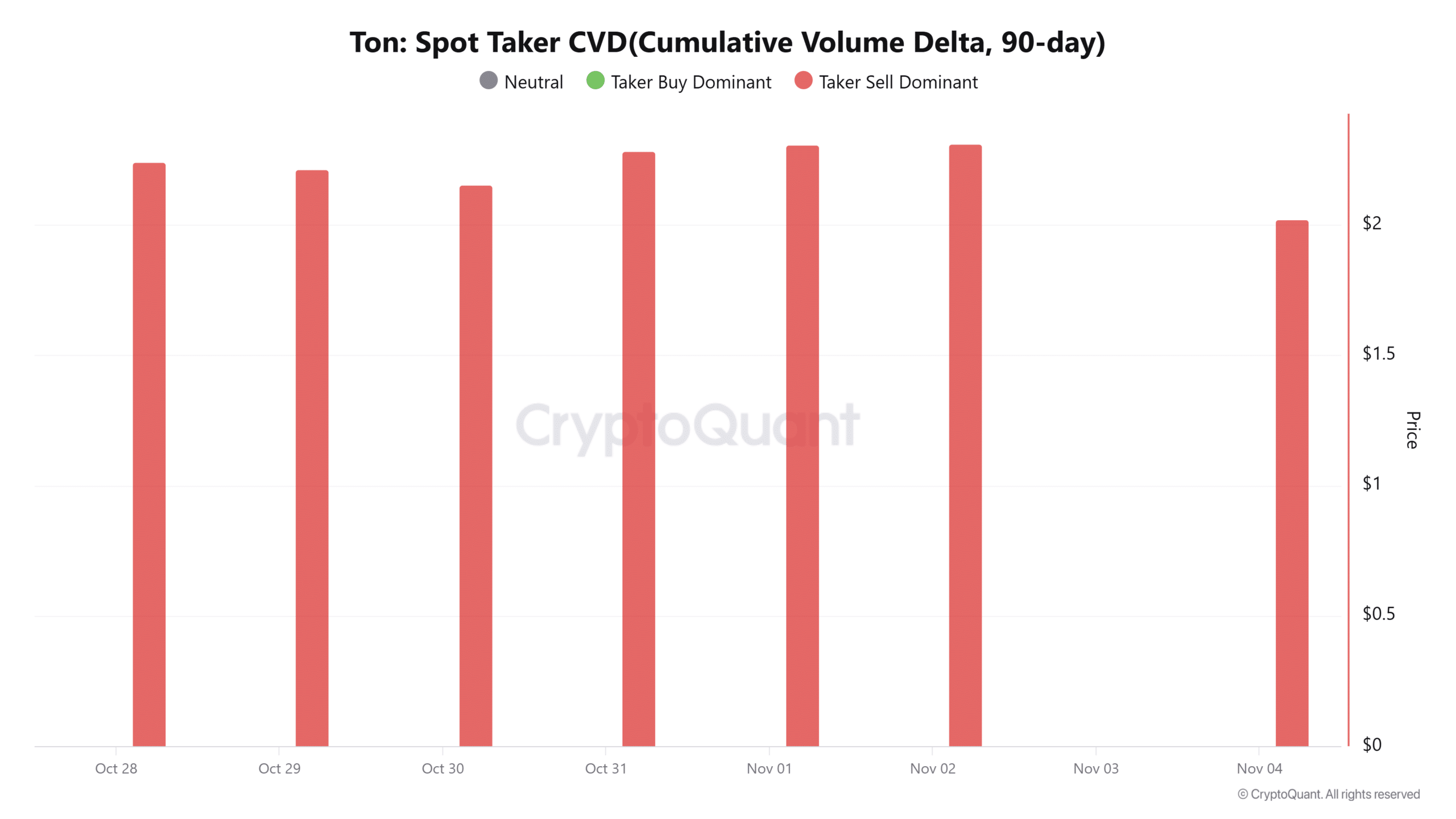

On the back of this move, the Aggregated Open Interest climbed past $8.2 billion, with traders piling into positions rather than cashing out.

On the price front, SOL rallied to $238, up by 4.2% on the day, with its RSI just below the overbought zone.

The MACD was firmly in positive territory too, underlining strong upward pressure on the charts.

Finally, at press time, both spot and derivatives action revealed sustained appetite. This makes Forward’s $1.65 billion treasury bet look more like a calculated strike.

If anything, the market may now be ready to back it.

Post Comment