Why Betting It All Is a Trap: The Hidden Power of Diversification for Explosive Long-Term Gains

Ever wondered if putting all your eggs in one basket really means catching the biggest fish — or just risking it all for a shot in the dark? I’ve always been a fan of the Buffett school of thought: if you truly understand your investments, why not concentrate and dig deep? It feels safer when you know the ins and outs of a handful of companies rather than spreading yourself thin. Yet here I am, with a portfolio that’s the polar opposite — sprawling and diverse. It’s a tug-of-war between the alluring promise of high returns through concentration and the comfort of diversification that cushions against the unexpected.

But hold on—there’s more beneath the surface. What about the unseen risks? The psychological toll? Survivorship bias? And oh, the sneaky volatility drag that chips away at your returns, often unnoticed until it’s too late. Verdad’s intriguing research and meticulous simulations shed light on this delicate balance, revealing how diversification can actually unlock factor premiums and reduce the wild swings that make concentrated portfolios a sleepless-night gamble.

Join me as we unravel these insights, weigh the pros and cons, and challenge long-held beliefs about concentration versus diversification. Whether you’re eyeing financial independence or just aiming for steadier sails in the investment sea, this dissection might just upend everything you thought you knew.

img#mv-trellis-img-1::before{padding-top:50.1953125%; }img#mv-trellis-img-1{display:block;}img#mv-trellis-img-2::before{padding-top:55.56640625%; }img#mv-trellis-img-2{display:block;}img#mv-trellis-img-3::before{padding-top:55.078125%; }img#mv-trellis-img-3{display:block;}img#mv-trellis-img-4::before{padding-top:100.68829891839%; }img#mv-trellis-img-4{display:block;}img#mv-trellis-img-5::before{padding-top:53.515625%; }img#mv-trellis-img-5{display:block;}

Verdad has a great article about total concentration and diversification:

I just want to take this opportunity to digest, reflect and take down some notes.

I came from the Buffett school that if you know what you are investing in, you should concentrate. There is safety in concentration because if you really know the few companies you know so well, you would know what are the risks that would directly, and indirectly affect them, and you won’t have to worry about the stuff that won’t affect them. That will help you sleep better at night. Your returns are also higher and most importantly it makes your effort worth, especially if you spend so much time investing in them.

Now… my portfolio is the opposite. Much more diversified.

I think people would also need to know the shortcomings:

- Most people don’t really know the few companies they own THAT well.

- There is owner-operator risks in that you can do a lot of work but you are not the operator and there are things that you don’t see coming that changes how you view the business today, in the future and this affects the valuation.

- 1 and 2 affects most things.

- You can still not consider every macro-economic factors if you understand things well.

- I tend to think concentration has its psychological baggage that prevents one from sleeping well at night at some point. Diversification also has its unique psychological baggage. But I think most can overcome the baggage of the diversified one better than the concentrated one.

Verdad’s research points out a few things (so that you don’t have to read the whole thing):

- There is survivorship bias in total concentration. Only those that survive lived to tell the tale.

- Volatility drag mathematically affects the returns.

- Diversification is also about capture returns without the survivorship bias.

- If you want to capture factor premiums, you need to also hold more to capture the factor premiums (read higher returns)

Verdad’s Simulations

Throughout the article, Verdad did some simulations and I would like to list them out here first so that you guys can have some context what they are doing:

- They attempt to simulate the returns of manager strategies over different degrees of concentration.

- They use the data of US stocks from S&P Capital IQ.

- This allow them to craft 10,000 simulated manager portfolios at different degree of concentration from 5 to 500 stocks.

- If the portfolio needs rebalancing, it is rebalance on an annual basis.

- There is no survivorship bias because no manager drops out.

- Fees are hedge fund fees: 1.5% management fees and 20% carry, above an 8% annual preferred return, subject to a high-water mark.

- Set minimum capitalization to $300 million for the companies.

I think with these, read less into the returns as what you could get, but more to discern differences.

How Concentrated Portfolios Affect University Endowments (And Your Income Strategy for Financial Independence)

Verdad brought up a good point about a very common linear planning thinking that didn’t hit me before this article.

The primarily problem for a highly concentrated portfolio is volatility. You probably want volatility to the upside but most would not always like when the volatility to the downside when you least expected it.

Verdad reminds that volatility drags returns:

- If portfolio is down 10% in year 1 and up 10% in year 2, the portfolio lost 1% in value.

- If portfolio is down 20% in year 1 and up 20% in year 2, the portfolio lost 4% in value.

- If portfolio is down 30% in year 1 and up 30% in year 2, the portfolio lost 9% in value.

This is volatility drag or what readers here might be familiar with: sequence of return risks. This gets worse when you spend from the portfolio in that imagine if you spend 6% after it being down, you move from closer to 10% down to 20% down and so your portfolio needs much higher returns just to break even. But if you spend 1% of the portfolio (because you have so much capital relative to your income), it is still closer to 10% down. You don’t need so much to make back the returns.

Verdad’s example is those university endowment, which has the same dynamics as your income strategy for financial independence, except that they have donations haha.

It hasn’t occur to me just how impactful volatility drag is:

The probability of return shortfall is a real measure of risk that matters even to patient investors who can ride out drawdowns and bear volatility. If a foundation is required to pay out 5% of its assets every year, it needs to generate an annualized portfolio return above 5%, net of fees, in order avoid a shrinking asset base over time. Falling short of this threshold over a long horizon, such as 10 years, represents a material loss of capital that would curtail a foundation’s ability to fund its mission in the future.

There is a common thinking that:

- If I can earn 7% p.a. return.

- Then I just spend 5% because it is dividends.

- I can rely on the 2% p.a. to keep up with inflation.

This used to be my planning blueprint.

In a way, this kind of planning norms doesn’t take into consideration that the 2% is actually needed firstly to keep the portfolio afloat.

And if so, can we still adjust our dividend income to keep up with inflation?

Some would say a dividend portfolio is less volatile… but I think those serious ones would tell you.. they are are individual stocks. They are still very volatile. You also don’t spend the capital and the capital can recover… but I think I won’t go too deep into it.

Verdad can generate a lot of portfolios and so in this first part, what they want to do is to see what is the probability that the portfolio will have a shortfall.

They measure shortfall as whether they can fall below a 5% net annualized return after investing for 10 years:

Kyith, why 5%?

Because the standard model for endowment funds is to spend 5% of the fund’s value and so going through 10,000 portfolios for each concentration level allow us to see that. Or that this is the risk-hurdle that the endowment fund require their manager to hit (I think it is likely this)

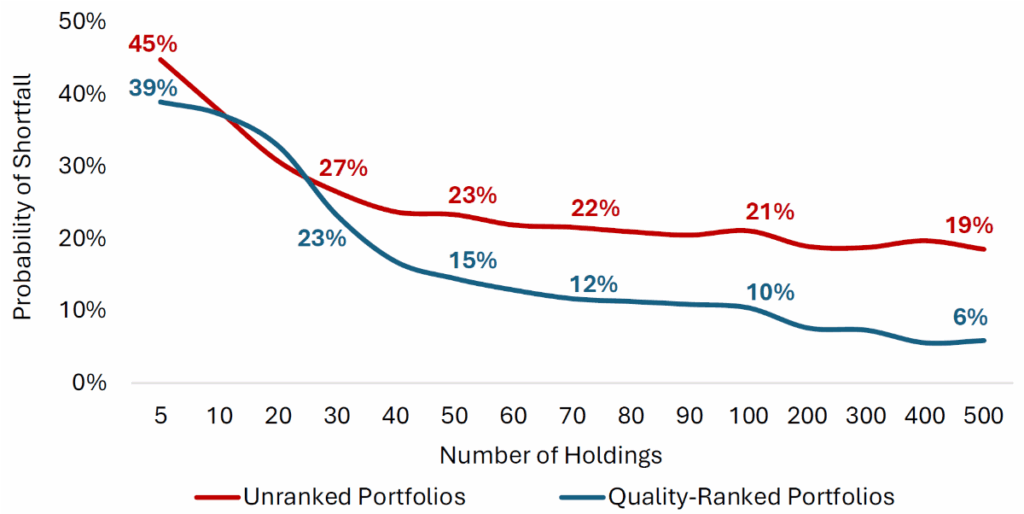

Now you will see two lines and they are two groups of portfolios:

- Quality-ranked portfolios: These are simulated portfolios to simulate managers selecting based on their best ideas according to profitability and free cash flow generation. The portfolios are formed from a universe that is rank with 50% weight on Gross Profit/Assets and 50% weight on Free Cash Flow/Assets.

- Unranked portfolios: The holdings are selected at random without factor tilts.

So we are able to see how both factor or non-factor based portfolios behave.

One thing we notice is that if we have a highly concentrated portfolios, the probability of shortfall, or falling below 5% after 10 years is much higher.

There aren’t much discernable difference between a quality strategy or a non-quality strategy at high concentration.

But as we increase the concentration, then you can see the probability for both fall, with the quality portfolios doing even better.

Quality Premium Shows Up Better With More Diversifications

The reason for this is because volatility drag offsets the return premium from factor exposure, as shown in the figure below. Hyper-concentrated portfolios comprising 5–10 of the highest-ranked stocks actually have lower gross returns than diversified portfolios of 50 or more stocks. This is evident among unranked portfolios, where hyper-concentrated strategies of 5–10 stocks trail diversified portfolios by more than a percentage point, on average. It is also true among ranked portfolios, where hyper-concentrated quality strategies underperform diversified quality portfolios by 1–2 percentage points, even though the hyper-concentrated portfolios consistently rebalance into higher-ranked stocks than the diversified portfolios.

The chart below shows the same two groups of portfolios but in gross returns (before fees):

Quality Premium (green bars) is excess gross return relative to the 10% market return. Positive means there are excess premiums and as we observe, we cannot tell if there are discernable premiums for portfolios with less than 20 quality stocks.

You can see the blue and red line starts separating with more concentration.

Since the 10,000 portfolios were randomly picking from a quality universe, this premium also means differently to me compare to merely owning the whole US equity market but tilting towards those rank high with gross profit to assets and free cash flow to assets.

How Much Research to Gain 1% of Outperformance Over the Market?

Okay this one is the one that I struggle to understand but I understood what they were trying to find out. If you want to achieve 1% more outperformance over the market return, how much more effort do you have to put in (by hours), depending on the degree of concentration?

The left vertical axis is for the red and blue line, which shows the percentage points of value add to outperform the market by 1% annualized. A higher number means the manager really needs to be good.

So if a number is 3.3% on the red line for 500 securities, it means that the amount of value add is less than if it is 5.2% for 5 stocks. If you have a quality-ranked portfolio, the need for value add is even less.

The Range of Outcomes of Concentrated Portfolios are Just Wider.

If you concentrate, you are going to get portfolios that perform wildly well and also those that died fast.

The problem is… we seldom hear about those who died.

Verdad’s simuluation is able to factor in those who don’t do so well, which is what is challenging to do in real life.

Whether the portfolio is concentrated, more diversified, quality or no-quality separation, there is going to be a range of 10-year annualized return.

But when we look at very concentrated portfolios you either get very good 15% p.a. 10-year return, or get -3.9% p.a. 10-year return.

By choosing to diversify the range of outcomes narrows.

I find this interesting purely because of the 10,000 simulations and less about real life. Even with its limitations, it kind of shows the virtues of diversification to capture long term returns well.

When Sapp and Yann (2008) did a study with real mutual funds data, they also found the same thing. They tried to avoid the survivorship bias by including all US equity mutual funds that exist in the CRSP and WRDS databases from 1984 to 2002.

The percentage of acquired or liquidated funds show that more concentrated funds has a higher death rate.

The 3-factor Alpha (which control the market beta, size and value) shows that the more diversified fund are less negative. Those concentrated ones are more negative (less negative is better).

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

Post Comment