Fartcoin’s 11% Plunge: Is This the Memecoin Meltdown That Finally Breaks the Market, or Just a Temporary Speedbump?

Ever wondered why a memecoin with a name like FARTCOIN could suddenly nosedive 11% in a single day? It’s almost poetic, isn’t it? Beneath the humorous name lies a telling tale of market tension—a 12% drop in Open Interest signaling that traders are scrambling, closing $84.5 million in contracts and squeezing liquidity out of the system. Yet, despite this bearish burst, retail investors keep piling in, pumping $11 million over four weeks into spot inflows like they believe the bottom’s near. But just hold on a second—is this relentless buying by the little guys enough to push through a market weighed down by heavy liquidations? The dynamics here are as fragile as a house of cards poised on a windy day. Dive in as we untangle why FARTCOIN is the talk of the town, balancing between bullish optimism and bearish pressure like no other. LEARN MORE

Key Takeaways

Why did FARTCOIN fall 11%?

Open Interest dropped 12% to $685.9 million. That meant $84.5 million in contracts closed, showing traders pulled liquidity and added pressure.

What supports FARTCOIN’s outlook?

Spot inflows totaled $11 million across four weeks. Retail investors kept buying, but heavy liquidations suggest prices could still face more downside.

In the past day, Fartcoin [FARTCOIN] led the market decline, plunging 11% as bears became increasingly aggressive.

The broader market showed mixed sentiment across segments, leaving direction unclear. AMBCrypto reviewed key datasets to assess near-term price risks.

Meme segment and community push for FARTCOIN

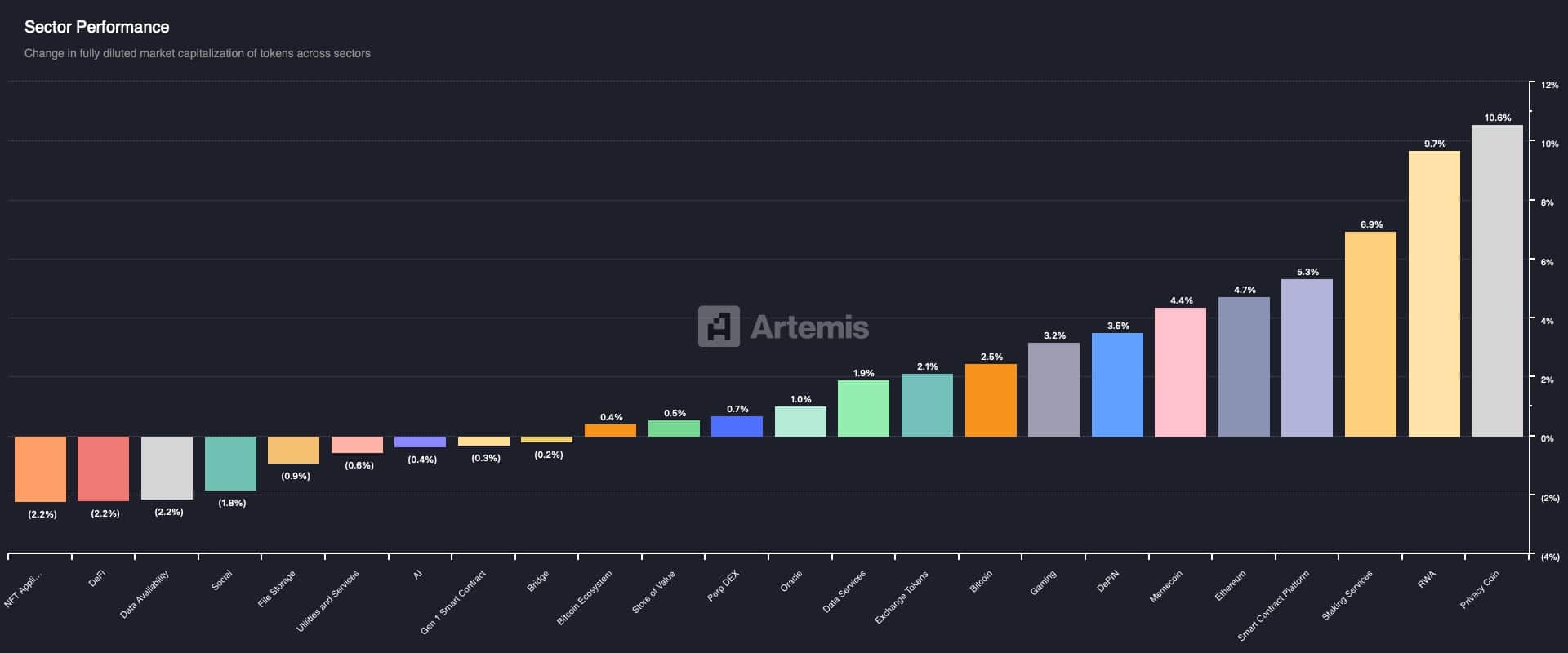

The memecoin market segment continued to rally over the past week, posting a 4.4% gain.

This figure was determined using the Weighted Average on Artemis, which evaluates various memecoins to establish potential market direction for the asset.

At the same time, investor sentiment has turned more bullish.

CoinMarketCap data showed a 6% jump, rising from 62% to 68%. Investors backed this optimism with Spot purchases, adding bullish weight to the trend.

AMBCrypto reviewed the Spot market and confirmed that investors were matching their votes with actual buys.

Spot inflows vs. derivative pressure

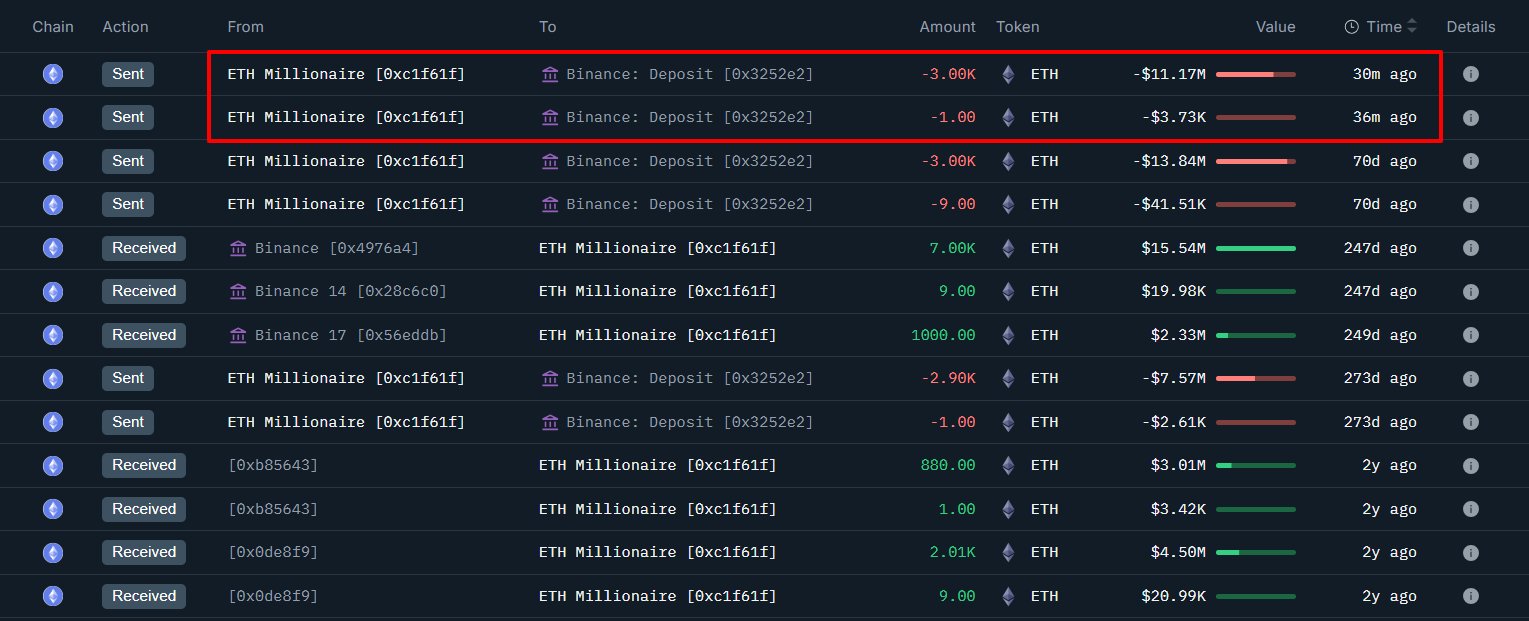

According to CoinGlass’ Spot Exchange Netflow data, investors have been accumulating the memecoin steadily.

During 24 hours, there was an inflow of $2.47 million, which added to the bullish outlook. On a weekly scale, total inflows reached $11 million.

This marked the fourth consecutive week of net purchases by this group of investors.

When negative outflows appear on the chart, it means investors are moving funds off exchanges into private wallets for long-term holding.

In addition, the Accumulation/Distribution indicator showed that daily trading volume reached 2.14 million FARTCOIN.

With the indicator trending upward and Spot investors maintaining their buying spree, the market continues to reflect a strong bullish bias.

By contrast, Derivatives data showed weakness.

Open Interest dropped 12% in the past 24 hours to $685.92 million. This meant $84.5 million worth of contracts were closed, including liquidations.

A shrinking Open Interest often signals less liquidity and reduced risk appetite. With bearish traders profiting, the short side could attract more participation.

Fragile near-term outlook

For now, the overall outlook looks fragile. Spot inflows provide some cushion, but liquidation cascades are weighing heavily on price action.

If bearish momentum remains high, spot investors could suffer notable losses despite their steady accumulation.

Post Comment