PUMP Whale Just Unloaded 250M Tokens — Is a Price Crash Below $0.005 Inevitable or a Hidden Opportunity?

When a crypto whale ditches 250 million PUMP tokens, totaling a cool $1.53 million, you’ve got to wonder—is this the canary in the coal mine for Pump.fun’s meteoric 150% rally? I mean, who wouldn’t raise an eyebrow when a single “3xAMM” wallet, sitting on a staggering 2.5 billion PUMP, starts cashing out? It’s like watching a high-stakes poker game where one of the biggest players suddenly starts folding—are they bluffing, or is the bubble about to burst? On one hand, the short-term vibes are holding strong; prices still inch upward despite a 45% plummet in trading volume. On the other hand, the darker shadow of long-term selling pressure looms large. This isn’t your everyday pump-and-dump tale—it’s a complex dance of bullish optimism tangled with signs of fatigue. Ready to dive deeper and see if PUMP’s next move is a breakout or a breakdown? LEARN MORE

Key Takeaways

A crypto whale dumped 250 million PUMP worth $1.53 million. On-chain data revealed that short-term sentiment remains bullish, but long-term signals strong selling pressure.

Pump.fun [PUMP] has caught the attention of crypto enthusiasts with a parabolic 150% price surge over the past three weeks.

This continuous rally is now raising concerns about whether this marks the peak of the PUMP bull run, or if the asset could see further upside ahead.

This concern arises as a private investor wallet address, “3xAMM,” holding 2.5 billion PUMP, has begun profit-taking.

Whale dumps 250 million PUMP, time to sell?

Data from crypto transaction tracker Lookonchain reveals that the wallet recently dumped 250 million PUMP worth $1.53 million on Binance.

Yet, it still holds a massive 2.25 billion PUMP worth $13.6 million.

Despite the massive sell-off, PUMP continued climbing over the past 24 hours, registering a 3.85% price gain. The asset is currently trading near the $0.006325 level.

However, investors and traders appear to be avoiding participation during the same period, resulting in a 45% drop in trading volume.

This decline in trading volume, despite the rising price, indicates that market participants are not interested in pushing PUMP higher.

PUMP price action and upcoming levels

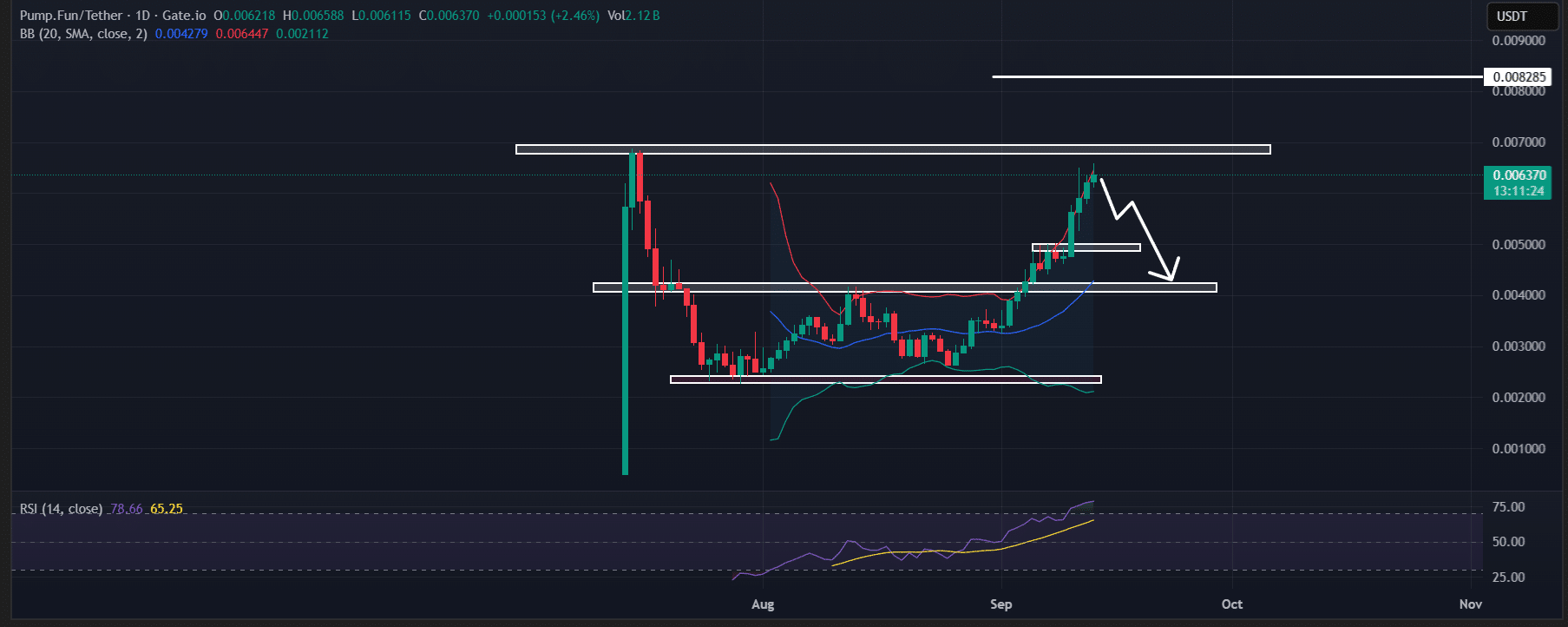

AMBCrypto’s technical analysis shows that the recent price gain has pushed PUMP to a key resistance level of $0.0070.

This is the same level from which the asset plunged over 63% following its launch. In addition, selling pressure is also evident on the daily candle due to the presence of a long upper wick.

Based on the current price action, if PUMP moves near the $0.0069 or $0.0068 level and forms any bearish candlestick pattern, it would signal a potential price reversal.

If this happens, PUMP could plunge to its previous support level of $0.005 or the breakout level of $0.0042.

At press time, indicators including the Bollinger Bands and the Relative Strength Index (RSI) appeared to be flashing bearish signals.

On the daily chart, the Bollinger Bands have broadened, and the price is hovering near the upper boundary, hinting at a potential reversal soon.

Meanwhile, PUMP’s RSI has crossed into overbought territory, also suggesting a potential price reversal as the asset appears overstretched in recent days.

On-chain flashes mixed sentiment

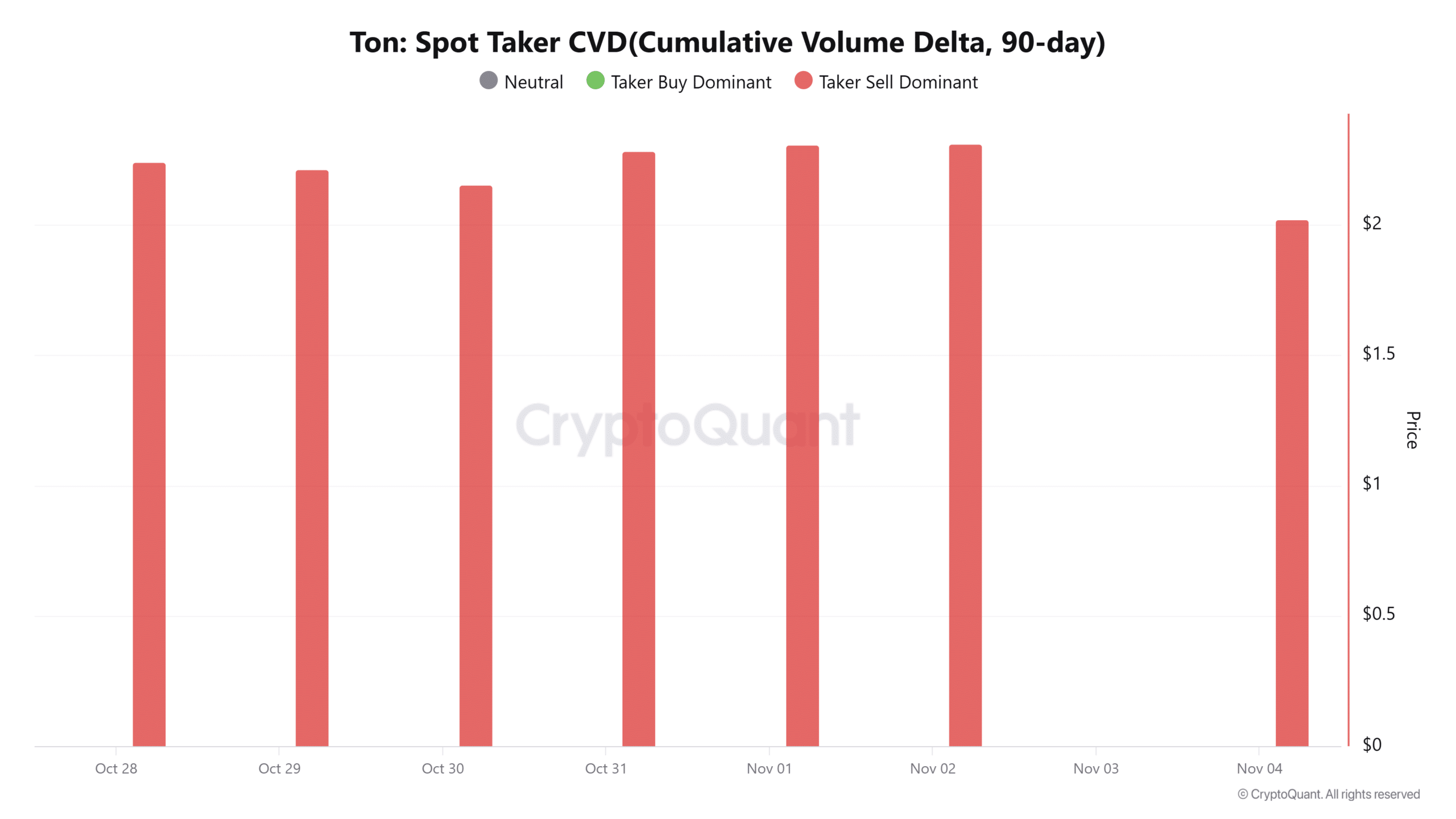

Besides whale activity, on-chain analytics platform CoinGlass reveals that exchanges have been witnessing continuous inflows of tokens for the past five trading days.

In the last 24 hours alone, $5.90 million worth of PUMP has moved into exchanges.

This indicates a potential sell-off by investors and long-term holders, reducing buying pressure.

At press time, traders appeared to be following the trend by placing strong bets on long positions.

Data from CoinGlass reveals two major liquidation levels at $0.00597 and $0.0067, where traders are overleveraged with $12.57 million in long positions and $3.72 million in short positions.

This reflects mixed sentiment between buyers and sellers. While today’s sentiment may appear bullish, whale and investor activity on higher time frames suggests that sentiment is beginning to shift toward the bearish side.

Post Comment