Could PancakeSwap’s CAKE Rally to $3.25 Be Fueled by a Surging Wave of Binance Traders?

Ever wonder what sparks a sudden surge in a token’s momentum like a rocket launched from a bake sale? Well, PancakeSwap’s CAKE just whipped up an unexpected frenzy—an 11% climb in a single day backed by a staggering $2.3 billion in trading volume. The twist? It’s not just any traders lighting the fire; Binance investors are steppin’ up big time on the derivatives front with a Taker Buy-Sell Ratio north of 2, signaling they’re all in and hungry for more. Now, here’s the kicker: will this bullish blaze push CAKE beyond its tricky descending resistance line toward that sweet $3.25 prize, or will it simmer down into a short-lived stall? As the BNB ecosystem expands, liquidity’s pumping lifeblood through the veins of this rally. So, what’s really driving this heat, and can it keep baking profits in the long haul? Let’s slice into the analysis and see what’s in the recipe for CAKE’s next move. LEARN MORE

Key Takeaways

Why is CAKE showing strong bullish momentum?

Trading volume surged to $2.3 billion, with Binance investors dominating derivatives activity and a Taker Buy-Sell Ratio of 2.04, signaling heavy buying pressure.

What price levels could CAKE target next?

A breakout above the descending resistance line could push CAKE toward potentially $3.25, while failure to break out may lead to short-term consolidation.

PancakeSwap’s [CAKE] token has recorded a notable gain, climbing 11% in the past day as capital inflows continue to rise.

Market analysis shows that liquidity across the market is elevated, driven by the expanding BNB ecosystem. The key question is whether the rally will remain self-sustaining.

AMBCrypto examines what may come next.

CAKE benefits from the BNB ecosystem

Market analyst Joao Wedson observed that liquidity inflows into BNB ecosystem–linked assets could trigger a rally.

He described this trend as the “Binance Coin Season,” adding,

“Altcoins connected to the Binance Smart Chain will start to attract attention soon.”

The analysis relies on the SOL/BNB Sharpe Ratio, which has historically indicated capital rotation whenever the pair trends downward.

CAKE is already capturing liquidity from the BNB ecosystem, not only in price movement but also in trading activity.

At the time of reporting, PancakeSwap had generated $2.3 billion in daily trading volume, surpassing Hyperliquid’s [HYPE] $773 million, per DeFiLlama.

Binance liquidity remains high

Binance investors are currently the most bullish on CAKE.

Derivatives data from CoinGlass showed that Binance users dominated this segment of the market, with the Taker Buy-Sell Ratio at 2.04. A reading above 1 signals stronger buying activity than selling.

The Spot market has also added to the bullish pressure, though on a smaller scale.

Within the same period, these investors purchased about $260,000 worth of CAKE. Still, weekly spot purchases have risen to $1.47 million, indicating that bullish momentum remains strong.

AMBCrypto’s extended analysis suggests that another rally is likely if market conditions continue in the same direction.

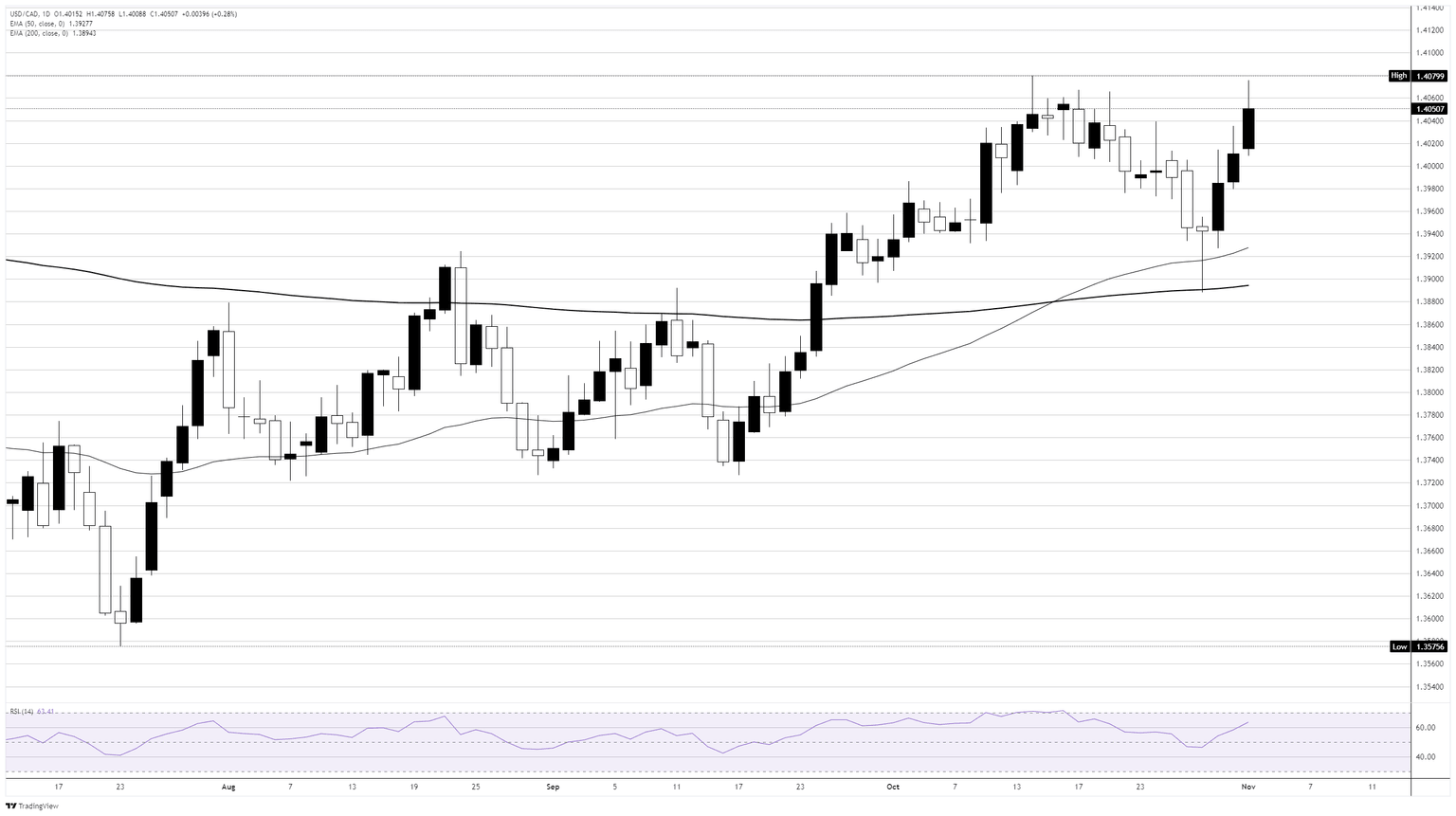

Outlook on the price chart

CAKE’s price chart showed that a major breakout remained possible. A further rally will depend on the token breaching resistance at the descending line pattern, a setup that often acts as a bullish catalyst.

If CAKE breaks this level, it could advance toward $2.66, $2.97, or even the upper target of $3.25.

If momentum weakens, however, price action may remain subdued. Even so, overall market sentiment continues to point toward a rally being more likely than bearish dominance.

Post Comment